The Trading Pit Spreads, leverage, minimum deposit Revealed

Abstract:The Trading Pit is an award-winning global proprietary trading firm, aiming to challenge the conditions that traders have been working under for years. The Trading Pit boasts that it offers global access to all major asset classes, including forex, stocks, ETFs, Futures, Options, and Cryptos.

| The Trading Pit Review Summary | |

| Founded | 2004 |

| Registered Country/Region | Germany |

| Regulation | Not Regulated |

| Market Instruments | forex, commodities, indices, crypto & stocks CFDs |

| Demo Account | Not Mentioned |

| Leverage | Up to 1:50 |

| Customer Support | support@thetradingpit.com |

| +4232379000 | |

The Trading Pit Information

The Trading Pit is a fintech-focused private equity firm. The platform offers global access to all major asset classes, including forex, commodities, indices, crypto & stocks CFDs on the global markets. It designs different plans for CFDs trading and Futures trading, where clients can choose an evaluation type that aligns most with their trading style and risk tolerance.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

Is The Trading Pit Legit?

The Trading Pit is an unregulated broker. The WHOIS search shows the domain thetradingpit.com was registered on October 13, 2004. Its present state is “client transfer prohibited,” which indicates the domain is locked and cannot be moved to another registrar.

What Can I Trade on The Trading Pit?

The Trading Pit gives clients the opportunity to trade forex, commodities, indices, crypto & stocks CFDs on the global markets.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Stocks | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Crypto | ✔ |

| Shares | ❌ |

| Metals | ❌ |

Trading Plans

The Trading Pit has designed various trading plans or accounts for CFDs trading and Futures trading.

For CFDs trading, you can “Build Your Challenge” with two evaluation types: 1-Phase Evaluation with fast progress and limited drawdowns, and 2-Phase Evaluation with steady progress and extended drawdowns. You can select an initial account balance ranging from $5,000 to $200,000.

You will get your own “Order Summary” based on the selected configuration, detailing parameters like daily and maximum drawdown, profit target, minimum trading days, profit share, and the price.

