User Reviews

More

User comment

1

CommentsWrite a review

2024-02-29 14:40

2024-02-29 14:40

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index7.41

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Maybank Kim Eng Securities Pte Ltd

Company Abbreviation

Maybank Kim Eng

Platform registered country and region

Singapore

Company website

YouTube

Company summary

Pyramid scheme complaint

Expose

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Maybank Securities Review Summary in 9 Points | |

| Founded | 1972 |

| Registered Country/Region | Singapore |

| Regulation | Not regulated |

| Demo Account | Available |

| Products & Services | Stocks, Contract for Difference, Forex, Exchange Traded Fund, Bond & Fixed Income, Warrants, Real Estate Investment Trust, Daily Leverage Certificates, Margin Facility, Multi-Currency e-Pay, Securities Lending, Securities Lending & Borrowing, Shenzhen-HK Connect, Shanghai-HK Stock, Special Purpose Acquisition Companies, Investment Banking & Advisory, Investment Banking & Advisory, Investment Banking & Advisory, Prime Brokerage, Equities & Trading |

| Trading Platforms | Maybank Trade, Maybank CFD, Maybank Forex |

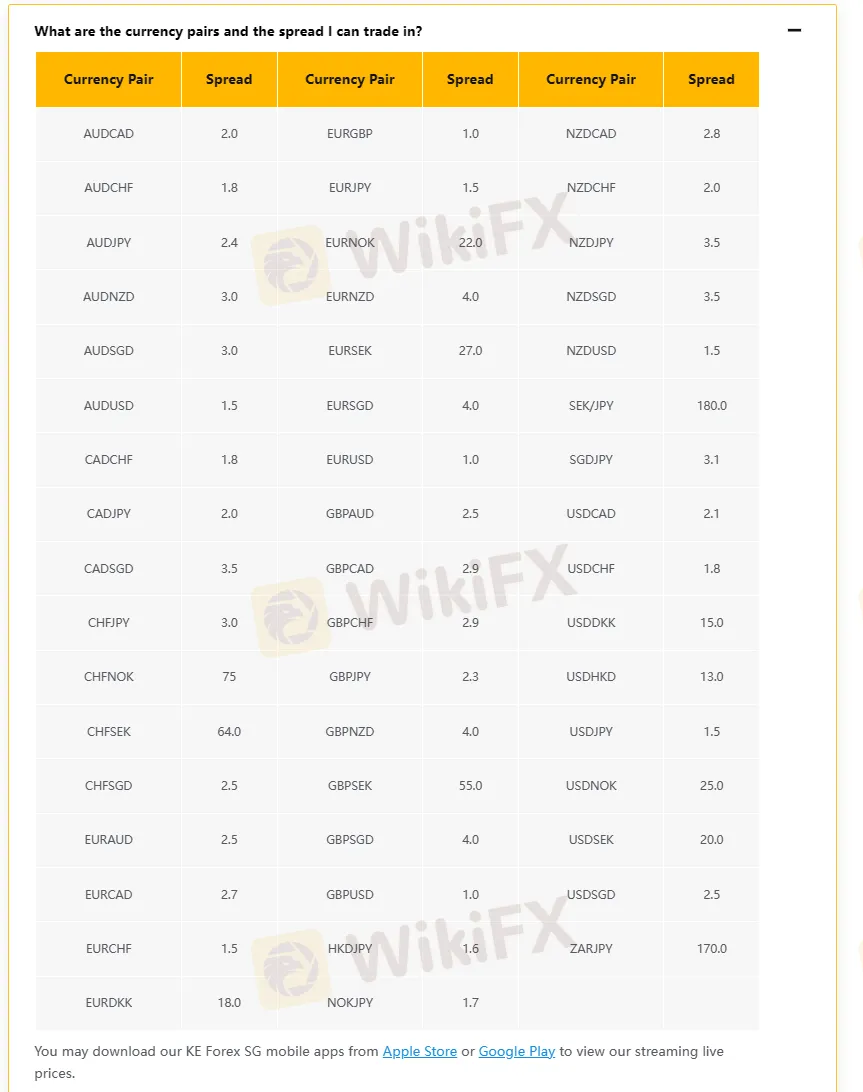

| EURUSD Spreads | 1.0 pips |

| Minimum Deposit | 0 |

| Customer Support | Enquiry form, Phone, Email, Social Media, Address |

Maybank Securities is a global financial company based in Singapore who provides traders with access to products and services including Stocks, Contract for Difference, Forex, Exchange Traded Fund, Bond & Fixed Income, Warrants, Real Estate Investment Trust, Daily Leverage Certificates, Margin Facility, Multi-Currency e-Pay, Securities Lending, Securities Lending & Borrowing, Shenzhen-HK Connect, Shanghai-HK Stock, Special Purpose Acquisition Companies, Investment Banking & Advisory, Investment Banking & Advisory, Investment Banking & Advisory, Equities & Trading. It is currently not regulated by any recognized financial authorities which may raise concerns when trading.

