2024-11-13 19:30

IndustryS&P 500 Forward P/E Ratio Analysis

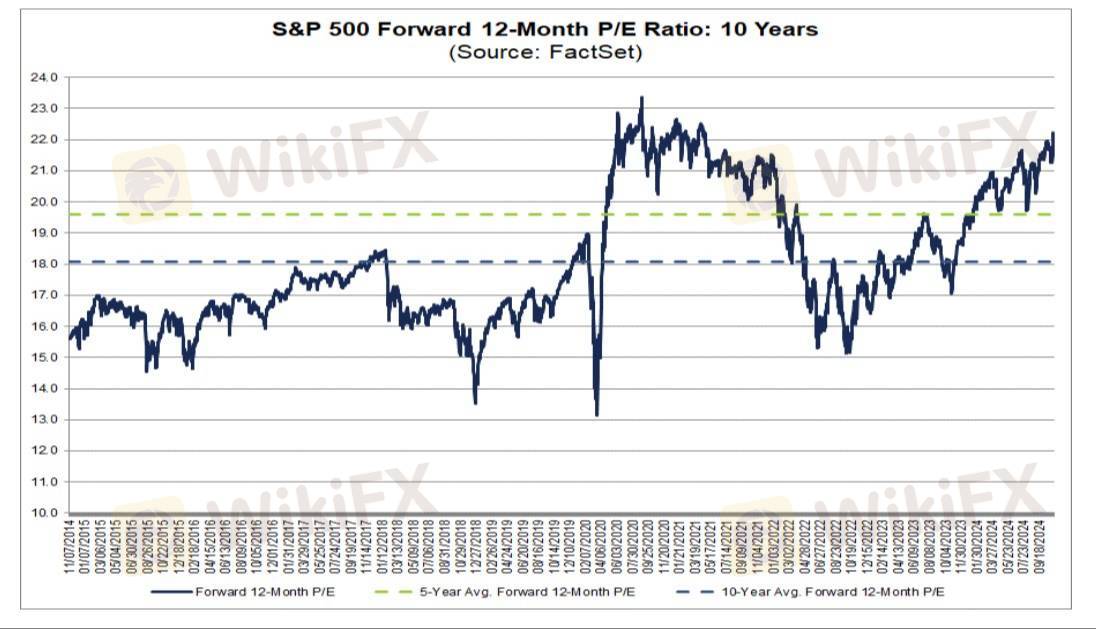

The S&P 500's forward 12-month P/E ratio is currently 22.2, sitting above both the 5-year average of 19.6 and the 10-year average of 18.1. This elevated ratio suggests that investors are paying a premium based on high expectations for future earnings. While it reflects optimism, a P/E ratio this high could also signal potential risks if earnings fail to meet projections, as the market may be vulnerable to corrections. For investors, this calls for a balanced approach, considering both the growth outlook and the risks of an overvalued market.

Like 0

Kevin Cao

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

S&P 500 Forward P/E Ratio Analysis

Hong Kong | 2024-11-13 19:30

Hong Kong | 2024-11-13 19:30

The S&P 500's forward 12-month P/E ratio is currently 22.2, sitting above both the 5-year average of 19.6 and the 10-year average of 18.1. This elevated ratio suggests that investors are paying a premium based on high expectations for future earnings. While it reflects optimism, a P/E ratio this high could also signal potential risks if earnings fail to meet projections, as the market may be vulnerable to corrections. For investors, this calls for a balanced approach, considering both the growth outlook and the risks of an overvalued market.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.