User Reviews

More

User comment

6

CommentsWrite a review

2024-08-22 18:20

2024-08-22 18:20

2022-12-15 11:43

2022-12-15 11:43

Score

15-20 years

15-20 yearsRegulated in Japan

Market Making License (MM)

Self-developed

Capital Ratio

Influence

Add brokers

Comparison

Quantity 3

Exposure

Score

Regulatory Index7.83

Business Index8.00

Risk Management Index9.79

Software Index7.05

License Index7.85

Single Core

1G

40G

Warning

More

Company Name

Matsui Securities Co., Ltd.

Company Abbreviation

MATSUI

Platform registered country and region

Japan

Number of employees

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

Capital

Higher than 98% Japanese brokers $92,596,899(USD)

| Matsui Review Summary | |

| Founded | 1996 |

| Registered Country/Region | Japan |

| Regulation | The Financial Services Agency (FSA) |

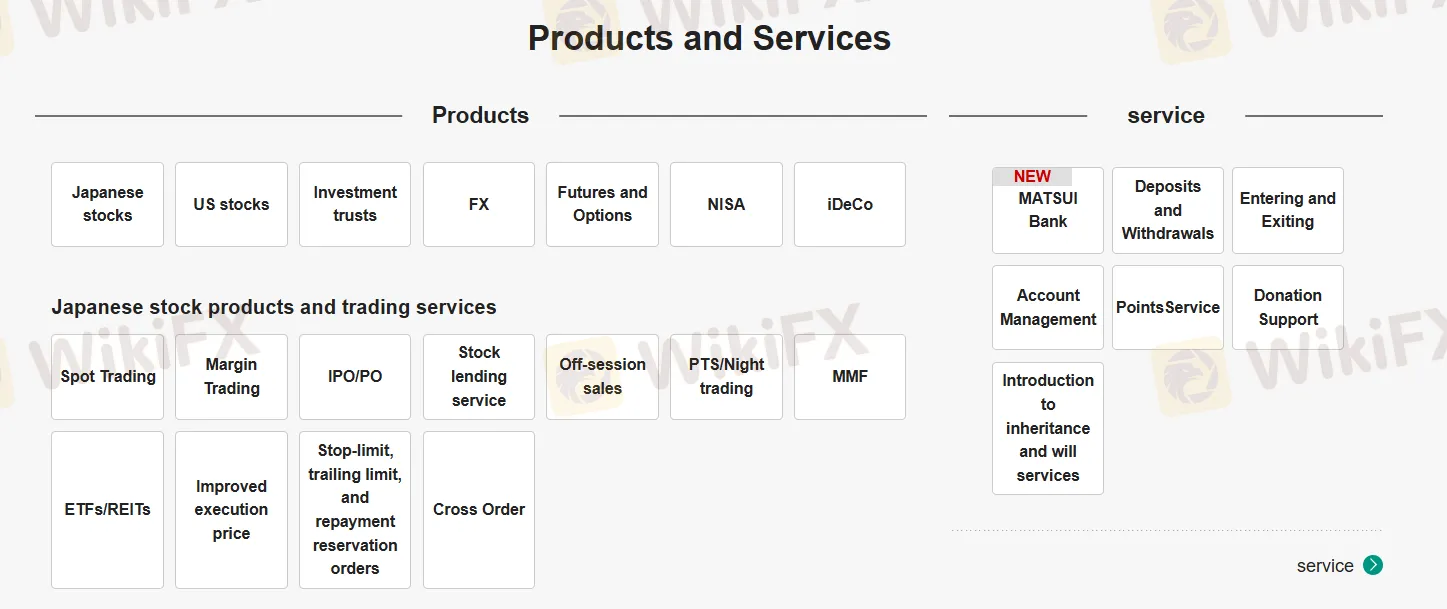

| Market Instruments | Japanese stocks, US stocks, Investment trusts, FX, Futures and Options, NISA, iDeCo, MMF. |

