User Reviews

More

User comment

3

CommentsWrite a review

2022-11-24 14:26

2022-11-24 14:26 2022-11-21 12:11

2022-11-21 12:11

Score

15-20 years

15-20 yearsRegulated in Japan

Market Making License (MM)

Self-developed

Medium potential risk

Capital Ratio

Influence

Add brokers

Comparison

Quantity 5

Exposure

Score

Regulatory Index7.83

Business Index8.00

Risk Management Index8.22

Software Index7.05

License Index7.70

Single Core

1G

40G

More

Company Name

GMO Gaika, Inc.

Company Abbreviation

GMO Gaika

Platform registered country and region

Japan

Number of employees

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

Capital

Higher than 90% Japanese brokers $3,798,450(USD)

| GMO Gaika Review Summary | |

| Founded | 2003 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Market Instruments | Forex and CFD |

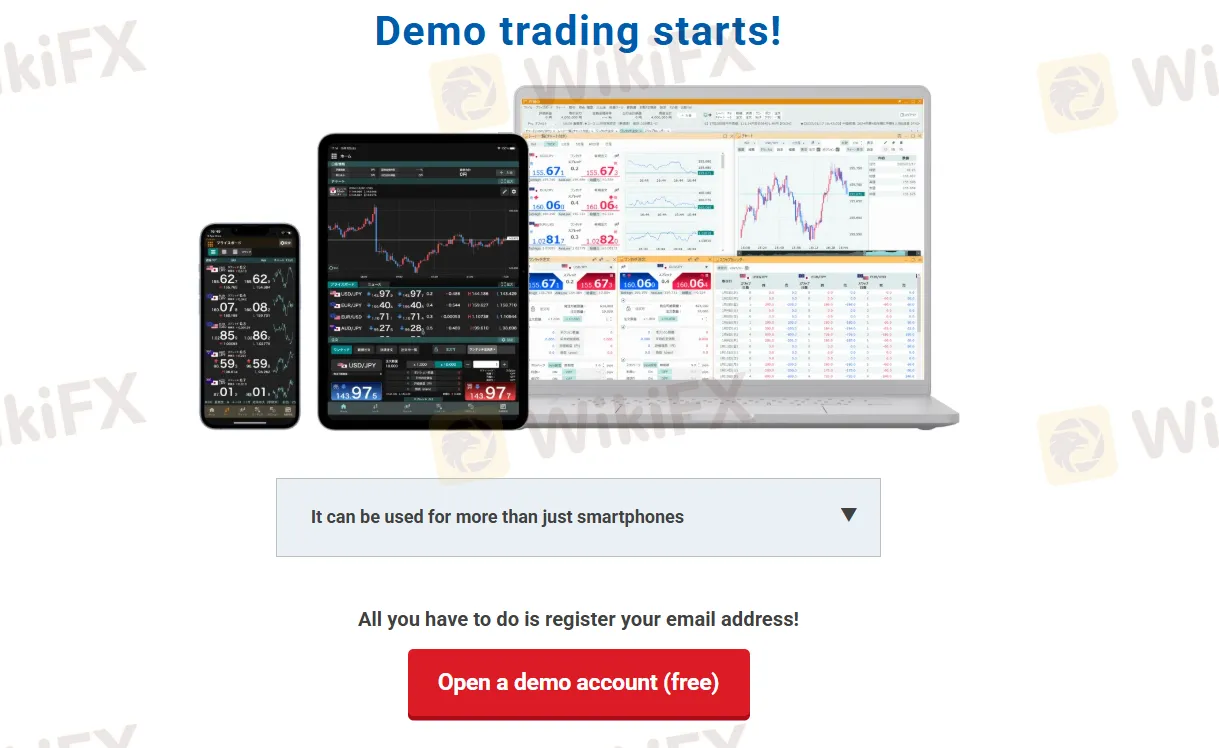

| Demo Account | Yes |

| Leverage | Not Mentioned |

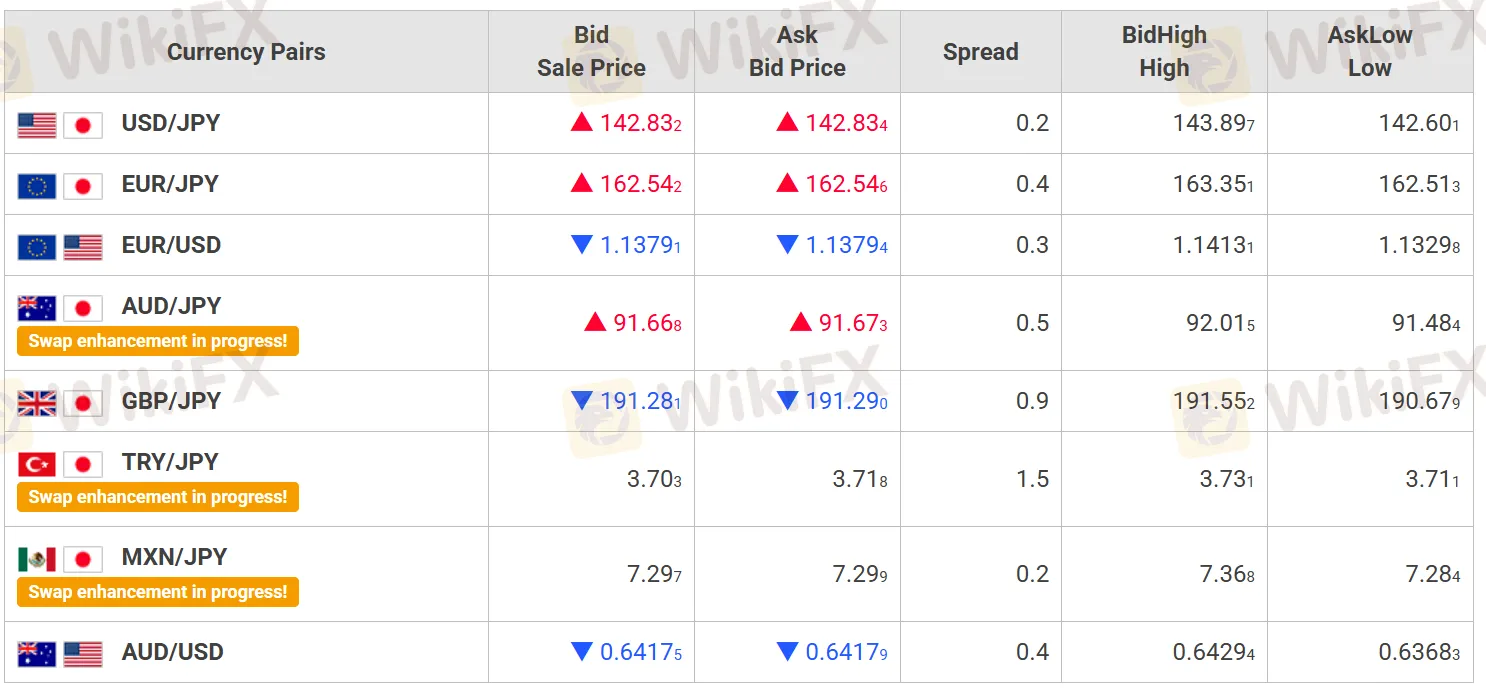

| Spread | 0.3 pips on the EUR/USD pair |

| Trading Platform | 外貨ex |

| Min Deposit | 2,000 yen |

| Customer Support | 24/7 Live Chat |

GMO Gaika, regulated by Japan's FSA, primarily offers Forex and CFD trading on its proprietary “外貨ex” platform, accessible on PC and mobile. Notably, they feature a tight 0.3 pips spread on EUR/USD and offer commission-free trading with a low minimum deposit of around 2,000 yen. While a demo account is available, information on leverage and specific account types is limited.

