IIFL Spreads, leverage, minimum deposit Revealed

Abstract: IIFL is an online trading platform, offering a variety of loan products, including instant Gold Loans and Business Loans up to ₹75 Lakhs, with transparent rates and clear prepayment policies. They provide a convenient online payment system via their IIFL Loans Mobile App and popular payment apps like Google Pay and Paytm.

| IIFL Review Summary | |

| Founded | 1995 |

| Registered Country/Region | India |

| Regulation | No Regulation |

| Services | Gold Loans, Gold Loans at Home, and Business Loans |

| Platform/APP | IIFL Loans Mobile App |

| Customer Support | Live chat |

| Tel: 1860-267-3000, 7039-050-000(09:30 am to 6:00 pm from Monday to Friday & 09.30 am to 4.00 pm on Saturdays) | |

| Email: gold-helpline@iifl.com | |

IIFL Information

IIFL is an online trading platform, offering a variety of loan products, including instant Gold Loans and Business Loans up to ₹75 Lakhs, with transparent rates and clear prepayment policies. They provide a convenient online payment system via their IIFL Loans Mobile App and popular payment apps like Google Pay and Paytm.

Pros and Cons

| Pros | Cons |

| Diverse loan offerings | Unregulated broker |

| Transparent rates and charges | High interest rates |

Is IIFL Legit?

IIFL is an unregulated broker. Please be aware of the risk!

The WHOIS search shows the domain iifl.com was registered on July 28, 2003. Its present state is “client transfer prohibited,” which indicates the domain is locked and cannot be moved to another registrar.

Loan Services

RIIFL offers a variety of loan products, including instant Gold Loans, Gold Loans at Home, and Business Loans up to ₹75 Lakhs.

