2025-02-26 17:36

IndustryAI-powered forex order book analysis for liqui

#AITradingAffectsForex

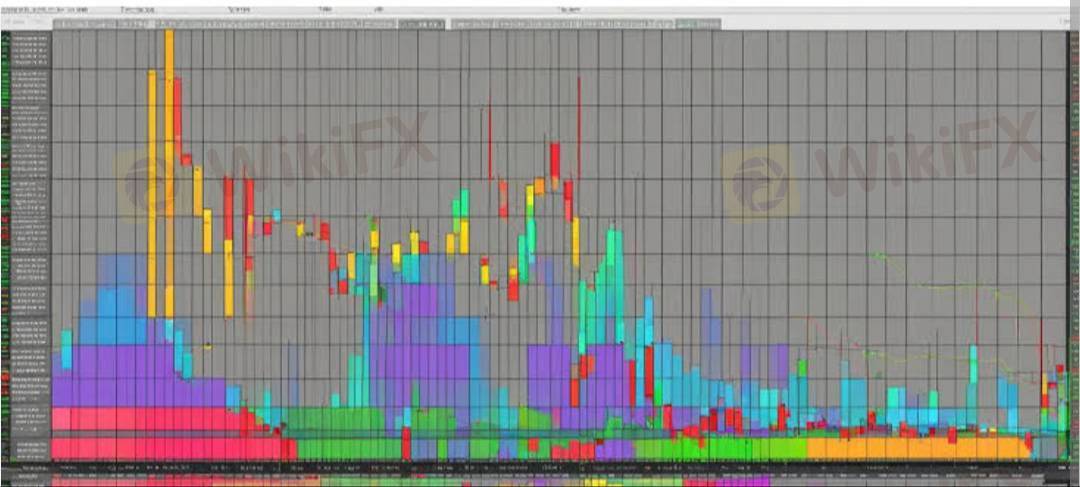

AI-powered forex order book analysis for liquidity trends is an advanced approach that leverages machine learning and data-driven insights to evaluate and predict shifts in liquidity based on real-time market data. The forex order book, which represents the buy and sell orders at various price levels, offers valuable insights into market sentiment, price levels, and potential liquidity imbalances. By utilizing AI techniques, traders can identify patterns, forecast liquidity trends, and optimize their strategies to maximize profitability and minimize risk. Here’s a detailed breakdown of how AI is used to analyze order books and track liquidity trends:

1. Real-Time Order Book Data Analysis

AI algorithms can process vast amounts of real-time order book data to extract meaningful insights about market liquidity trends.

Market Depth Monitoring: AI continuously monitors the market depth (the number of buy and sell orders at various price levels) across different forex pairs and trading venues. It can identify periods of low or high liquidity by analyzing the depth of the order book, as a deeper order book generally indicates more liquidity.

Imbalance Detection: AI models are capable of detecting imbalances between buy and sell orders. For example, if there is an excess of buy orders at a particular price level but few sell orders, AI can predict upward price pressure, signaling a potential liquidity squeeze or price spike.

2. Liquidity Forecasting

AI systems can forecast future liquidity conditions based on historical and real-time order book data, enhancing a trader’s ability to anticipate market trends.

Trend Prediction: By analyzing historical order book data alongside price movements, AI can identify recurring liquidity patterns and market trends. For instance, it may detect periods when liquidity tightens ahead of major economic releases or market events and forecast future liquidity trends, enabling traders to plan their trades accordingly.

Time Series Forecasting: Using machine learning models like Long Short-Term Memory (LSTM) networks or other time series algorithms, AI can predict the future state of the order book based on past patterns. These predictions can help traders understand where the liquidity will likely be concentrated and which price levels might experience liquidity shortages.

3. Liquidity Risk Management

AI helps traders manage liquidity risk by providing real-time insights into the likelihood of liquidity imbalances and helping adjust trading strategies.

Risk Signals: AI models can generate alerts when there is an impending risk of liquidity disruption. For example, if liquidity at a certain price level drops significantly, AI can signal that slippage may occur, enabling traders to adjust their strategy by executing smaller orders or using limit orders to reduce market impact.

Adaptive Position Sizing: Based on liquidity trends identified in the order book, AI can suggest optimal position sizes to avoid excessive slippage during low-liquidity conditions. It can recommend smaller positions in less liquid market segments and larger positions when liquidity is high to maximize execution efficiency.

4. Price Action and Liquidity Trends Correlation

AI analyzes the relationship between price movements and order book liquidity to assess how liquidity affects price volatility.

Price Impact Analysis: By monitoring the relationship between order book depth and price movements, AI can assess how much price impact a trade is likely to have based on liquidity. For example, if there are few orders at certain price levels, even a small trade can cause a significant price move, signaling higher volatility.

Liquidity Gaps Identification: AI can identify liquidity gaps in the order book, where there is little or no liquidity at certain price levels. These gaps can result in rapid price fluctuations or slippage. By identifying these gaps in advance, AI helps traders avoid entering trades during these vulnerable periods or adjust their strategies to mitigate the associated risks.

