User Reviews

More

User comment

14

CommentsWrite a review

2024-07-23 17:22

2024-07-23 17:22

2023-12-06 10:19

2023-12-06 10:19

Score

5-10 years

5-10 yearsRegulated in Seychelles

Derivatives Trading License (EP)

MT4 Full License

High potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Quantity 8

Exposure

Score

Regulatory Index1.76

Business Index7.51

Risk Management Index0.00

Software Index8.08

License Index0.00

Single Core

1G

40G

More

Company Name

CMT Processing Limited

Company Abbreviation

CMTrading

Platform registered country and region

Cyprus

Company website

X

YouTube

27664750016

Company summary

Pyramid scheme complaint

Expose

A client has reported that he has been scammed by an employee of this broker.

140976643 Emine cunedioglu cm trading I can't withdraw money from my account please help.

140976667 Ahmet cuneydioğlu Cm Trading cant withdraw money from my account. The broker called cmtrading.com doesn't withdraw the profits I earn by staying in front of the screen day and night with great effort. Im under a lot of stress bcz they didn't deposit mu money and I cant even sleep at night. Please get back to this mistakes you made

I deposited money to numerous account, what is shocking me is that they telling me that they can't transfer my profit because I got insufficient balance in my account, to my surprise, how they know that? I gave them my account to deposit money into it also they wanted my email address which I gave them, now they telling me to deposit into my account another R500 so that my profit could reflect, how is that possible? I already deposited R2000 into 3 separate account. Kindly explain and help me in this regard

I was charged $77 for withdrawing $552, like what on earth is that? that's pretty crazy.

I can not withdraw $4500 from my CMtrading account ID: 140976643. Can you please help? All documents are attached. The institution where I live in January is cheating on me with different excuses. I want to withdraw my deposit.

This is my first time investing in this company. I traded and made a profit for the first time I withdraw 600 usd. Sent 3 days later. I then continued trading and made some more profits. I wanted to withdraw 2000 usd more. The money hasn't come for exactly 1 week, and my total of 4470 usd money is kept in my account at the company. Do not invest money in this company until you are sure. I will also initiate the necessary complaints to the relevant languages. my meta trade number is 140905106

I traded with cmtrading and withdrew little moneys but when I deposited huge fund cmtrading refused to process my withdrawal accessing me that they mistaken send fund to my account which I didn't see because my address changes. norther have refused to pay me my money because of the false account they refused to give me my money. They also closes my trade unauthorized to blow my account I complained . I was trading with another broker before Caesar from Cmtrading persuaded me to use their broker. After reading bad and scam review i refused but he persisted which I later agreed now I'm a victim of the scam. they refused to give me my money. everything about cmtrading is terrible even their license is exceeded. they open and close trades in my account. cmtrading give me my money.

| CM Trading Review Summary | |

| Founded | 2002 |

| Registered Country/Region | South Africa |

| Regulation | FSA (Offshore regulated), FSCA (Suspicious clone) |

| Market Instruments | Forex, currencies, CFDs, commodities, indices, stocks, cryptocurrencies |

| Demo Account | / |

| Islamic Account | ✅ |

| Leverage | / |

| Spread | From 1.9 pips |

| Trading Platform | MT4, Webtrader, CMTrading |

| Minimum Deposit | $20 |

| Customer Support | Phone: +44 161 388 3321 |

| Email: support@cmtrading.com | |

| Adress: 14th Floor Sandton City Office Towers, 158 5th St, Sandton, 2196, South Africa | |

| Bonus | ✅ |

CM Trading was established in 2002 and is offshore regulated by the Seychelles Financial Services Authority (FSA) and holds a suspicious clone license issued by the Financial Sector Conduct Authority (FSCA) of South Africa. It offers a variety of trading instruments including forex, CFDs, and cryptocurrencies. The platform supports multiple deposit and withdrawal methods, with a minimum deposit of $20, and provides five account types along with interest-free Islamic accounts.

