TS Markets Spreads, leverage, minimum deposit Revealed

Abstract:TS Markets, also known as Trade Strategy Markets, is a China-based trading platform offering various market instruments such as Forex, Stocks, Indices, Commodities, and Cryptocurrencies. However, TS Markets lacks proper regulation, raising concerns about trader security and investment protection. It provides a single account type with leverage ranging from 1:10 to 1:500, and minimum deposits of $100. The platform offers multiple deposit and withdrawal methods, including credit/debit cards, bank transfers, and e-wallets, with withdrawals processed within 24 hours on business days. TS Markets provides trading through a web-based platform (TS Trader) and a mobile app (TS Mobile). It also incorporates SS-D anti-surveillance technology for enhanced data security. Reviews of TS Markets on WikiFX raise issues related to fund withdrawals, allegations of fraudulent activities, and investment restrictions, casting doubts on its legitimacy.

| Aspect | Information |

| Registered Country/Area | China |

| Founded Year | Up to 1 year |

| Company Name | Trade Strategy Markets |

| Regulation | Lacks proper regulation |

| Minimum Deposit | $100 |

| Maximum Leverage | Forex: 1:500, Stocks: 1:20, Indices: 1:100, Commodities: 1:100, Cryptocurrencies: 1:10 |

| Spreads | Forex (EUR/USD): 1.3 pips, Stocks: $0.02 per share, Indices: $0.01 per contract, Commodities: $1 per contract, Cryptocurrencies: 0.1% |

| Trading Platforms | TS Trader (Web-based), TS Mobile (iOS and Android) |

| Tradable Assets | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| Account Types | Single account type |

| Demo Account | Information not provided |

| Islamic Account | Information not provided |

| Customer Support | Market Makers: support@novopus.org for certain criteria, Technical Support: @NovopusOfficialGroup on Telegram or support@novopus.org |

| Payment Methods | Credit/debit cards, bank transfers, e-wallets, USDT blockchain |

| Trading Tools | SS-D anti-surveillance technology |

| Reviews | Highlight significant issues, including difficulties in withdrawing funds, allegations of fraudulent activities, and restrictions on investing |

Overview of TS Markets

TS Markets, operating under the full company name Trade Strategy Markets, is a China-based trading platform that offers various financial instruments for trading, including Forex, Stocks, Indices, Commodities, and Cryptocurrencies. While it provides a diverse range of trading options, TS Markets lacks proper regulation, which raises concerns about trader security and investment protection. Traders should exercise caution and be aware of the associated risks when considering this platform for trading.

TS Markets offers a single account type with varying leverage levels for different asset classes, such as Forex, Stocks, Indices, Commodities, and Cryptocurrencies. The platform has low spreads and commissions, with a minimum deposit requirement of $100. It supports multiple deposit and withdrawal methods, including credit/debit cards, bank transfers, and e-wallets, with no withdrawal fees and a 24-hour processing time on business days.

The trading platforms provided by TS Markets include TS Trader, a web-based platform with real-time charting and technical analysis tools, and TS Mobile, a mobile trading app for iOS and Android devices. Additionally, the platform incorporates SS-D anti-surveillance technology to enhance data security, encrypting data before transmission to protect user privacy. However, reviews of TS Markets on WikiFX have raised concerns about fund withdrawals, allegations of fraudulent activities, and investment restrictions, highlighting potential risks associated with the platform.

Pros and Cons

TS Markets presents several advantages and drawbacks for potential traders. On the positive side, the platform primarily focuses on cryptocurrencies, offering high leverage options for the chance of increased profits. It also boasts low spreads starting from 0.01 and a low minimum deposit requirement of $100, making it accessible to many. Moreover, multiple deposit and withdrawal methods are available with no associated fees, and the user-friendly web-based and mobile trading platforms are also available. Additionally, TS Markets offers SS-D anti-surveillance technology to enhance data security. However, it's important to note that the lack of proper regulation raises security concerns, and negative reviews have highlighted difficulties in fund withdrawals and allegations of fraudulent activities. Limited information on commissions for stocks and indices, a complex technology description for anti-surveillance technology, and complicated support requirements for Market Makers and Technical Support are some of the platform's notable drawbacks. Additionally, there is limited account diversity, as TS Markets offers only one account type, and there is no clear information on spreads for commodities and cryptocurrencies.