| Demo Account | Not Mentioned |

| Spread | EUR/USD at 0.4 pips |

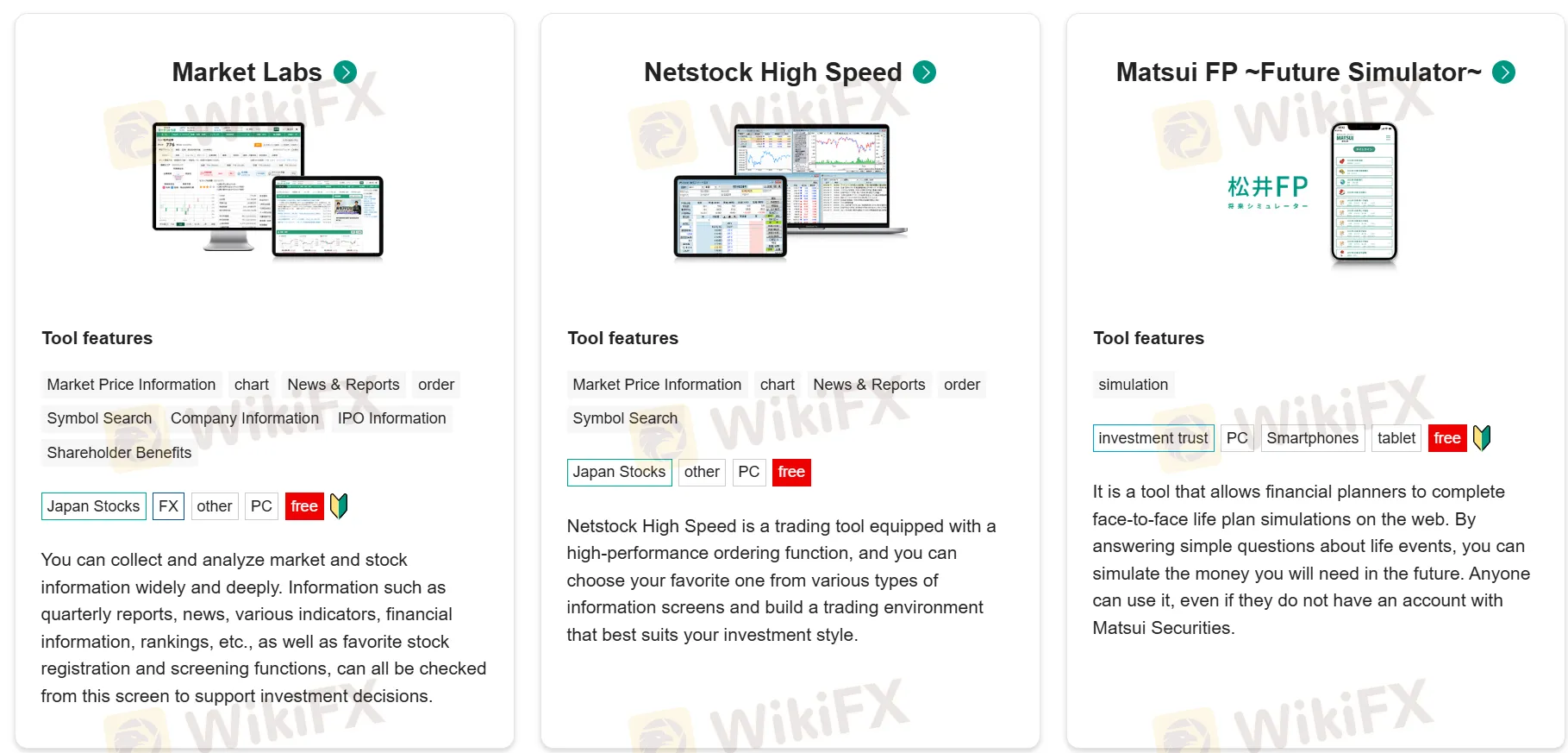

| Trading Platform | Japanese Equity App, U.S. Stocks App, Investment Trust App, Forex App, Futures OP App, Netstock High Speed, FX Trader Plus |

