User Reviews

More

User comment

5

CommentsWrite a review

2024-08-14 11:09

2024-08-14 11:09

2024-03-29 14:42

2024-03-29 14:42

Score

5-10 years

5-10 yearsSuspicious Regulatory License

MT5 Full License

Regional Brokers

High potential risk

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index7.37

Risk Management Index0.00

Software Index8.44

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Ngel Partners PTE. LTD

Company Abbreviation

NGEL PARTNERS

Platform registered country and region

Malaysia

Company website

Company summary

Pyramid scheme complaint

Expose

| Ngel Partners Review Summary | |

| Founded | 2019 |

| Registered Country/Region | Malaysia |

| Regulation | Labuan FSA |

| Market Instruments | Forex, Indices, Commodities, Cryptocurrencies, Metals |

| Demo Account | ✅ |

| Leverage | Up to 1:200 |

| Spread | From 1.5-2.5 pips (Standard account) |

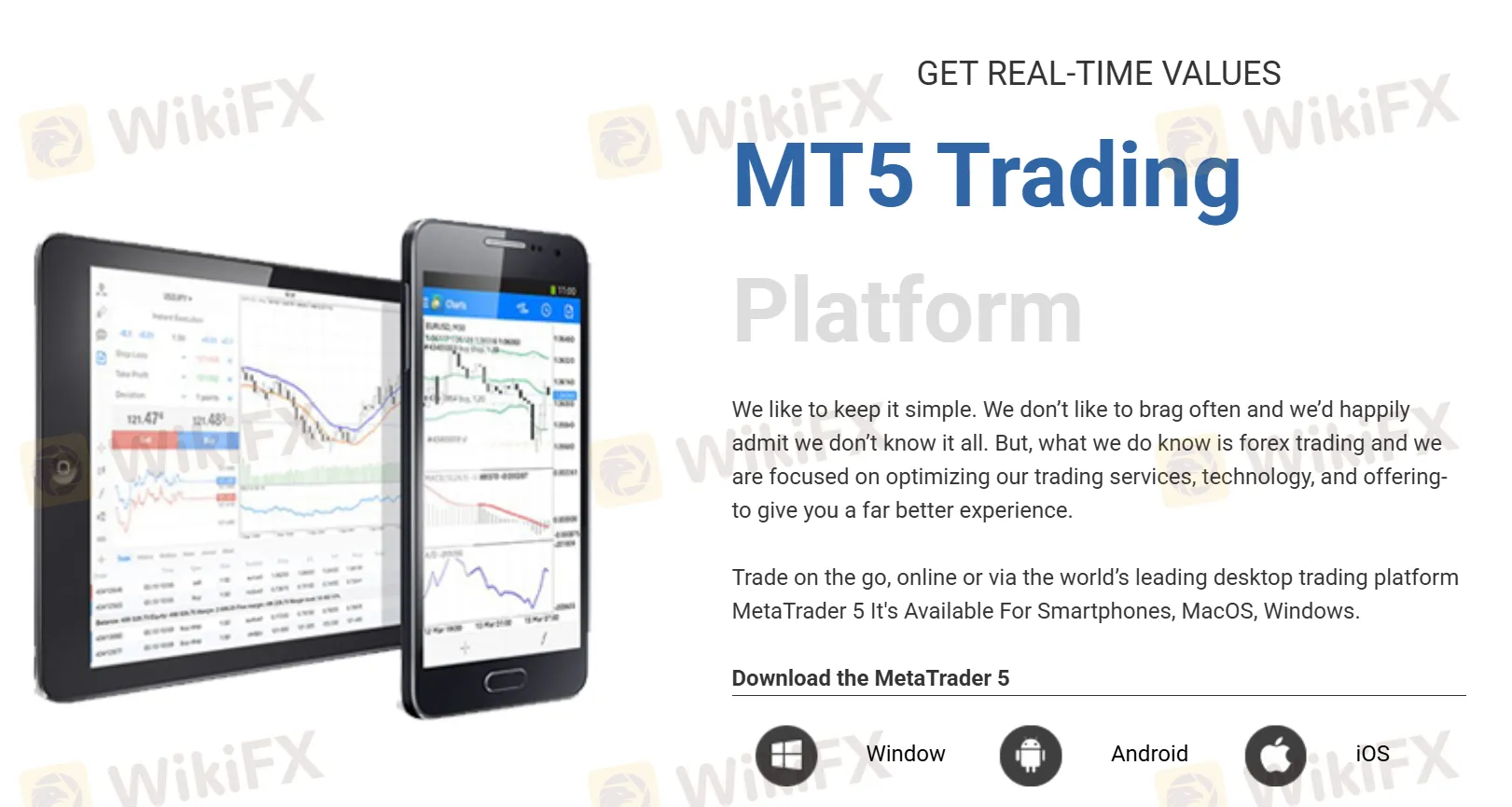

| Trading Platform | MT5 |

| Minimum Deposit | $200 |

| Customer Support | Tel: +60 087504220 |

| Email: support@ngelpartners.com | |

Ngel Partners is a brokerage regulated by Labuan FSA in Malaysia, offering trading in forex, indices, commodities, cryptocurrencies, and metals via the MT5 platform with a minimum deposit of $200 and leverage up to 1:200.

| Pros | Cons |

| MT5 available | High minimum deposit |

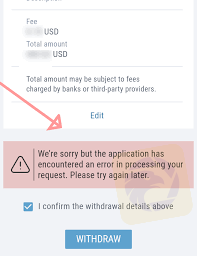

| Regulated by Labuan FSA | Withdrawal fees charged |

| Various trading instruments | |

| Popular payment options | |

| Demo accounts available | |

| No deposit fees |

Ngel Partners has a Straight Through Processing (STP) license regulated by Labuan Financial Services Authority (Labuan FSA) in Malaysia with a license number of MB/20/0048.

| Regulated Authority | Current Status | Regulated Country | Licensed Entity | License Type | License No. |

| Labuan Financial Services Authority (Labuan FSA) | Regulated | Malaysia | Ngel Partners Pte. Ltd. | Straight Through Processing (STP) | MB/20/0048 |

