User Reviews

More

User comment

2

CommentsWrite a review

2023-10-05 16:47

2023-10-05 16:47

2022-12-12 12:19

2022-12-12 12:19

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Global Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.49

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Zerodha Broking Ltd.

Company Abbreviation

Zerodha

Platform registered country and region

India

Company website

X

Company summary

Pyramid scheme complaint

Expose

| Zerodha Review Summary | |

| Founded | 2010 |

| Registered Country | India |

| Regulation | No regulation |

| Market Instruments | Stocks, Derivatives (F&O), Mutual Funds, ETFs, Bonds, IPOs |

| Demo Account | ✅ |

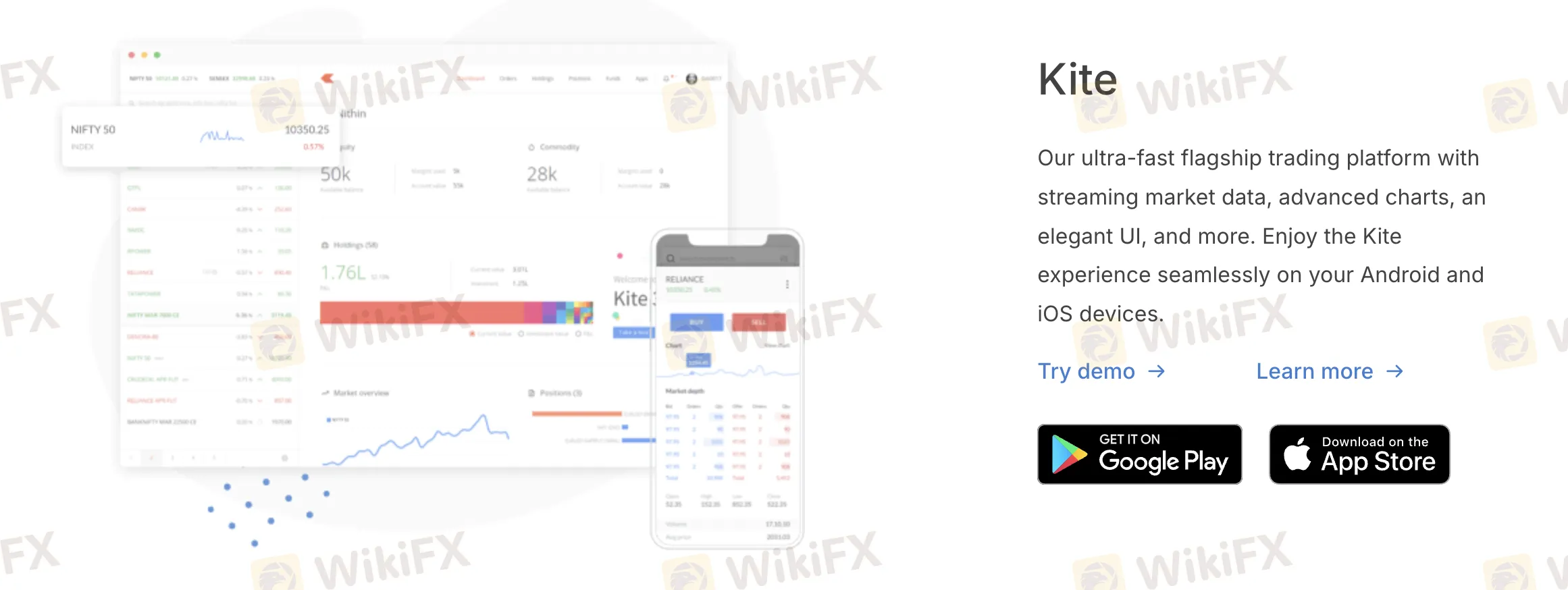

| Trading Platform | Kite, Console, Coin, Kite Connect API, Varsity Mobile |

| Minimum Deposit | ₹1 |

| Customer Support | Phone: 080 4719 2020 / 080 7117 5337 |

| Email (Emergency) : stoptrade@zerodha.com | |

| Email (Media): press@zerodha.com | |

| Address: Zerodha HQ: #153/154, 4th Cross, J.P. Nagar 4th Phase, Bengaluru - 560078 | |

Founded in 2010, Indian brokerage company Zerodha provides inexpensive access to equities, F&O, ETFs, bonds, and mutual funds. It is not governed worldwide and offers no FX services. Retail investors like its platform ecosystem—Kite, Console, Coin—because of simple use and open pricing.

| Pros | Cons |

| Zero brokerage on equity delivery | No regulation |

| ₹20 flat fee for intraday and F&O trades | No Islamic (swap-free) account support |

| Demo accounts available |

Zerodha has no licenses from major international authorities including the FCA, ASIC, or CySEC and is unregulated for forex trading in its registered country, India.

