2024-11-15 21:53

IndustryPowell helped the dollar rally

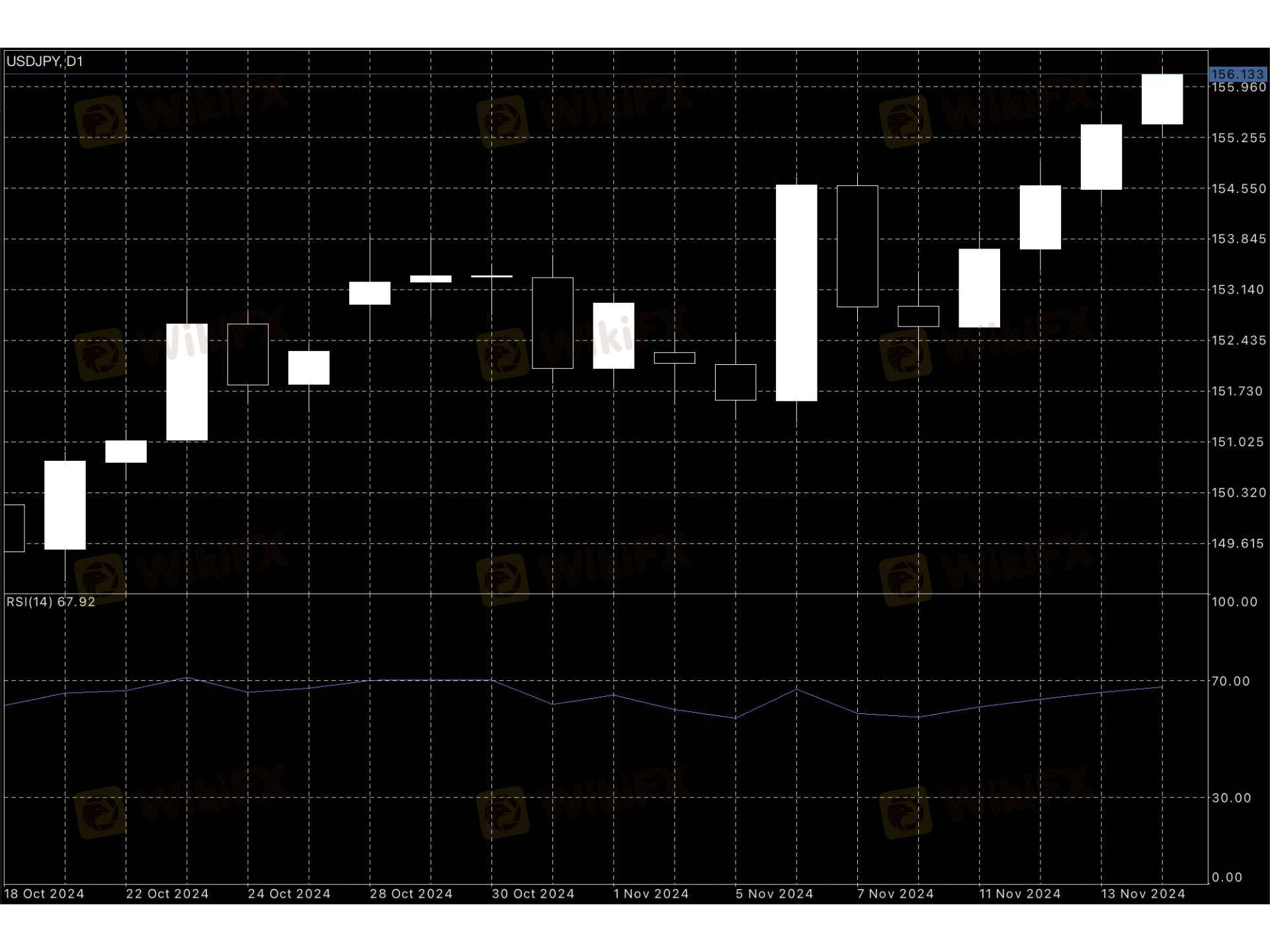

We can see that the dollar index rose to the 107 level yesterday, and then oil fell back, but after Powell's hawkish speech, it resumed to close up 0.36% at 106.87, achieving its fifth consecutive positive close.

After Powell's speech, traders repriced expectations of a rate cut in December, and the probability of a rate cut was reduced. Both initial and continuing claims for jobless benefits were lower than expected, suggesting the labor market may not be functioning as expected. On the other hand,PPI data achieved "three consecutive rises", suggesting that the road of inflation recovery is strongly blocked. The dollar index continued to pull upward, but fell back in overbought conditions.

The Fed will continue with its easing program in the near term, but the lack of progress in further easing inflation means the Fed will slow their rate cuts. Here, the USD/JPY is expected to stabilize around 155 and may rise further to 158 by the first quarter of 2025 before starting to fall back and possibly to 149 by the end of the year.

Like 0

Steven123

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Powell helped the dollar rally

Hong Kong | 2024-11-15 21:53

Hong Kong | 2024-11-15 21:53We can see that the dollar index rose to the 107 level yesterday, and then oil fell back, but after Powell's hawkish speech, it resumed to close up 0.36% at 106.87, achieving its fifth consecutive positive close.

After Powell's speech, traders repriced expectations of a rate cut in December, and the probability of a rate cut was reduced. Both initial and continuing claims for jobless benefits were lower than expected, suggesting the labor market may not be functioning as expected. On the other hand,PPI data achieved "three consecutive rises", suggesting that the road of inflation recovery is strongly blocked. The dollar index continued to pull upward, but fell back in overbought conditions.

The Fed will continue with its easing program in the near term, but the lack of progress in further easing inflation means the Fed will slow their rate cuts. Here, the USD/JPY is expected to stabilize around 155 and may rise further to 158 by the first quarter of 2025 before starting to fall back and possibly to 149 by the end of the year.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.