2024-11-12 23:10

IndustryUSD/JPY may remain volatile

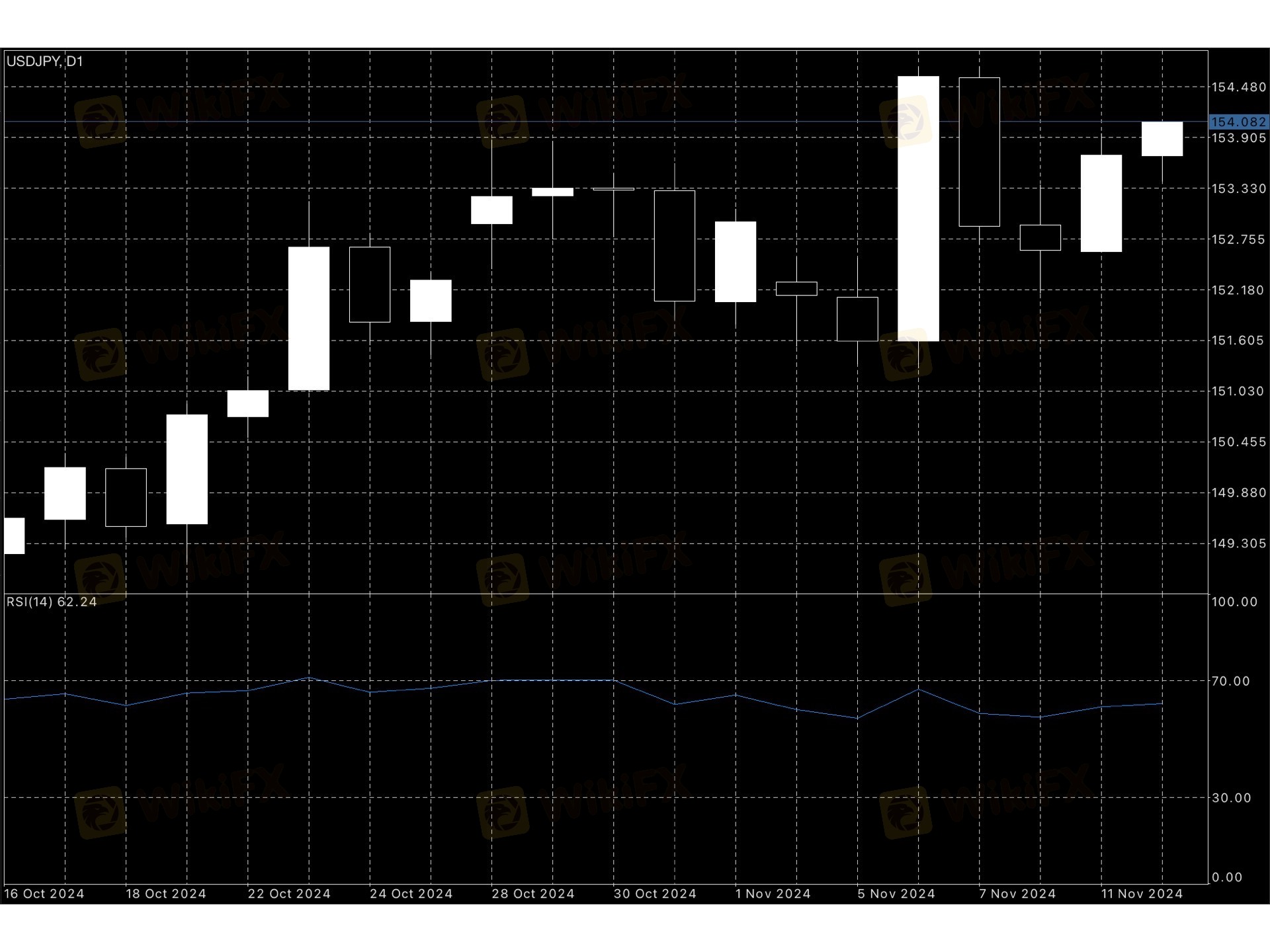

USD/JPY returned to the 154 high on Monday. The rationale for the rally was first the market's disappointment over the pace of interest rate hikes by the Bank of Japan, and then the Trump trade. If we take the drop in the USD/JPY from 162 to 139 as a correction to the uptrend since the start of 2020, a new upward momentum is expected to approach 200. However, the end of this major scenario can only be confirmed if the US Treasury and BOJ act passively if the US and Japan break above the 162 level.

In the near term, USD/JPY's upward momentum has weakened; The USD/JPY is expected to trade in the 151.30-154.70 range.

Like 0

Steven123

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

USD/JPY may remain volatile

Hong Kong | 2024-11-12 23:10

Hong Kong | 2024-11-12 23:10USD/JPY returned to the 154 high on Monday. The rationale for the rally was first the market's disappointment over the pace of interest rate hikes by the Bank of Japan, and then the Trump trade. If we take the drop in the USD/JPY from 162 to 139 as a correction to the uptrend since the start of 2020, a new upward momentum is expected to approach 200. However, the end of this major scenario can only be confirmed if the US Treasury and BOJ act passively if the US and Japan break above the 162 level.

In the near term, USD/JPY's upward momentum has weakened; The USD/JPY is expected to trade in the 151.30-154.70 range.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.