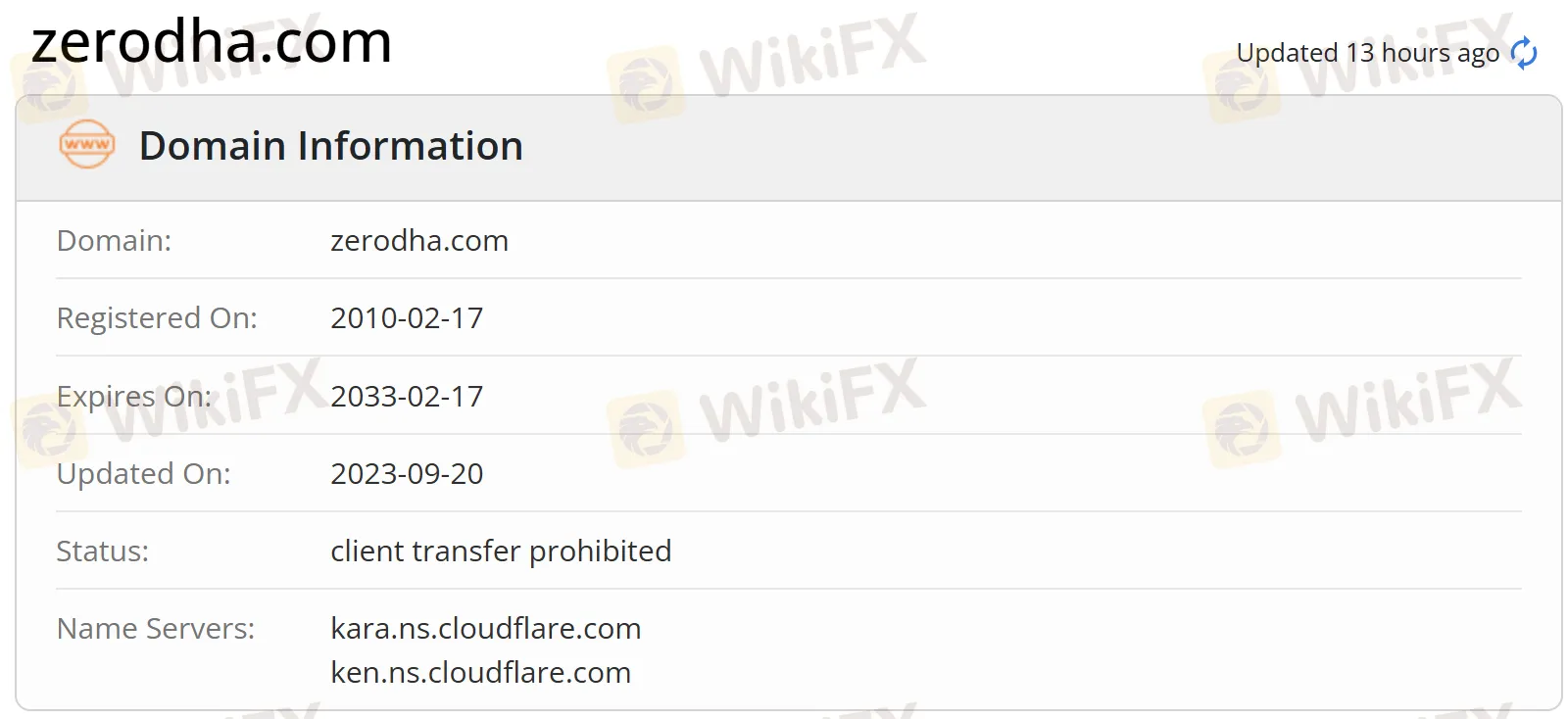

WHOIS data shows that zerodha.com was registered on February 17, 2010, updated on September 20, 2023, and expires in 2033. The domain is operational and protected, but not regulated.

