Difx-Some important Details about This Broker

Abstract:Difx, an online trading platform, offers a diverse range of products across various asset classes to cater to different investment preferences. However, it is currently operating without valid regulation. Reports have emerged regarding users experiencing difficulties in withdrawing funds from their accounts, raising concerns about the transparency and reliability of the platform.

| Difx Review Summary | |

| Founded | 2017 |

| Registered Country/Region | Singapore |

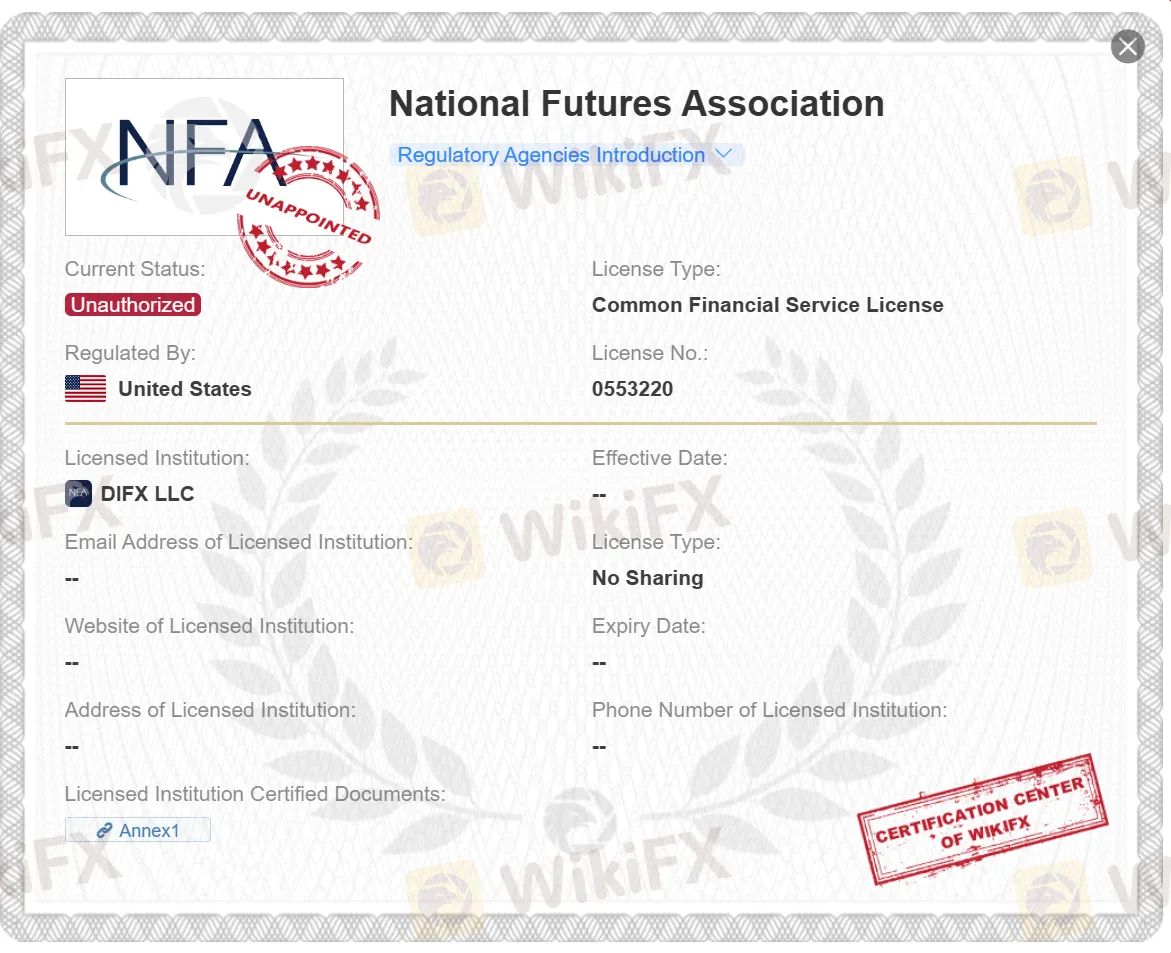

| Regulation | NFA (Unauthorized) |

| Trading Products | Forex, stocks, commodities and so on |

| Demo Account | Available |

| Leverage | 1:500 |

| EUR/ USD Spreads | 0.4 pips |

| Trading Platforms | MT5 |

| Customer Support | 24/7 email, online messaging, live chat |

What is Difx?

