User Reviews

More

User comment

7

CommentsWrite a review

2023-12-06 10:52

2023-12-06 10:52 2023-12-05 13:52

2023-12-05 13:52

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.24

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Dizicx Global Limited

Company Abbreviation

dizicx

Platform registered country and region

Mauritius

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Dizicx Review Summary | |

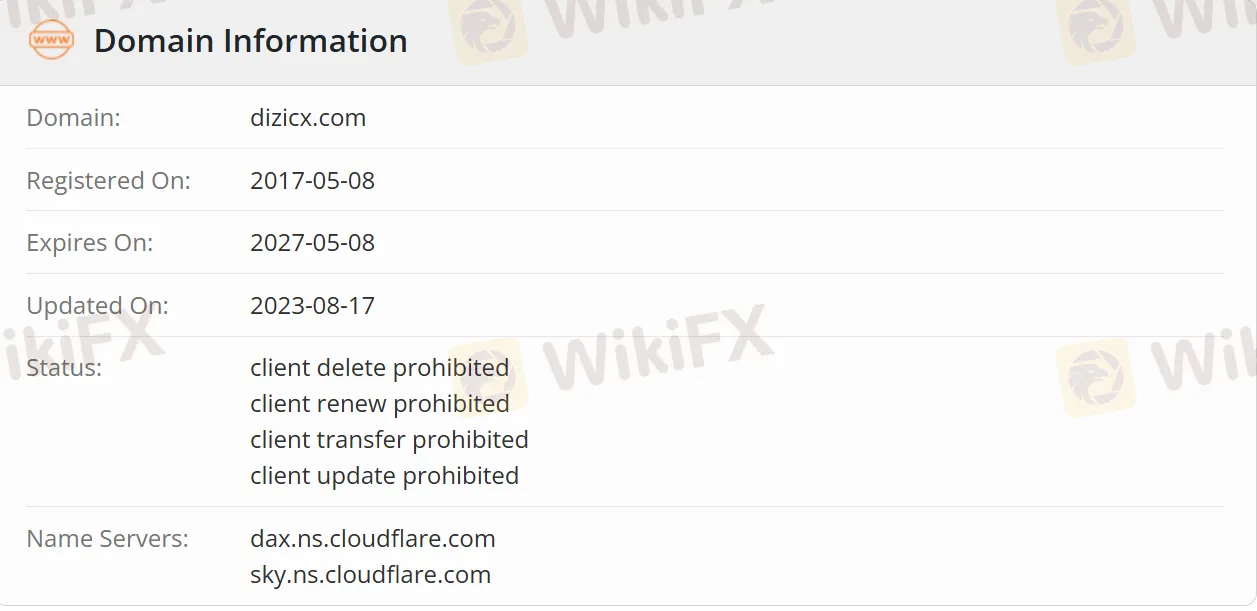

| Registered On | 2017-05-08 |

| Registered Country/Region | Mauritius |

| Regulation | Unregulated |

| Market Instruments | Currency Pairs, Commodities, Indices, Metals, and Shares |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 0.1 pips |

| Trading Platform | MT5 and DiziCX (Web, Android, iOS, and Windows) |

| Min Deposit | $1 |

| Customer Support | +230 260 0342 |

| support@dizicx.com | |

| Live Chat | |

| Facebook, Instagram, Twitter, YouTube, LinkedIn | |

| Physical Address:C9/17, Chitrakoot Scheme, Chitrakoot Marg, Vaishali Nagar, Jaipur, India. 302021 | |

Dizicx is a forex trading platform dedicated to providing global trading services for retail and institutional traders. The platform supports trading in over 180 CFD instruments, covering categories such as foreign exchange, cryptocurrencies, stock indices, and commodities, and offers multiple account types.

| Pros | Cons |

| The minimum deposit of $1 | Unregulated |

| Spread as low as 0.1 pips | $3 (Both Side, Pro account) |

| MT5 available | |

| Leverage up to 1:500 |

Dizicx is unregulated. Even if the platform claims to be regulated by the FSC, you can check the license through the official website of the regulatory authority.

Dizicx offers various trading instruments, including foreign exchange, commodities, stock indices, metals, and shares.

| Tradable Instruments | Supported |

| Currency Pairs | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Metals | ✔ |

| Shares | ✔ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

| Account Type | Standard Cent | Standard | Pro |

| Base Currency Options | USC | USD | USD |

| Minimum Deposit | $1 | $25 | $500 |

| Leverage | 1:1000 | 1:1000 | 1:200 |

| Spreads | Starts from 1 pips | Starts from 1 pips | Starts from 0.1 pips |

| Commission | No | No | $3 (Both Side) |

| Trading instruments | FOREX, METAL | FOREX, CFD, METAL | FOREX, CFD, METAL |

| Hedging allowed | YES | YES | YES |

| Stop out | 25/15 | 25/15 | 25/15 |

| Order Execution | INSTANT | INSTANT | MARKET EXECUTION |

| SWAP | No | No | Yes |

| Scalping | Allowed | Allowed | Allowed |

The spread for the Standard account starts from 1 pip, while that for the Pro account starts from 0.1 pip. There is no commission for the Standard account, but professional accounts such as the Pro account charge a bilateral commission of $3 per lot.

