Pepperstone

Abstract:Pepperstone is a Forex and CFD broker founded in 2010 in Melbourne, Australia. The company has quickly grown to become one of the largest Forex and CFD brokers in the world with over 150,000 clients across the globe. Pepperstone is regulated by top-tier financial authorities, including the Australian Securities and Investments Commission (ASIC), the UK Financial Conduct Authority (FCA), etc. It offers a wide range of trading instruments including forex, indices, commodities, and cryptocurrencies.

| Quick Pepperstone Review Summary | |

| Founded | 2010 |

| Headquarters | Melbourne, Australia |

| Regulation | ASIC, CySEC, FCA, DFSA, SCB (Offshore) |

| Market Instruments | Forex, shares, ETFs, indices, commodities, currency indices, cryptocurrencies, CFD forwards |

| Demo Account | ✅(30 days, $50,000 virtual funds) |

| Account Type | Razor, Standard, Swap-free, Pro |

| Min Deposit | $0 |

| Leverage | Up to 1:200 (Retail)/1:500 (Professional) |

| EUR/USD Spread | Average 1.1 pips (Standard account) |

| Trading Platforms | TradingView, MT4/5, Pepperstone platform, cTrader |

| Copy/Social Trading | ✅ |

| Payment Methods | Apple Pay, Google Pay, Visa, MasterCard, Bank Transfer, PayPal, Neteller, Skrill, Union Pay, and USDT |

| Customer Support | 24/7 |

| Tel: +1786 628 1209 | |

| Email: support@pepperstone.com, marketing@pepperstone.com | |

Pepperstone Information

Pepperstone is a Forex and CFD broker founded in 2010 in Melbourne, Australia. The company has quickly grown to become one of the largest Forex and CFD brokers in the world with over 150,000 clients across the globe. Pepperstone is regulated by top-tier financial authorities, including the Australian Securities and Investments Commission (ASIC), the UK Financial Conduct Authority (FCA), etc. It offers a wide range of trading instruments including forex, commodities, indices, currency indices, cryptocurrencies, shares, and ETFs.

Pros & Cons

| Pros | Cons |

| • Regulated by reputable financial authorities including ASIC, CySEC, FCA, DFSA, SCB (Offshore) | • High minimum deposit for swap-free accounts |

| • Multiple account options and funding methods | • No clear info on deposits and withdrawals |

| • Low spreads and commissions, particularly for active traders | |

| • Advanced trading platforms including MT4, MT5, cTrader, and TradingView | |

| • Negative balance protection |

Is Pepperstone Legit?

Pepperstone, a reputable and respected online broker, has five regulated entities, operating under a strong regulatory framework globally.

| Regulated Country | Regulated by | Current Status | Regulated Entity | License Type | License Number |

| ASIC | Regulated | PEPPERSTONE GROUP LIMITED | Market Making (MM) | 000414530 |

| CySEC | Regulated | Pepperstone EU Limited | Market Making (MM) | 388/20 |

| FCA | Regulated | Pepperstone Limited | Straight Through Processing (STP) | 684312 |

| DFSA | Regulated | Pepperstone Financial Services (DIFC) Limited | Retail Forex License | F004356 |

| SCB | Offshore Regulated | Pepperstone Markets Limited | Retail Forex License | SIA-F217 |

PEPPERSTONE GROUP LIMITED, its entity in Australia, is regulated by ASIC under license no. 414530.

Pepperstone EU Limited, its entity in Cyprus, regulated by CYSEC under license no. 388/20.

Pepperstone Limited, this broker's anothe entity in the UK, is regulate by the FCA under license no. 684312.

Pepperstone Financial Services (DIFC) Limited, its entity in the United Arab Emirates, operates under the DFSA regulation, with license no. F004356.

Pepperstone Markets Limited, its global entity, is regulated by SCB offshore, with license no. SIA-F217.

How are you protected?

Pepperstone has implemented a number of measures to ensure the safety and protection of its clients' funds and personal information.

