2025-02-28 21:00

Industry#AITradingAffectsForex

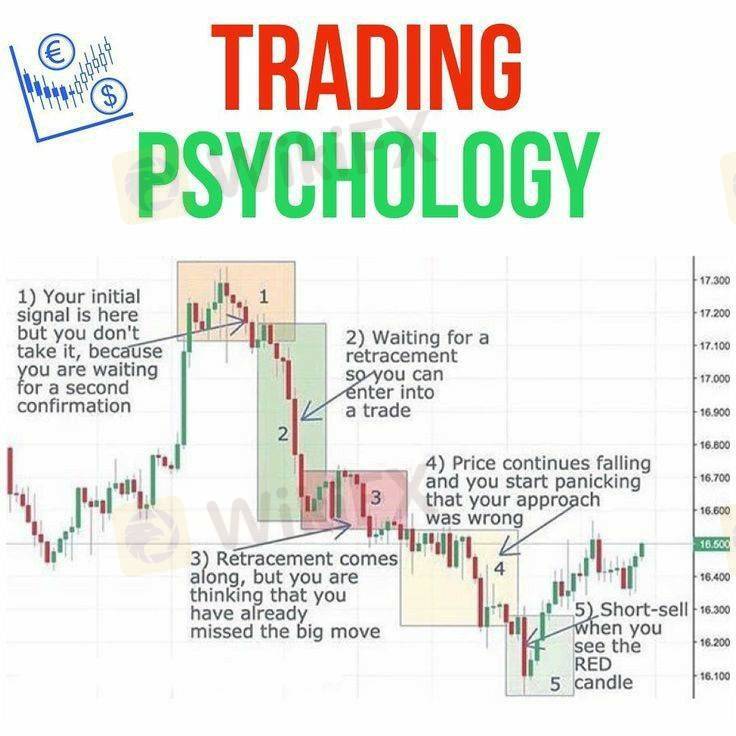

AI AND FOREX TRADING PSYCHOLOGY

AI in Forex trading has become a powerful tool, integrating deep learning, machine learning, and data analytics to improve trading strategies and decision-making. However, the psychology of Forex trading, which heavily influences human traders, is still a critical factor to consider. Here's how AI and Forex trading psychology intersect:

1. AI's Role in Forex Trading

Automation & Algorithmic Trading: AI-driven algorithms can analyze vast amounts of market data and execute trades based on predetermined strategies, eliminating emotional trading that often results from human biases.

Predictive Analytics: AI uses historical data to predict market trends, identify patterns, and provide insights into potential price movements. This can help traders make more informed decisions.

Risk Management: AI systems can continuously monitor risk levels and adjust strategies to ensure that a trader’s capital is protected, avoiding over-leveraging or excessive risk-taking.

24/7 Trading: Unlike humans, AI systems can operate around the clock, analyzing and acting on market conditions without fatigue or emotional fluctuations.

2. Forex Trading Psychology

Emotional Decision-Making: Human traders are often driven by emotions like fear, greed, overconfidence, and impatience, which can lead to poor trading decisions (e.g., holding losing positions too long or chasing after quick profits).

Cognitive Biases: Biases such as confirmation bias (seeking information that supports your position) or loss aversion (the fear of realizing a loss) affect the decision-making process, often leading to suboptimal results.

Stress and Mental Fatigue: The constant pressure to make profitable trades can wear down a trader’s mental state, leading to burnout or decisions driven by emotion rather than logic.

3. AI’s Impact on Human Psychology in Forex Trading

Reducing Emotional Influence: AI removes emotional impulses from trading decisions, helping traders to stick to their strategies without letting feelings like fear or greed take over. This is especially beneficial for novice traders who may struggle with self-control.

Improved Discipline: Since AI follows clear, data-driven rules, traders who use AI tools can rely on them for a more disciplined, consistent approach to trading. This can counteract the tendency for overtrading or impulsive decisions.

Real-time Feedback: AI provides real-time data and alerts, enabling traders to make quicker, more informed decisions. This reduces the mental strain of monitoring multiple markets or assets continuously.

4. Combining Human Psychology with AI Tools

AI as a Tool for Emotional Control: Traders can use AI systems to guide their decisions while maintaining an awareness of their own psychological tendencies. Understanding when to trust the AI versus when to rely on intuition can help balance data-driven decisions with human judgment.

Self-awareness & AI Integration: Traders can incorporate AI-driven strategies while becoming more aware of their emotions and biases. This combination allows for better decision-making, as human traders can step back and let AI take over when emotions start clouding judgment.

Trust and Over-reliance: One potential downside is that traders might become over-reliant on AI systems, ignoring their intuition and judgment. It's important to maintain a balance where AI enhances, but does not entirely replace, the trader's personal strategies and expertise.