In the following article, we will analyze the characteristics of this financial company from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the company's characteristics at a glance.

| Pros | Cons |

| • Wide range of financial products and services | • Not regulated |

| • Rich educational resources | • Wide forex spreads |

| • Multiple customer support channels | • Negative reviews from their clients |

| • No minimum deposit requirement | |

| • Various account types to suit different trading needs | |

| • Demo account available |

When considering the safety of a financial service company like Maybank Securities or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a financial service company:

Regulatory sight: It is currently not regulated by any major financial authorities, which means that there is no guarantee that it is a safe platform to trade with.

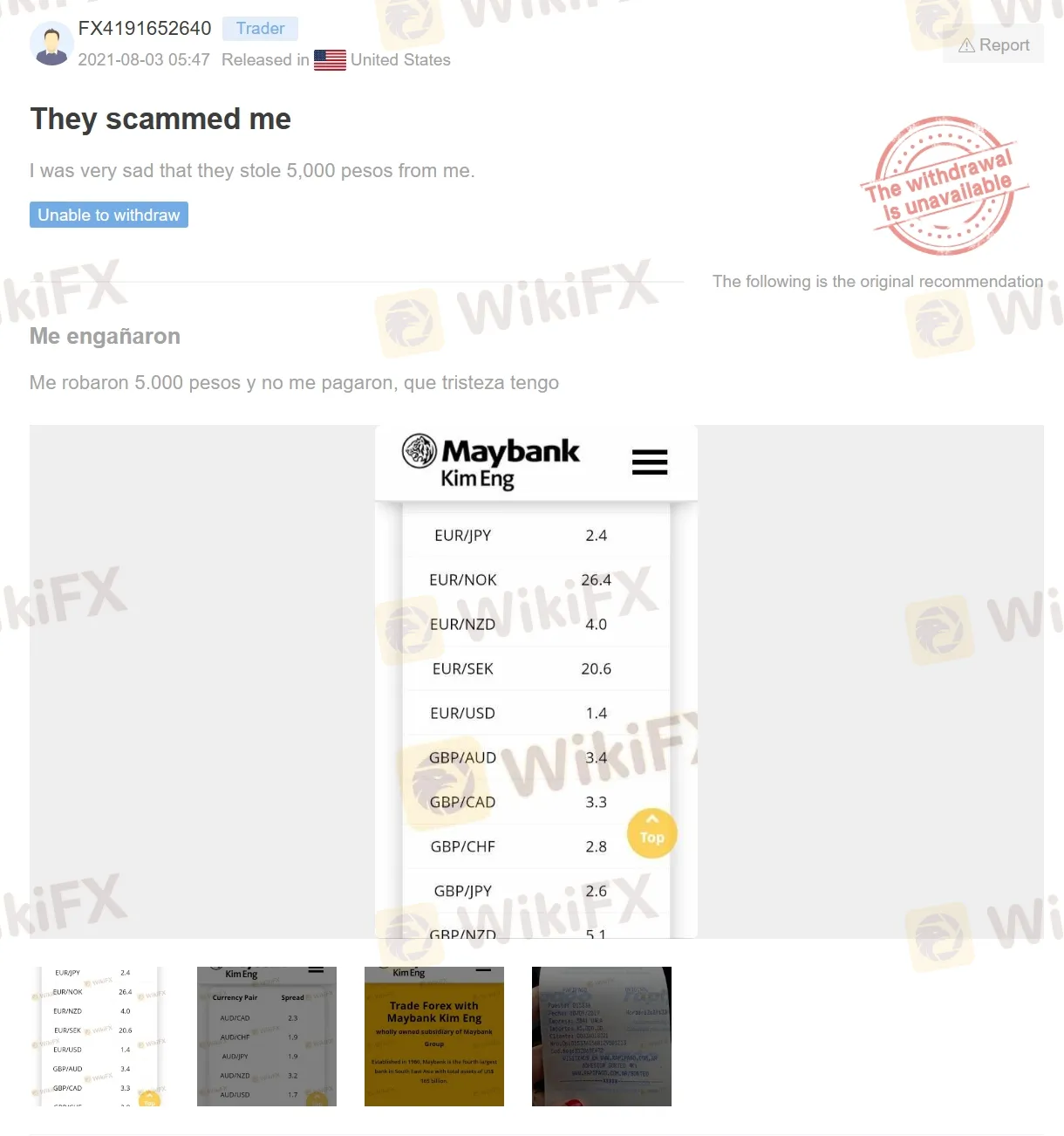

User feedback: A report of scam on WikiFX has raised a red flag for Maybank Securities, indicating potential concerns or risks associated with the brokerage firm's operations or services. Traders and investors should exercise caution and conduct thorough due diligence before engaging with Maybank Securities to ensure the safety and legitimacy of their investments.

Security measures: Maybank Securities implements a robust privacy policy to safeguard clients' personal and financial information, ensuring strict confidentiality and data protection as vital security measures.

Ultimately, the decision of whether or not to trade with Maybank Securities is a personal one. You should weigh the risks and benefits carefully before making a decision.

Maybank Securities presents a comprehensive suite of financial products and services, catering to the diverse needs of investors and traders.

Clients can access a wide range of investment opportunities, including traditional Stocks, Contract for Difference (CFDs), and the dynamic Forex market. Additionally, the platform offers Exchange Traded Funds (ETFs), Bonds & Fixed Income, and Warrants, allowing investors to diversify their portfolios.

For those seeking real estate exposure, Real Estate Investment Trusts (REITs) are available. Daily Leverage Certificates provide leveraged trading options, while the Margin Facility empowers investors with additional trading power. Multi-Currency e-Pay facilitates seamless cross-border transactions, and Securities Lending and Borrowing options further enhance flexibility.

With access to Shenzhen-Hong Kong Connect and Shanghai-Hong Kong Stock Connect, clients can partake in cross-border investments. Special Purpose Acquisition Companies (SPACs) services enable participation in potential mergers and acquisitions.