| Customer Support | 0120-021-906 |

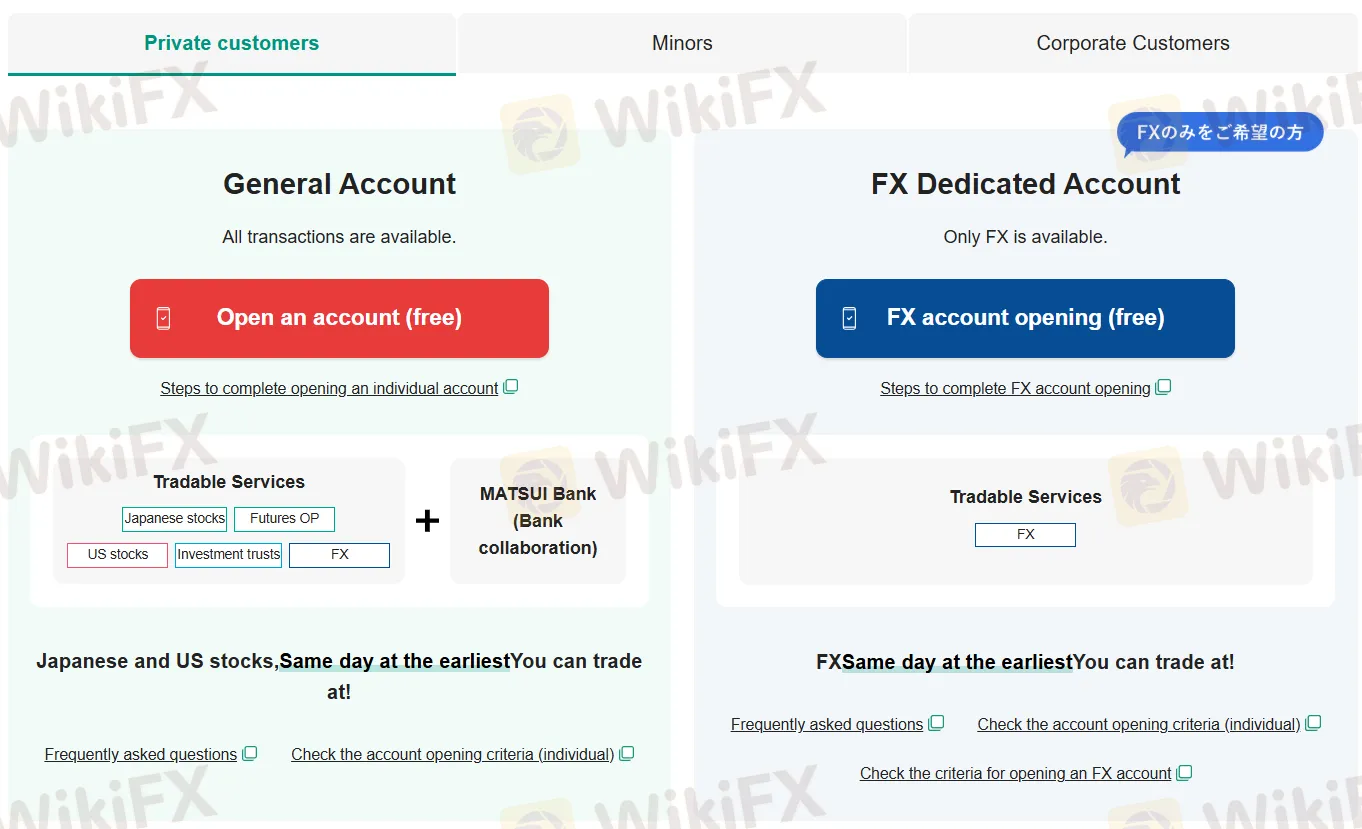

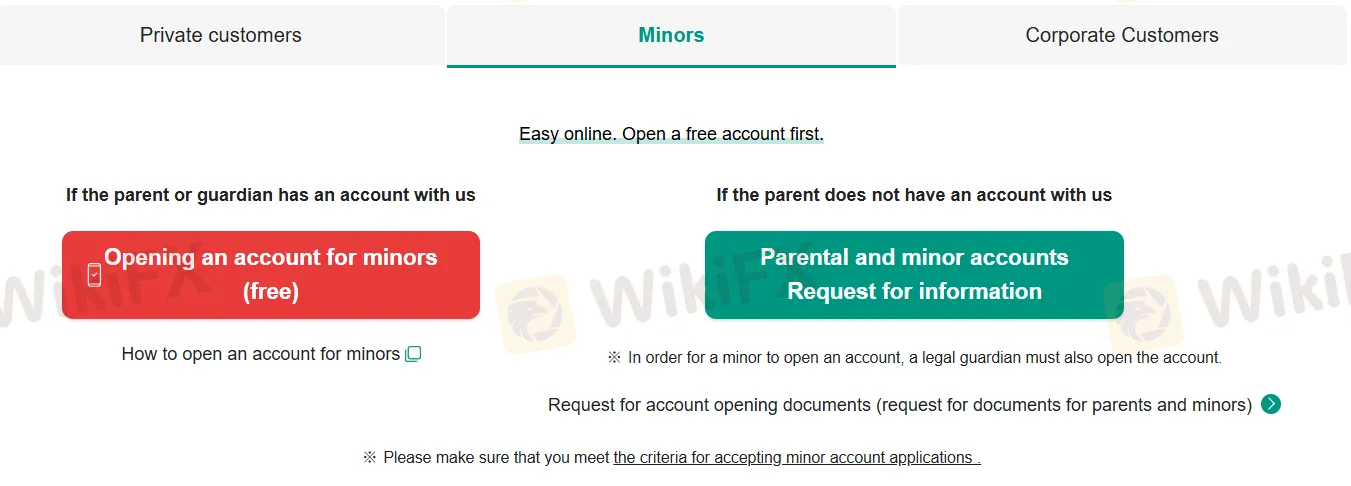

Matsui Securities, regulated by Japan's FSA, offers financial instruments including Japanese and US stocks, investment trusts, FX, futures and options, NISA, iDeCo, and MMFs. They provide various trading platforms for both mobile and PC, and notably feature free deposits and withdrawals.

| Pros | Cons |

|

|

|

|

|

Matsui has a Retail Forex License regulated by the Financial Services Agency (FSA) in Japan with a license number of 関東財務局長(金商)第164号.

Matsui offers diverse financial products, including Japanese stocks, US stocks, investment trusts, FX, futures and options, NISA, iDeCo, and MMFs. Their services cover banking, account management, deposits/withdrawals, points service, and more.

| Tradable Instruments | Supported |

| Futures | ✔ |

| Options | ✔ |

| Forex | ✔ |

| iDeCo | ✔ |

| Cryptocurrency | ❌ |

| Shares | ❌ |

| Metals | ❌ |

Spreads: Matsui offers spreads for major currency pairs, including USD/JPY at 0.2-0.9 sen, EUR/JPY at 0.5 sen, AUD/JPY at 0.7 sen, and EUR/USD at 0.4 pips.

