AS Expobank Spreads, leverage, minimum deposit Revealed

Abstract:Founded in 2013, Signet Bank offers diverse services for businesses and entrepreneurs. As an unregulated financial institution, they provide loans, investments, and payment services.

| Signet Bank Review Summary | |

| Founded | 2013 |

| Registered Country/Region | Latvia |

| Regulation | No Regulation |

| Services | Loan, Bond issuance, Capital preservation |

| Customer Support | Phone: +371 67 080 000 |

| Fax: +371 67 080 001 | |

| Email: info@signetbank.com | |

Signet Bank Information

Founded in 2013, Signet Bank offers diverse services for businesses and entrepreneurs. As an unregulated financial institution, they provide loans, investments, and payment services.

Pros and Cons

| Pros | Cons |

| Comprehensive service offering | Lack of regulation |

| Significant loan amounts | Unclear fee structure |

Is Signet Bank Legit?

Signet Bank is an unregulated platform. Please be aware of the risk!

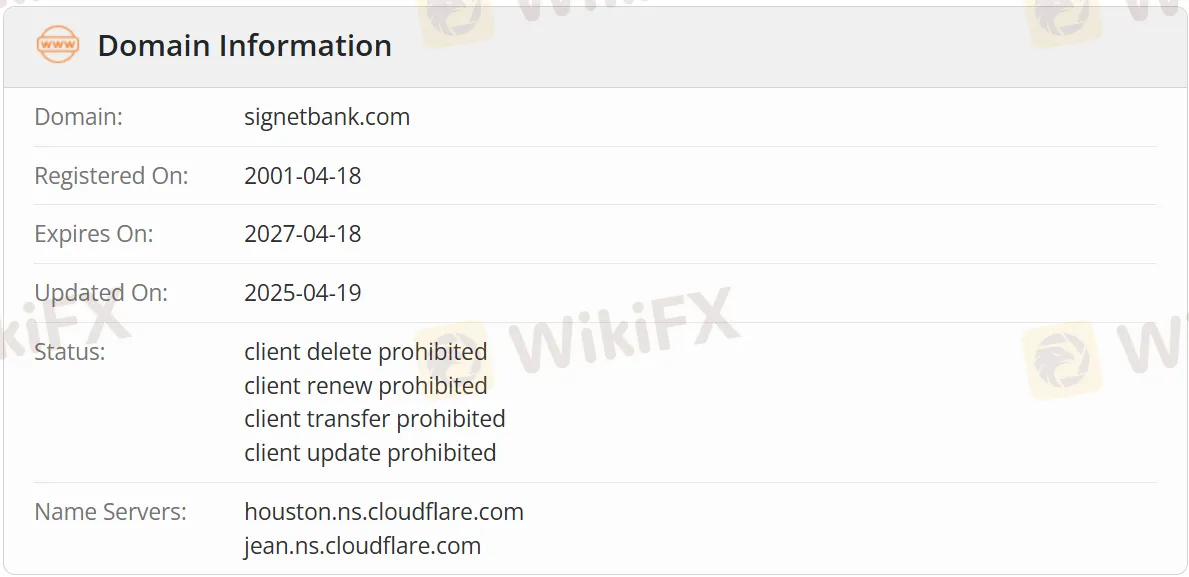

The domain name signetbank.com on WHOIS was registered on April 18, 2001; updated on April 19, 2025; and will expire on April 18, 2027. Its present status is “client delete/renew/transfer/update prohibited”.

Services

Signet Bank offers business growth loans up to 10 million euros, assists companies with bond issuance for additional financing, and provides access to investment markets for capital preservation and growth.

Services for individuals:

Signet Bank offers individual services for everyday use, including current accounts, MasterCard credit, payment cards, and investment options relating to club transactions, the Signet Bond Fund, brokerage services and investment portfolio management, and term deposit services.

Services for entrepreneurs:

Signet Bank has financing accessible to entrepreneurs, such as green financing for sustainable projects, loans for business growth, assistance with organizing bond issues, and short-term loans against financial instrument collateral.

Latest News

Absolute Markets 2025: Is It Scam or Safe? Suitable for Traders in Pakistan?

Offshore Forex Brokers Ramp Up Expansion in Vietnam as Authorities Crack Down on Scams

'Worse Than COVID': Weak US Manufacturing Surveys Signal Stagflation In November

Scam Alert: 8,500 People Duped with Fake 8% Monthly Return Promises from Forex and Stock Investments

UK snack brand Graze to be sold to Jamie Laing\s Candy Kittens

FTMO Completes Acquisition of Global CFDs Broker OANDA, Marking a Major Milestone

ThinkMarkets Review: Why High Ratings Are Masking a "Withdrawal Black Hole"

Delta Fx Review: Are Technical Glitches and Scam-Like Practices Draining Trader Profits?

Deriv Review and Global Regulation Explained

FXGROW Exposed: Complete Review & Customer Complaints Analysis

Rate Calc