The Investment Banking & Advisory services, together with Prime Brokerage and Equities & Trading offerings, deliver comprehensive support for both corporate and individual clients, ensuring a holistic and well-rounded financial experience with Maybank Securities.

Maybank Securities offers both Demo and Live accounts to cater to the diverse trading needs of its clients.

The Demo Account provides an opportunity for traders to practice and familiarize themselves with the trading platform and strategies without risking real money.

On the other hand, the Live Account presents a range of options with no minimum sum requirement, ensuring accessibility to traders of all levels.

Clients can choose from various live account types, such as the Maybank Trade Cash Account for straightforward cash trading, the Maybank Trade Pre-Funded Account with pre-funded balances, and the Maybank Margin Financing Account for leveraged trading. For those interested in Contract for Difference (CFD) trading, the Maybank CFD Account requires a minimum deposit of SGD3,000, while the Maybank FOREX Account provides access to the dynamic foreign exchange market.

If your Maybank account has had no transactions in the past 4 years, it will be considered dormant due to the lack of activity. However, you can reactivate the dormant account by using MyInfo, a secure and convenient method to update your account information and resume its active status.

Maybank Securities provides a trading environment with relatively wide spreads, particularly on the popular EURUSD currency pair, where the spread starts from 1.0 pips. The spread represents the difference between the buying and selling price of a financial instrument, and a wider spread may result in higher trading costs for traders. Traders should carefully consider the impact of spreads on their trading strategies and account performance. While wider spreads may be suitable for certain trading styles, others may prefer brokers with tighter spreads to optimize their trading costs. It is essential for traders to weigh their options and choose a brokerage that aligns with their trading objectives and risk tolerance.

Maybank Trade offers its clients the convenience and flexibility of accessing their trading accounts through either a Web Platform or a Mobile Application.

The web-based Maybank Trade platform enables traders to access their accounts from any internet-connected device with a compatible web browser, providing a seamless and user-friendly trading experience.

For those on the go, Maybank Trade Mobile Application is available on both iOS and Android devices, ensuring that traders can monitor and execute trades anytime, anywhere.

Furthermore, with Maybank CFD (Contract for Difference) and Maybank Forex available on both iOS and Android devices, clients have access to a diverse range of financial instruments to trade and invest in, catering to various trading preferences and strategies.

