User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Global Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.43

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| BTGPactual Review Summary | |

| Founded | 1983 |

| Registered Country/Region | Brazil |

| Regulation | Not regulated |

| Products and Services | Fixed Income, Treasury Direct, Investment Funds, Exchange, Cryptoassets, etc. |

| Demo Account | ❌ |

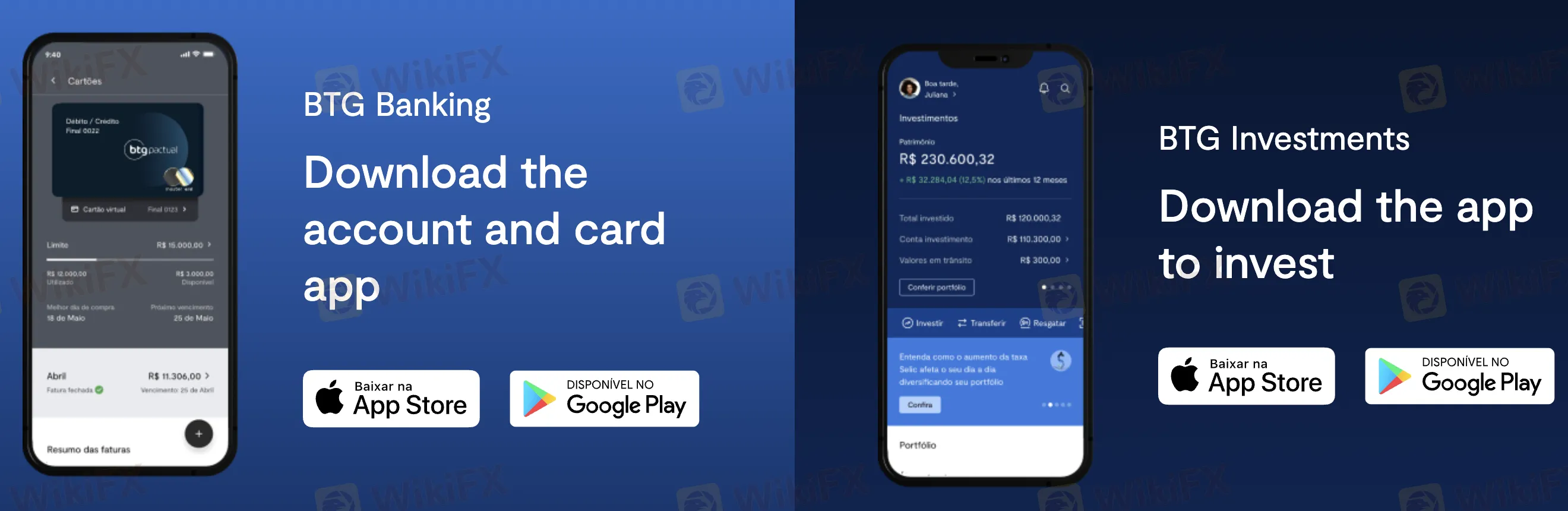

| Trading Platform | BTG Banking App, BTG Investments App |

| Min Deposit | No minimum |

| Customer Support | Phone: 4007-2511 / 0800-001-2511 |

| WhatsApp: (11) 4007-2511 | |

Headquartered in Brazil, BTG Pactual is a multi-service financial platform founded in 1983 that provides a wide range of investing and banking products. Though it runs without control from Brazil's CVM or other major international organizations, which can worry certain customers, it helps zero-fee trading for numerous instruments and flexible accounts.

| Pros | Cons |

| Zero deposit and custody fees | Not regulated |

| Wide range of products (10+ categories) | No demo or Islamic (swap-free) account options |

| User-friendly apps for banking & investing | No MT4/MT5 or desktop trading support |

BTG Pactual is not regulated as a brokerage firm under Brazils primary financial authorities for retail trading, such as the Comissão de Valores Mobiliários (CVM). Additionally, it does not hold licenses from well-known global financial regulators such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC).