Difx, an online trading platform, offers a diverse range of products across various asset classes to cater to different investment preferences.

However, it is currently operating without valid regulation. Reports have emerged regarding users experiencing difficulties in withdrawing funds from their accounts, raising concerns about the transparency and reliability of the platform.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

Difx Alternative Brokers

There are many alternative brokers to Difx depending on the specific needs and preferences of the trader. Some popular options include:

TeraFX - A reputable forex broker that offers a diverse range of trading solutions, backed by advanced trading tools and exceptional customer support.

Equiti - A trusted global broker specializing in online trading of forex, commodities, and indices, offering cutting-edge technology, superior execution, and comprehensive market analysis.

Markets.com - A well-regulated online trading platform offering a comprehensive suite of trading tools, educational resources, and excellent customer support.

Is Difx Safe or Scam?

United States NFA (license number: 0553220) The regulatory status is abnormal and the official regulatory status is unauthorized. Therefore, Difx currently has no valid regulation, which means that there is no government or financial authority oversighting their operations. It makes investing with them risky.

If you are considering investing with Difx, it is important to do your research thoroughly and weigh the potential risks against the potential rewards before making a decision. In general, it is recommended to invest with well-regulated brokers to ensure your funds are protected.

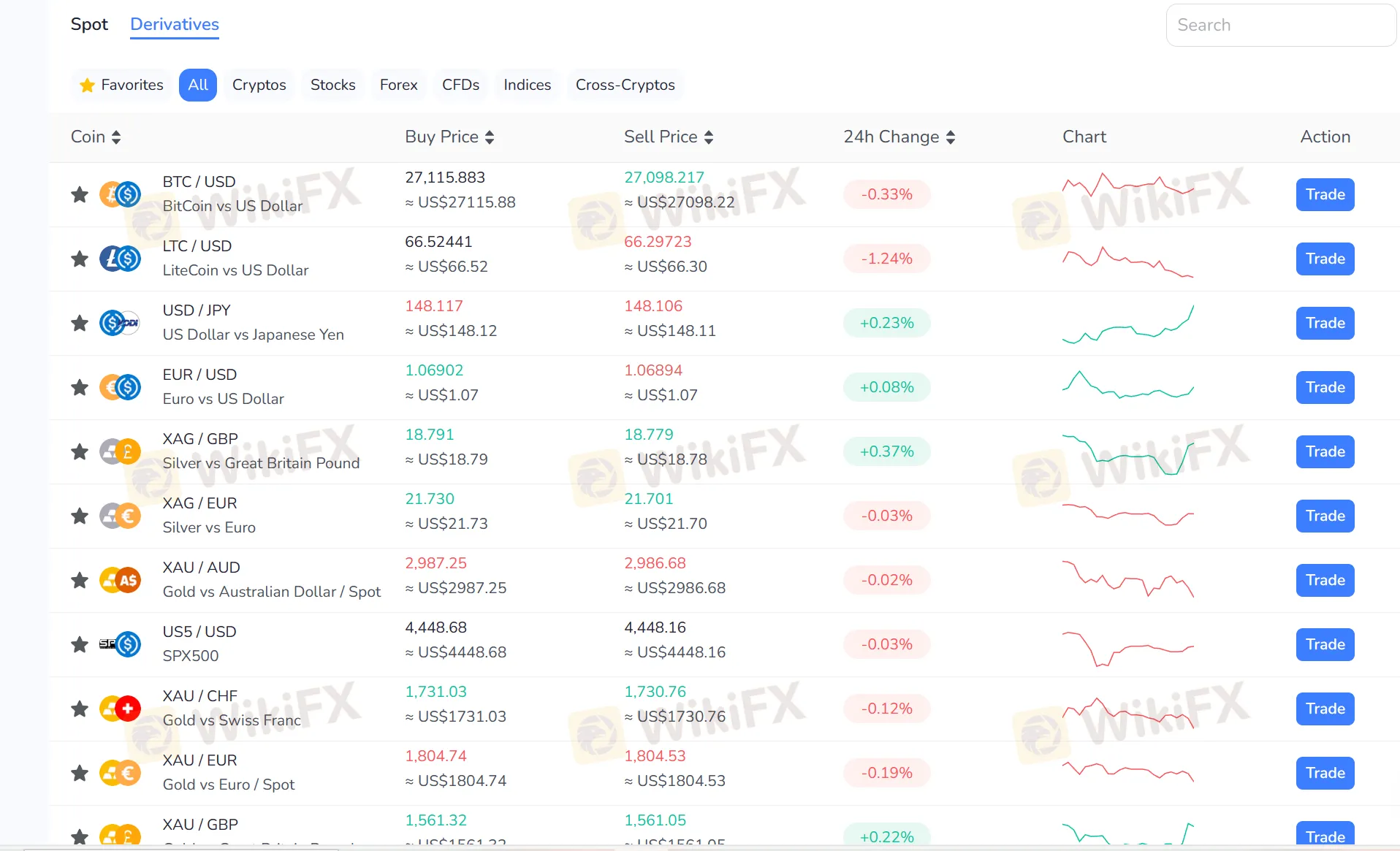

Trading Products

Difx offers a diverse range of products across various asset classes to cater to different investment preferences.

Forex: Forex trading provides opportunities to speculate on currency fluctuations, making it one of the largest and most liquid financial markets.

Stocks: By investing in stocks, you can take ownership in these companies and potentially benefit from capital appreciation and dividends.

Commodities: Difx offers trading in commodities, including natural resources like gold, silver, oil, and agricultural products. Commodities trading allows investors to speculate on price movements and hedge against inflation or other market risks.

Indices: Difx allows trading in market indices, such as the S&P 500, FTSE 100, or Nikkei 225. These indices represent the performance of a specific group of stocks and provide a benchmark for investors to assess market trends and diversify their portfolios.