| Pros | Cons |

| No commission fees | Offshore regulation risks |

| No deposit fees | Suspicious clone FSCA license |

| Long operational history | |

| MT4 available | |

| Various trading instruments | |

| Offers five account types | |

| Various payment options | |

| Low minimum deposit |

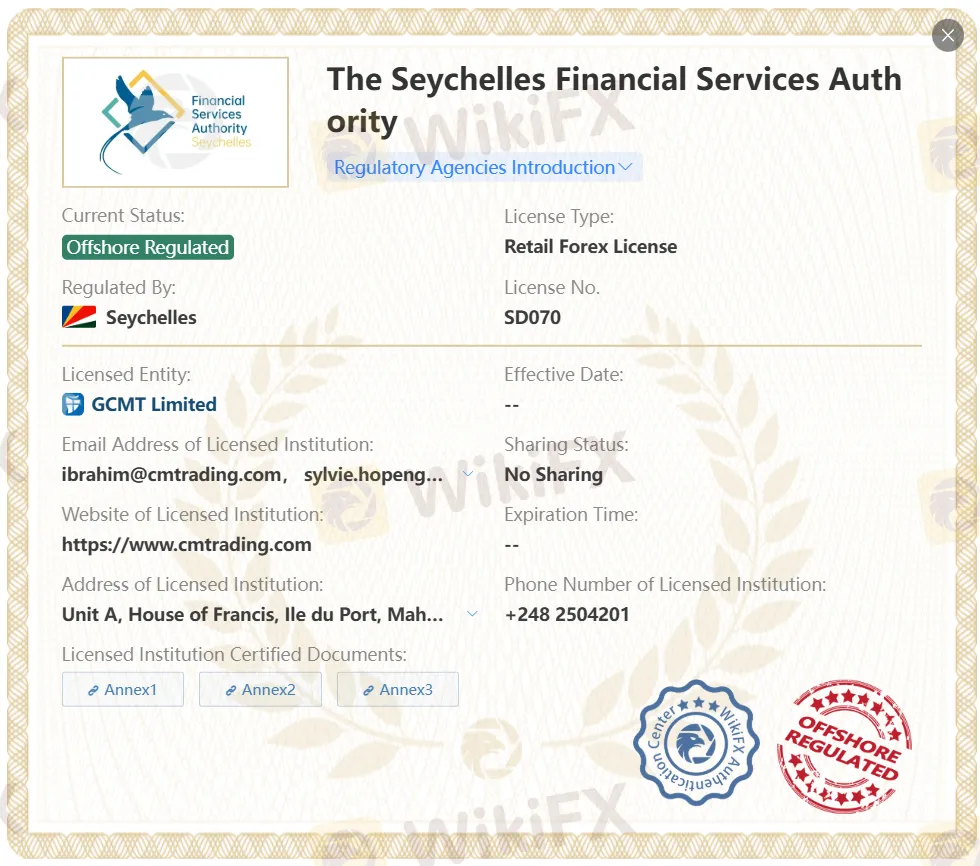

CM Trading is offshore regulated by the Seychelles Financial Services Authority (FSA) and is also registered with the Financial Sector Conduct Authority (FSCA) of South Africa, holding a suspicious clone Financial Services Provider license.

| Regulated by | Regulatory Status | Licensed Institution | Licensed Type | Licensed Number |

| Seychelles Financial Services Authority (FSA) | Offshore Regulated | GCMT Limited | Retail Forex License | SD070 |

| Financial Sector Conduct Authority (FSCA) | Suspicious clone | BLACKSTONE MARKETING SA (PTY) LTD | Financial Service Corporate | 38782 |

CM Trading offers seven types of trading instruments, including forex, currencies, CFDs, commodities, indices, stocks, and cryptocurrencies.

