User Reviews

More

User comment

3

CommentsWrite a review

2022-11-28 18:16

2022-11-28 18:16 2022-11-27 15:25

2022-11-27 15:25

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

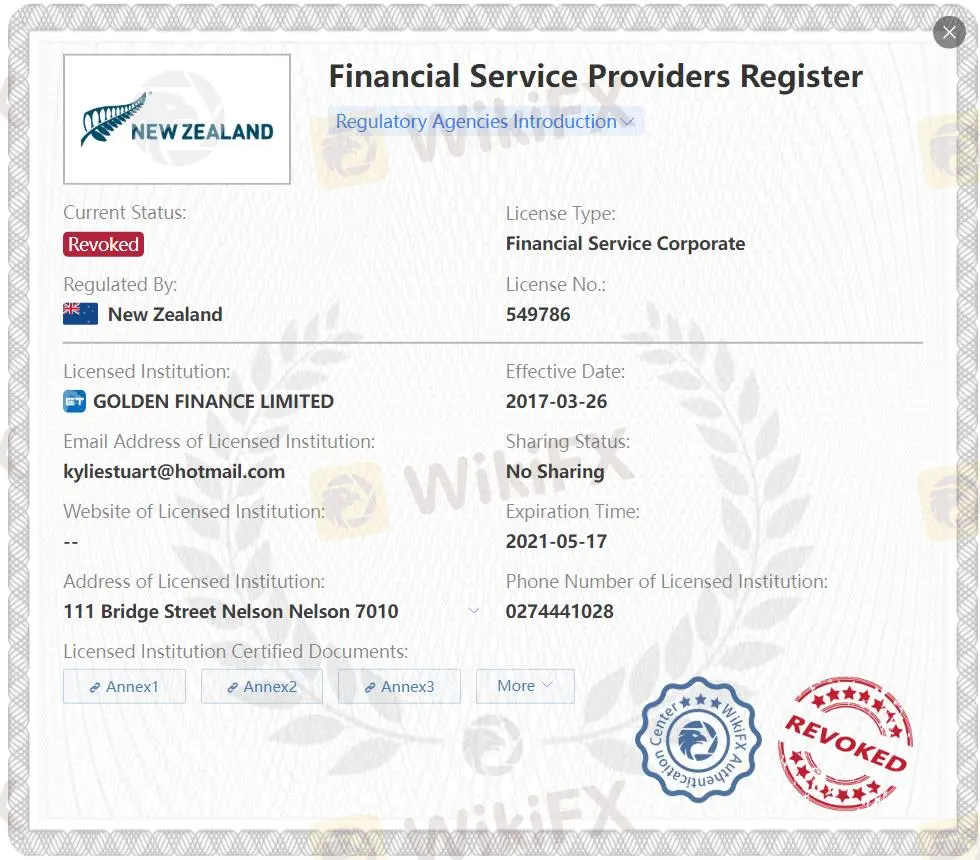

New Zealand Financial Service Corporate Revoked

Suspicious Overrun

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.70

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

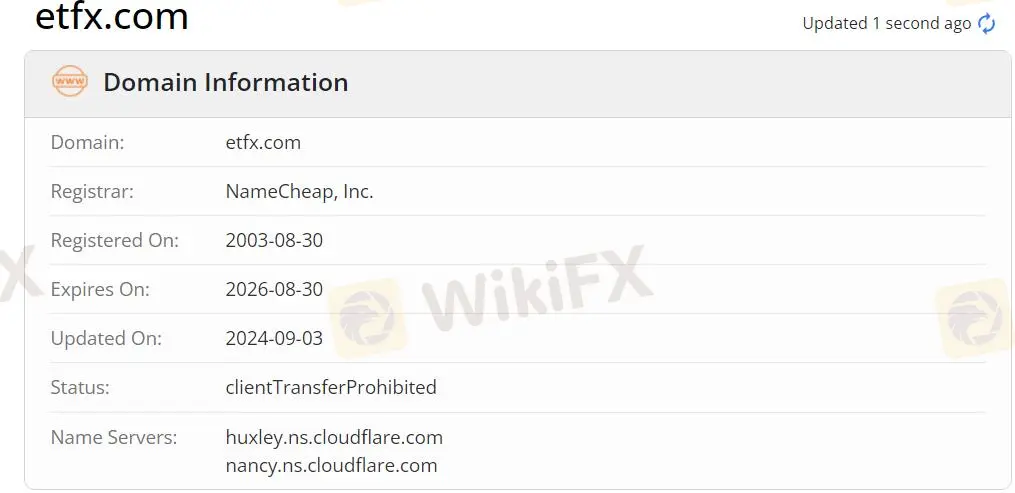

Note: ETFX's official website - http://www.etfx.com/# is currently inaccessible normally.