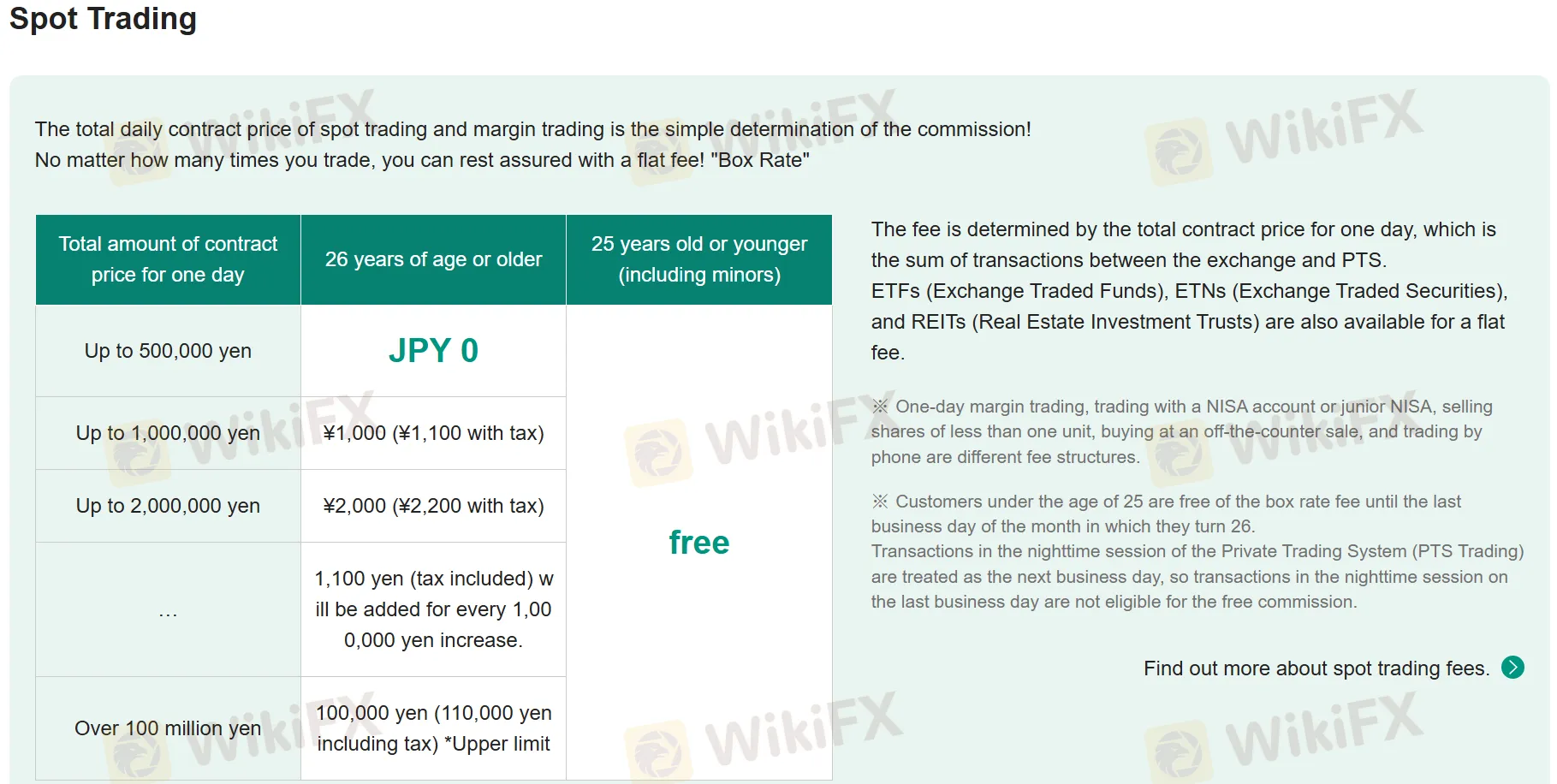

Commissions: Matsui's spot trading features a flat “Box Rate” fee structure based on the total daily contract price. Customers aged 25 or younger (including minors) enjoy commission-free trading. For those older, fees start at JPY 0 for up to 500,000 yen and increase with the total contract value.

| Total amount of contract price for one day | 26 years of age or older | 25 years old or younger (including minors) |

| Up to 500,000 yen | JPY 0 | Free |

| Up to 1,000,000 yen | ¥1,000 (¥1,100 with tax) | Free |

| Up to 2,000,000 yen | ¥2,000 (¥2,200 with tax) | Free |

| ... | ¥1,100 yen (tax included) will be added for every 1,000,000 yen increase. | Free |

| Over 100 million yen | ¥100,000 (¥110,000 yen including tax) *Upper limit | Free |

