PassivetradeFX Spreads, leverage, minimum deposit Revealed

Abstract:PassivetradeFX is a globally-oriented brokerage based in the United Kingdom, offering a range of financial instruments and services such as Cryptocurrency trading, Forex trading, Oil & Gas investments, Real Estate investment services, Retirement and Insurance services, and Gold trading.

| PassivetradeFX Review Summary in 10 Points | |

| Founded | 2021 |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments & Services | Cryptocurrency, Forex, Oil & gas, Real estate, Retirement and insurance services, Gold |

| Demo Account | Not Available |

| Leverage | Not disclosed |

| EUR/USD Spread | Not disclosed |

| Trading Platforms | Not disclosed |

| Minimum Deposit | USD 300 |

| Customer Support | Phone, email, address, contact us form, social media |

What is PassivetradeFX?

PassivetradeFX is a globally-oriented brokerage based in the United Kingdom, offering a range of financial instruments and services such as Cryptocurrency trading, Forex trading, Oil & Gas investments, Real Estate investment services, Retirement and Insurance services, and Gold trading. Despite these diverse offerings, it is critical to highlight that PassivetradeFX operates without the oversight of any acknowledged regulatory bodies.

In our upcoming article, we will present a comprehensive and well-structured evaluation of the broker's services and offerings. We encourage interested readers to delve further into the article for valuable insights. In conclusion, we will provide a concise summary that highlights the distinct characteristics of the broker for a clear understanding.

Pros & Cons

| Pros | Cons |

| • Diversified instruments and services | • Unregulated |

| • Multiple account types | • Lack of transparency on spreads/commissions/trading platform |

Diversified Instruments and Services: PassivetradeFX offers a diversity of trading instruments and services, including Cryptocurrency, Forex, Oil & Gas, Real Estate, Retirement and insurance services, and Gold. This diverse offering meets the need of a wide variety of investment interests and strategies.

Multiple Account Types: The broker provides multiple account types - Tier 1, Tier 2, Tier 3, and VIP Plan. These account types cater to investors with varying investment capacity and trading experience, allowing flexibility and customization to best suit the clients' needs.

Cons:

Unregulated: PassivetradeFX is not regulated by any recognized financial authority. This raises serious concerns over its adherence to industry standards and best practices, potentially posing risk to clients' funds and data.

Lack of Transparency: There is a noticeable lack of transparency around the broker's spreads, commission structure, and trading platform operation etc. which makes it difficult for clients to make informed decisions. The absence of clear information could potentially lead to unexpected costs and difficulties for the traders.

Is PassivetradeFX Safe or Scam?

When considering the safety of a brokerage like PassivetradeFX or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: Given PassivetradeFX's broad operational scope, the lack of supervision from established regulatory authorities raises significant concerns. The absence of regulatory oversight calls into question the broker's legal status and accountability.

User feedback: To gain a more profound understanding of the brokerage, it is recommended that traders delve into reviews and feedback from current clients. These useful insights and experiences offered by users can be found on reliable websites and discussion forums.

Security measures: PassivetradeFX employs encrypted algorithms as a key security measure to ensure the protection and security of user accounts, safeguarding against unauthorized access and cyber threats.

Ultimately, the decision to trade with PassivetradeFX rests with the individual. It's important to carefully weigh the potential risks and returns before initiating any trading activities.

Market Instruments & Services

PassivetradeFX offers a varied range of market instruments and services to its customers.

These services include Cryptocurrency trading, where traders can speculate on the volatile digital currency market. Additionally, Forex trading services allow for dealing in various foreign currencies. The broker also provides opportunities to invest in the oil and gas sectors, crucial components of the global energy market.

For those interested in physical assets, real estate investment services are available. Moreover, the broker extends retirement and insurance services, assisting clients in planning for a financially stable future. Lastly, gold trading services are offered, enabling investments in this traditionally secure and stable asset.

