User Reviews

More

User comment

1

CommentsWrite a review

2024-03-25 00:51

2024-03-25 00:51

Score

10-15 years

10-15 yearsRegulated in Cyprus

Forex Execution License (STP)

MT4 Full License

Regional Brokers

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index5.50

Business Index8.00

Risk Management Index0.00

Software Index9.94

License Index3.92

Single Core

1G

40G

More

Company Name

L.F. Investment Ltd

Company Abbreviation

PURPLE TRADING

Platform registered country and region

Cyprus

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Purple Trading Review Summary | |

| Founded | 2016 |

| Registered Country/Area | Cyprus |

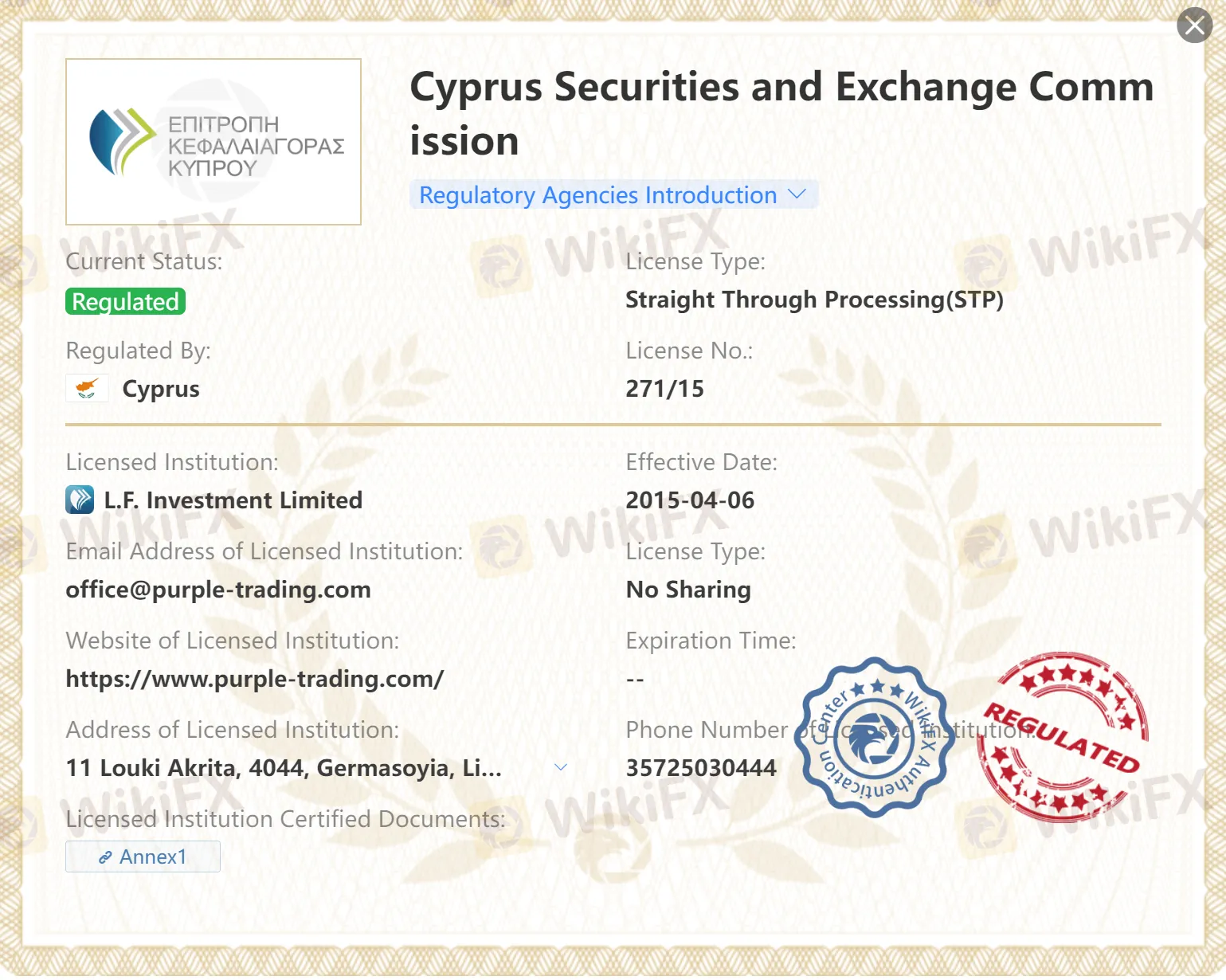

| Regulation | CYSEC |

| Tradable Assets | Forex, indices, commodities, stocks, futures |

| Demo Account | ✅ |

| Islamic Account | ❌ |

| Account Types | STP, ECN, PRO |

| Maximum Leverage | 1:30 (retail)/1:500 (professional) |

| EUR/USD Spread | From 0.3 pips |

| Trading Platforms | MT4/5, cTrader |

| Payment Methods | Visa, MasterCard |

| Deposit & Withdrawal Fee | ❌ |

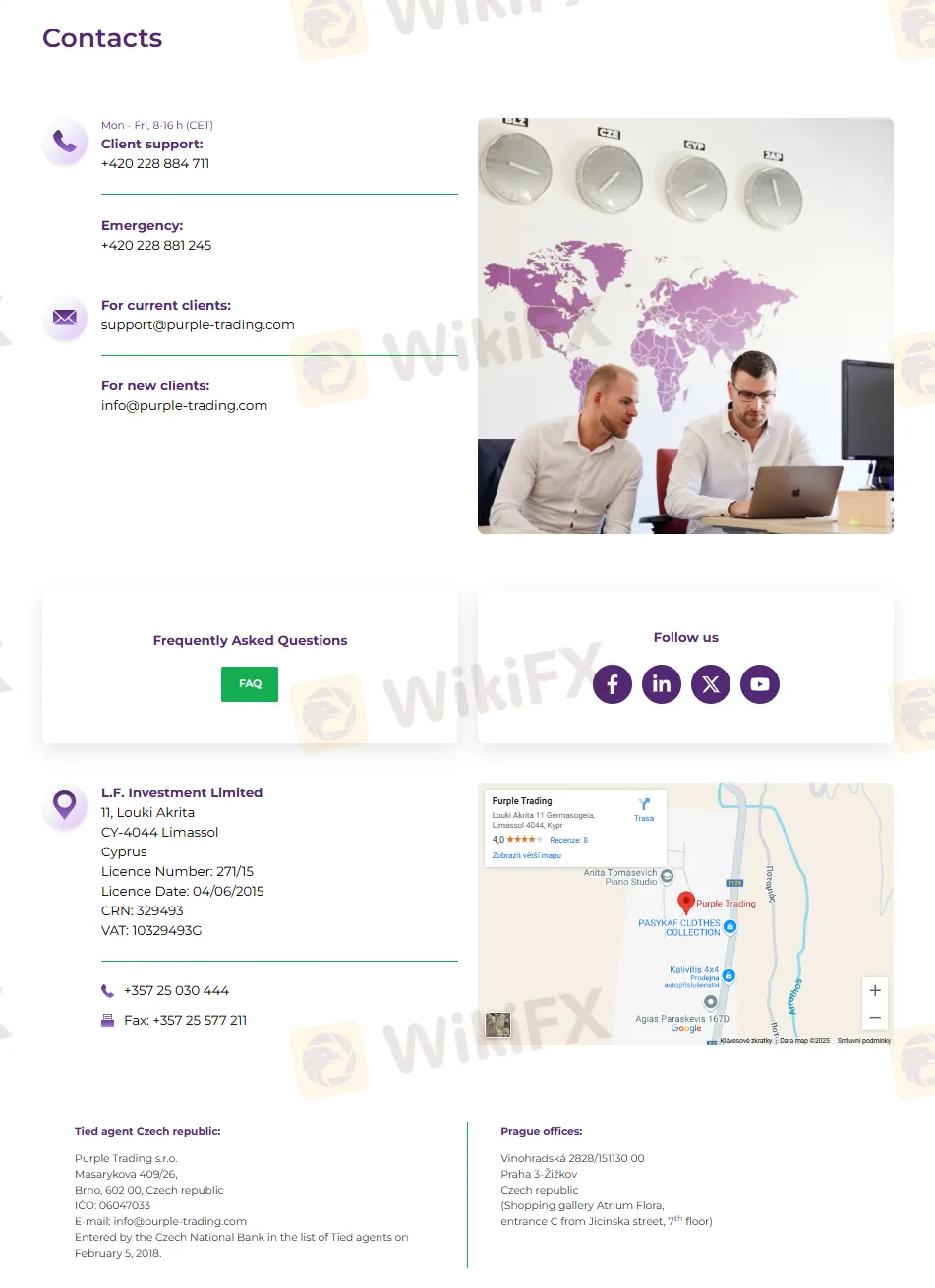

| Customer Support | Mon - Fri, 8-16 h (CET) |

| Live chat | |

| Tel: +420 228 884 711 | |

| Email: support@purple-trading.com (for current clients) | |

| info@purple-trading.com (for new clients) | |

| Regional Restrictions | Not accept clients from outside the European Economic Area and from Belgium, Switzerland and USA |