The maximum leverage for the Standard Cent/Standard account is 1:1000, while the leverage for professional accounts is 1:200.

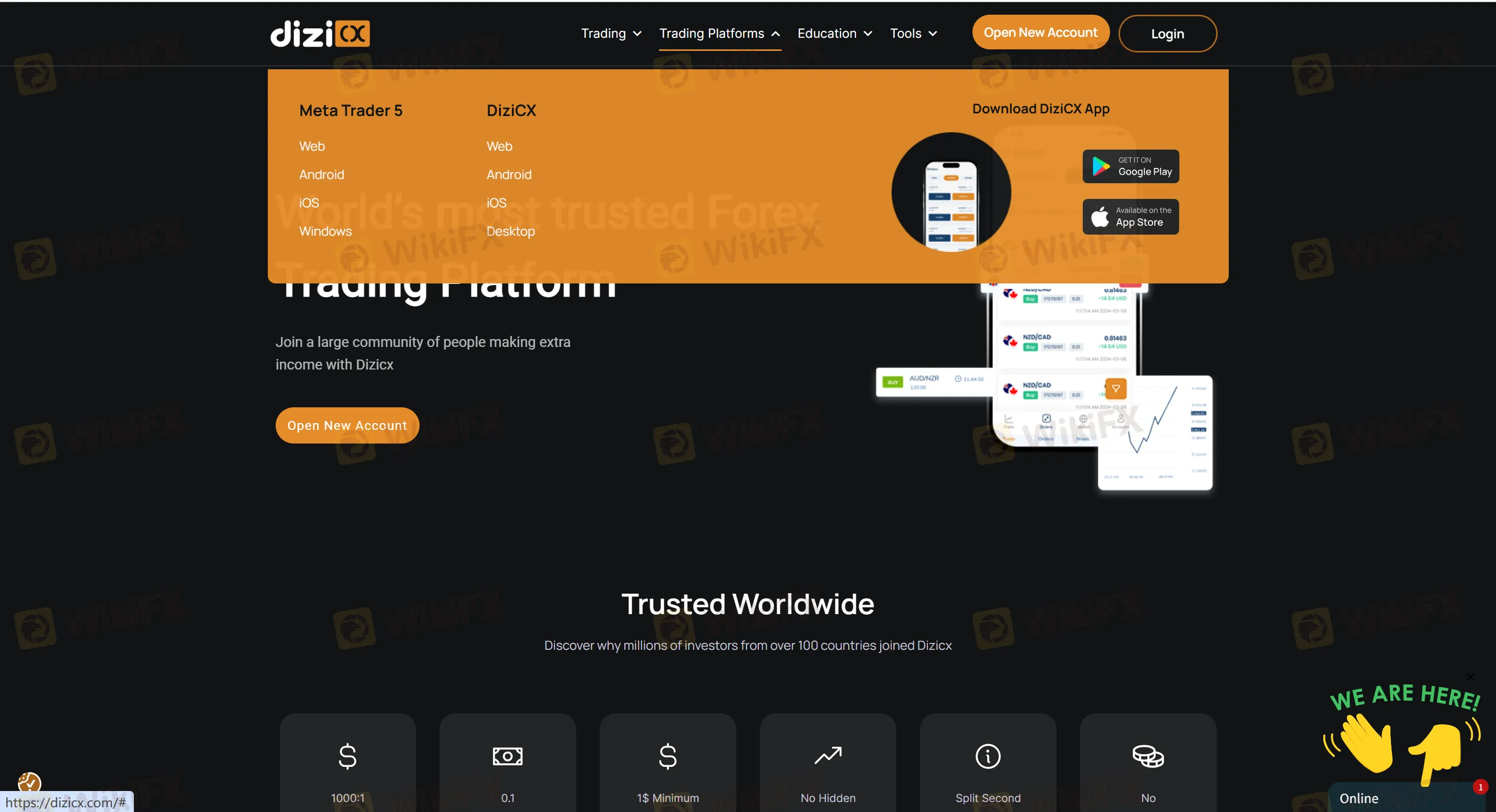

Dizicx offers the mainstream platform MetaTrader 5, supporting desktop, mobile (iOS/Android), and web versions. In addition, traders can also invest through the self-developed platform DiziCX.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Web, Android, iOS, and Windows | Experienced Traders |

| DiziCX | ✔ | Web, Android, iOS, and Windows | / |

The minimum account deposit is $1. Dizicx supports multiple electronic payment systems and bank cards, with 24/7 withdrawal services. It mainly supports USD and EUR. For other currencies, users need to consult customer service in advance. They also pointed out that electronic payments will be credited within 24 hours.

More

User comment

7

CommentsWrite a review

2023-12-06 10:52

2023-12-06 10:52 2023-12-05 13:52

2023-12-05 13:52