Account Types

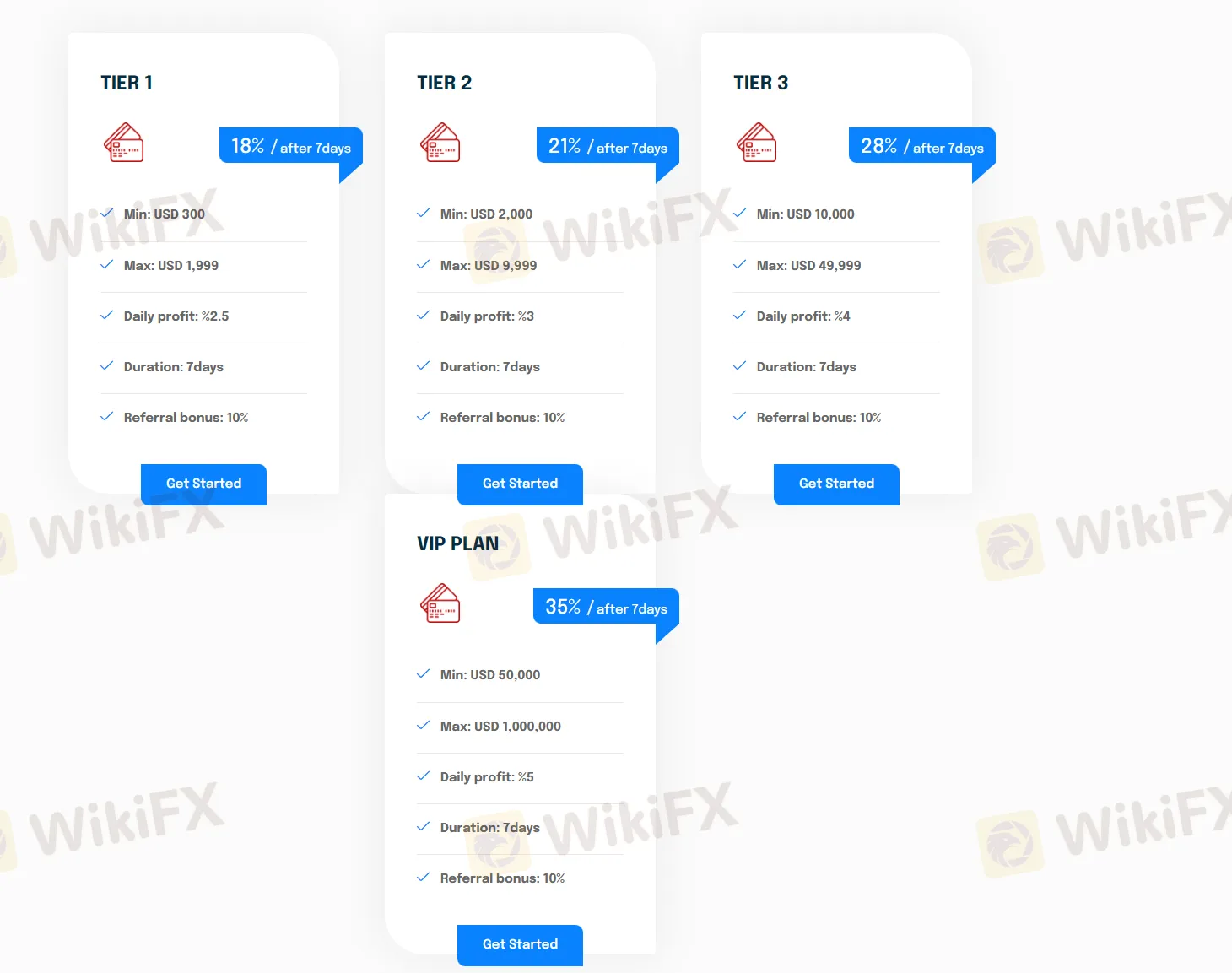

The broker offers four main types of accounts with different investment sizes and strategies.

First, the Tier 1 account requires a minimum deposit of USD 300, making it an accessible entry point for those new to trading.

Next, the Tier 2 account, with a minimum deposit requirement of USD 2000, provides greater trading opportunities and potential returns.

The Tier 3 account, requiring a minimum USD 10,000 deposit, is suited for experienced traders seeking higher stakes and benefits.

Last but not least, the VIP Plan account is designed for high-net-worth individuals or institutional traders, necessitating a significant minimum deposit of USD 50,000, and offering superior features and premium support.

How to Open an Account?

Step 1: Visit the PassivetradeFX website.

Step 2: Click the “Login” button located on the homepage.