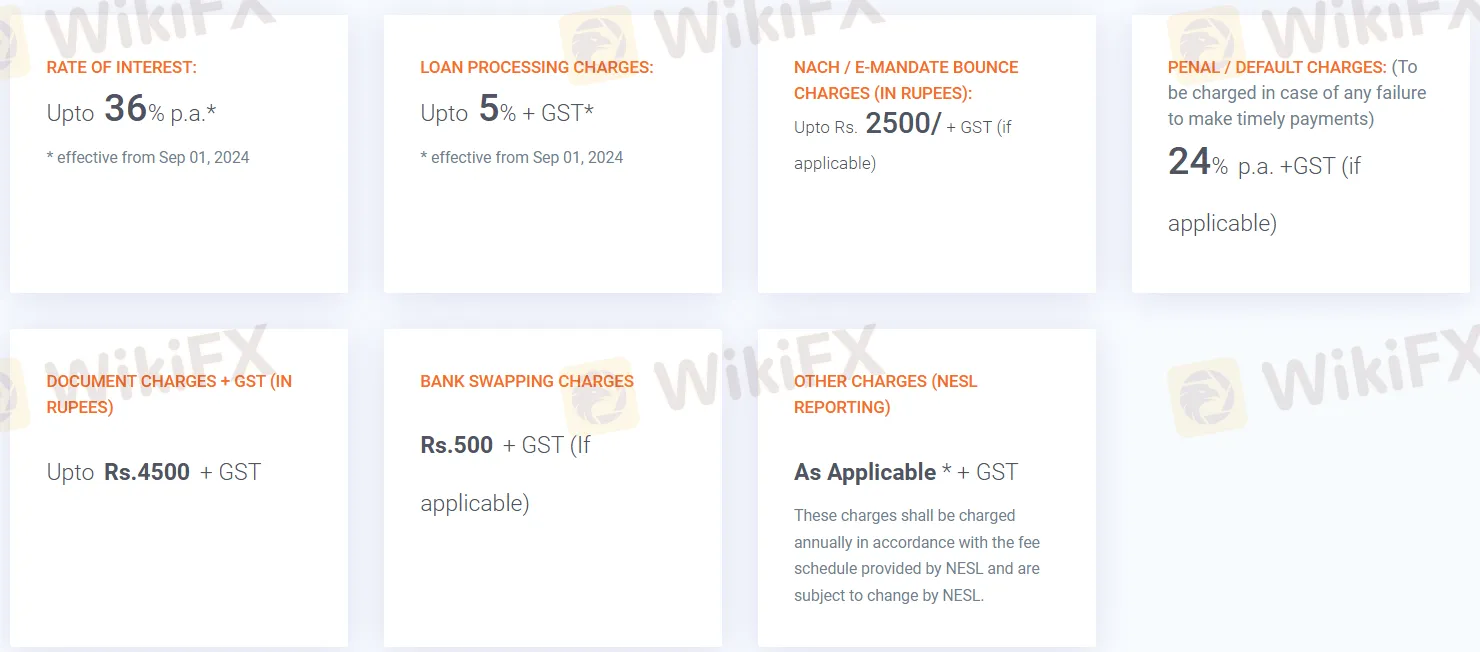

Fees

| Charge Type | Details/Amount | Notes |

| Rate of Interest | Upto 36% p.a. | Effective from Sep 01, 2024 |

| Loan Processing Charges | Upto 5% + GST | |

| NACH / E-Mandate Bounce Charges | Upto Rs. 2500/- + GST | If applicable |

| Penal / Default Charges | 24% p.a. + GST | For failure to make timely payments (if applicable) |

| Document Charges + GST | Upto Rs. 4500 + GST | In Rupees |

| Bank Swapping Charges | Rs. 500 + GST | If applicable |

| Other Charges (NESL Reporting) | As Applicable + GST | Charged annually per NESL fee schedule; subject to change by NESL |

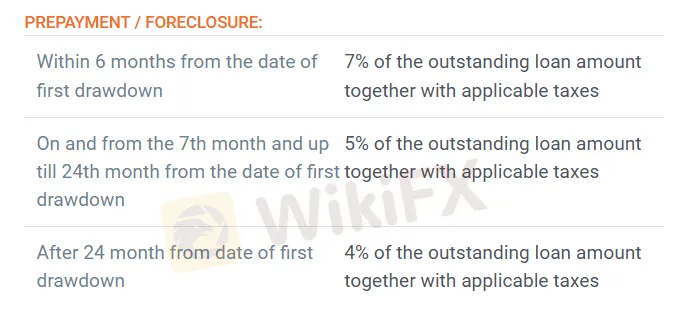

Prepayment / Foreclosure

| Condition | Charge |

| Within 6 months from the date of first drawdown | 7% of the outstanding loan amount together with applicable taxes |

| On and from the 7th month up till 24th month from the date of first drawdown | 5% of the outstanding loan amount together with applicable taxes |

| After 24 months from date of first drawdown | 4% of the outstanding loan amount together with applicable taxes |

Platform/APP

| Trading Platform | Supported | Available Devices |

| IIFL Loans Mobile App | ✔ | Android, iOS |

Payments

RIIFL offers a quick, easy, and convenient online payment system for loan dues. Customers can conveniently make payments anytime, anywhere, directly through popular apps such as Google Pay, Paytm, Bhim, PhonePe, and Mobikwik.

Latest News

Gold Cements Historic 66% Gain as Silver Supply Crunch Looms for 2026

2025 Global Economic Year in Review: How Tariffs and AI Rewrote the Playbook

Yen in Peril: Wall Street Eyes 160 as Structural Outflows Persist

RM238,000 Lost to a Fake Stock Scheme | Don't Be The Next Victim!

What Is a Forex Expert Advisor and How Does It Work?

Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

What Is a Liquid Broker and How Does It Work?

“Elites’ View in Arab Region” Event Successfully Concludes

Commodities Wrap: Copper Surges on ‘Green Squeeze’ Fears; Oil Dips on Peace Hopes

GivTrade Secures UAE SCA Category 5 Licence

Rate Calc