| Tradable Instruments | Supported |

| Forex/Currencies | ✔ |

| CFDs | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

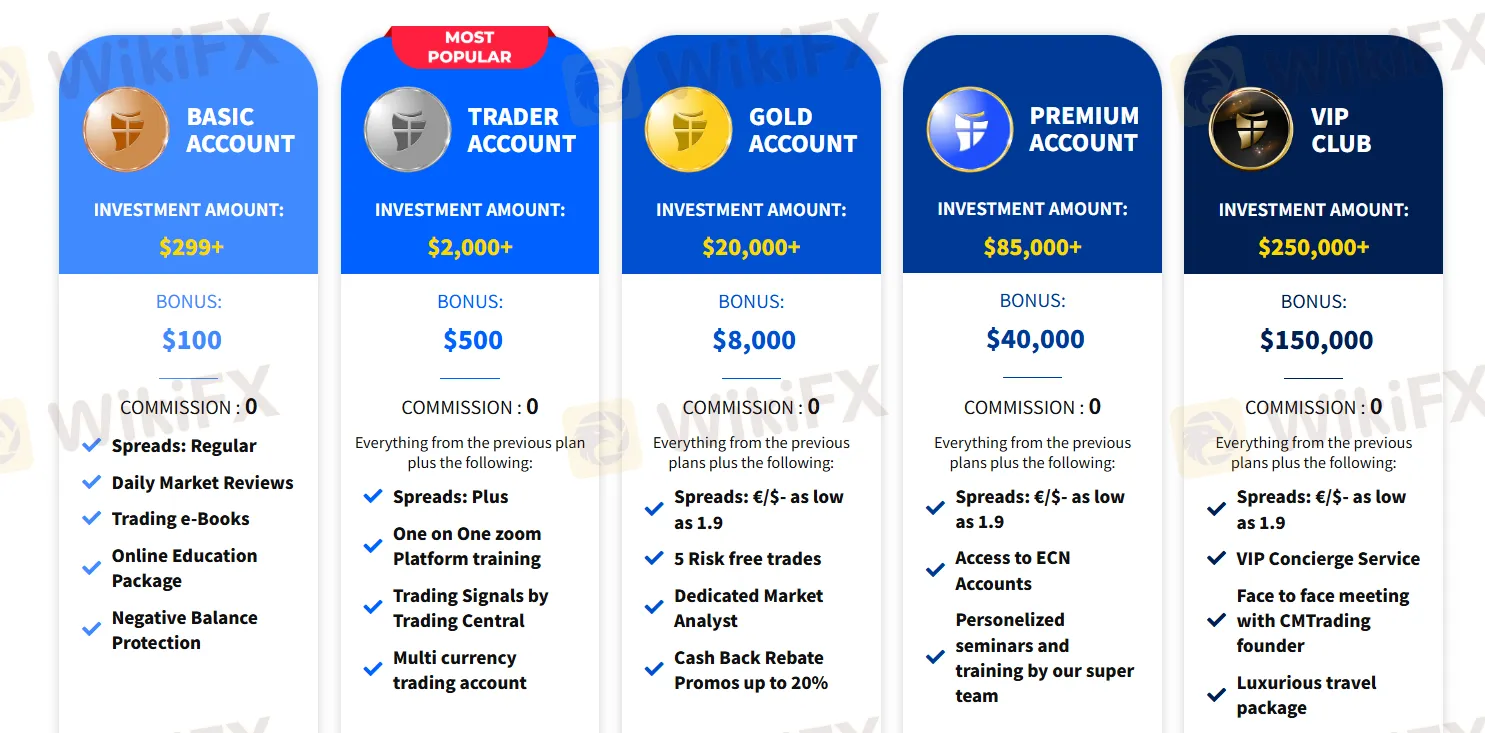

CM Trading offers five account types: Basic Account, Trader Account, Gold Account, Premium Account, and VIP Club. In addition, CM Trading also offers interest-free Islamic accounts.

| Account Type | Minimum Deposit | Spread | Commission | Bonus |

| Basic | $299+ | Regular | 0 | $100 |

| Trader | $2,000+ | Plus | $500 | |

| Gold | $20,000+ | From 1.9 pips | $8,000 | |

| Premium | $85,000+ | $40,000 | ||

| VIP Club | $250,000+ | $150,000 |

CM Trading offers three trading platforms: MetaTrader 4 (MT4), CMTrading Webtrader, and CMTrading platforms.

