BS GFS Spreads, leverage, minimum deposit Revealed

Abstract:Established in 2021 and headquartered in Saint Vincent and the Grenadines, BS GFS is an online trading platform that offers a range of market instruments. These include Shares, Currency (Forex), Metals, Indices, Commodities, and Futures. The platform provides various account types — Classic, Platinum, and Professional — with a minimum deposit requirement starting at $100 and leverage options reaching up to 1:500. The trading experience is facilitated through MT5 Desktop, MT5 Mobile, and a Web Terminal, with spreads typically around 1.5 pips. BS GFS operates without regulatory oversight, which presents a significant consideration for potential clients. While the platform offers a suite of trading instruments and multiple account types for a range of traders, the non-regulated status of the company means that it does not have to adhere to the stringent rules that govern regulated entities. Customer support is accessible via phone and email, providing traders with direct channels for a

| Aspect | Information |

| Company Name | BS GFS |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2021 |

| Regulation | Not regulated |

| Market Instruments | Shares, Currency (Forex), Metals, Indices, Commodities, and Futures |

| Account Types | Classic, Platinum, Professional |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Typically around 1.5 pips |

| Trading Platforms | MT5 Desktop, MT5 Mobile, Web Terminal |

| Customer Support | Phone (+84 901 769 988) , email (support@gfstrader.com) |

Overview of BS GFS

Established in 2021 and headquartered in Saint Vincent and the Grenadines, BS GFS is an online trading platform that offers a range of market instruments. These include Shares, Currency (Forex), Metals, Indices, Commodities, and Futures. The platform provides various account types — Classic, Platinum, and Professional — with a minimum deposit requirement starting at $100 and leverage options reaching up to 1:500. The trading experience is facilitated through MT5 Desktop, MT5 Mobile, and a Web Terminal, with spreads typically around 1.5 pips.

BS GFS operates without regulatory oversight, which presents a significant consideration for potential clients. While the platform offers a suite of trading instruments and multiple account types for a range of traders, the non-regulated status of the company means that it does not have to adhere to the stringent rules that govern regulated entities. Customer support is accessible via phone and email, providing traders with direct channels for assistance.

Is BS GFS legit or a scam?

BS GFS operates without the oversight of any regulatory authority, a situation that could cast doubts on the transparency and supervision of the exchange. Exchanges that are not regulated are devoid of the legal protections and rigorous scrutiny typically enforced by such authorities. Consequently, they will be more vulnerable to fraudulent activities, market manipulation, and security infringements.

The lack of regulation also means that users will encounter difficulties in obtaining recourse or settling disputes. Furthermore, the absence of regulatory oversight will lead to an opaque trading environment, hindering users' ability to evaluate the legitimacy and dependability of the exchange.

Pros and Cons

| Pros | Cons |

| Various account options | Not Regulated |

| Easy-to-use platform | Limited market analysis and insights |

| High maximum leverage | Limited educational resource |

| No commission fee |

Pros:

Various Account Options: BS GFS provides a range of account types to suit different trader profiles, from beginners to experienced professionals. This flexibility allows users to choose an account that aligns with their investment size and risk tolerance.

Easy-to-Use Platform: The platform's interface is typically user-friendly for both novice and seasoned traders. An intuitive design can enhance the overall trading experience by allowing users to navigate the platform efficiently and execute trades with ease.

High Maximum Leverage: Offering high leverage up to 1:500, BS GFS enables traders to open larger positions with a smaller amount of capital. This can amplify potential profits, but it is important to manage the associated risks carefully.

No Commission Fee: Accounts at BS GFS are structured with no commission fees on trades, which can reduce the cost of trading. This is particularly appealing for traders who execute a high volume of trades.

Cons:

Not Regulated: The lack of regulation can be a significant drawback as it often implies that the platform does not adhere to any financial regulatory standards, which can be a red flag for the security of clients' funds and fair trading practices.

Limited Market Analysis and Insights: Without market analysis and insights, traders will find it challenging to make informed decisions. This limitation could be a disadvantage for those who rely on broker-provided research to guide their trading strategies.

Limited Educational Resources: For new traders, educational resources are crucial for learning the ropes. A scarcity of these resources hinders the learning curve, especially for those looking to understand the basics of trading and markets.

Market Instruments

BS GFS facilitates trading in a variety of financial instruments, each distinct in nature and function:

Shares represent equity stakes in public companies, providing shareholders with a proportionate claim on a company's assets and profits. Trading in shares involves analyzing market trends and company performance to buy low and sell high.

Currency trading, or forex, involves the simultaneous buying of one currency while selling another. This market is driven by factors such as interest rates, economic performance, and geopolitical stability.

Metals trading focuses on hard commodities like gold and silver, which are typically used as a hedge against inflation or currency devaluation.

Indices offer exposure to various segments of the financial markets by tracking the performance of a group of stocks, representing a particular sector or the market as a whole.

Commodities include a range of raw materials and primary agricultural products. Their prices can be influenced by supply and demand dynamics, geopolitical tensions, and changes in currency values.