Zerodha's all-inclusive online investing system lets users buy bonds, ETFs, mutual funds, stocks, derivatives, and more all from one interface.

| Trading Instruments | Supported |

| Stocks | ✔ |

| Derivatives (Futures & Options) | ✔ |

| Mutual Funds | ✔ |

| ETFs | ✔ |

| Bonds | ✔ |

| IPOs | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

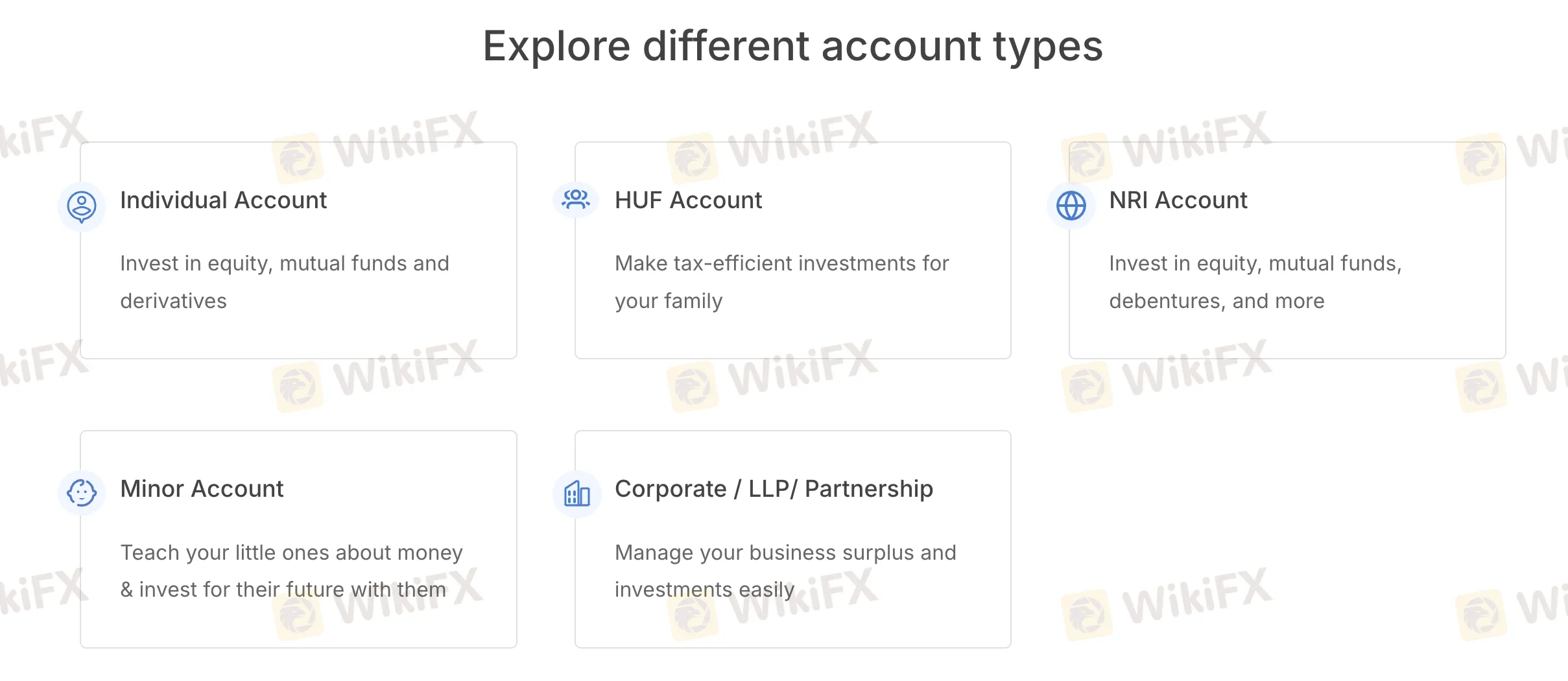

Real trading (demat) accounts from Zerodha suit different investor types. Since it's not a forex broker, it offers a fully working demo environment on platforms like Kite for strategy testing but no Islamic (swap-free) accounts. All account categories offer equity, F&O, mutual funds, and IPOs on a common platform with low fees.

| Account Type | Suitable for |

| Individual Account | Retail investors and traders looking to invest/trade personally |

| HUF Account | Hindu Undivided Families aiming for tax-efficient investing |

| NRI Account | Non-resident Indians investing in Indian markets (equity, MF) |

| Minor Account | Guardians investing for childrens financial future |

| Corporate / LLP / Firm | Businesses managing surplus and investments |

With no brokerage on equity delivery and flat ₹20 or less per order for intraday and F&O transactions, Zerodha provides a fair fee structure. Its costs are cheap and very clear compared to industry standards, which makes it one of the most affordable brokers in India for aggressive traders as well as long-term investors.