| Pros | Cons |

| Offers mainly Cryptocurrencies | Lacks proper regulation, raising security concerns |

| High leverage options available, allowing for potentially larger profits | Negative reviews highlighting difficulties in fund withdrawals and allegations of fraudulent activities |

| Low spreads from 0.01 | Limited information on commissions for stocks and indices |

| Low minimum deposit requirement of $100 | Complex technology description for anti-surveillance technology |

| Multiple deposit and withdrawal methods available with no fees | Complicated support requirements for Market Makers and Technical Support |

| User-friendly web-based and mobile trading platforms | Limited account options, offering only one account type |

| Offers SS-D anti-surveillance technology for enhanced data security | No clear information on spreads for commodities and cryptocurrencies |

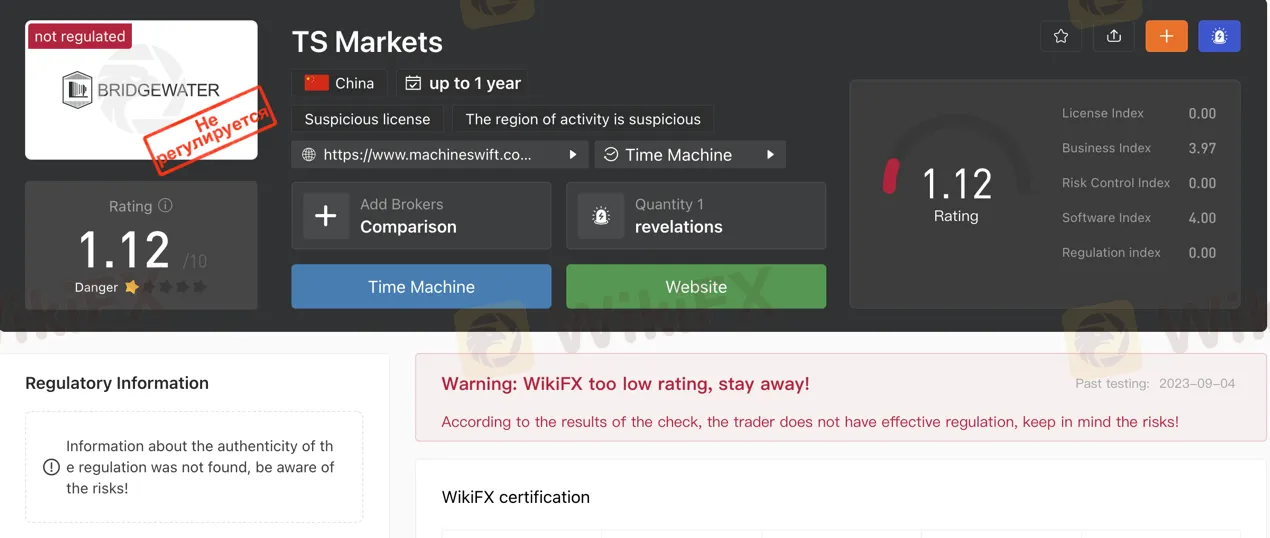

Is TS Markets Legit?

TS Markets lacks proper regulation, which raises concerns about the trader's security and the protection of their investments. It is crucial to be cautious and aware of the associated risks when considering this platform for trading.

Market Instruments

FOREX

TS Markets provides a range of forex trading options, encompassing major pairs like EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CAD, USD/CHF, as well as minor and exotic currency pairs.

STOCKS

TS Markets facilitates trading in stocks from diverse global exchanges, including prominent companies like Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Tesla (TSLA), Alphabet (GOOGL), Meta (META), and Berkshire Hathaway (BRK.A).

INDICES

TS Markets offers trading opportunities on various indices such as the S&P 500, Dow Jones Industrial Average, Nasdaq 100, FTSE 100, DAX, CAC 40, and Nikkei 225, which represent baskets of stocks tracking specific market or sector performances.