Purple Trading, headquartered in Cyprus, operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CYSEC). It offers a maximum leverage of up to 1:30 for retail clients and up to 1:500 for professional clients, varying by instrument. Spreads start from 1.3 pips for STP accounts and 0.3 pips for ECN accounts. Clients can trade a diverse range of assets including Forex, Indices, Commodities, Stocks, and Futures. Purple Trading provides multiple account types such as ECN, STP, and PRO, each with its own fee structures and benefits. It also offers a free demo account for users to practice trading strategies.

| Pros | Cons |

|

|

|

|

|

|

| |

| |

| |

|

Purple Trading is regulated by the Cyprus Securities and Exchange Commission (CYSEC) with license no. 271/15, ensuring compliance with strict financial standards and protocols. This regulatory oversight instills confidence in clients, as it indicates that Purple Trading operates within a regulated framework, offering greater transparency and protection for investors. CYSEC's supervision ensures Purple Trading's adherence to legal and ethical practices in the financial industry.

Purple Trading offers a comprehensive array of market instruments across various categories: forex, indices, commodities, stocks, and futures.

| Tradable Assets | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Futures | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Purple Trading offers free demo accounts with a minimum initial virtual deposit of 1,000 (EUR, GBP, USD, CZK, or PLN).

It also offers three real account types, including STP, ECN, and PRO, with minimum deposit requirement of $100. You can find similarities and differences between different account types in the table below:

