2024-09-25 03:05

IndustryThe Truth About Forex Market Manipulation.

Forex market manipulation has long been a topic of discussion among traders, with some claiming that it's a widespread practice that affects the integrity of the market. But is there any truth to these claims? In this article, we'll delve into the world of Forex market manipulation, exploring what it is, how it's done, and whether it's a significant concern for traders.

What is Forex Market Manipulation?

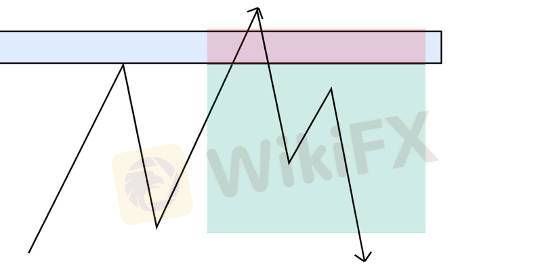

Forex market manipulation refers to the intentional attempt to influence the price of a currency pair or the overall market direction. This can be done through various means, including:

1. Price manipulation: Traders or institutions artificially inflate or deflate prices to create a false market impression.

2. Order flow manipulation: Traders or institutions manipulate order flow to create a false sense of market demand or supply.

3. News manipulation: Traders or institutions spread false or misleading information to influence market sentiment.

How Widespread is Forex Market Manipulation?

While Forex market manipulation does occur, its prevalence is often exaggerated. The majority of market movements are the result of genuine supply and demand forces. However, manipulation can occur in specific circumstances, such as:

1. Thin markets: Manipulation is more likely to occur in thin markets with low liquidity.

2. High-impact events: Manipulation can occur during high-impact events, such as economic data releases or geopolitical events.

3. Collusion: Manipulation can occur when multiple parties collude to influence the market.

Who is Behind Forex Market Manipulation?

Forex market manipulation can be perpetrated by various entities, including:

1. Institutional traders: Large institutions may engage in manipulation to achieve their trading objectives.

2. Individual traders: Some individual traders may attempt to manipulate the market for personal gain.

3. Market makers: Market makers may engage in manipulation to manage their risk exposure.

Like 0

天黑路滑人心杂

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

The Truth About Forex Market Manipulation.

| 2024-09-25 03:05

| 2024-09-25 03:05

Forex market manipulation has long been a topic of discussion among traders, with some claiming that it's a widespread practice that affects the integrity of the market. But is there any truth to these claims? In this article, we'll delve into the world of Forex market manipulation, exploring what it is, how it's done, and whether it's a significant concern for traders.

What is Forex Market Manipulation?

Forex market manipulation refers to the intentional attempt to influence the price of a currency pair or the overall market direction. This can be done through various means, including:

1. Price manipulation: Traders or institutions artificially inflate or deflate prices to create a false market impression.

2. Order flow manipulation: Traders or institutions manipulate order flow to create a false sense of market demand or supply.

3. News manipulation: Traders or institutions spread false or misleading information to influence market sentiment.

How Widespread is Forex Market Manipulation?

While Forex market manipulation does occur, its prevalence is often exaggerated. The majority of market movements are the result of genuine supply and demand forces. However, manipulation can occur in specific circumstances, such as:

1. Thin markets: Manipulation is more likely to occur in thin markets with low liquidity.

2. High-impact events: Manipulation can occur during high-impact events, such as economic data releases or geopolitical events.

3. Collusion: Manipulation can occur when multiple parties collude to influence the market.

Who is Behind Forex Market Manipulation?

Forex market manipulation can be perpetrated by various entities, including:

1. Institutional traders: Large institutions may engage in manipulation to achieve their trading objectives.

2. Individual traders: Some individual traders may attempt to manipulate the market for personal gain.

3. Market makers: Market makers may engage in manipulation to manage their risk exposure.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.