Zerodha Trading Charges

| Segment | Brokerage | Notes |

| Equity Delivery | ₹0 | Absolutely free |

| Equity Intraday | ₹20 or 0.03% per executed order (lower of) | Applies across equity, currency, and commodities |

| Futures | Applicable on equity/currency/commodity futures | |

| Options | Flat ₹20 per executed order | No percentage-based fee |

| Mutual Funds | ₹0 | Direct MF investments, no commissions or DP charges |

Other Key Trading-Related Fees

| Fee Type | Amount |

| SEBI Charges | ₹10 per crore |

| GST | 18% on brokerage + SEBI + transaction charges |

| Transaction Charges | Varies by exchange and segment (e.g. 0.00375% for BSE equity delivery) |

| STT/CTT | Government tax; varies by segment (e.g. 0.1% on buy/sell in equity delivery) |

| Stamp Duty | 0.015% on buy side for equity delivery, varies by segment |

| Call & Trade | ₹50 per order (placed through dealer) |

Non-Trading Fees

| Fee Type | Amount |

| Account Opening | Online: ₹0, NRI & Corporate: ₹500 |

| Annual Maintenance (AMC) | ₹300/year + GST (free for BSDA accounts < ₹4 lakh holding) |

| DP Charges (on sell) | ₹15.34 per scrip (CDSL + Zerodha + GST) |

| Withdrawal Fee | ₹0 |

| Inactivity Fee | ₹0 |

| Payment Gateway (deposit) | ₹9 + GST (waived for UPI) |

| Margin Interest (MTF) | 0.04% per day |

| Pledging / Unpledging | ₹30 + GST per ISIN |

| Delayed Payment Charges | 18% annual or 0.05% per day |

| Corporate Action Order | ₹20 + GST per order (OFS, buyback, etc.) |

| Off-market Transfer | ₹25 per transaction |

| Trading Platform | Supported | Available Devices | Suitable for |

| Kite | ✔ | Web, Android, iOS | Active traders seeking fast execution and charting |

| Console | ✔ | Web | Investors needing reports, analytics, and account view |

| Coin | ✔ | Web, Android, iOS | Mutual fund investors looking for zero-commission buys |

| Kite Connect API | ✔ | Web (API integration) | Developers, fintech startups |

| Varsity Mobile | ✔ | Android, iOS | Beginners learning trading and investing |

Withdrawals are free and Zerodha charges no deposit fees. Though the suggested sum may change based on trading requirements and segment (equity, commodities, etc.), the minimum deposit is ₹1.

Deposit Options

| Deposit Method | Minimum Deposit | Deposit Fees | Deposit Time |

| UPI | ₹1 | ₹0 | Instant |

| Payment Gateway | ₹9 + 18% GST | ||

| IMPS | ₹0 (bank charges may apply) | Within 10 minutes | |

| NEFT/RTGS | Within 2 hours | ||

| Cheque | – | ₹0 | 3–5 working days |

Withdrawal Options

| Channel | Minimum Withdrawal | Withdrawal Fees | Withdrawal Time |

| Via Console/Kite | No fixed minimum | ₹0 | Within 24–48 hrs depending on cut-off time |

Zerodha operates without valid regulation, posing high risks for traders. Learn the implications, risks, and compliance gaps in this in-depth analysis.

WikiFX

WikiFX

Indian investor Maryam Khan, 35, was scammed out of nearly ₹35 Lakh in a fraudulent stock investment scheme orchestrated by individuals impersonating the legitimate financial firm Zerodha. The scam began when Khan came across a Facebook Reel on July 4 promoting fake investment opportunities. After contacting the WhatsApp number listed in the ad,

WikiFX

WikiFX

Zerodha is not limited to stock or forex market but it also fulfills its social responsibility. As part of its CSR initiative, Zerodha Cares, it gives back to society.

WikiFX

WikiFX

Zerodha is a discount broker that has been facing serious challenges with fraud, downtimes, and bad user experiences. There have also been technical glitches and wide-scale money scandals involving the platform, raising concerns about its operations and reliability.

WikiFX

WikiFX

More

User comment

2

CommentsWrite a review

2023-10-05 16:47

2023-10-05 16:47

2022-12-12 12:19

2022-12-12 12:19