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 4 (MT4) | ✔ | Windows, Mac, Android, iOS | Beginners |

| CMTrading Webtrader | ✔ | Windows, Mac, iOS, Web Browsers | / |

| CMTrading | ✔ | Windows, Mac, iOS, Web Browsers | / |

| MetaTrader 5 (MT5) | ❌ | / | Experienced traders |

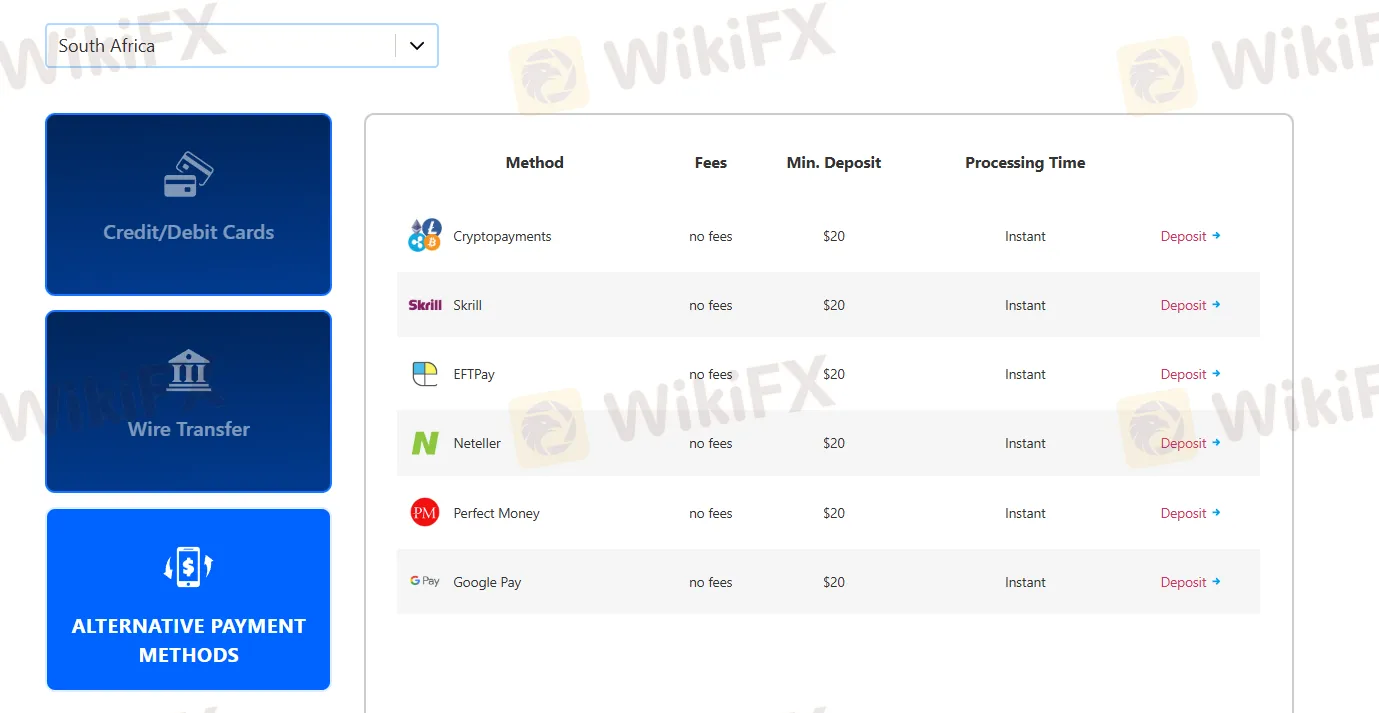

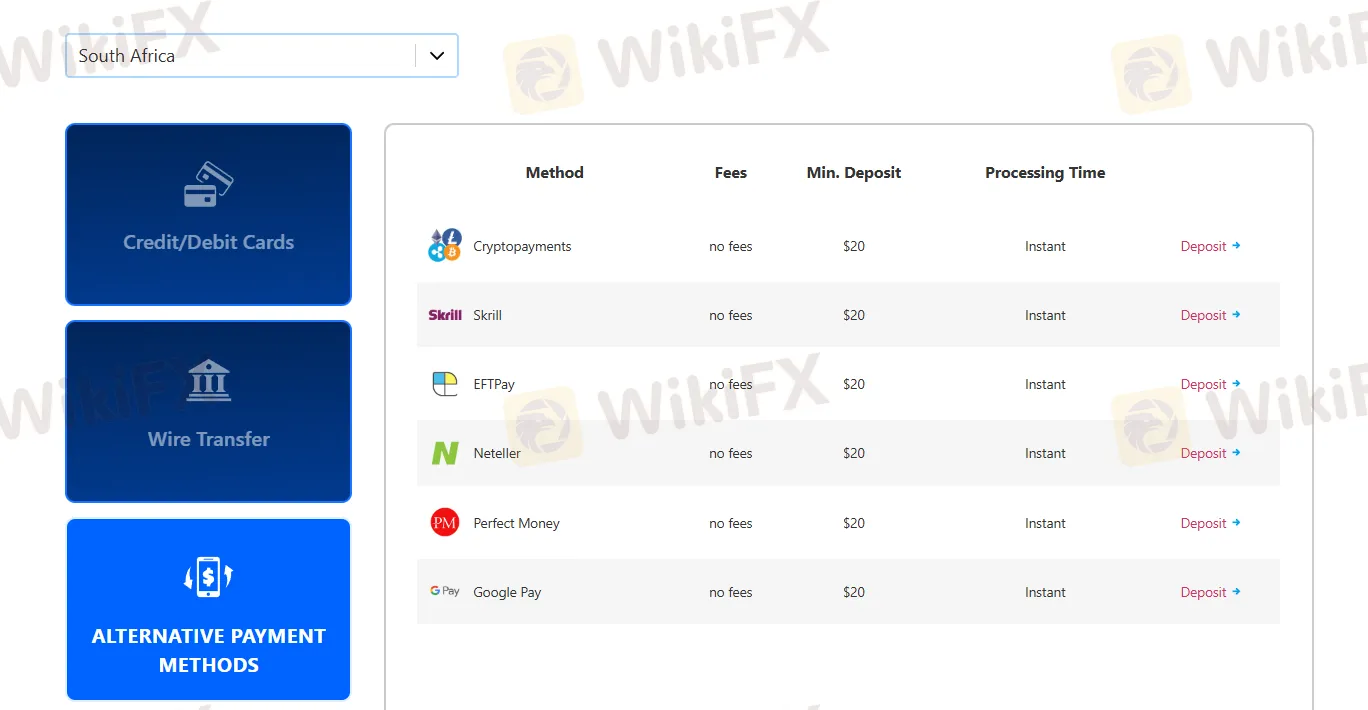

CM Trading supports multiple deposit methods including credit/debit cards, bank transfers (Standard ZAR and NedBank ZAR), cryptocurrency payments, and various e-wallets such as Skrill, EFTPay, Neteller, Perfect Money, and Google Pay. All deposits have a minimum amount of $20 and are mostly processed instantly, except bank transfers which take 1–3 business days.