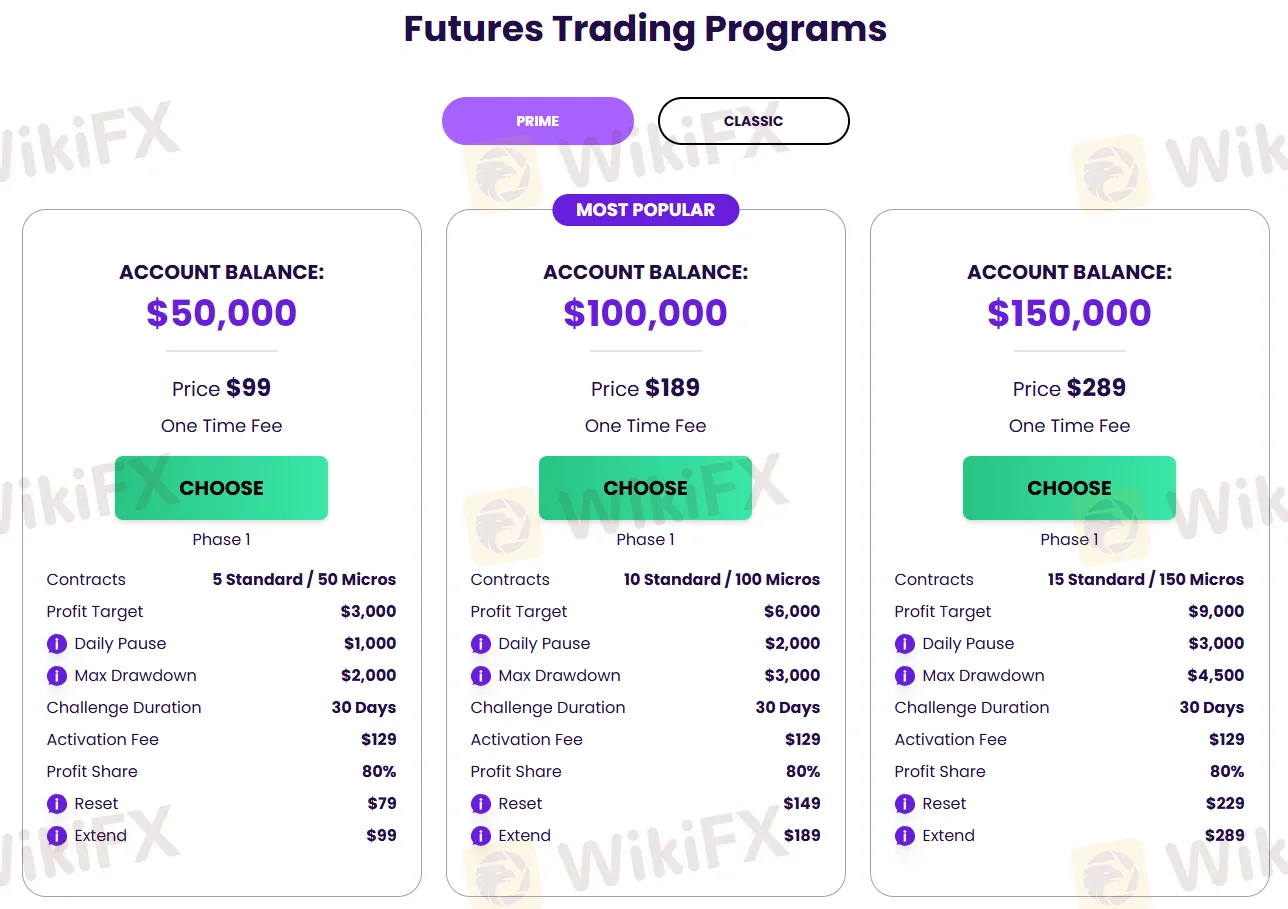

For futures trading, there are PRIME and CLASSIC programs. PRIME offers three plans with the same activation fee of $129 and an 80% share profit. The most popular PRIME program is the $189 contract with an account balance of $100,00.

| Account Balance | Price | Contracts | Daily Pause | Max Drawdown | Reset | Extend |

| $50,000 | $99 | 5 Standard / 50 Micros | $1,000 | $2,000 | $79 | $99 |

| $100,000 | $189 | 10 Standard / 100 Micros | $2,000 | $3,000 | $149 | $189 |

| $150,000 | $289 | 15 Standard / 150 Micros | $3,000 | $4,500 | $229 | $289 |

CLASSIC program offers four plans with no activation fee. If you're starting out or prefer lower risk, the $20,000 plan offers the lowest entry price and drawdown. For higher potential profit share and more trading capacity, consider the $200,000 or $250,000 plans.

| Account Balance | Price | Contracts | Max Drawdown | Profit Share | Reset | Extend |

| $20,000 | $99 | 10 Micros | $500 | Up To 70% | $49 | $99 |

| $150,000 | $169 | 5 Standard / 50 Micros | $3,000 | Up To 70% | $85 | $169 |

| $200,000 | $349 | 7 Standard / 70 Micros | $3,500 | Up To 80% | $179 | $349 |

| $250,000 | $599 | 10 Standard / 100 Micros | $5,000 | Up To 80% | $299 | $599 |

Leverage

The leverage offered for different CFD instruments includes 1:50 for Forex, 1:10 for Metals, Energies, and CFD Cash Indices, and 1:2 for Crypto and Equities.

Deposit and Withdrawal

The Trading Pit supports many payment methods, including Credit Cards, PayPal, Apple Pay, Google Pay, Cryptos, and BinancePay. Online bank transfers are also available based on the region. But other information, like the minimum amount or the fees for deposit and withdrawal, is not provided.

Latest News

New AI laws to arrest deepfakes

Global Macro: Real Wage Growth Expected to Return by 2026

XAU/USD: Gold Rally Signals 'Paradigm Shift' as Middle East Tensions Simmer

MONAXA Review 2026: Comprehensive Safety Assessment

BoC Preview: Macklem to Hold at 2.25% Amidst Trade Anxiety

Fed Holds Rates as Political Storm Intensifies; Trump to Name New Chair Imminently

Meta and Samsung Fuel AI Capex Boom, Keeping Risk Sentiment Alive

Gold Smashes $5,600 Record on Shutdown Fears; Analysts Flash Crash Warning for Silver

FxPro Enhances MetaTrader 5 Execution with New LD4 Cross-Connect

Fed Holds Rates Amidst Political Siege; Dollar Sinks to Four-Year Lows

Rate Calc