Crypto: Difx offers the ability to buy, sell, and trade cryptocurrencies. You can invest in popular cryptocurrencies like Bitcoin, Ethereum, or Litecoin, taking advantage of the growing digital asset market.

Accounts

Difx provides two types of accounts for traders: Professional and Standard accounts. However, the specific minimum deposit amounts for these accounts are not disclosed. To obtain the most accurate and updated information regarding the minimum deposit amounts, it is advisable to reach out to their customer support team.

Difx also provides demo accounts for traders who want to practice and familiarize themselves with the platform before trading with real funds. Demo accounts simulate real market conditions, allowing traders to execute trades using virtual funds.

Leverage

Difx offers a maximum leverage of 1:500, which refers to the ratio between the trader's invested capital and the borrowed funds provided by the broker. Leverage allows traders to control larger positions with a smaller amount of capital, potentially amplifying their profits.

However, it is important to understand that leverage is a double-edged sword. While it can enhance potential returns, it also magnifies the risks involved in trading. Higher leverage increases the exposure to market fluctuations, meaning that even small price movements can have a significant impact on the trader's account.

Spreads & Commissions

In the Professional account, traders are charged a commission fee of $12 per lot traded.

On the other hand, the Standard account offered by Difx does not have any commission charges on trades. Instead, traders are charged based on the spread, which is the difference between the bid (sell) and ask (buy) prices. The spreads for Standard accounts start from 0.4 pips.

| Account Type | Professional | Standard |

| Commission | $12 per lot | None |

| Spreads | N/A | From 0.4 pips |

Trading Platforms

Difx offers its clients the popular and widely used trading platform, MetaTrader 5 (MT5). MT5 is a comprehensive and advanced trading platform that provides traders with a range of powerful tools and features to conduct their trading activities.

The MT5 platform is designed to offer a user-friendly interface, making it accessible to both beginner and experienced traders. It provides a wide array of technical analysis tools, charting capabilities, and customizable indicators that allow traders to analyze market trends, identify patterns, and make informed trading decisions.

