Comprehensive OANDA Review of Regulation, Account Types & More

Abstract:Discover if OANDA is a trustworthy broker. Explore its global regulations, account types, fees, deposit methods, trading platforms, and more in this detailed review.

| OANDA Broker Overview | |

| Feature | Details |

| Founded | 1996 |

| Registered Country/Region | United States |

| Regulation | ASIC, FCA, FSA, NFA, CIRO, MAS |

| Market Instruments | Forex, Cryptocurrencies, Commodities, Indices |

| Demo Account | Available |

| Leverage | Up to 50:1 for Forex, No leverage for Cryptos |

| Spread | From 0.1 pips (depending on account type) |

| Trading Platforms | OANDA Web Platform, MetaTrader 4, TradingView, Mobile Apps |

| Minimum Deposit | No minimum deposit (Premium account requires USD 20,000 minimum) |

| Customer Support | Office: 17 State Street, Suite 300, New York, NY 10004-1501 |

What Is OANDA?

OANDA is a global online trading platform that was established in 2001 and is registered in the United States. It is regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). OANDA provides trading services in a variety of markets, including Forex, cryptocurrencies, commodities, and indices.

The platform is widely recognized for its low spreads, user-friendly tools, and robust educational resources. These features make it suitable for both beginner and experienced traders. OANDA also offers demo accounts, allowing users to practice trading with virtual funds before trading with real money.

For Forex trading, OANDA provides flexible leverage options. Traders can access the platform through MetaTrader 4 (MT4), TradingView, or its own proprietary OANDA trading platform, giving them multiple options to execute their trades.

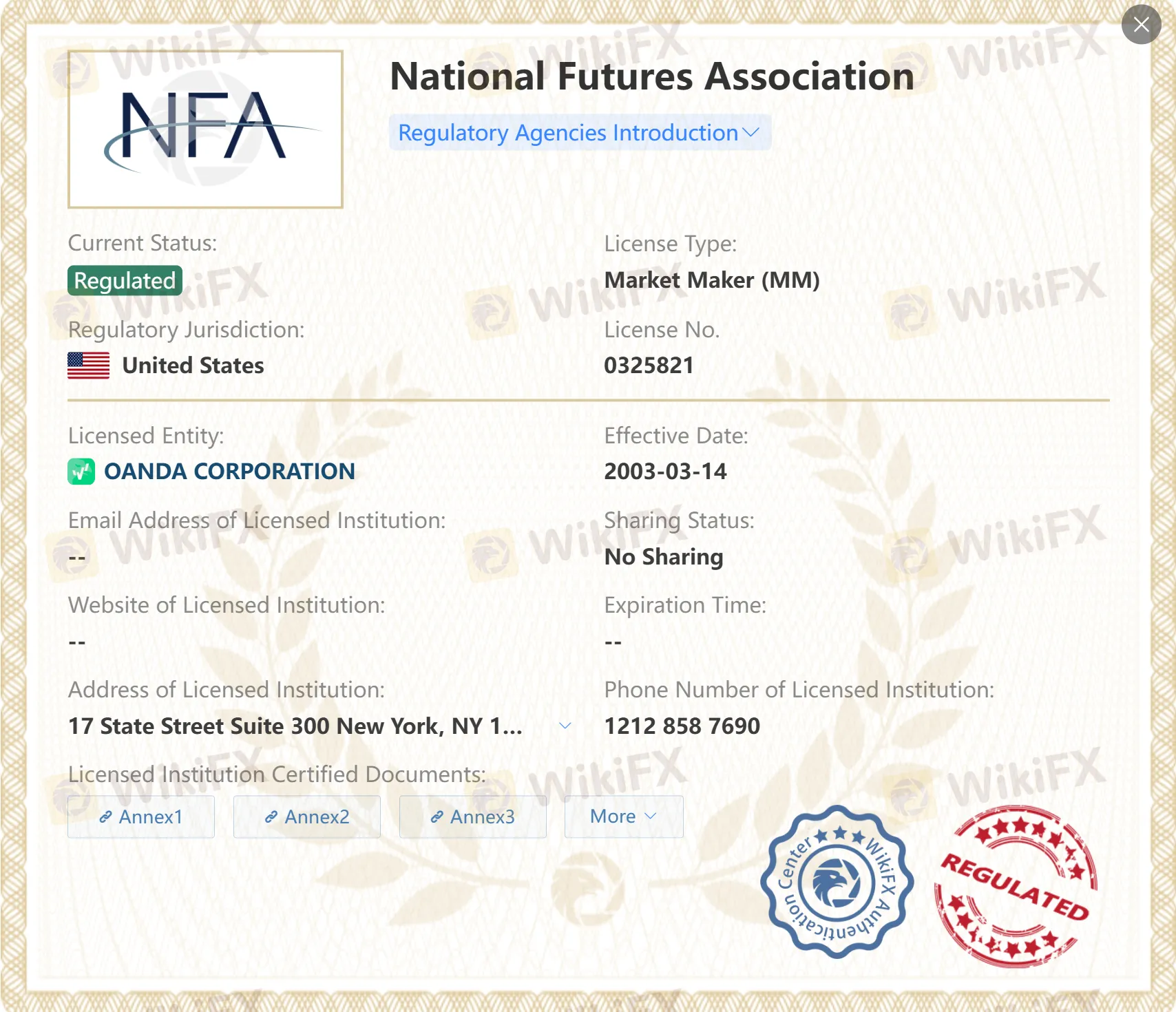

Is OANDA Legit?