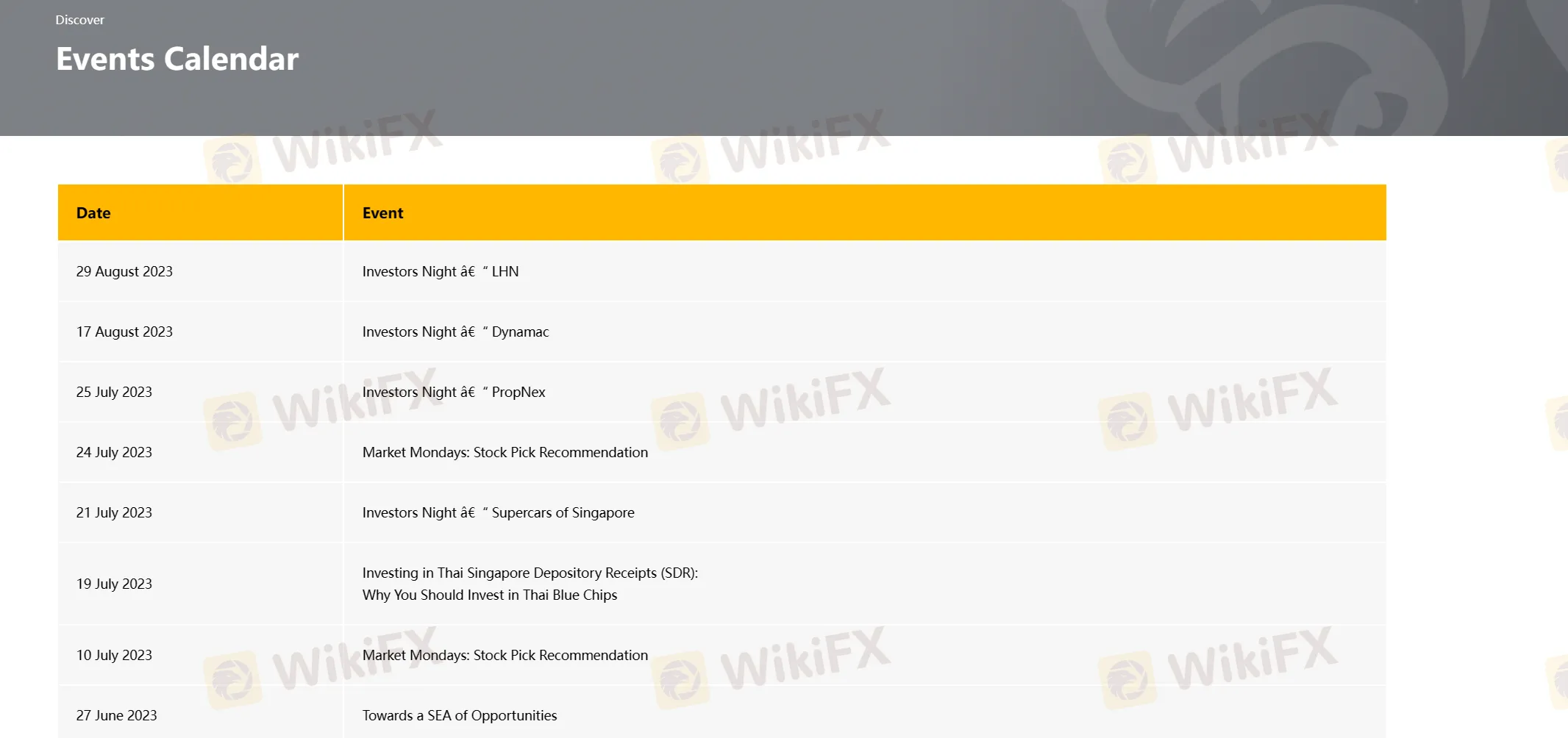

Maybank Securities provides an event calendar as a valuable trading tool to empower its clients with timely and crucial market information. The event calendar includes a comprehensive schedule of upcoming economic events, corporate announcements, central bank meetings, and other significant financial occurrences that may impact the financial markets. Traders can use this calendar to plan their trading strategies, stay informed about potential market-moving events, and make well-informed decisions based on the expected impact of each event.

Maybank Securities offers its clients a variety of payment methods for both funding their trading accounts and withdrawing funds in Forex accounts.

Clients can deposit funds using Internet Banking, Telegraphic Transfer (TT), and other convenient options.

