2024-11-11 05:14

IndustryAUD/USD weekly outlook

AUD/USD snapped a 5-week losing streak with a marginal 0.3% gain. But it was the most volatile week since April thanks to the US election, and volatility is expected to remain elevated.With Donald Trump set to return to the Whitehouse, he will likely remain a key driver for sentiment and therefor AUD/USD. It also means AUD/USD will likely retain its strong positive correlation with the Chinese yuan, which will make it sensitive to headline risk surrounding US and China relations. We have a host of Fed members speaking, who now have even less reason to be overly dovish given Trump 2.0 on the horizon.

I doubt Australia’s wage price index will tell us anything more than the hotter-then-expected CPI and PPI reports haven’t already, but it is the biggest domestic economic figure released this week. Also note that the RBA governor speaks this week at the ASIC annual forum.US CPI is the biggest release from the US, with some headlines suggesting it will move sideways in this month’s report. And that will do little to move the needle for the Fed, and it remains up in the air as to whether we can expect another cut in December. Of course, a hot report likely weighs on AUD/USD on bets of a more hawkish Fed, or sends it higher should it come in soft. US retails sales warrants a look, but overall economic data remains strong outside of the NFP report.

AUD/USD seems to have the tightest relationship with iron ore, given its strong positive readings across the 20, 10 and 3-day timeframes

The USD index is the next best, with strong negative correlations across the 60 and 3-day correlations

The CRB is then the next in line, with strong positive correlations across the 10 and 3-day timeframes

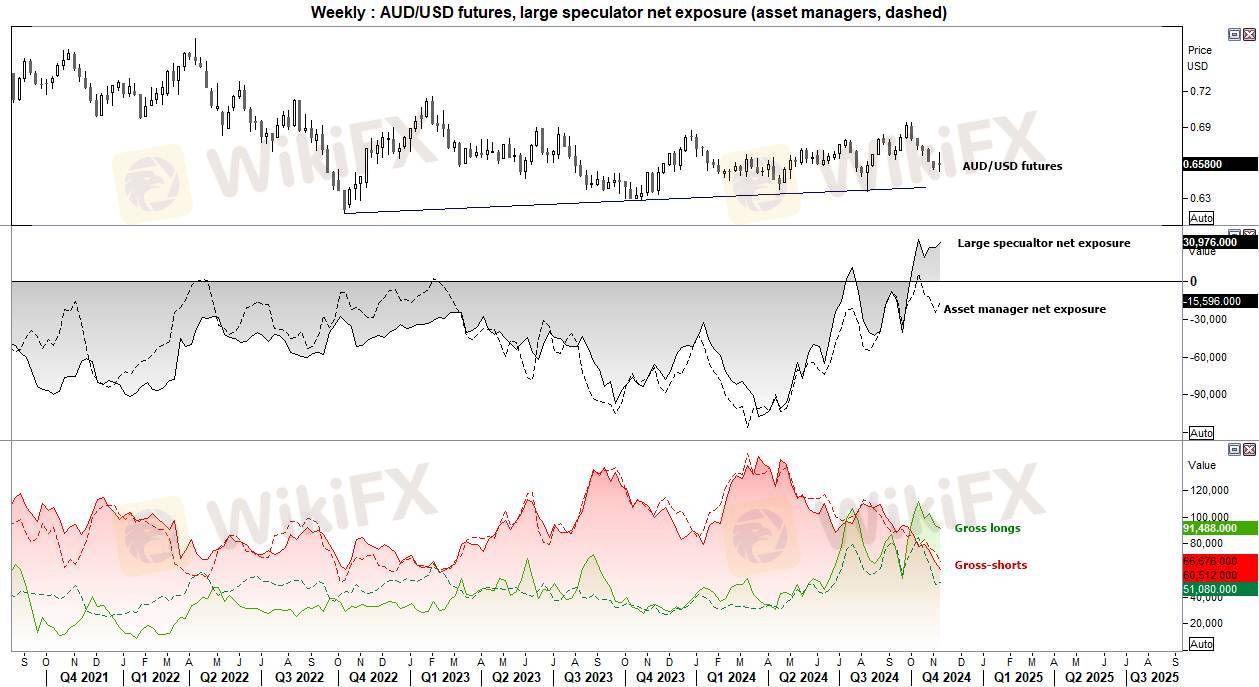

AUD/USD futures – market positioning from the COT report:Large speculators increased their net-long exposure to a 4-week high