5. Order Book Clustering and Pattern Recognition

AI can use unsupervised learning techniques, such as clustering algorithms, to identify hidden patterns and trends in order book data that might not be obvious to the human eye.

Clustering Algorithms: AI models like k-means or hierarchical clustering can group similar order book structures together to identify recurring liquidity patterns. For example, AI might detect specific configurations of order book imbalances that historically lead to large price moves, enabling traders to act on these patterns in real-time.

Anomaly Detection: AI can identify anomalies in the order book, such as sudden spikes in order volume or unexpected shifts in liquidity concentration, which may indicate a sudden change in market conditions. These anomalies can help traders anticipate sudden liquidity shifts or potential market disruptions.

6. Market Sentim

Like 0

FX2576976752

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

AI-powered forex order book analysis for liqui

India | 2025-02-26 17:36

India | 2025-02-26 17:36#AITradingAffectsForex

AI-powered forex order book analysis for liquidity trends is an advanced approach that leverages machine learning and data-driven insights to evaluate and predict shifts in liquidity based on real-time market data. The forex order book, which represents the buy and sell orders at various price levels, offers valuable insights into market sentiment, price levels, and potential liquidity imbalances. By utilizing AI techniques, traders can identify patterns, forecast liquidity trends, and optimize their strategies to maximize profitability and minimize risk. Here’s a detailed breakdown of how AI is used to analyze order books and track liquidity trends:

1. Real-Time Order Book Data Analysis

AI algorithms can process vast amounts of real-time order book data to extract meaningful insights about market liquidity trends.

Market Depth Monitoring: AI continuously monitors the market depth (the number of buy and sell orders at various price levels) across different forex pairs and trading venues. It can identify periods of low or high liquidity by analyzing the depth of the order book, as a deeper order book generally indicates more liquidity.

Imbalance Detection: AI models are capable of detecting imbalances between buy and sell orders. For example, if there is an excess of buy orders at a particular price level but few sell orders, AI can predict upward price pressure, signaling a potential liquidity squeeze or price spike.

2. Liquidity Forecasting

AI systems can forecast future liquidity conditions based on historical and real-time order book data, enhancing a trader’s ability to anticipate market trends.

Trend Prediction: By analyzing historical order book data alongside price movements, AI can identify recurring liquidity patterns and market trends. For instance, it may detect periods when liquidity tightens ahead of major economic releases or market events and forecast future liquidity trends, enabling traders to plan their trades accordingly.

Time Series Forecasting: Using machine learning models like Long Short-Term Memory (LSTM) networks or other time series algorithms, AI can predict the future state of the order book based on past patterns. These predictions can help traders understand where the liquidity will likely be concentrated and which price levels might experience liquidity shortages.

3. Liquidity Risk Management

AI helps traders manage liquidity risk by providing real-time insights into the likelihood of liquidity imbalances and helping adjust trading strategies.

Risk Signals: AI models can generate alerts when there is an impending risk of liquidity disruption. For example, if liquidity at a certain price level drops significantly, AI can signal that slippage may occur, enabling traders to adjust their strategy by executing smaller orders or using limit orders to reduce market impact.

Adaptive Position Sizing: Based on liquidity trends identified in the order book, AI can suggest optimal position sizes to avoid excessive slippage during low-liquidity conditions. It can recommend smaller positions in less liquid market segments and larger positions when liquidity is high to maximize execution efficiency.

4. Price Action and Liquidity Trends Correlation

AI analyzes the relationship between price movements and order book liquidity to assess how liquidity affects price volatility.

Price Impact Analysis: By monitoring the relationship between order book depth and price movements, AI can assess how much price impact a trade is likely to have based on liquidity. For example, if there are few orders at certain price levels, even a small trade can cause a significant price move, signaling higher volatility.

Liquidity Gaps Identification: AI can identify liquidity gaps in the order book, where there is little or no liquidity at certain price levels. These gaps can result in rapid price fluctuations or slippage. By identifying these gaps in advance, AI helps traders avoid entering trades during these vulnerable periods or adjust their strategies to mitigate the associated risks.

5. Order Book Clustering and Pattern Recognition

AI can use unsupervised learning techniques, such as clustering algorithms, to identify hidden patterns and trends in order book data that might not be obvious to the human eye.

Clustering Algorithms: AI models like k-means or hierarchical clustering can group similar order book structures together to identify recurring liquidity patterns. For example, AI might detect specific configurations of order book imbalances that historically lead to large price moves, enabling traders to act on these patterns in real-time.

Anomaly Detection: AI can identify anomalies in the order book, such as sudden spikes in order volume or unexpected shifts in liquidity concentration, which may indicate a sudden change in market conditions. These anomalies can help traders anticipate sudden liquidity shifts or potential market disruptions.

6. Market Sentim

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.