Futures are derivative financial contracts obligating the buyer to purchase an asset, or the seller to sell an asset, at a predetermined future date and price. Futures trading can serve as a risk management tool to hedge against price changes in the underlying asset.

Account Types

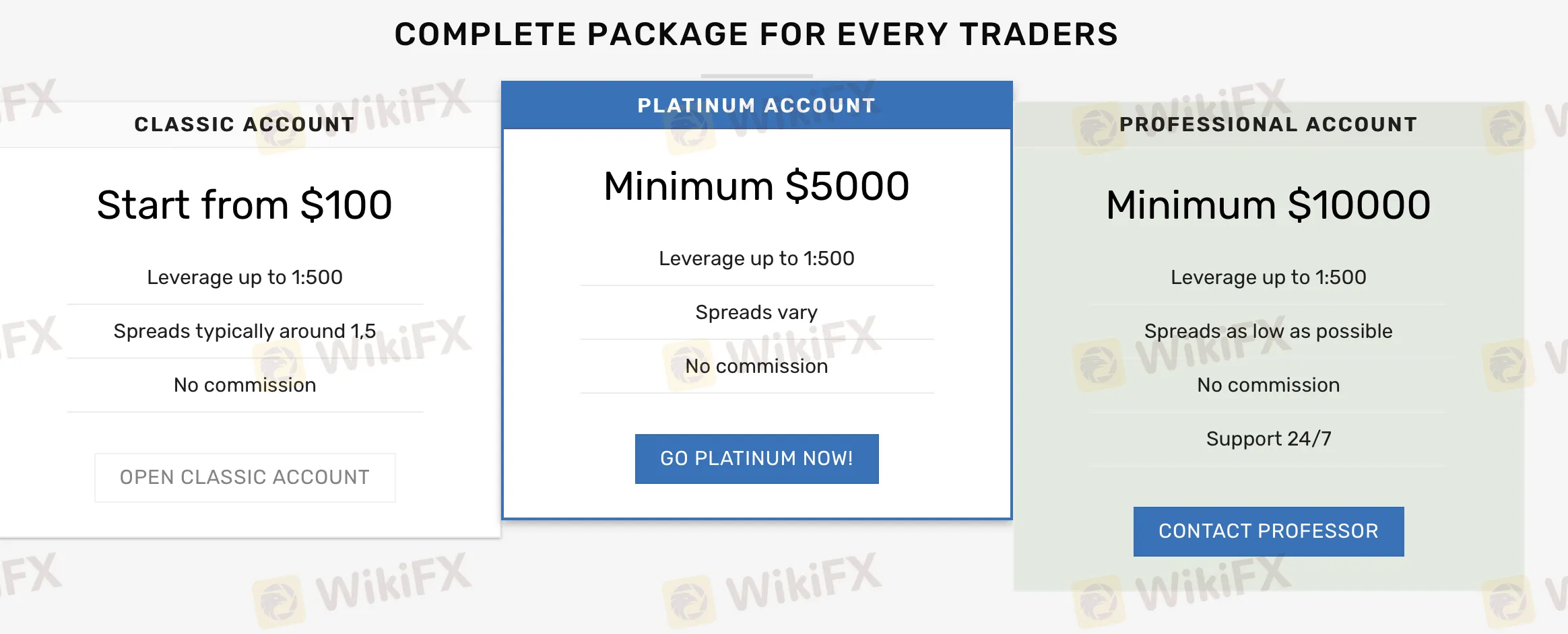

BS GFS provides three distinct types of accounts to accommodate the varying needs and experience levels of traders.

The Classic Account requires a minimum deposit of $100 and offers leverage of up to 1:500. Spreads are typically around 1.5 pips, and there is no commission charged on trades. This type of account is suitable for entry-level traders who are looking to start with a lower investment and still take advantage of relatively high leverage.

The Platinum Account is for more experienced traders, with a higher minimum deposit requirement of $5,000. It provides the same leverage of up to 1:500, but spreads can vary. Similar to the Classic Account, the Platinum Account does not charge any commission. Traders who choose this account are looking for more flexibility in spreads and are prepared to invest more capital.

Lastly, the Professional Account demands a minimum deposit of $10,000. It also offers leverage of up to 1:500 and provides spreads that are as low as possible. There is no commission fee, and 24/7 support is available. This account type is suitable for high-volume, experienced traders who require around-the-clock service and are able to commit a significant amount of capital.

| Account Type | Minimum Deposit | Maximum Leverage | Spreads | Commission | Support | Suitable for |

| Classic Account | $100 | 1:500 | Typically around 1.5 pips | No commission | Standard | Entry-level traders |

| Platinum Account | $5,000 | 1:500 | Can vary | No commission | Standard | Experienced traders |

| Professional Account | $10,000 | 1:500 | As low as possible | No commission | 24/7 | High-volume, experienced traders |

How to Open an Account?

To open an account with BS GFS, follow these concrete steps:

Select Account Type: Choose the desired account type (Classic, Platinum, or Professional) based on your trading needs and capital availability.

Complete the Application: Fill out the online application form with your personal details, including name, address, and date of birth, along with your financial information and trading experience.

Verification: Submit the required identification documents, such as a government-issued ID and proof of address, for verification purposes.