OANDA is a well-regulated broker with oversight from several major financial regulatory bodies. Here's a summary of OANDA's regulatory information:

| Regulatory Agency | Status | License Type | Regulatory Jurisdiction | License Number | Licensed Entity |

| Australian Securities and Investments Commission (ASIC) | Regulated | Market Maker (MM) | Australia | 412981 | OANDA AUSTRALIA PTY LTD |

| Financial Conduct Authority (FCA) | Regulated | Market Maker (MM) | United Kingdom | 542574 | OANDA Europe Limited |

| Financial Services Agency (FSA) | Regulated | Retail Forex License | Japan | 関東財務局長(金商)第2137号 | OANDA証券株式会社 |

| National Futures Association (NFA) | Regulated | Market Maker (MM) | United States | 325821 | OANDA CORPORATION |

| Canadian Investment Regulatory Organization (CIRO) | Regulated | Market Maker (MM) | Canada | Unreleased | OANDA (Canada) Corporation ULC |

| Monetary Authority of Singapore (MAS) | Regulated | Retail Forex License | Singapore | Unreleased | OANDA ASIA PACIFIC PTE. LTD. |

What Can I Trade on OANDA?

OANDA offers a variety of tradable instruments, including:

| Market Instrument | Available? |

| Forex | ✅ |

| Cryptocurrencies | ✅ |

| Commodities | ✅ |

| Indices | ✅ |

| Stocks | ❌ |

| ETFs | ❌ |

| Options | ❌ |

What Are the Account Types and Fees on OANDA?

OANDA provides several account types tailored to different needs:

| Account Type | Minimum Deposit | Leverage | Spreads | Commission |

| Standard Account | No minimum | Up to 50:1 (Forex) | From 0.1 pips | None |

| Premium Account | USD 20,000+ | Up to 50:1 (Forex) | From 0.1 pips | Discounts on Spreads |

| Demo Account | None | None | Virtual funds | None |

What Trading Platforms Does OANDA Offer?

OANDA supports multiple trading platforms to cater to various user preferences:

| Platform | Device | Target Audience |

| OANDA Web Platform | Web (Desktop, Mobile) | Beginner to Advanced Traders |

| MetaTrader 4 (MT4) | Desktop, Mobile, Tablet | Advanced Traders (Automated Trading) |

| TradingView | Web (Desktop, Mobile) | Chart Enthusiasts, Advanced Traders |

| OANDA Mobile App | Mobile | On-the-Go Traders |

What Are the Deposit and Withdrawal Methods on OANDA?

OANDA supports a variety of deposit and withdrawal methods:

| Deposit Method | Fees | Processing Time |

| Bank Wire Transfer | No fees from OANDA | 1-3 business days |

| Debit Card (Visa/Mastercard) | No fees from OANDA | Immediate |

| ACH Transfer | No fees from OANDA | Immediate (for Instant ACH) |

Risk Disclaimer: Trading involves significant risk, and it is not suitable for everyone. You should only trade with money that you can afford to lose. Please ensure you understand the risks involved and seek independent advice if necessary. OANDA offers leverage on Forex, but be aware that leverage can magnify both gains and losses. Always trade responsibly.

Ready to start trading with OANDA? Open an account today and take advantage of their competitive spreads and advanced trading tools.

Read more

FIBO Group Under the Lens: Disappearing Deposits & Withdrawal Problems Explained

FIBO Group has grabbed attention from traders for mostly the wrong reasons, as traders have accused the broker of causing financial losses using malicious tactics. Whether it is about withdrawal access, deposit disappearance, trade manipulation, or awful customer support service, the broker is receiving flak from traders on all aspects online. Our team accumulated a list of complaints against the FIBO Group broker. Let’s screen these with us in this FIBO Group review article.

GMO-Z.com Review: Do Traders Face Unfair Tax Payment on Withdrawals?

Do you have to pay taxes or margin when seeking fund withdrawals from GMO-Z.com, a Thailand-based forex broker? Do you witness heavy slippage when trading on the broker’s platform? These are some complaints traders have made against the broker. In this GMO-Z.com review article, we have explained these complaints. Take a look!

EO Broker Review: Why You Should Avoid It

EOBroker Review shows a low WikiFX score of 1.33/10. No regulation, fake license, and unsafe trading make this broker dangerous.

Pocket Broker Review: Why Traders Should Avoid It

Pocket Broker review highlights user complaints of blocked accounts, rejected withdrawals, and fraudulent practices.

WikiFX Broker

Latest News

TEMO Review 2025: Institutional Audit & Risk Assessment

FIBO Group Under the Lens: Disappearing Deposits & Withdrawal Problems Explained

Is GMG Safe or a Scam? A 2026 Deep Dive

FBS Review: The "Balance Fixed" Trap and the $30,000 Ghost Candle

Pocket Broker Review: Why Traders Should Avoid It

Why Southeast Asia Can’t Stop Online Scams

Gold and Silver Buckle Under BCOM Rebalancing Weight Ahead of Critical NFP

Trump Triggers Fiscal Jitters with $1.5tn Defense Ambition Funded by Tariffs

Is Assexmarkets Legit or a Scam? 5 Key Questions Answered (2025)

TibiGlobe Review 2025: Institutional Audit & Risk Assessment

Rate Calc