| STP | ECN | PRO | |

| Suitable for | Position/swing traders | Intraday/scalping traders | Professional traders |

| Trading Platforms | MT4 / MT5 / cTrader | ||

| Account Opening Fee | ❌ | ||

| Minimum Deposit | $100 | ||

| Accepted Currencies | EUR / GBP / USD / CZK / PLN | ||

| Spread | From 1.3 pips | From 0.3 pips | - |

| Commission | ❌ | 5-10 USD/lot | - |

Additionally, Purple Trading also offers a managed account, which serves as your link to the wide range of investment products that Purple Trading offers to their clients, including passive ETF portfolios, dynamic investment strategies created by professional traders, as well as their “mini” version which is more suitable for smaller investments because they can invest as little as 100 EUR.

Purple Trading offers varying levels of leverage depending on the instrument being traded and the classification of the client:

Purple Trading provides access to three leading trading platforms, MetaTrader 4/5 (MT4/5) and cTrader, offering clients a comprehensive suite of tools and features for effective trading.

MetaTrader 4/5, a widely acclaimed platform in the industry, offers advanced charting capabilities, customizable indicators, and automated trading through Expert Advisors (EAs), empowering traders with robust technical analysis tools.

On the other hand, cTrader stands out with its intuitive interface, lightning-fast execution, and Level II pricing transparency, catering to traders who prioritize speed, precision, and depth of market insights.