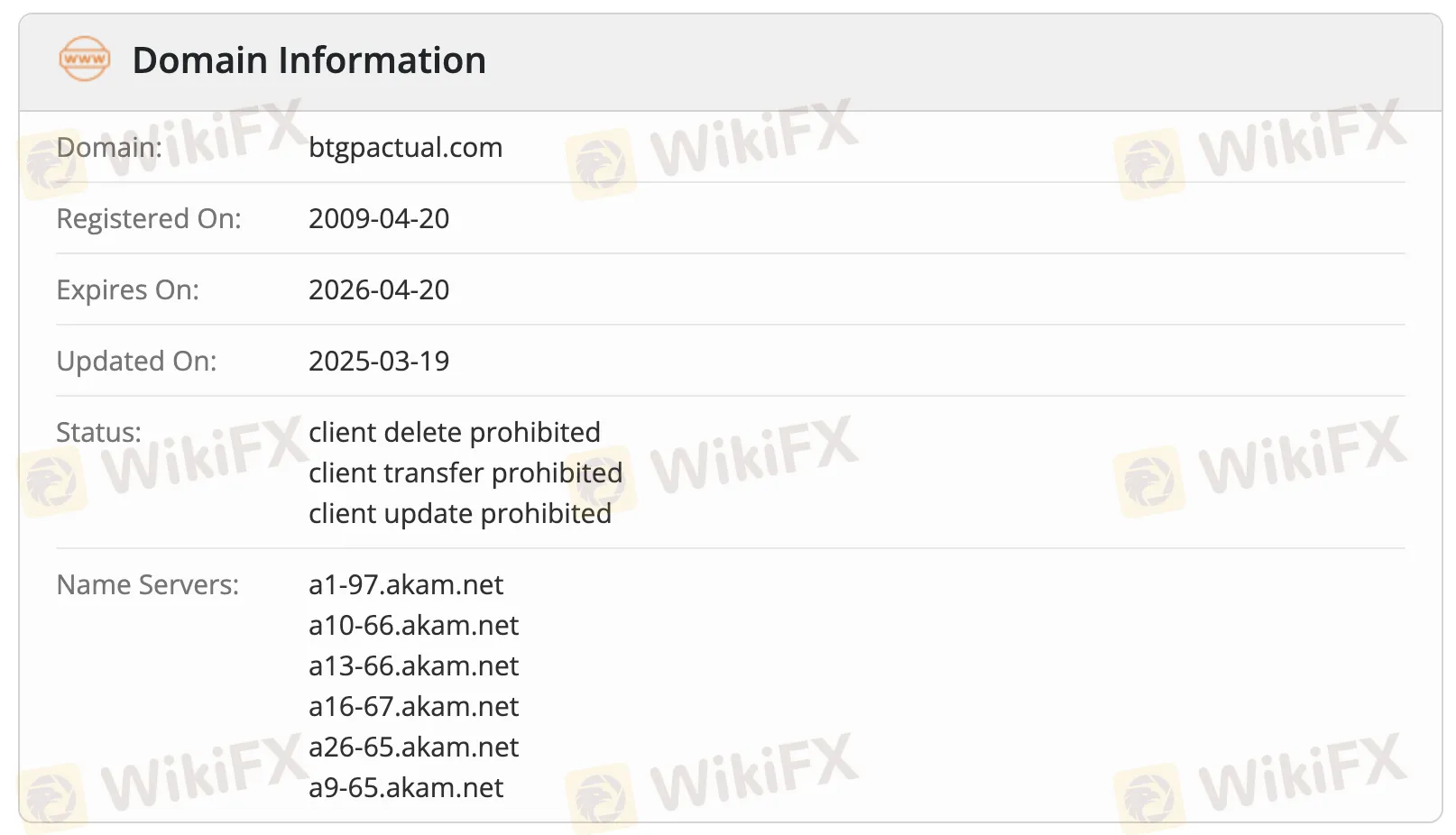

According to WHOIS records, the domain btgpactual.com was registered on April 20, 2009, and is currently active. It was last updated on March 19, 2025, and is valid until April 20, 2026.

