User Reviews

More

User comment

1

CommentsWrite a review

2025-03-20 22:22

2025-03-20 22:22

Score

15-20 years

15-20 yearsRegulated in Japan

Market Making License (MM)

Suspicious Scope of Business

Medium potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index7.83

Business Index8.00

Risk Management Index8.90

Software Index7.05

License Index7.83

Single Core

1G

40G

| HACHIJUNI Review Summary | |

| Founded | 2006 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Products and Services | Stocks, investment trusts, bonds |

| Demo Account | / |

| Trading Platform | Online Trading System |

| Minimum Deposit | ¥1,000 |

| Customer Support | Phone: 0120-70-3782 |

Hachijuni Securities, founded in 2006, is a Japan-based financial services firm regulated by the Financial Services Agency (FSA). It provides a wide range of products, including stocks, investment trusts, and bonds, with an emphasis on customized face-to-face service, however prices are greater than those charged by online brokers.

| Pros | Cons |

| Regulated by FSA | Higher fees, especially for face-to-face trading |

| No deposit/withdrawal fees | Limited to Hachijuni Bank for transfer services |

| Personalized customer service | High minimum deposit |

Yes, HACHIJUNI (八十二証券株式会社) is authentic. The Financial Services Agency (FSA) of Japan regulates it under the Retail Forex License, with the official license number 関東財務局長(金商)第21号.

Hachijuni Securities offers a lot of different financial products to both new and experienced investors. These include stocks, investment trusts, and bonds.

| Trading Instruments | Supported |

| Stocks | ✓ |

| Investment Trusts | ✓ |

| Bonds | ✓ |

| Forex | × |

| Commodities | × |

| Indices | × |

| Cryptocurrencies | × |

| Options | × |

| ETFs | × |

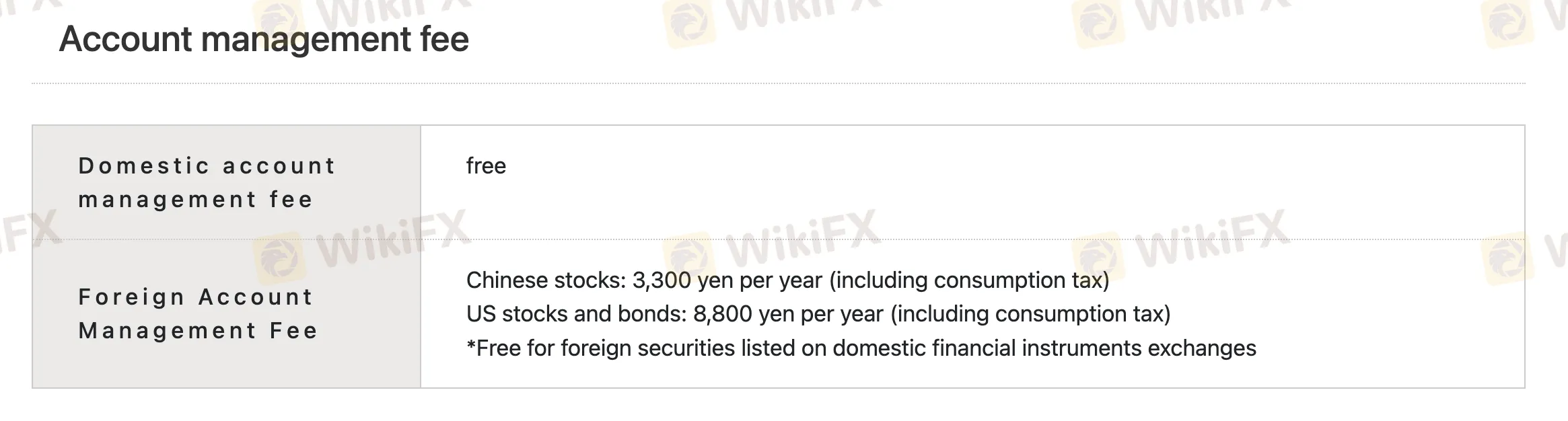

HACHIJUNI's fees are higher than the norm for the global internet trading business, especially for face-to-face stock transactions and managing foreign asset accounts. This makes it a better choice for traditional or local investors than for online traders who are trying to save money.

| Contract Price Range | Commission (Face-to-Face, Tax Included) |

| Under 1 million yen | 1.265% of contract price (minimum 2,750 yen) |

| 1M–1.5M yen | 0.990% + 2,750 yen |

| 1.5M–2.5M yen | 0.935% + 3,575 yen |

| 2.5M–3M yen | 0.913% + 4,125 yen |

| 3M–5M yen | 0.880% + 5,115 yen |

| 5M–10M yen | 0.715% + 13,365 yen |

| 10M–20M yen | 0.495% + 35,365 yen |

| 20M–30M yen | 0.440% + 46,365 yen |

| 30M–40M yen | 0.330% + 79,365 yen |

| 40M–50M yen | 0.275% + 101,365 yen |

| Over 50M yen | Flat 242,000 yen |

Non-Trading Fees

| Fee Type | Amount |

| Domestic Account Fee | 0 |

| Foreign Account Fee | Chinese stocks: 3,300 yen/year |

| US stocks & bonds: 8,800 yen/year (free for some assets) | |

| Share Transfer (<1 unit) | 1,100 yen per stock |

| Share Transfer (>1 unit) | 550 yen per unit (max 11,000 yen per stock) |

| Copies, Certificates | 1,100 yen each (account ledgers, balance certificates, bills of sale, etc.) |