More details can be found in the table below:

| Client Protection Measures | Detail |

| Regulation | ASIC, CySEC, FCA, DFSA, SCB (Offshore) |

| Segregated Accounts | Ensuring that client funds are protected in the event of company insolvency |

| Negative Balance Protection | Clients can not lose more than their account balance |

| Two-Factor Authentication | Providing an additional layer of security to protect against unauthorized access to their trading accounts |

| Encryption Technology | To protect client information and transactions from potential threats such as hacking or fraud |

| Investor Compensation Scheme | Provide protection to clients in the event of financial loss or misconduct by the broker |

Our Conclusion on Pepperstone Reliability:

Overall, Pepperstone uses advanced security measures to protect its clients' personal and financial information. The broker's commitment to transparency, and customer satisfaction makes it a trustworthy choice for traders.

Market Instruments

Pepperstone offers various trading instruments across multiple asset classes, including:

Forex: Major, minor and exotic currency pairs, including USD/EUR, AUD/USD, EUR/GBP, and more.

Stocks: Trading of popular global stocks including Apple, Amazon, Google, etc.

Indices: CFDs on global indices, including S&P 500, FTSE 100, Nikkei 225, and more.

Commodities: CFDs on gold, silver, oil, and other popular commodities.

Cryptocurrencies: Trading of popular cryptocurrencies including Bitcoin, Ethereum, Litecoin, etc.

| Asset Class | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Currency indices | ✔ |

| Cryptocurrencies | ✔ |

| Shares | ✔ |

| ETFs | ✔ |

| Bonds | ❌ |

| Options | ❌ |

Accounts/Fees

Pepperstone offers two types of CFD trading accounts, including Razor and Standard accounts.

| Razor | Standard | |

| Best for | Experienced traders | Beginners |

| Minimum Deposit | 0 | |

| Account Currencies | USD, EUR, GBP, AUD, CAD, CHF, JPY, NZD, SGD, HKD | |

| Trading Platform | MT4/5, cTrader, TradingView, Pepperstone platform | MT4/5, cTrader, Pepperstone platform |

| Maximum Leverage (Retail) | 1:200 | |

| Maximum Leverage (Professional) | 1:500 | |

| Market Execution | No dealing desk (NDD) | |

| Minimum Trading Size | 0.01 lots | |

| Maximum Trading Size | 100 lots | |

| Spread | Raw (from 0 pips) | Raw + 1 pip increase |

| Commission (FX Only) | From 3 USD per lot per side | ❌ |

| Stop Out (Retail) | 50% | |

| Stop Out (Professional) | 20% | |

| Scalping | ✅ | ✅ |

| Expert Advisors (EAs) | ✅ | ✅ |

| Hedging | ✅ | ✅ |

| News Trading | ✅ | ✅ |

Pepperstone also offer demo accounts, especially for traders to practice their trading skills and strategies. MetaTrader 4 and 5 demo accounts expire automatically after 30 days unless you have a live funded account and ask Pepperstone to set it to non-expiry for you. However, a non-expiry demo account can still be archived if its non-active after 90 days.

It provides traders with virtual funds to trade with and access to real-time market data, allowing them to simulate trading conditions without risking real money. It is a useful tool for beginners to get familiar with the trading platform and for experienced traders to test new strategies or instruments.

Sawp-free and Pro accounts are also available.

Leverage

Regarding European traders and those whose accounts are registered with Pepperstone UK, the European ESMA law has recently reduced the maximum permitted leverage for security reasons.

On Forex instruments, the maximum leverage allowed for retail clients is 1:30. However, leverage levels are contingent upon the entity's laws, such as international offerings. Pepperstone continues to offer leverage of 1:500 for professional clients on each asset.

Nonetheless, ensure you have a thorough understanding of leverage and how to utilize it intelligently, as an increase in your trading size can have a major impact on your potential earnings or losses.