5. The Future of AI in Forex Trading Psychology

Hybrid Models: We might see more hybrid approaches where human traders work in tandem with AI, using it for data analysis and execution while maintaining control over strategic decision-making.

AI-Powered Emotional Monitoring: In the future, AI might help traders monitor their psychological states, suggesting when to take breaks or adjust their strategies based on detected emotional stress or decision-making patterns.

Adaptability: AI systems could evolve to better understand the human trader’s psychological tendencies, adapting trading strategies based on both market conditions and the trader's emotional state.

In summary, AI can dramatically improve the discipline, consistency, and logic of Forex trading, reducing the emotional pitfalls that often lead to poor decisions. At the same time, understanding and managing human psychology will still play an important role, as traders must learn to interact with AI tools effectively while maintaining self-awareness and emotional control.

Like 0

FX1283216378

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

#AITradingAffectsForex

| 2025-02-28 21:00

| 2025-02-28 21:00AI AND FOREX TRADING PSYCHOLOGY

AI in Forex trading has become a powerful tool, integrating deep learning, machine learning, and data analytics to improve trading strategies and decision-making. However, the psychology of Forex trading, which heavily influences human traders, is still a critical factor to consider. Here's how AI and Forex trading psychology intersect:

1. AI's Role in Forex Trading

Automation & Algorithmic Trading: AI-driven algorithms can analyze vast amounts of market data and execute trades based on predetermined strategies, eliminating emotional trading that often results from human biases.

Predictive Analytics: AI uses historical data to predict market trends, identify patterns, and provide insights into potential price movements. This can help traders make more informed decisions.

Risk Management: AI systems can continuously monitor risk levels and adjust strategies to ensure that a trader’s capital is protected, avoiding over-leveraging or excessive risk-taking.

24/7 Trading: Unlike humans, AI systems can operate around the clock, analyzing and acting on market conditions without fatigue or emotional fluctuations.

2. Forex Trading Psychology

Emotional Decision-Making: Human traders are often driven by emotions like fear, greed, overconfidence, and impatience, which can lead to poor trading decisions (e.g., holding losing positions too long or chasing after quick profits).

Cognitive Biases: Biases such as confirmation bias (seeking information that supports your position) or loss aversion (the fear of realizing a loss) affect the decision-making process, often leading to suboptimal results.

Stress and Mental Fatigue: The constant pressure to make profitable trades can wear down a trader’s mental state, leading to burnout or decisions driven by emotion rather than logic.

3. AI’s Impact on Human Psychology in Forex Trading

Reducing Emotional Influence: AI removes emotional impulses from trading decisions, helping traders to stick to their strategies without letting feelings like fear or greed take over. This is especially beneficial for novice traders who may struggle with self-control.

Improved Discipline: Since AI follows clear, data-driven rules, traders who use AI tools can rely on them for a more disciplined, consistent approach to trading. This can counteract the tendency for overtrading or impulsive decisions.

Real-time Feedback: AI provides real-time data and alerts, enabling traders to make quicker, more informed decisions. This reduces the mental strain of monitoring multiple markets or assets continuously.

4. Combining Human Psychology with AI Tools

AI as a Tool for Emotional Control: Traders can use AI systems to guide their decisions while maintaining an awareness of their own psychological tendencies. Understanding when to trust the AI versus when to rely on intuition can help balance data-driven decisions with human judgment.

Self-awareness & AI Integration: Traders can incorporate AI-driven strategies while becoming more aware of their emotions and biases. This combination allows for better decision-making, as human traders can step back and let AI take over when emotions start clouding judgment.

Trust and Over-reliance: One potential downside is that traders might become over-reliant on AI systems, ignoring their intuition and judgment. It's important to maintain a balance where AI enhances, but does not entirely replace, the trader's personal strategies and expertise.

5. The Future of AI in Forex Trading Psychology

Hybrid Models: We might see more hybrid approaches where human traders work in tandem with AI, using it for data analysis and execution while maintaining control over strategic decision-making.

AI-Powered Emotional Monitoring: In the future, AI might help traders monitor their psychological states, suggesting when to take breaks or adjust their strategies based on detected emotional stress or decision-making patterns.

Adaptability: AI systems could evolve to better understand the human trader’s psychological tendencies, adapting trading strategies based on both market conditions and the trader's emotional state.

In summary, AI can dramatically improve the discipline, consistency, and logic of Forex trading, reducing the emotional pitfalls that often lead to poor decisions. At the same time, understanding and managing human psychology will still play an important role, as traders must learn to interact with AI tools effectively while maintaining self-awareness and emotional control.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.