2024-11-13 17:59

IndustryEUR/USD remains bearish

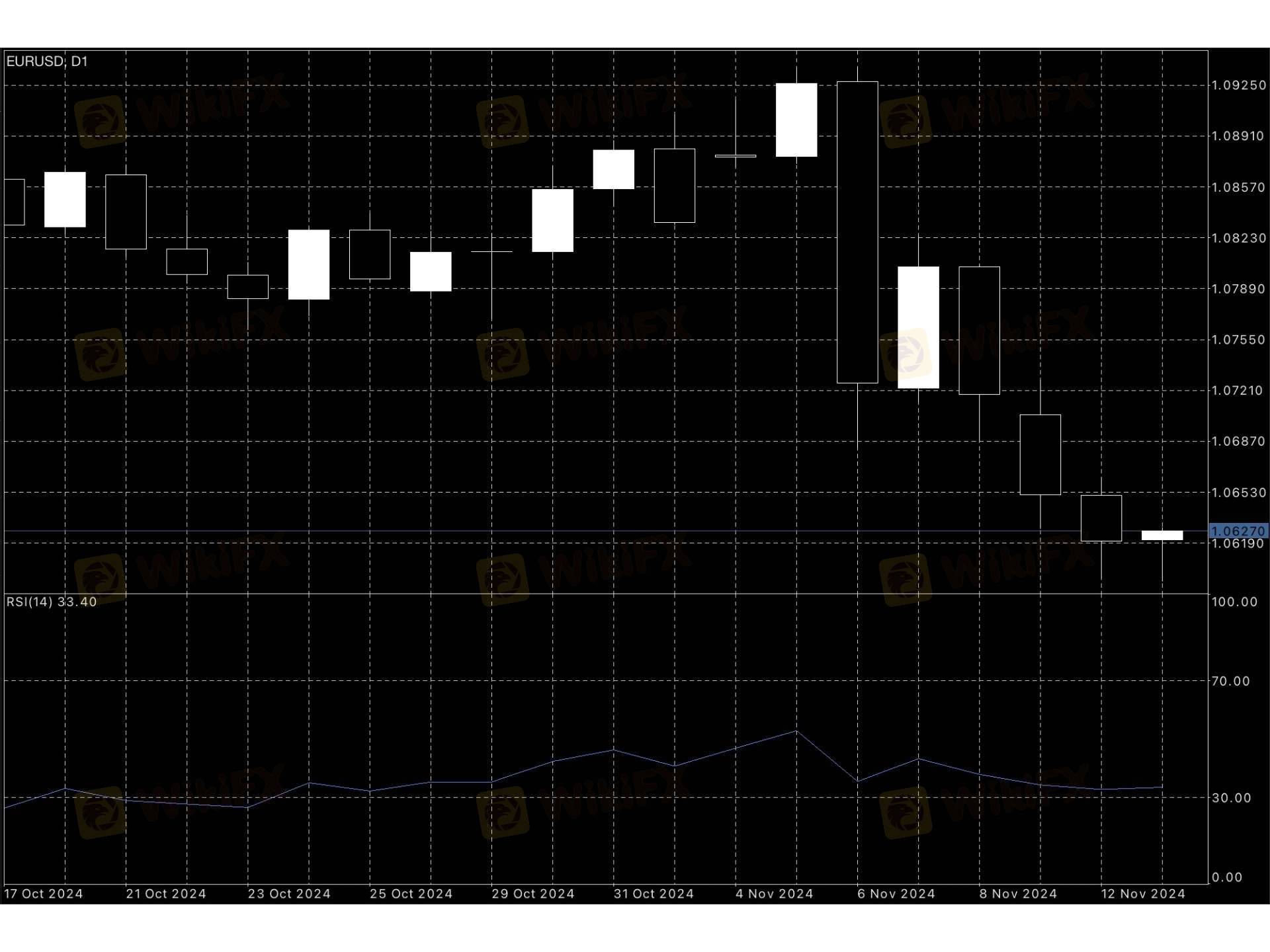

It's not hard to see that the downside in EUR/USD remains strong. Now the important level is 1.0555. On the upside, the "strong resistance" moved down from 1.0760 to 1.0705. Looking ahead, if EurUSD breaks below 1.0555, the next technical target lies at 1.0500.

For now, the downward pressure on EUR/USD is mainly due to the sharp rise in the US dollar, and if the US core CPI rises 0.3% m/m as expected in the October CPI data released today, the EUR/USD may decisively break below the 1.0600 mark.

Despite the recent decline in EUR/USD, it is important to note that the ECB is now widely expected to cut rates more aggressively than the Fed before trade tariffs have an impact on European growth. I think it is entirely possible that the ECB will cut rates by 50 basis points in December. In addition, no matter how EUR/USD rebounds in the short term, it will not change its eventual downward trend, which is expected to fall to 1.0400 by the end of the year.

Like 0

Steven123

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

EUR/USD remains bearish

Hong Kong | 2024-11-13 17:59

Hong Kong | 2024-11-13 17:59It's not hard to see that the downside in EUR/USD remains strong. Now the important level is 1.0555. On the upside, the "strong resistance" moved down from 1.0760 to 1.0705. Looking ahead, if EurUSD breaks below 1.0555, the next technical target lies at 1.0500.

For now, the downward pressure on EUR/USD is mainly due to the sharp rise in the US dollar, and if the US core CPI rises 0.3% m/m as expected in the October CPI data released today, the EUR/USD may decisively break below the 1.0600 mark.

Despite the recent decline in EUR/USD, it is important to note that the ECB is now widely expected to cut rates more aggressively than the Fed before trade tariffs have an impact on European growth. I think it is entirely possible that the ECB will cut rates by 50 basis points in December. In addition, no matter how EUR/USD rebounds in the short term, it will not change its eventual downward trend, which is expected to fall to 1.0400 by the end of the year.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.