Trading Platforms

Pepperstone supports a variety of trading platforms, in addition to its proprietary Pepperstone App, it also offers popular TradingView, MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader. These platforms are known for their advanced charting tools, technical analysis capabilities, and automated trading capabilities.

Pepperstone has mobile apps for MT4, MT5 and cTrader and is compatible with Android and iOS devices. Besides, traders at Pepperstone can trade on the official website without downloading any software.

Deposits & Withdrawals

Pepperstone offers various deposit and withdrawal methods for its clients, including: UnionPay, Alipay, Visa, MasterCard, bank transfers, Neteller, Skrill, and U-Payment, USDT (Tether), Google Pay, and Apple Pay.

Pepperstone does not charge any deposit or withdrawal fees. But most International TTs are approximately $20.

Withdrawal forms received after 21:00 (GMT) will be processed the following day. If these are received before 07:00 (AEST) they will be processed on the same day. Withdrawals made by Bank Wire Transfer usually take 3-5 working days to reach your account.

Pepperstone minimum deposit vs other brokers

| Pepperstone | Most Other | |

| Minimum Deposit | $0 | $/€/£100 |

Frequently Asked Questions (FAQs)

Is Pepperstone regulated?

Yes. Pepperstone is regulated by ASIC, CySEC, FCA, DFSA, and SCB (Offshore).

Does Pepperstone offer demo accounts?

Yes.

Does Pepperstone offer industry-standard MT4 & MT5?

Yes. Both MT4 and MT5 are available. Pepperstone also supports cTrader, TradingView, and its proprietary Pepperstone App.

What is the minimum deposit for Pepperstone?

There is no minimum deposit requirement.

Is Pepperstone a good broker for beginners?

Yes. Pepperstone is a good choice for beginners because it is regulated well and offers a wide variety of trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Read more

From CFDs to Crypto: Why Global Brokers Are Moving Deeper into Digital Assets

As regulation matures, brokers are entering crypto at scale. IG Group and Capital.com signal a broader shift toward compliant digital asset trading.

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

The forex market is a happening place with currency pairs getting traded almost non-stop for five days a week. Some currencies become stronger, some become weaker, and some remain neutral or rangebound. If you talk about the Indian National Rupee (INR), it has dipped sharply against major currencies globally over the past year. The USD/INR was valued at around 85-86 in Feb 2025. As we stand in Feb 2026, the value has dipped to over 90. The dip or rise, whatever the case may be, impacts our daily lives. It determines the price of an overseas holiday and imported goods, while influencing foreign investors’ perception of a country. The foreign exchange rates change constantly, sometimes multiple times a day, amid breaking news in the economic and political spheres globally. In this article, we have uncovered details on exchange rate fluctuations and key facts that every trader should know regarding these. Read on!

VPS Review: Do Clients Face Trading Issues Due to Constant Login Errors?

Do you face numerous login errors with VPS, a Vietnam-based forex broker? Did these errors lead to missed opportunities or losses? Does your trading account often have an insufficient balance despite numerous trades on the VPS login? Does the broker compel you to renew your subscription even if it’s not required? These issues have become synonymous with many of its traders. They have highlighted these online. In this VPS review article, we have investigated these issues. Read on!

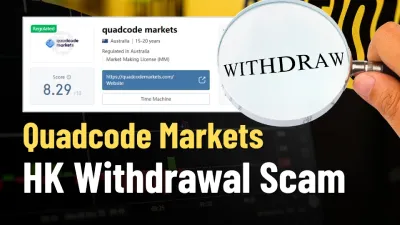

Quadcode Markets HK Withdrawal Scam

HK victims slam Quadcode Markets: Jan 2025 delays, frozen accounts, no replies; “withdrawal too long!” Report scam, recover funds now!

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

The Deriv Review: A Masterclass in Regulatory Smoke and Mirrors

Swissquote Scam Alert: 53/64 Negative Cases Exposed

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

Rate Calc