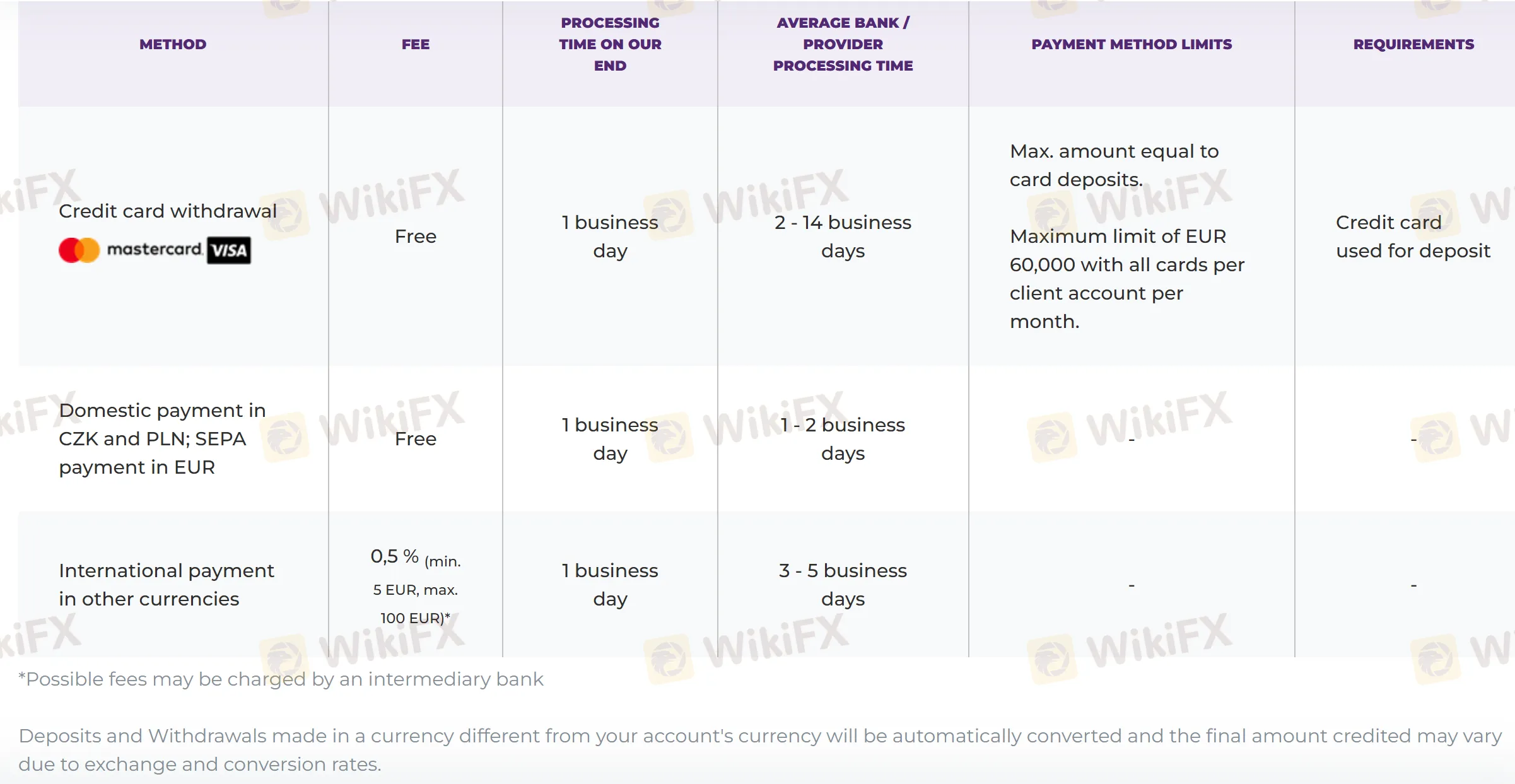

| Payment Methods | Deposit/Withdrawal Fee | Max. Deposit/Withdrawal | Deposit Time | Withdrawal Time |

| MasterCard/Visa | ❌ | EUR 60,000 | Instantly | 1 business day |

| Domestic payment in CZK and PLN; SEPA payment in EUR | ❌ | - | 1 business day | |

| International payment in other currencies | 0.5% (min. 5 EUR, max. 100 EUR) | - | 1 business day | |

Note that deposits and withdrawals made in a currency different from your account's currency will be automatically converted and the final amount credited may vary due to exchange and conversion rates.

Purple Trading offers comprehensive customer support through various channels:

If you want to see whether a broker is truly reliable, you must read real user reviews. Therefore, to tell you the truth about Purple Trading, we collected genuine reviews for you that reveal the real story about this broker. In this article, you will learn about Purple Trading Regulation , its Trading Platform, Account Types and user reviews.

WikiFX

WikiFX

CySEC has fined Purple Trading operator L.F. Investment Ltd €150,000 for compliance failures related to conflicts of interest and the marketing of high-risk CFDs to retail investors.

WikiFX

WikiFX

More

User comment

1

CommentsWrite a review

2024-03-25 00:51

2024-03-25 00:51