COMMODITIES

Commodity trading is available on TS Markets, covering assets like gold, silver, oil, wheat, corn, and soybeans, allowing users to engage in raw material and agricultural product trading.

CRYPTOCURRENCIES

TS Markets accommodates cryptocurrency trading with options like Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance Coin (BNB), USD Coin (USDC), as well as other cryptocurrencies including XRP and Cardano (ADA), all operating on cryptographic principles for secure transactions and supply control.

Pros and Cons

| Pros | Cons |

| Wide range of forex trading options | Lack of information on spreads and commissions for forex trading |

| Access to trading in stocks from global exchanges | Limited information on stock and index commissions |

| Access to trading opportunities on various indices | No clear information on the availability and cost structure for commodity and cryptocurrency trading |

Account Types

TS Markets offers a single account type, with no variations or options to choose from.

Leverage

For forex, the maximum leverage is 1:500. For stocks, the maximum leverage is 1:20. For indices, the maximum leverage is 1:100. For commodities, the maximum leverage is 1:100. For cryptocurrencies, the maximum leverage is 1:10.

Spreads & Commissions

For forex, the average spread on the EUR/USD pair is 1.3 pips. For stocks, the average commission is $0.02 per share. For indices, the average commission is $0.01 per contract. For commodities, the average commission is $1 per contract. For cryptocurrencies, the average commission is 0.1%.

Minimum Deposit

The minimum deposit required to open a trading account with TS Markets is $100.

Deposit & Withdrawal

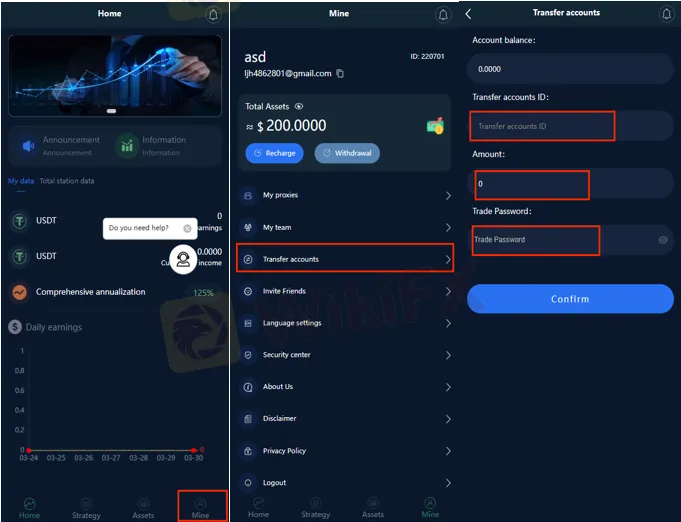

TS Markets offers a variety of deposit and withdrawal methods, including credit/debit cards, bank transfers, and e-wallets. TS Markets also offers deposit and withdrawal of USDT through the Tether (USDT) blockchain. Withdrawals are processed within 24 hours on business days and there are no fees.

Pros and Cons

| Pros | Cons |

| Variety of deposit and withdrawal methods | Lack of information on availability and cost structure for some trading instruments |

| No fees for deposits and withdrawals | |

| Withdrawals processed within 24 hours on business days |

Trading Platforms

TS Trader: A web-based trading platform that is accessible from any device with a web browser. It is easy to use and offers a variety of features, including real-time charting, technical analysis tools, and one-click order entry.

TS Mobile: A mobile trading app that is available for iOS and Android devices. It allows traders to trade on the go and offers many of the same features as the TS Trader platform.

Pros and Cons

| Pros | Cons |

| Wide range of trading instruments | Lack of transparency on trading costs |

| User-friendly trading platforms | Limited information on commodity and cryptocurrency trading |