| Deposit Method | Minimum Deposit | Deposit Fees | Deposit Time |

| Cryptocurrencies | $20 | ❌ | Instant |

| Skrill | |||

| EFTPay | |||

| Neteller | |||

| Perfect Money | |||

| Google Pay | |||

| Standard ZAR | 1 - 3 business days | ||

| NedBank ZAR |

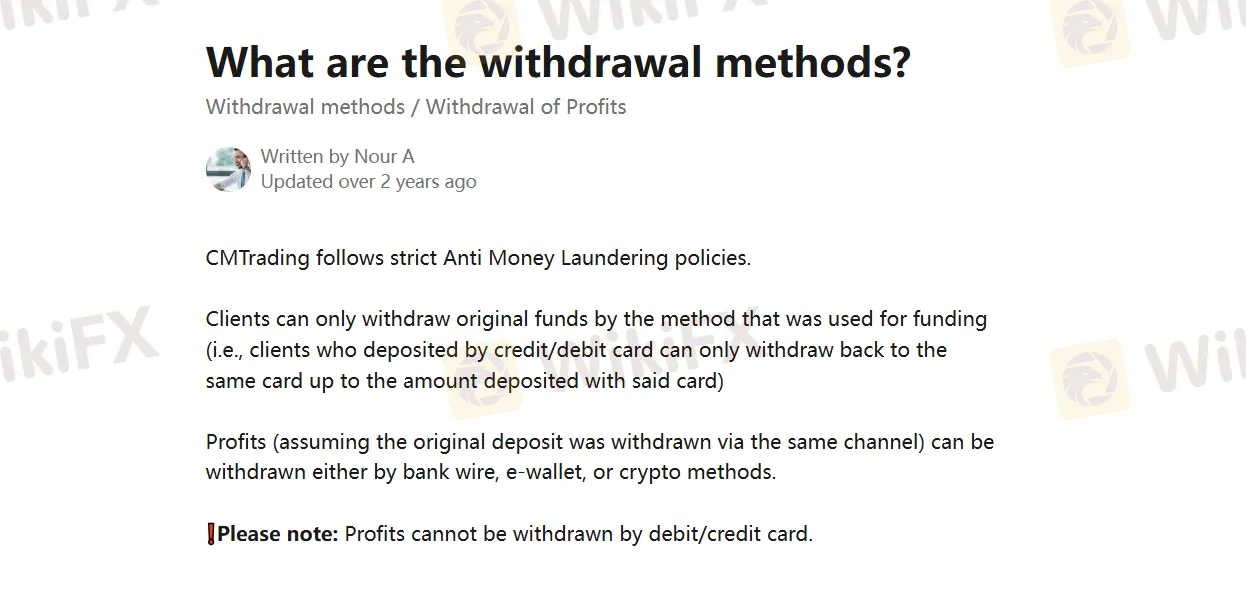

Withdrawals of the original deposited funds must be made via the same method used for deposit, with amounts limited to the original deposit. Profits can be withdrawn via bank wire transfer, e-wallets, or cryptocurrency, but not through credit or debit cards.

Did you experience a difference in the CMTrading withdrawal experience when requesting a small and a large amount? Did the Cyprus-based forex broker accept your requests when the withdrawal amount was small and deny when it was high? Were you told to pay a processing fee that seemed illegitimate in your context? Did the broker scam you by prompting you to deposit more after showing your initial profits? In this CMTrading review article, we have investigated the broker in light of the complaints. Check them out.

WikiFX

WikiFX

CM Trading is a South Africa based broker that provides wide variety of market instruments such as forex, CFDs, commodities, indices, stocks, and cryptocurrencies. In today's article, you will read a complete review of CM trading and learn everything about it. Let's go .

WikiFX

WikiFX

This article sheds light on the alarming experiences of a trader who encountered CM Trading.

WikiFX

WikiFX

Online trading is booming. Despite market conditions during the first half of 2022, there’s never been a better time to get involved with the financial markets.

WikiFX

WikiFX

More

User comment

14

CommentsWrite a review

2024-07-23 17:22

2024-07-23 17:22

2023-12-06 10:19

2023-12-06 10:19