| Trading Platform | Supported | Available Devices |

| Online Trading System | ✔ | PC, Tablet, Smartphone |

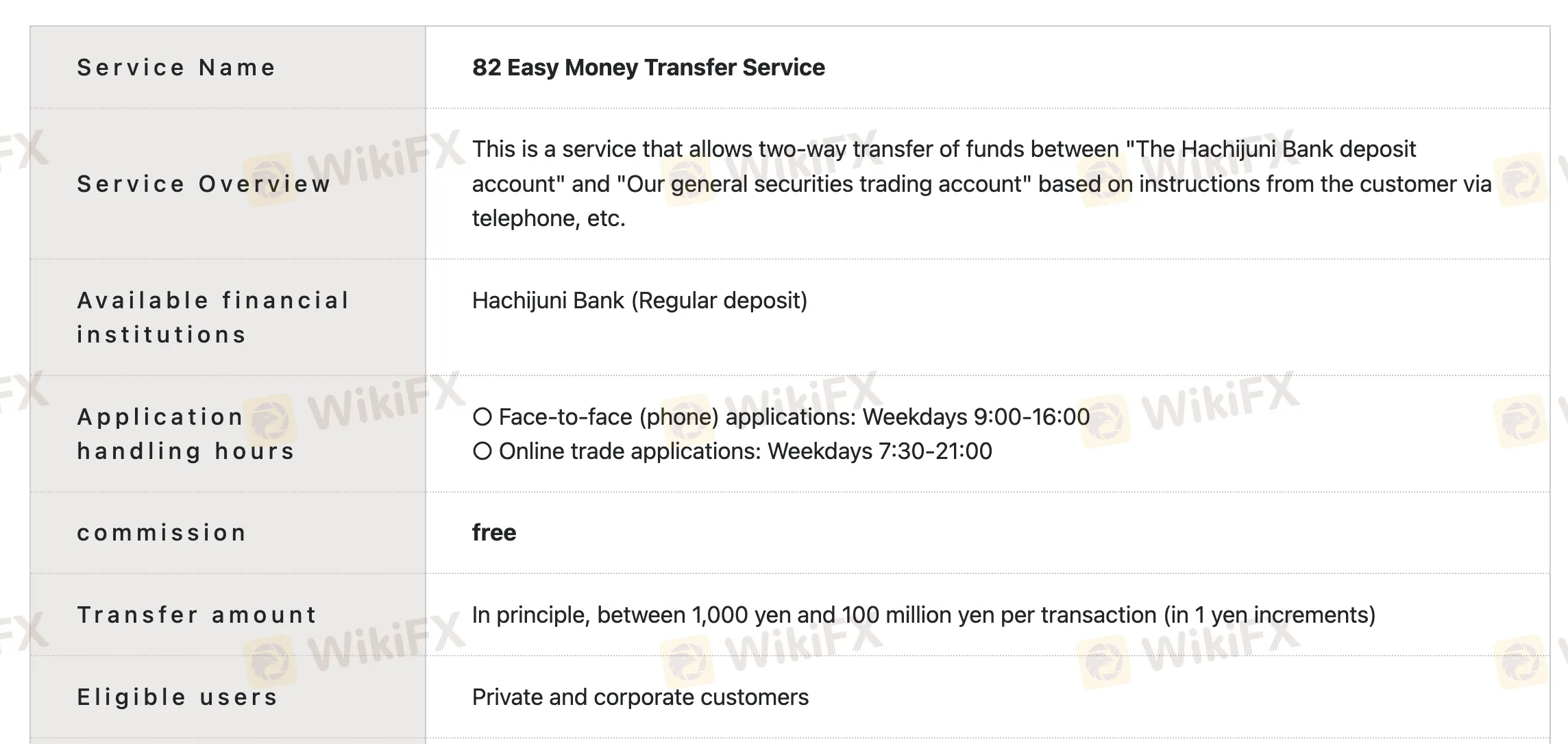

Hachijuni Securities does not impose deposit or withdrawal fees, and all transfer and remittance fees are covered by the company. The minimum deposit for the “82 Easy Money Transfer Service” is typically ¥1,000 per transaction.

| Paymenr Option | Minimum Amount | Fee | Processing Time |

| 82 Easy Money Transfer (Bank ↔ Securities) | ¥1,000 – ¥100 million per transaction | 0 | Phone: Weekdays 9:00–16:00; |

| Online: Weekdays 7:30–21:00 |

More

User comment

1

CommentsWrite a review

2025-03-20 22:22

2025-03-20 22:22