2024-09-22 23:04

IndustryForex Market Analysis

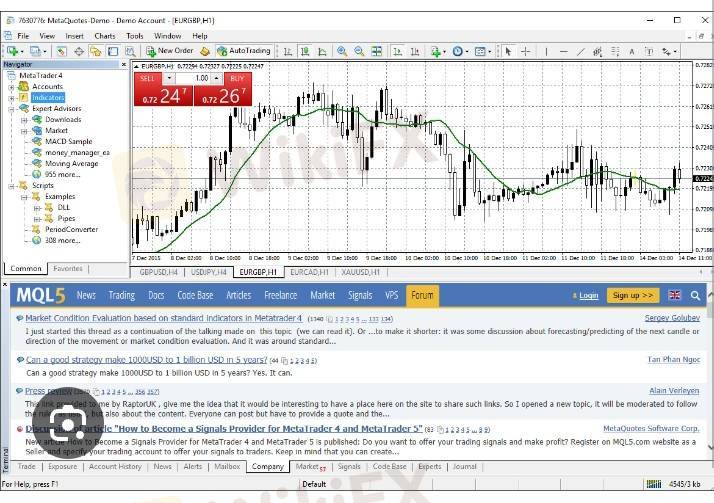

Forex market analysis is the process of evaluating currency pairs to make informed trading decisions. There are three primary methods of analysis:

1. **Technical Analysis**: This approach involves studying historical price movements and chart patterns to forecast future price action. Traders use various tools, including trend lines, support and resistance levels, and indicators like moving averages and Relative Strength Index (RSI).

2. **Fundamental Analysis**: This method focuses on economic indicators, geopolitical events, and central bank policies that influence currency values. Key factors include interest rates, inflation rates, employment data, and Gross Domestic Product (GDP). Traders analyze news releases and economic reports to assess the strength or weakness of a currency.

3. **Sentiment Analysis**: This involves gauging market sentiment, or the overall attitude of traders towards a particular currency or market. It can be assessed through surveys, sentiment indicators, and analyzing trader positions. Understanding market psychology can help traders anticipate potential reversals or continuations in price trends.

Successful forex trading often combines these methods to develop a comprehensive market view, allowing traders to make more informed decisions.

Like 0

别致的依恋

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Forex Market Analysis

| 2024-09-22 23:04

| 2024-09-22 23:04

Forex market analysis is the process of evaluating currency pairs to make informed trading decisions. There are three primary methods of analysis:

1. **Technical Analysis**: This approach involves studying historical price movements and chart patterns to forecast future price action. Traders use various tools, including trend lines, support and resistance levels, and indicators like moving averages and Relative Strength Index (RSI).

2. **Fundamental Analysis**: This method focuses on economic indicators, geopolitical events, and central bank policies that influence currency values. Key factors include interest rates, inflation rates, employment data, and Gross Domestic Product (GDP). Traders analyze news releases and economic reports to assess the strength or weakness of a currency.

3. **Sentiment Analysis**: This involves gauging market sentiment, or the overall attitude of traders towards a particular currency or market. It can be assessed through surveys, sentiment indicators, and analyzing trader positions. Understanding market psychology can help traders anticipate potential reversals or continuations in price trends.

Successful forex trading often combines these methods to develop a comprehensive market view, allowing traders to make more informed decisions.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.