For withdrawals, clients can request funds via email using their registered email address, and they have the option to receive a cheque or have the funds directly deposited into their bank account.

Withdrawal requests received before 12 pm on a working day are typically processed within 2 working days. It's important to note that Maybank Securities does not allow third-party funds transfer, thus to ensure enhanced security for their clients' transactions. The withdrawal options are limited to the client's name and bank account, further reinforcing the focus on client safety and protection.

A report of a scam on WikiFX has raised a red flag for Maybank Securities, signaling potential concerns regarding the brokerage's operations or services. This incident should prompt traders and investors to exercise caution and conduct thorough due diligence before engaging with Maybank Securities. Verifying the legitimacy and reliability of the brokerage is crucial in safeguarding one's investments and ensuring a secure and trustworthy trading environment. Clients should seek additional information and reviews from reputable sources to make informed decisions and protect their financial interests.

Maybank Securities provides multiple customer service options to assist its clients. Customers can reach out to Maybank Securities through various channels to address their queries and concerns as below:

Address: 50 North Canal Road, Singapore 059304, 9am - 6pm (Monday - Friday)

Email: MSSG_Helpdesk@maybank.com.

Email for Forex: MSSG_LeveragedFXDept@maybank.com.

Email for Investment Banking & Advisory: MSSG_LeveragedFXDept@maybank.com.

Email for Data Protection: MSSG_dpo@maybank.com.

Phone: +65 6231 5888

Night Desk (US Trading): +65 6231 5554 (Operating Hours: 9:30pm to 4:00am during Daylight Saving Time; US Market trading days: 10:30pm to 5:00am during Standard Time)

As part of their comprehensive customer support services, Maybank Securities offers a user-friendly Enquiry form, allowing clients to conveniently reach out to the company with their inquiries, concerns, or any assistance they may require.

Maybank Securities presents its Invest Academy as a comprehensive educational resource divided into three sections to cater to the diverse learning needs of its clients.

In the “Starting Out” section, beginners can find valuable insights and guidance on the fundamentals of investing, introducing them to the world of financial markets.

The “Knowledge Boost” section offers intermediate-level content, providing traders with in-depth knowledge and strategies to enhance their trading skills and decision-making abilities. For experienced traders seeking to further expand their horizons, the “Expanding Your Horizon” section offers advanced topics and market insights, empowering traders to navigate complex market conditions with confidence.

According to available information, Maybank Securities is a non-regulated Singapore -based financial service company. It provides traders with a comprehensive range of financial products and services including Stocks, Contract for Difference, Forex, Exchange Traded Fund, Bond & Fixed Income, Warrants, Real Estate Investment Trust, Daily Leverage Certificates, Margin Facility, Multi-Currency e-Pay, Securities Lending, Securities Lending & Borrowing, Shenzhen-HK Connect, Shanghai-HK Stock, Special Purpose Acquisition Companies, Investment Banking & Advisory, Investment Banking & Advisory, Investment Banking & Advisory, Prime Brokerage, Equities & Trading. However, it is important to consider certain factors such as lack of regulations that may raise concerns, it is critical that potential clients exercise caution, conduct thorough research and seek up-to-date information directly from Maybank Securities before making any investment decisions.

| Q 1: | Is Maybank Securities regulated? |

| A 1: | No. It has been verified that this company currently has no valid regulation. |

| Q 2: | Is Maybank Securities a good broker for beginners? |

| A2: | No. It is not a good choice for beginners since its currently not under regulation by any recognized financial authorities. Besides, a report of scam on WikiFX is also a red flag that raises concerns. |

| Q 3: | Whats the products and services of Maybank Securities? |

| A 3: | Maybank Securities provides traders with a comprehensive range of financial products and services including Stocks, Contract for Difference, Forex, Exchange Traded Fund, Bond & Fixed Income, Warrants, Real Estate Investment Trust, Daily Leverage Certificates, Margin Facility, Multi-Currency e-Pay, Securities Lending, Securities Lending & Borrowing, Shenzhen-HK Connect, Shanghai-HK Stock, Special Purpose Acquisition Companies, Investment Banking & Advisory, Investment Banking & Advisory, Investment Banking & Advisory, Prime Brokerage, Equities & Trading. |

| Q 4: | What is the minimum deposit for Maybank Securities? |

| A 4: | The minimum initial deposit to open an account is $ 0. |

More

User comment

1

CommentsWrite a review

2024-02-29 14:40

2024-02-29 14:40