Deposits & Withdrawals

Difx provides the convenience of depositing and withdrawing funds using Mastercard and VISA, two widely recognized and accepted payment methods globally. The process typically involves linking the card to the trading account, entering the desired deposit amount, and initiating the transaction.

User Exposure on WikiFX

On our website, you can see that reports of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

Difx offers live chat. With live chat, customers can get their questions answered quickly and receive help with any issues they may have. It's a convenient and effective communication channel that can improve customer satisfaction and increase sales.

Customers can visit their office or get in touch with customer service line using the information provided below:

Email: support@difx.com

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, Instagram, YouTube and Linkedin.

Difxoffers online messaging as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform. Online messaging can be a convenient way to get real-time assistance or to engage in discussions with fellow traders.

Conclusion

In conclusion, Difx is a trading platform that offers a range of services to its clients. The platform provides access to various financial markets, allowing traders to diversify their portfolios and capitalize on different trading opportunities. With its user-friendly interface and advanced charting tools, Difx's trading platform, MT5, caters to the needs of both beginner and advanced traders.

However, Difx doesnt have regulation. Therefore, traders should verify the regulatory status of Difx or any broker they choose to work with to ensure compliance with industry standards and regulatory requirements.

Frequently Asked Questions (FAQs)

| Q 1: | Is Difx regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at Difx? |

| A 2: | You can contact via email, support@difx.com. |

| Q 3: | Does Difx offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does Difx offer the industry leading MT4 & MT5? |

| A 4: | Yes. It offers MT5. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Read more

A Comprehensive Guide to Hedge Funds: Definition, Structure & Strategies

Did you stumble upon the term ‘Hedge Funds’ in pursuit of wealth creation? Want to know more details about them, such as their definition, benefits, structure, strategies, etc? We’ve got you! Firstly, let us define hedge funds as private investment funds that collect money from institutional investors or wealthy individuals with the goal of achieving greater returns. To outperform the broader market, these funds incorporate strategies such as derivatives, leverage and short selling. Read on to know more about how these funds work.

An Insightful Guide to the Importance of Forex Trading

The forex market, with an average trading volume of approximately $7.51 trillion per day, presents a wide range of avenues for traders, banks and other institutions engaged in this space. This market facilitates global trade and investment, offers hedging options for risk management, provides them with liquidity and profit accessibility, and ensures economic integration globally. Read on to know the utility of forex trading.

Forex Market Liquidity Explained: Definition, Importance & Key Insights

The global forex market involves the trading of different currencies worth trillions of dollars. It functions like a decentralized network of participants trading various currency pairs, with demand and supply forces influencing their pricing. Forex traders are not just individuals; they also include banks and other financial institutions. However, the forex market's liquidity is what keeps it growing. But what exactly is forex liquidity, and why does it matter to traders? Let’s find out in this article.

Top 5 Forex Trading Risks Every Trader Must Handle Smartly

Forex trading is a dynamic market with fast-changing investor sentiments due to several economic, political and technical factors. So, while the profit avenues are massive, there is no denying the forex trading risks that can erode your capital value if not strategized properly. In this article, we will let you know of the top five forex trading risks you should handle effectively. Let’s begin!

WikiFX Broker

Latest News

WikiEXPO Global Expert Interviews:Stanislav Bublik Building Market Integrity and Product Innovation

IQ Option Scam Alert: Withdrawal Issues and Fraud

How a Facebook Investment Scam Cost a Retiree RM76,740

IG Group Acquires Independent Reserve for £86.8M

JP Markets Review: Is This FX Broker Really Worth Investing? Know the Truth!

Defcofx Review – Is This Platform Right for Investing in Forex?

Binarycent’s Traders are Hopeless and Hapless as Withdrawal Denials, Login Issues & More

WikiEXPO 2025 Cyprus “Welcome Party” Kicks Off Tonight in Limassol

Pros, Cons & Reality of Investing in Forex

Axi CCO Louis Cooper to Retire in Sept 2025

Rate Calc