| ETFXReview Summary | |

| Founded | 2003 |

| Registered Country/Region | New Zealand |

| Regulation | FSPR/VFSC (Revoked) |

| Market Instruments | Forex currency pairs, Gold, Silver, CFDs, Crude oil |

| Demo Account | ✅ |

| Leverage | Up to 1:200 |

| EUR/USD Spread | Average 1.9 pips (Standard account) |

| Trading Platform | МetaТrader4 |

| Min Deposit | / |

| Customer Support | Tel: 4001338228 |

| Email: service@etfx.com | |

ETFX was registered in New Zealand in 2003 and has regulatory issues. You can register a demo account, with a maximum leverage of up to 1:200 and average spread of 1.9 pips through the MT4 platform.

| Pros | Cons |

| Long history | Unavailable website |

| Demo accounts | Regulatory issues |

| MT4 platform | Wide EUR/USD spreads |

| Limited payment options |

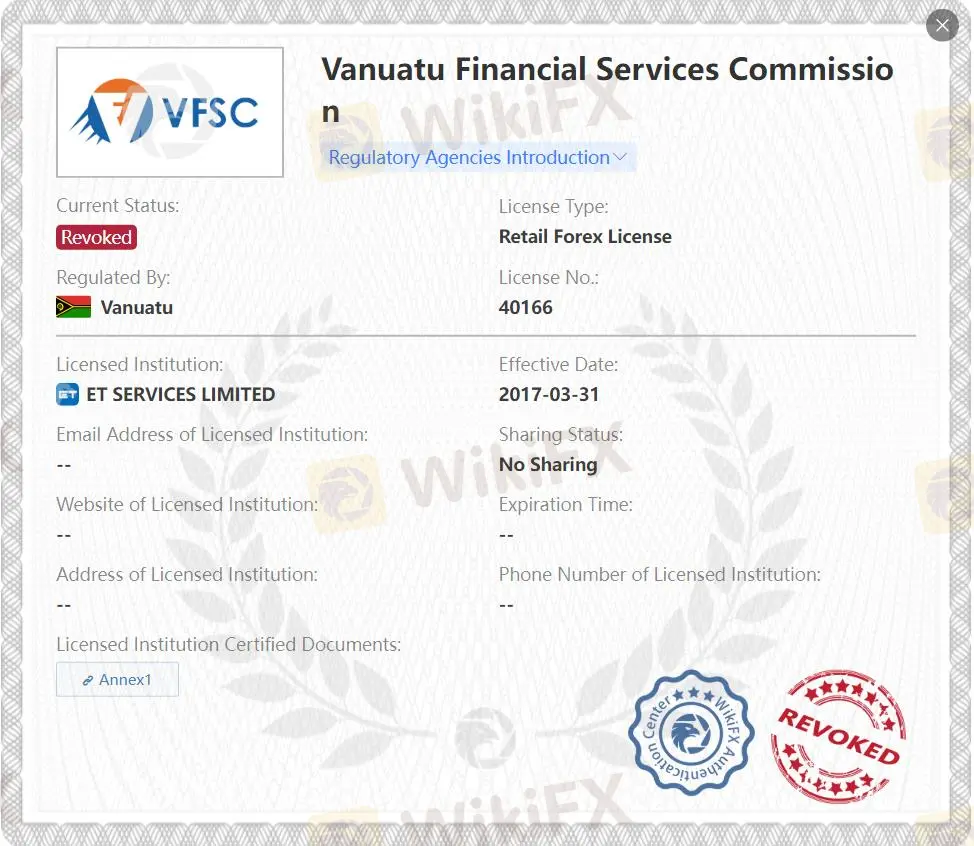

No. ETFX currently has no valid regulations. It only holds two revoked regulatory licenses. Please be aware of the risk!

| Regulatory Status | Revoked |

| Regulated by | Financial Service Providers Register (FSPR) |

| Licensed Institution | GOLDEN FINANCE LIMITED |

| Licensed Type | Financial Service Corporate |

| Licensed Number | 549786 |

| Regulatory Status | Revoked |

| Regulated by | Vanuatu Financial Services Commission (VFSC) |

| Licensed Institution | ET SERVICES LIMITED |

| Licensed Type | Retail Forex License |

| Licensed Number | 40166 |

| Tradable Instruments | Supported |

| Forex currency pairs | ✔ |

| Gold & Silver | ✔ |

| CFDs | ✔ |

| Crude oil | ✔ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

ETFX offers leverage up to 1:200. Although lower leverage results in relatively lower returns, the risk is also reduced accordingly.

The average EUR/USD spread on ETFX for the Standard account is 1.9 pips, higher than the industry average, with most brokers offering EUR/USD spreads between 1.1 and 1.5 pips. We all know that high spreads mean higher trading costs.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

ETFX only supports traders to deposit and withdraw funds to their investment accounts via UnionPay cards.

More

User comment

3

CommentsWrite a review

2022-11-28 18:16

2022-11-28 18:16 2022-11-27 15:25

2022-11-27 15:25