| Pros | Cons |

|

|

|

|

GMO Gaika has a Retail Forex License regulated by the Financial Services Agency (FSA) in Japan with a license number of 関東財務局長(金商)第271号.

GMO Gaika mainly offers foreign exchange margin trading and CFD trading, covering gasoline, gold spot, and

US Stock NQ100.

| Tradable Instruments | Supported |

| Forex | ✔ |

| CFD | ✔ |

| Stock | ❌ |

| Indices | ❌ |

| Cryptocurrency | ❌ |

| Shares | ❌ |

| Metals | ❌ |

GMO Gaika offers demo accounts for clients. However, other account types are not mentioned on the website.

GMO Gaika offers an EUR/USD spread of 0.3 pips. For other currency pairs, you can check the table.

| Currency Pairs | Spread |

| USD/JPY | 0.2 |

| EUR/JPY | 0.4 |

| EUR/USD | 0.3 |

| AUD/JPY | 0.5 |

| GBP/JPY | 0.9 |

| TRY/JPY | 1.5 |

| MXN/JPY | 0.2 |

| AUD/USD | 0.4 |

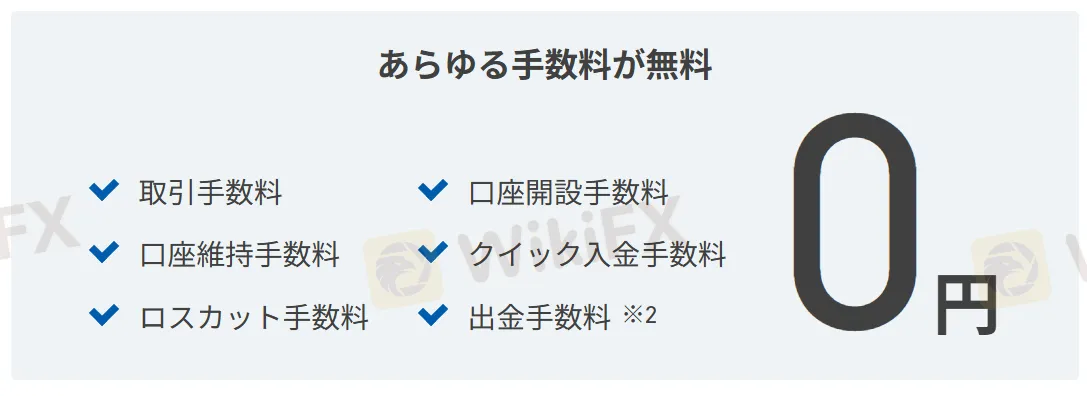

Besides, GMO Gaika offers trading with all fees listed being free, including trading fees, account maintenance fees, loss-cut fees, account opening fees, quick deposit fees, and withdrawal fees, all amounting to 0 yen.

| Trading Platform | Supported | Available Devices | Suitable for |

| 外貨ex | ✔ | PC and Mobile | Investors of all experience levels |

GMO Gaika charges no deposit or withdrawal fees. The minimum amount to start FX trading is approximately 2,000 yen.

More

User comment

3

CommentsWrite a review

2022-11-24 14:26

2022-11-24 14:26 2022-11-21 12:11

2022-11-21 12:11