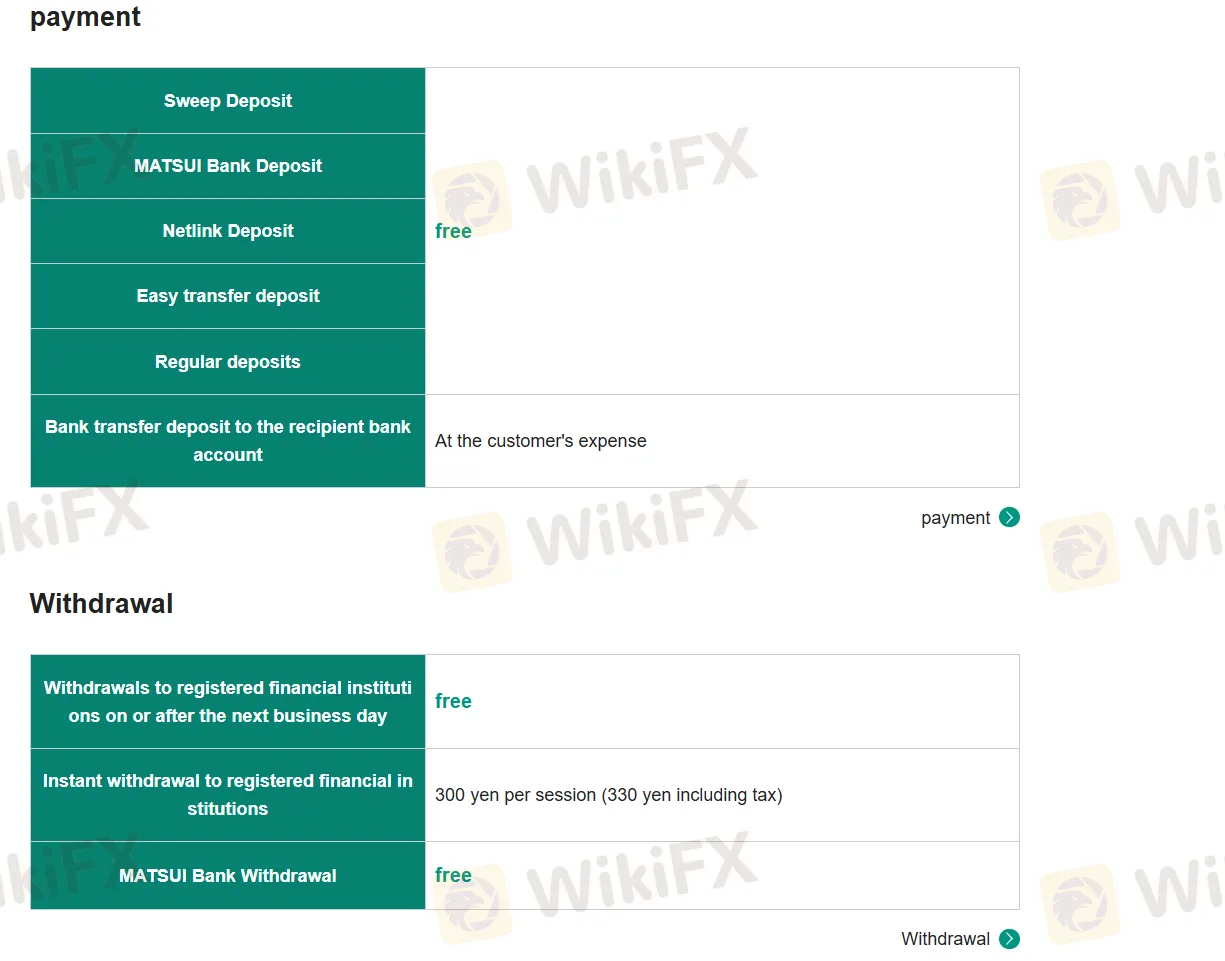

Non-Trading Fees

| Deposit Fee | Free |

| Withdrawal Fee | Free |

| Trading Platform | Supported | Available Devices | Suitable for |

| Japanese Equity App | ✔ | IOS and Android | Investors of all experience levels |

| U.S. Stocks App | ✔ | IOS and Android | Investors of all experience levels |

| Futures OP App | ✔ | IOS and Android | Investors of all experience levels |

| xxxForex App | ✔ | IOS and Android | Investors of all experience levels |

| Investment Trust App | ✔ | IOS and Android | Investors of all experience levels |

| Netstock High Speed | ✔ | PC | Investors of all experience levels |

| FX Trader Plus | ✔ | PC | Investors of all experience levels |

Matsui charges no fees for deposits and withdrawals.

More

User comment

6

CommentsWrite a review

2024-08-22 18:20

2024-08-22 18:20

2022-12-15 11:43

2022-12-15 11:43