However, they trimmed longs by -2.3% (2.2k contracts) and also reduced longs by -8.5% (-5.7k contracts)

Asset managers trimmed net-short exposure for the first week in four, by -8.5k contracts

They marginally increased longs by 3.1% (1.5k contracts) and reduced shorts by -9.5% (-7k contracts)AUD/USD technical analysisAUD/USD snapped its five-week losing streak as I suspect it would. Even if it only increased by a mere 0.34% for the week. It was, however, its most volatile week in 13 with a high-to-low range of 175 pips, or 2.6%. The direction of AUD/USD also alternated between bullish and bearish for the last four days and remains elevated, with Friday’s -1.34% selloff almost erasing Thursday’s 1.65% gain.

I’m now entering this week without much conviction for where it is headed next. If I had to make an assumption, it is that volatility will recede somewhat, yet prices could remain contained within last week’s range. If so, it could see bulls seeking dips around lows and bears fading into rallies towards the highs. But until we get a clear idea of whether a Trump presidency is good or bad for international trade, price action might remain twitchy and vulnerable to headlines.

Like 0

FX1803774651

Participants

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

AUD/USD weekly outlook

| 2024-11-11 05:14

| 2024-11-11 05:14AUD/USD snapped a 5-week losing streak with a marginal 0.3% gain. But it was the most volatile week since April thanks to the US election, and volatility is expected to remain elevated.With Donald Trump set to return to the Whitehouse, he will likely remain a key driver for sentiment and therefor AUD/USD. It also means AUD/USD will likely retain its strong positive correlation with the Chinese yuan, which will make it sensitive to headline risk surrounding US and China relations. We have a host of Fed members speaking, who now have even less reason to be overly dovish given Trump 2.0 on the horizon.

I doubt Australia’s wage price index will tell us anything more than the hotter-then-expected CPI and PPI reports haven’t already, but it is the biggest domestic economic figure released this week. Also note that the RBA governor speaks this week at the ASIC annual forum.US CPI is the biggest release from the US, with some headlines suggesting it will move sideways in this month’s report. And that will do little to move the needle for the Fed, and it remains up in the air as to whether we can expect another cut in December. Of course, a hot report likely weighs on AUD/USD on bets of a more hawkish Fed, or sends it higher should it come in soft. US retails sales warrants a look, but overall economic data remains strong outside of the NFP report.

AUD/USD seems to have the tightest relationship with iron ore, given its strong positive readings across the 20, 10 and 3-day timeframes

The USD index is the next best, with strong negative correlations across the 60 and 3-day correlations

The CRB is then the next in line, with strong positive correlations across the 10 and 3-day timeframes

AUD/USD futures – market positioning from the COT report:Large speculators increased their net-long exposure to a 4-week high

However, they trimmed longs by -2.3% (2.2k contracts) and also reduced longs by -8.5% (-5.7k contracts)

Asset managers trimmed net-short exposure for the first week in four, by -8.5k contracts

They marginally increased longs by 3.1% (1.5k contracts) and reduced shorts by -9.5% (-7k contracts)AUD/USD technical analysisAUD/USD snapped its five-week losing streak as I suspect it would. Even if it only increased by a mere 0.34% for the week. It was, however, its most volatile week in 13 with a high-to-low range of 175 pips, or 2.6%. The direction of AUD/USD also alternated between bullish and bearish for the last four days and remains elevated, with Friday’s -1.34% selloff almost erasing Thursday’s 1.65% gain.

I’m now entering this week without much conviction for where it is headed next. If I had to make an assumption, it is that volatility will recede somewhat, yet prices could remain contained within last week’s range. If so, it could see bulls seeking dips around lows and bears fading into rallies towards the highs. But until we get a clear idea of whether a Trump presidency is good or bad for international trade, price action might remain twitchy and vulnerable to headlines.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.