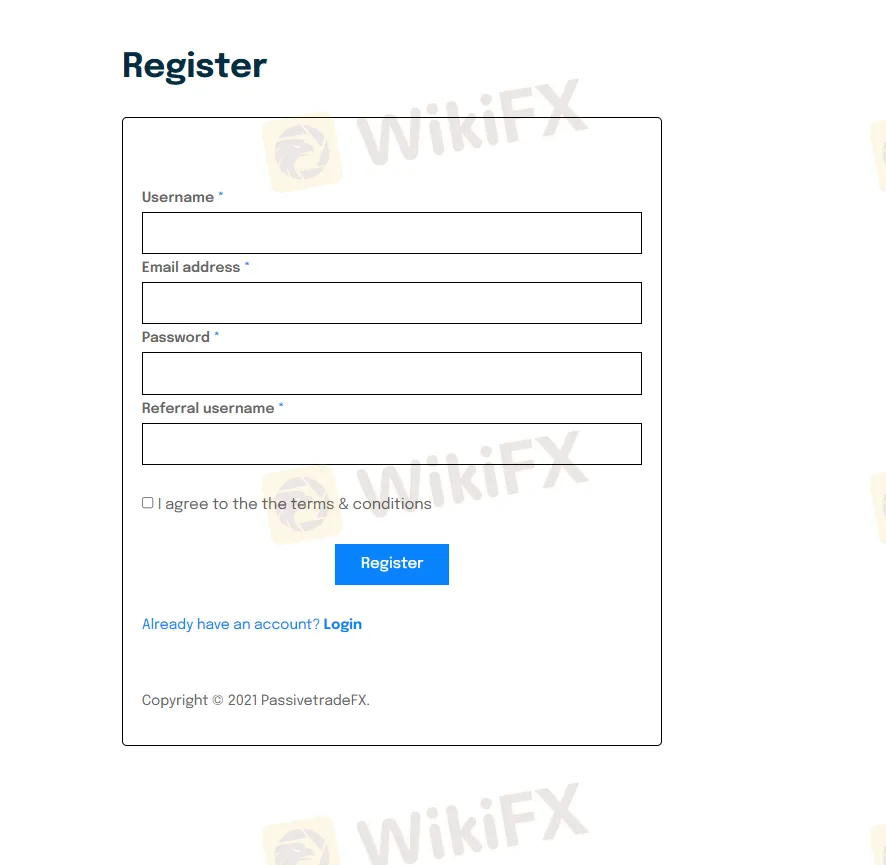

Step 3: Choose “register” button and click.

Step 4: You will then be required to fill in certain information such as personal details and password.

Step 5: You will also be required to submit identification documents for verification according to KYC (Know Your Customer) regulations.

Step 6: Once the broker has verified your details, you'll be able to deposit funds and start trading.

Customer Service

PassivetradeFX provides multiple channels for customer support. These include email for detailed queries, phone for immediate supports, a contact us form on their website, and a physical address for official correspondence.

Address: 64 Thornton StHURSLEYSO21 1NS.

Email: support@passivetradeFX.com.

Phone: 123456.

Conclusion

To sum up, PassivetradeFX is a worldwide online brokerage, domiciled in the UK, offering a range of trading instruments and services such as Cryptocurrency, Forex, Oil & gas, Real estate, Retirement and insurance services, and Gold. Nonetheless, due to its concerning lack of regulatory oversight, interested investors are urged to be cautious. This regulatory gap questions the broker's commitment to abide by regulatory standards and client security.

Consequently, it is advised that interested traders consider other brokers that focus on transparency, adherence to regulatory guidelines, and professionalism.

Frequently Asked Questions (FAQs)

| Q 1: | Is PassivetradeFX regulated? |

| A 1: | No. The broker is currently under no valid regulations. |

| Q 2: | Is PassivetradeFX a good broker for beginners? |

| A 2: | No. It is not a good choice for beginners because it‘s unregulated by any recognized bodies. |

| Q 3: | What’s the minimum deposit does PassivetradeFX require? |

| A 3: | Minimum deposit required by this broker is $300. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Latest News

Trillium Financial Broker Exposed: Top Reasons Why Traders are Losing Trust Here

FIBO Group Ltd Review 2025: Find out whether FIBO Group Is Legit or Scam?

Amillex Withdrawal Problems

Is INGOT Brokers Safe or Scam? Critical 2025 Safety Review & Red Flags

150 Years Of Data Destroy Democrat Dogma On Tariffs: Fed Study Finds They Lower, Not Raise, Inflation

CQG Partners with Webull Singapore to Power the Broker’s New Futures Trading Offering

【WikiEXPO Global Expert Interviews】Ashish Kumar Singh: Building a Responsible and Interoperable Web3

Trump: India\s US exports jump despite 50% tariffs as trade tensions ease

IEXS Review 2025: A Complete Expert Analysis

CySEC Flags 21 Unauthorized Broker Websites in 2025 Crackdown

Rate Calc