| Mobile trading app |

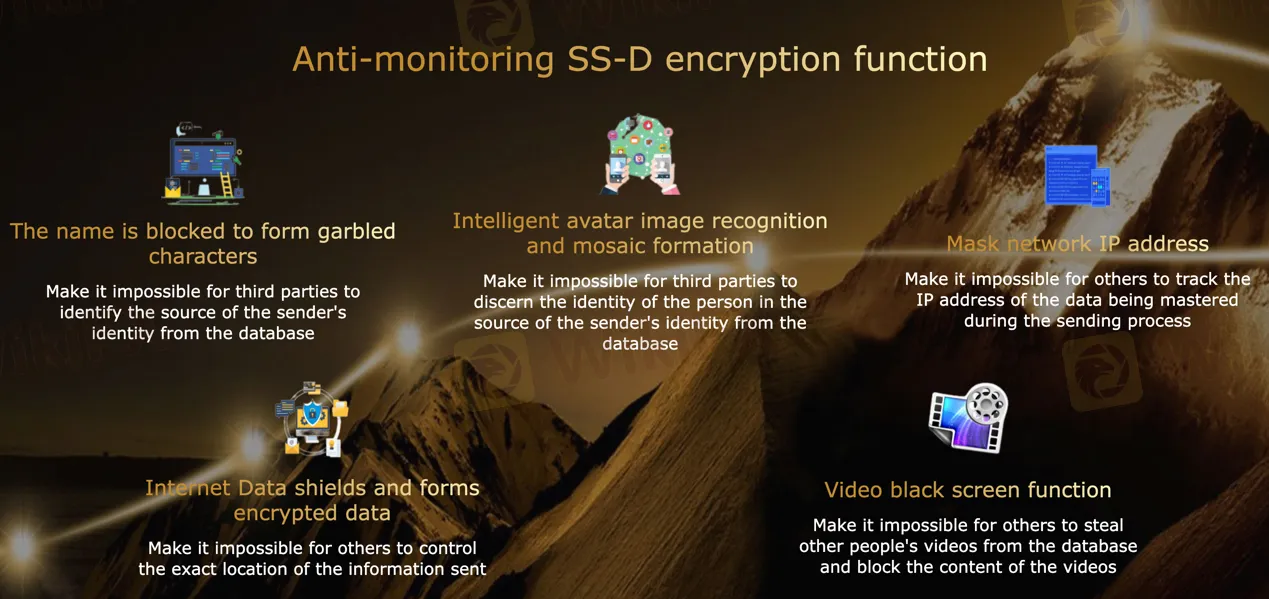

Trading Tools

TS Markets offers a range of trading tools, including SS-D anti-surveillance technology, which enhances data security. SS-D anti-surveillance technology employs a solid program development system that cannot be cracked. It integrates blockchain technology to safeguard personal privacy data by uploading data to the cloud in an anonymous form during transmission. This technology intercepts and encrypts data packets before they are sent to the cloud database, making it impossible for third parties to decipher the data or identify the sender's source, including the sender's identity, images, IP address, and information location. Additionally, it includes a video black screen function to protect against data theft and content exposure.