Fund Your Account: Once your account is verified, proceed to deposit funds. The minimum deposit amount will depend on the selected account type.

Set Up Trading Tools: Configure your trading platform and any necessary tools or indicators you wish to use.

Commence Trading: With your account funded and trading setup complete, you can now start trading the range of financial instruments offered by BS GFS.

Leverage

BS GFS offers a maximum leverage of up to 1:500 across its account types. This high leverage ratio allows traders to control a large position with a relatively small amount of capital.

However, it's important to note that while higher leverage can amplify gains, it also increases the risk of potential losses. Traders should consider their experience level and risk tolerance when using leverage in their trading strategy.

Spreads & Commissions

BS GFS structures its fees around spreads and commissions, tailored to each of its account offerings. The Classic Account is characterized by no commission fees and features spreads that are typically around 1.5 pips. This fee structure appeals to beginners or those with less capital, who are looking for a straightforward cost without additional commission charges.

Moving to the Platinum Account, the spreads vary, which indicates a more dynamic pricing model that could fluctuate with market conditions. Like the Classic Account, it also operates with zero commission fees. Traders with more experience and higher capital, who can take advantage of potentially tighter spreads during optimal trading conditions, will find this account more suitable.

For the Professional Account, BS GFS offers spreads that are as low as possible, again with no commission fees. This is advantageous for high-volume traders who engage in frequent transactions and require tight spreads to minimize the cost impact on their trades. With the promise of 24/7 support, the Professional Account is suitable for seasoned traders with significant capital, who can benefit from the potentially lower costs that tight spreads provide, especially in fast-moving markets.

Trading Platform

BS GFS offers a trading platform that includes MetaTrader 5 (MT5) Desktop, MT5 Mobile, and a Web Terminal option.

The MT5 Desktop version provides a trading experience with access to various financial instruments. It is utilized by retail investors for buying and selling currencies and supports trading in Forex, Futures, Indices, Equities, and other CFD transactions. The desktop platform is noted for its distributed architecture and robust security system.

For traders who require mobility, the MT5 Mobile application allows for trading on-the-go. The mobile platform retains many of the features of the desktop version, enabling users to manage their accounts and trade from anywhere.

Additionally, the Web Terminal offers a browser-based trading solution, eliminating the need for downloading software. This option provides ease of access and convenience, allowing for trading activities through the web.

Customer Support

BS GFS provides customer support primarily through a contact form available on their website, where users can submit their name, email address, phone number, and a message for assistance.

Additionally, they offer direct contact via a phone number(+84 901 769 988) and an email address(support@gfstrader.com) listed for support. The company is headquartered at First Floor, First St. Vincent Bank Ltd. Building on James Street in Kingstown, SVG, and has an office at Ngo Quyen Street in Ha Dong, Hanoi, Vietnam. This indicates a presence in both the Caribbean and Asia, suggesting that BS GFS has a global reach and a commitment to accessible customer service.

Conclusion

BS GFS offers traders a selection of account options, each tailored to different trading experiences and capital investments. The user-friendly platform facilitates the ease of trading for both new and seasoned traders. With high leverage available, traders have the opportunity to maximize potential returns on their trades. Moreover, the absence of commission fees on certain accounts can reduce transaction costs, benefiting frequent traders.

On the flip side, the lack of regulation for BS GFS could present a challenge for traders seeking the security of regulated oversight. The platform's limited market analysis tools and educational resources are also less than ideal for traders who depend on these services to inform their trading decisions and to enhance their trading skills. It is crucial for traders to weigh these aspects carefully against their personal trading requirements and risk appetite.

FAQs

Q: What account types does BS GFS offer?

A: BS GFS provides various account types including Classic, Platinum, and Professional, each with different features suitable for different levels of traders.

Q: Is BS GFS regulated?

A: No, BS GFS is not regulated, which means there's no financial authority overseeing its operations.

Q: Can I trade on mobile with BS GFS?

A: Yes, BS GFS offers mobile trading through the MT5 Mobile application.

Q: What is the minimum deposit required for BS GFS?

A: The minimum deposit starts at $100 for the Classic Account.

Q: Does BS GFS charge commission fees?

A: BS GFS offers accounts with no commission fees.

Q: Are there educational resources available on BS GFS?

A: BS GFS has limited educational resources, which is not enough for new traders.

Latest News

Najm Capital Ltd: Regulated Forex Broker Strengthens Its Presence in the MENA Online Forex Market

HEADWAY Rebate Service Review 2026: Is this Forex Broker Legit or a Scam?

UAE SCA Rebrands as CMA: What It Means for Forex and CFD Brokers?

OmegaPro Review 2026: Is This Forex Broker Safe?

Legal Headwinds for Tariffs: US States Sue to Block Trump's Trade Agenda

Is Malaysia Losing Control of the Online Scam Economy?

FINRA Fines Altruist Financial $150,000 for Supervisory Failures in Securities Lending Program

Angel One Exposure Review: Low Score & Unregulated Forex Broker Risks

A Complete Xlibre Review: High Leverage and Major Warning Signs to Consider

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Rate Calc