BTG Pactual provides a diverse mix of financial products and services in ten distinct areas, including fixed income, investment funds, exchange services, cryptoassets, and more.

| Product/Service | Available |

| Fixed Income | ✅ |

| Treasury Direct | ✅ |

| Investment Funds | ✅ |

| Private Pensions | ✅ |

| Exchange | ✅ |

| COE | ✅ |

| Invest Flex | ✅ |

| Variable Income | ✅ |

| Cryptoassets | ✅ |

BTG Pactual provides three types of live accounts, each targeted to a specific user need: a normal checking account, an exclusive Ultrablue account, and an overseas resident account (CDE). The broker does not provide demo accounts or Islamic (swap-free) accounts.

| Account Type | Features | Suitable For |

| Standard Checking Account | Zero-fee account for payments, transfers, and daily financial needs | Everyday users in Brazil |

| Ultrablue Account | Premium account with concierge services, travel benefits, and luxury perks | High-net-worth individuals & premium users |

| CDE (Overseas Account) | For non-residents managing finances or investing in Brazil remotely | Brazilians or foreigners living abroad |

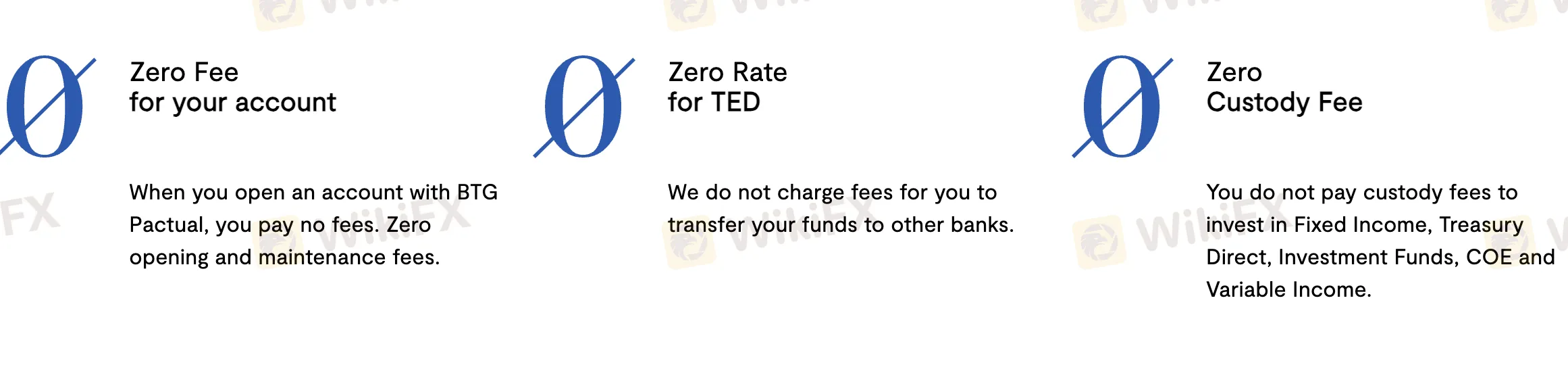

Compared to industry norms, BTG Pactual has a reasonable and usually low-cost charge structure. Most of their investment products—Fixed Income, Treasury Direct, Investment Funds, etc.—come with no custody or maintenance costs; brokerage is charged regressively—the more trades you conduct, the lower the per-order price. Frequent traders will find this appealing. Fees for services like currency conversion and interest on margin (INVEST FLEX), though, are rather normal or somewhat high.

| Product | Custody Fee | Other Fees |

| Fixed Income | Zero | – |

| Treasury Direct | Zero | B3 custody fee: 0.25% |

| Investment Funds | Zero | Management & performance fees apply |

| Private Pensions | Zero | Entry/exit loading rates |

| Exchange | – | Contract fee: R$90.00 |

| COE | Zero | – |

| Invest Flex | – | Interest: 5.99%/month |

| Variable Income | Zero | – |

| Cryptoassets | Zero | Brokerage: 0.5% |

| BTG DOL | Zero | Regressive brokerage fee |

| Trading Platform | Supported | Available Devices | Suitable for What Kind of Traders |

| BTG Banking App | ✔ | iOS, Android (Mobile) | Retail clients managing banking, cards, and daily payments |

| BTG Investments App | ✔ | iOS, Android (Mobile) | Investors focused on portfolio and fund investments |

| MetaTrader (MT4/MT5) | ❌ | Not available | Not suitable (not supported) |

| Desktop/Web Terminal | ❌ | Not available | Not suitable (not supported) |

Users find transactions affordable since BTG Pactual charges no deposit or withdrawal fees. The site also has no minimum deposit policy, so customers may begin with any sum.

Deposit Options

| Method | Min. Amount | Fees | Processing Time |

| Bank Transfer (Pix) | No minimum | Free | Instant |

| TED Transfer | No minimum | Free | Same business day |

| Remittance via Exchange | No minimum | Free | Varies by provider/country |

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment