Dollars Markets Spreads, leverage, minimum deposit Revealed

Abstract:Trade Currency Pairs, Precious Metals , Indicies ,Cryptocurrencies, Shares, Energy, and ETFs on MT4/MT5 at Dollars Markets. Access low fees, and professional tools. Regulated for safe trading.

| Dollars MarketsReview Summary | |

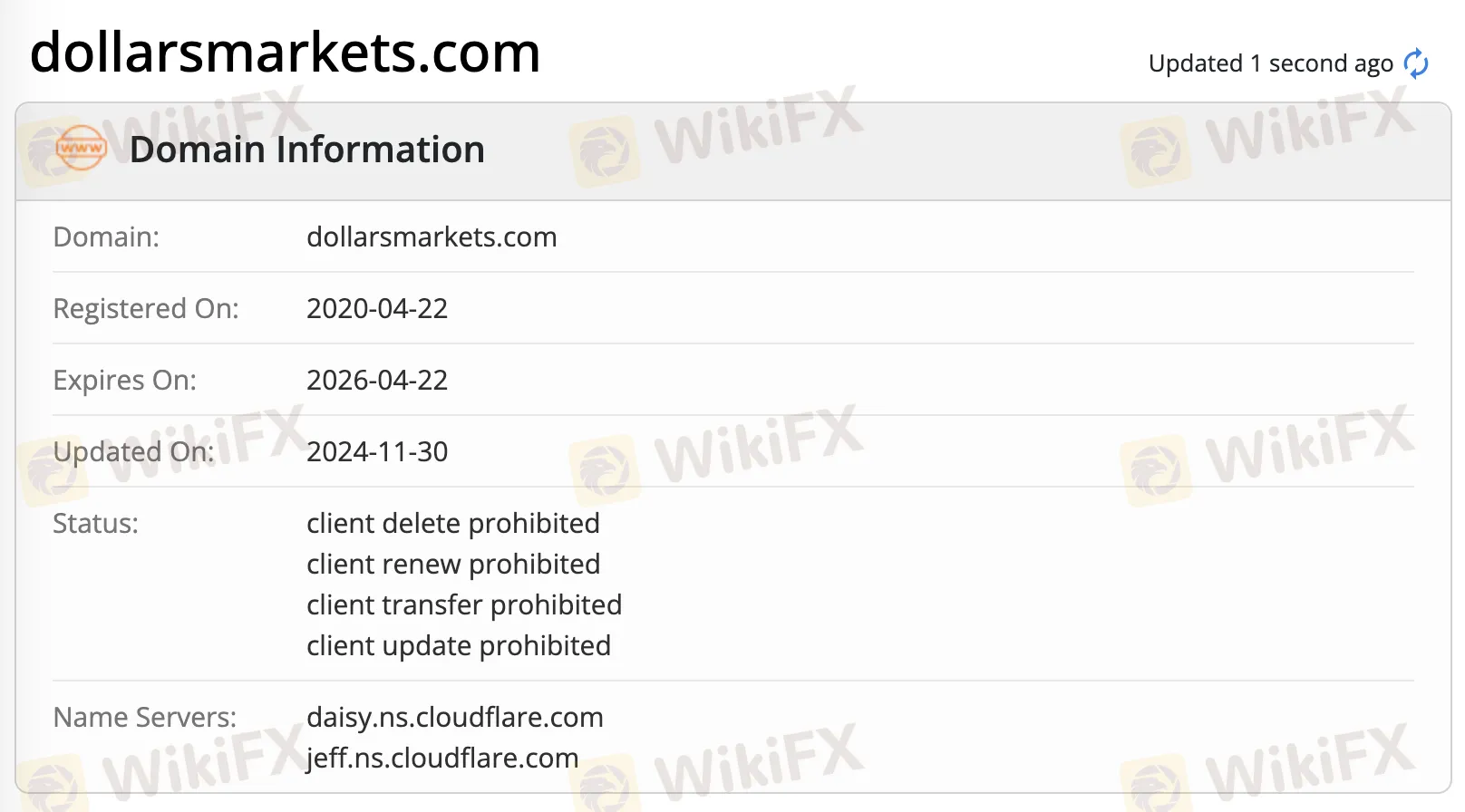

| Founded | 2020 |

| Registered Country/Region | Mauritius |

| Regulation | Offshore regulated |

| Market Instruments | Currency Pairs, Precious Metals , Indicies ,Cryptocurrencies, Shares, Energy, ETFs |

| Demo Account | ❌ |

| Leverage | Up to 1:3000 |

| Spread | From 0.02 pips |

| Trading Platform | MT4/MT5 |

| Min Deposit | $10 |

| Customer Support | Instagram, facebook, X, Tiktok, Youtube, Bloomberg |

| 24/5 customer support | |

| Contact form | |

| Regional Restrictions | US, Afghanistan, Bosnia and Herzegovina, Democratic People's Republic of Korea (DPRK), Guyana, Iran, Iraq, Lao People's Democratic Republic, Myanmar, Papua New Guinea, Syria, Uganda, Vanuatu, Yemen, Malaysia and Indonesia clients are not allowed |

Dollars Markets Information

Dollars Markets is an offshore regulated broker, offering trading on currency pairs, precious metals, indicies, cryptocurrencies, shares, energy and ETFs with leverage up to 1:3000 and spread from 0.02 pips on MT4/MT5 trading platform. The minimum deposit requirement is $10.

Pros and Cons

| Pros | Cons |

| Tight spreads | No contact Tel or email |

| Various trading products | Offshore regulation |

| MT4/MT5 platform | No demo accounts |

| Low minimum deposit requirement |

Is Dollars Markets Legit?

It is registered in Mauritius. It has offshore regulations currently.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| The Financial Services Commission | Offshore regulated | DOLLARS MARKETS LTD | Retail Forex License | GB21026297 |

What Can I Trade on Dollars Markets?

| Tradable Instruments | Supported |

| Currency Pairs | ✔ |

| Precious Metals | ✔ |

| Indicies | ✔ |

| Cryptocurrencies | ✔ |

| Shares | ✔ |

| Energy | ✔ |

| ETFs | ✔ |

| Bonds | ❌ |

Account Type

Here are three account types Dollars Markets offers:

| Account Type | Min Deposit |

| Standard | $10 |

| Pro | $10 |

| Ultra | $50 |

Leverage

The broker offers max leverage at 1:3000. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. Since leverage, can amplify both profits as well as losses, choosing the right amount is a key risk determination for traders.

Dollars Markets Fees

Trading Fees

| Account Type | Commission | Swaps |

| Standard | 0 | 0 |

| Pro | 0 | 0 |

| Ultra | 4% On FX & Metals | 0 |

Dollars Markets Spreads

Dollars Markets offers spreads from 0.02 pips.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | / | Beginners |

| MT5 | ✔ | / | Experienced trader |

Deposit and Withdrawal

The broker accepts payments via bank wire, cryptocurrency, Mastercard and Visa.

Deposit Options

| Deposit Options | Min. Deposit | Fixed Rate | Processing Time |

| Instant Bank Transfers | $15.00 | Available | 1-5 Minutes |

| Cryptocurrency | $100.00 | Available | 10-45 Minutes |

| Mastercard | $5.00 | No | 5-10 Minutes |

| Visa | $5.00 | No | 5-10 Minutes |

Withdrawal Options

| Withdrawal Options | Min. Withdrawal | Fixed Rate | Processing Time |

| Instant Bank Transfers | $15.00 | Available | 1-3 Business Day |

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

Rate Calc