2024-09-21 22:14

IndustryMoving Average Crossover Strategy

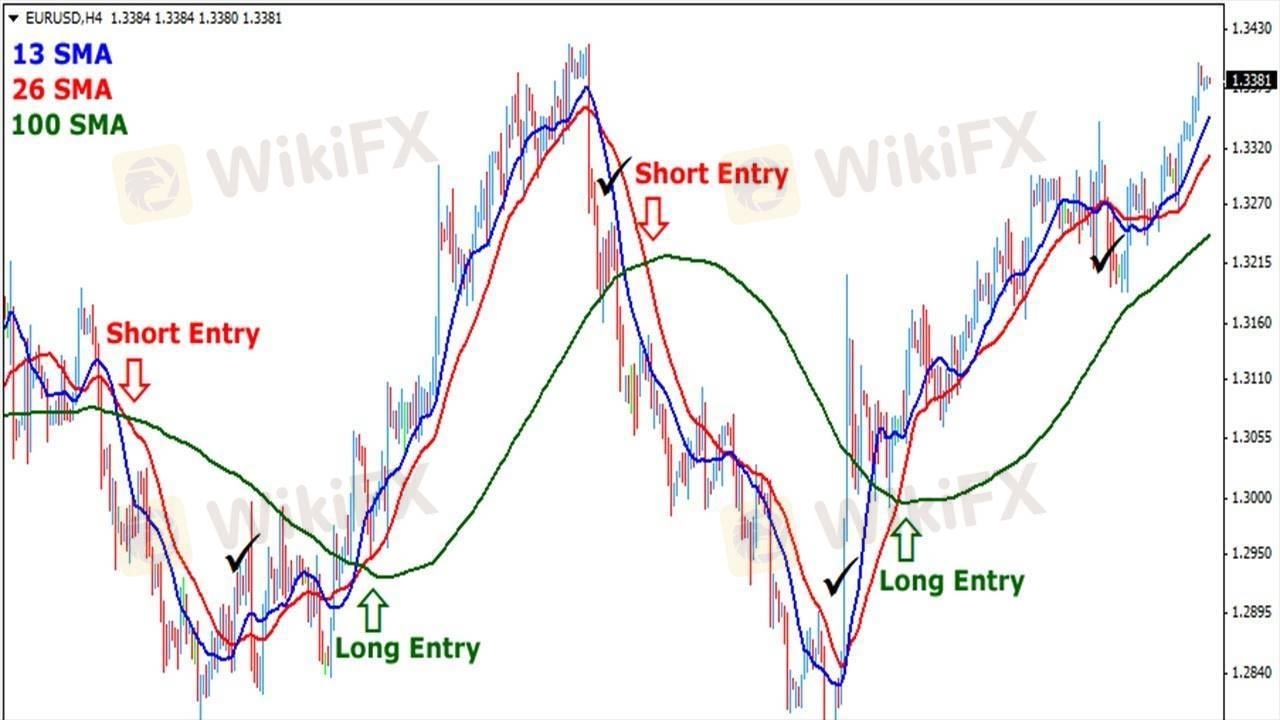

Here's an in-depth look at the Moving Average Crossover Strategy

A popular trading strategy using two moving averages (MA) with different time periods to identify trend reversals.

Key Components:

1. Short-term MA (50-period)

2. Long-term MA (200-period)

3. Crossover: Short-term MA crosses over/under Long-term MA

Trading Strategy:

1. Bullish Signal: Short-term MA crosses above Long-term MA

2. Bearish Signal: Short-term MA crosses below Long-term MA

Trade Entry:

1. Long: Buy when short-term MA crosses above long-term MA

2. Short: Sell when short-term MA crosses below long-term MA

Trade Exit:

1. Take-profit: Set at next resistance/support level

2. Stop-loss: Set below/above previous swing low/high

Advantages:

1. Simple and effective

2. Identifies trend reversals

3. Reduces false signals

Disadvantages:

1. Lagging indicator

2. Requires adjustment for volatility

Tips:

1. Use multiple time frames

2. Combine with other analysis methods

3. Monitor MA slope and distance

Example Trade:

GBP/USD, 4-hour chart:

1. Identify bullish crossover (50-period MA crosses above 200-period MA)

2. Enter long position

3. Set take-profit at next resistance level

4. Set stop-loss below previous swing low

Variations:

1. Golden Cross: 50-period MA crosses above 200-period MA

2. Death Cross: 50-period MA crosses below 200-period MA

3. Multiple MA Crossover: Using 3+ MAs

To master Moving Average Crossover:

1. Experiment with different MA periods

2. Study crossover patterns

3. Adjust for market context

4. Combine with other strategies

Like 0

李强7520

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Moving Average Crossover Strategy

| 2024-09-21 22:14

| 2024-09-21 22:14Here's an in-depth look at the Moving Average Crossover Strategy

A popular trading strategy using two moving averages (MA) with different time periods to identify trend reversals.

Key Components:

1. Short-term MA (50-period)

2. Long-term MA (200-period)

3. Crossover: Short-term MA crosses over/under Long-term MA

Trading Strategy:

1. Bullish Signal: Short-term MA crosses above Long-term MA

2. Bearish Signal: Short-term MA crosses below Long-term MA

Trade Entry:

1. Long: Buy when short-term MA crosses above long-term MA

2. Short: Sell when short-term MA crosses below long-term MA

Trade Exit:

1. Take-profit: Set at next resistance/support level

2. Stop-loss: Set below/above previous swing low/high

Advantages:

1. Simple and effective

2. Identifies trend reversals

3. Reduces false signals

Disadvantages:

1. Lagging indicator

2. Requires adjustment for volatility

Tips:

1. Use multiple time frames

2. Combine with other analysis methods

3. Monitor MA slope and distance

Example Trade:

GBP/USD, 4-hour chart:

1. Identify bullish crossover (50-period MA crosses above 200-period MA)

2. Enter long position

3. Set take-profit at next resistance level

4. Set stop-loss below previous swing low

Variations:

1. Golden Cross: 50-period MA crosses above 200-period MA

2. Death Cross: 50-period MA crosses below 200-period MA

3. Multiple MA Crossover: Using 3+ MAs

To master Moving Average Crossover:

1. Experiment with different MA periods

2. Study crossover patterns

3. Adjust for market context

4. Combine with other strategies

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.