User Reviews

More

User comment

4

CommentsWrite a review

2023-12-27 17:41

2023-12-27 17:41

2023-12-20 21:47

2023-12-20 21:47

Score

Above 20 years

Above 20 yearsRegulated in Hong Kong

Market Making License (MM)

Suspicious Scope of Business

Medium potential risk

Influence

Add brokers

Comparison

Quantity 3

Exposure

Score

Regulatory Index6.72

Business Index8.00

Risk Management Index8.90

Software Index6.05

License Index6.75

Single Core

1G

40G

More

Company Name

安盛投資管理

Company Abbreviation

AXA

Platform registered country and region

Hong Kong

Company website

X

YouTube

Company summary

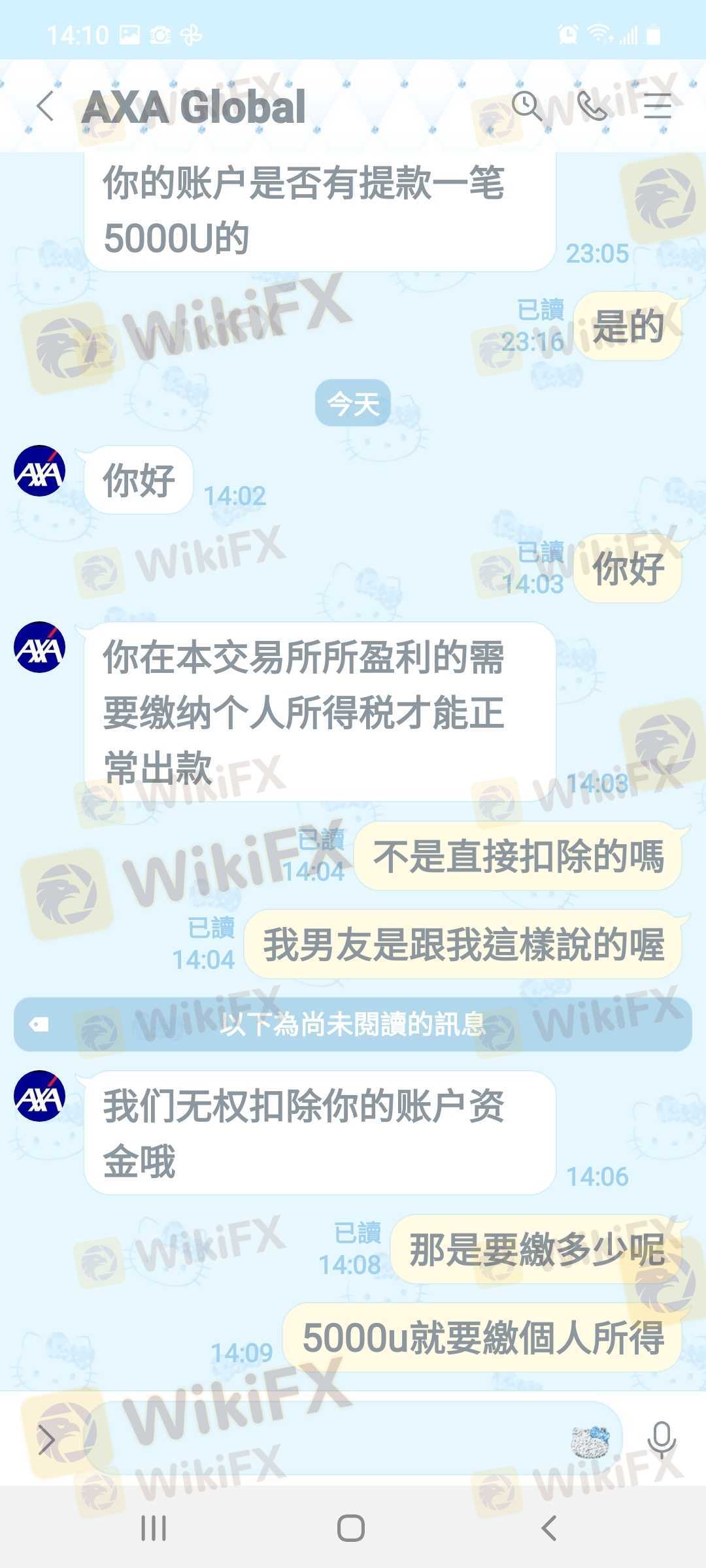

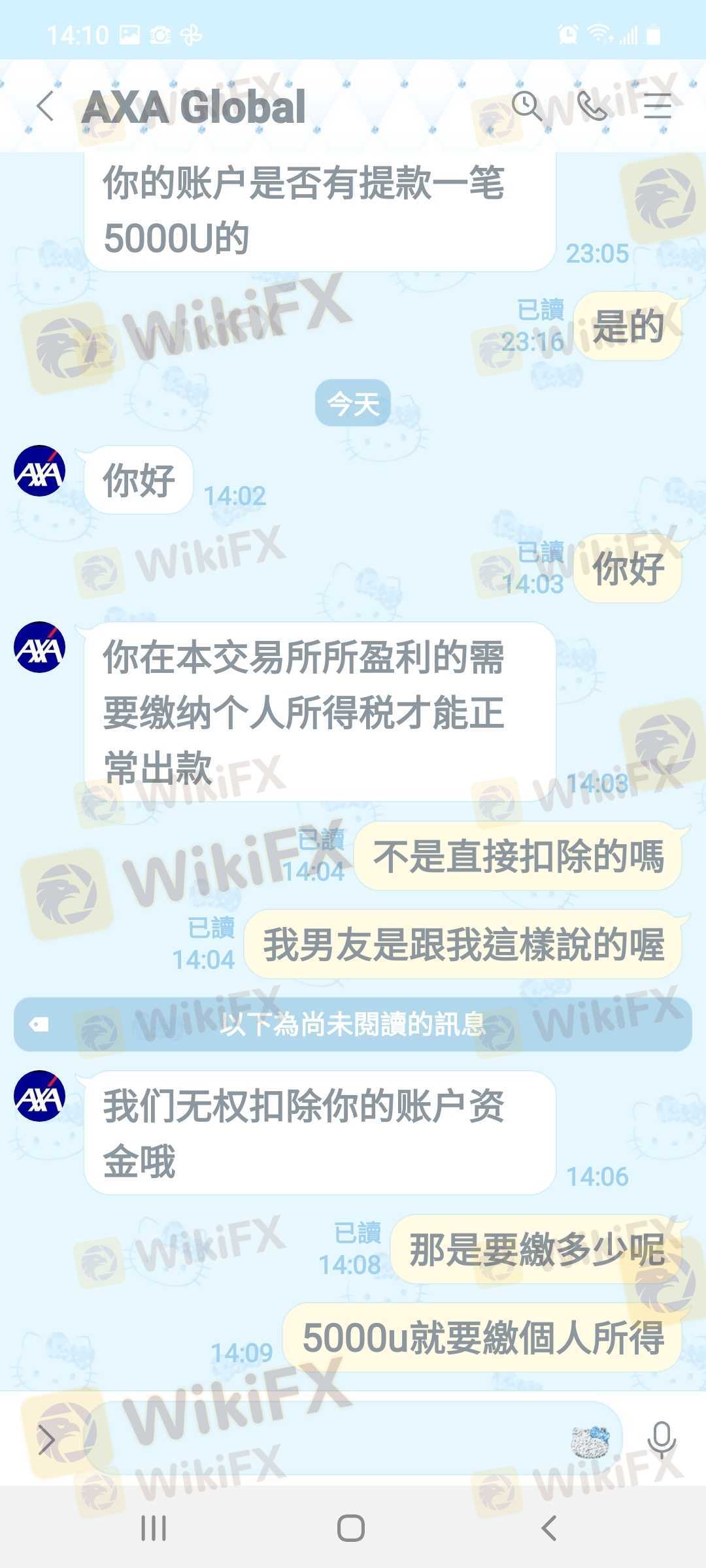

Pyramid scheme complaint

Expose

| Review Summary Review | |

| Founded | 1997 |

| Registered Country/Region | France |

| Regulation | SFC |

| Products | Real estate equity, private debt & alternative credit, private equity & infrastructure; Equities, Fixed Income, Multi Asset investments; Private equity, infrastructure equity, private debt, hedge funds |

| Customer Support | Tel: +33144457000 |

| Email: webmaster-COM@axa-im.com | |

| Headquarters: Tour Majunga La Défense, 6 Place de la Pyramide, 92800 Puteaux | |

| Link for address of other branch companies: https://www.axa-im.com/contact-us | |

AXA Investment Managers (AXA IM) is a global asset management company who has branch offices all over the world. It mainly deals in financial services with products including real estate equity, private debt & alternative credit, private equity & infrastructure, Equities, Fixed Income, Multi Asset investments, Private equity, infrastructure equity, private debt, hedge funds, etc.

The good thing is that the company is regulated by SFC, which means its financial activities are strictly watched by these authorities, to some extent guarantees a certain level of customer protection.

| Pros | Cons |

| SFC regulated | Limited info disclosed for trading conditions on its website |

| Global presence | |

| Various trading products |

AXAis currently being well regulated by Securities and Futures Commission of Hong Kong (SFC)with license no. AAP809.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| SFC | Regulated | AXA Investment Managers Asia Limited | Dealing in futures contracts & Leveraged foreign exchange trading | AAP809 |

Products and Services

Core Investments

ESG & Sustainable Strategies

Alternative Investments

Private Markets & Hedge Funds

Select (Multi-Manager & Advisory Services)

More

User comment

4

CommentsWrite a review

2023-12-27 17:41

2023-12-27 17:41

2023-12-20 21:47

2023-12-20 21:47