Customer Support

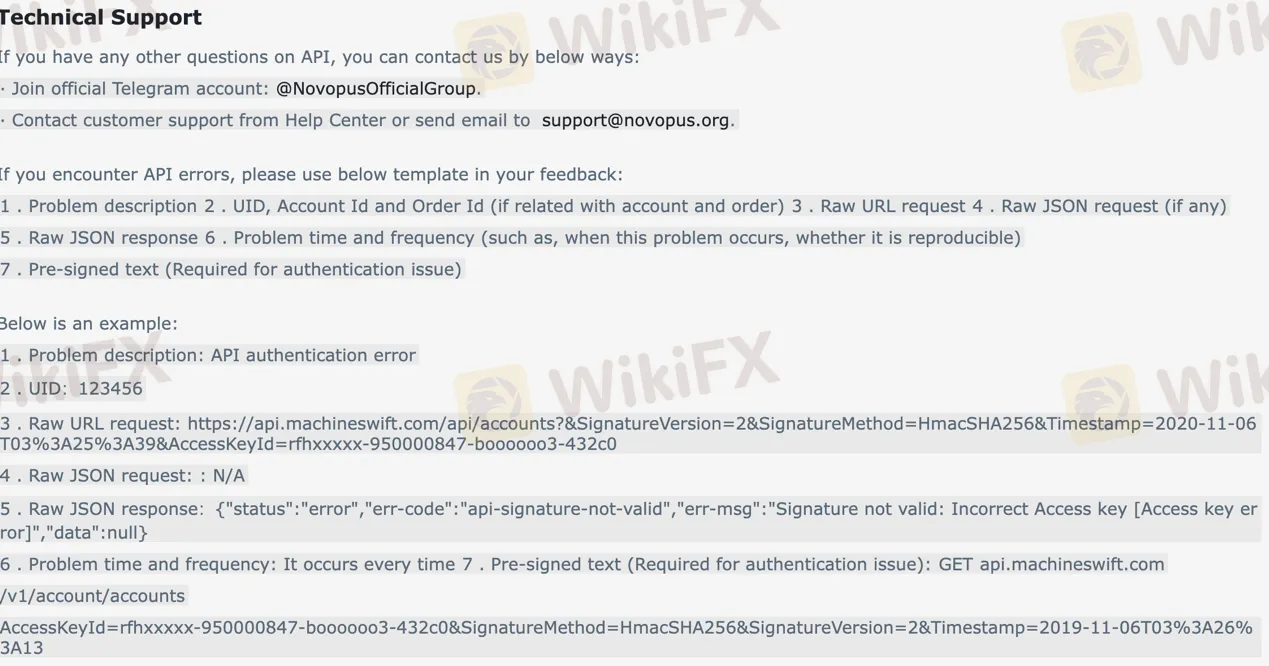

TS Markets provides contact options for Market Makers and Technical Support. Market Makers with a minimum of 10 BTC in their Novopus GPT Spot or Contract account can contact support at support@novopus.org, providing their UID, trading volume from another platform, and a brief market-making strategy description. Market makers are not eligible for point cards, VIP rates, rebates, or fee promotions. For Technical Support related to API inquiries, users can join the official Telegram account @NovopusOfficialGroup or contact customer support via the Help Center or support@novopus.org, using a provided template for reporting API errors.

Reviews

The reviews of TS Markets on WikiFX highlight significant issues, including difficulties in withdrawing funds, allegations of fraudulent activities, and restrictions on investing.

Conclusion

In conclusion, TS Markets presents both advantages and disadvantages for potential traders. On the positive side, the platform offers a wide range of trading instruments, including forex, stocks, indices, commodities, and cryptocurrencies. It also provides options for various trading platforms and offers certain security features like SS-D anti-surveillance technology. However, there are notable drawbacks to consider. TS Markets lacks proper regulation, raising concerns about trader security and investment protection. Additionally, the reviews available on WikiFX have highlighted issues such as difficulties in fund withdrawals, allegations of fraudulent activities, and investment restrictions. It is essential for traders to exercise caution and carefully evaluate the associated risks when considering TS Markets as their trading platform.

FAQs

Q: What is the full name of TS Markets?

A: TS Markets stands for “Trade Strategy Markets.”

Q: Is TS Markets a regulated trading platform?

A: No, TS Markets lacks proper regulation, which raises concerns about trader security and investment protection.

Q: What types of financial instruments can I trade on TS Markets?

A: TS Markets offers trading in Forex, stocks, indices, commodities, and cryptocurrencies.

Q: What is the minimum deposit required to open an account on TS Markets?

A: The minimum deposit for a TS Markets trading account is $100.

Q: What trading tools and technology does TS Markets provide?

A: TS Markets offers SS-D anti-surveillance technology to enhance data security and protect user privacy during data transmission.

Latest News

New AI laws to arrest deepfakes

Global Macro: Real Wage Growth Expected to Return by 2026

XAU/USD: Gold Rally Signals 'Paradigm Shift' as Middle East Tensions Simmer

MONAXA Review 2026: Comprehensive Safety Assessment

BoC Preview: Macklem to Hold at 2.25% Amidst Trade Anxiety

Fed Holds Rates as Political Storm Intensifies; Trump to Name New Chair Imminently

Meta and Samsung Fuel AI Capex Boom, Keeping Risk Sentiment Alive

Gold Smashes $5,600 Record on Shutdown Fears; Analysts Flash Crash Warning for Silver

FxPro Enhances MetaTrader 5 Execution with New LD4 Cross-Connect

Fed Holds Rates Amidst Political Siege; Dollar Sinks to Four-Year Lows

Rate Calc