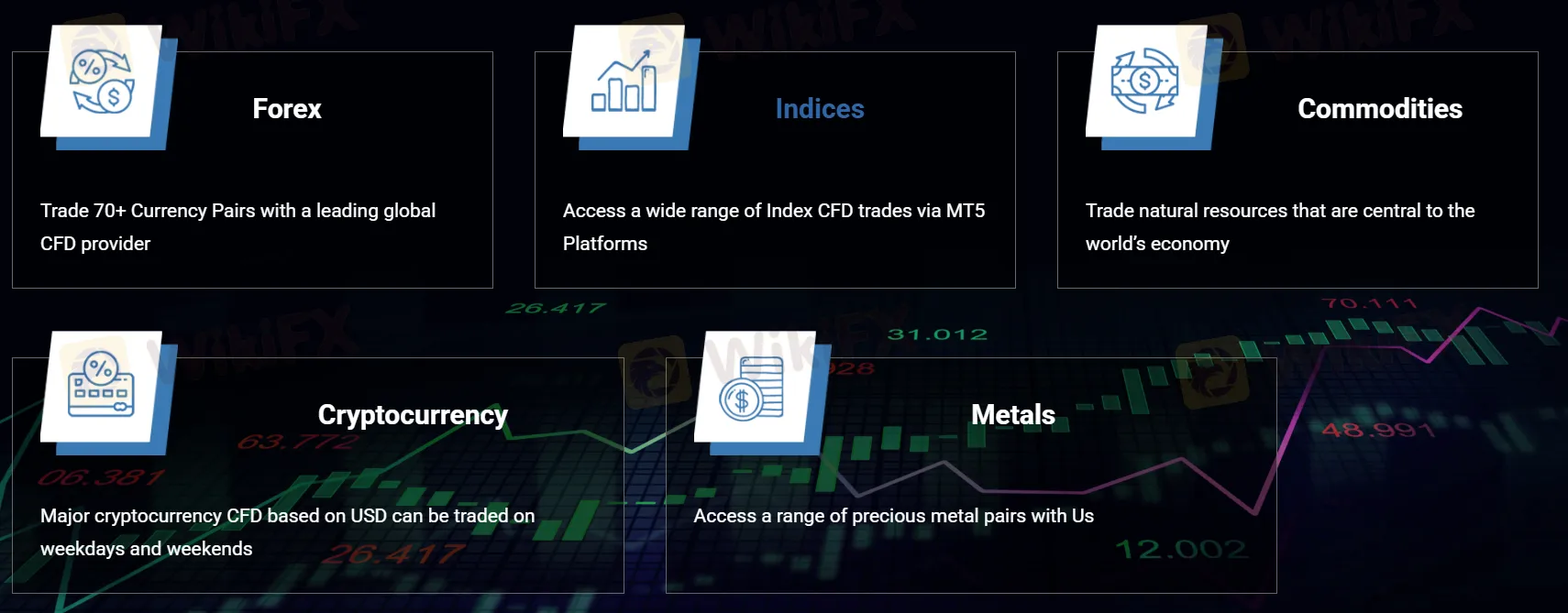

Ngel Partners offers diverse trading options including Forex, Indices, Commodities, Cryptocurrencies, and Metals.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

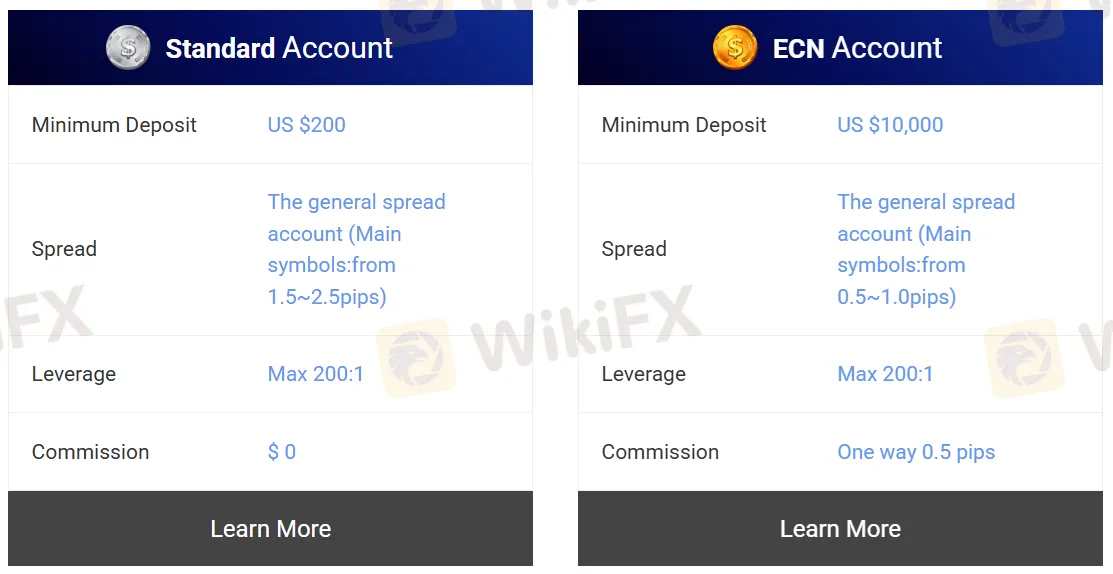

Ngel Partners offers two main account types: Standard and ECN. A free demo account is also provided.

| Account Type | Standard Account | ECN Account |

| Minimum Deposit | US $200 | US $10,000 |

| Maximum Leverage | 1:200 | |

| Spread from | 1.5~2.5 pips | 0.5~1.0 pips |

| Commission | $0 | One way 0.5 pips |

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Windows, Android, iOS | Experienced traders |

| MT4 | ❌ | / | Beginners |

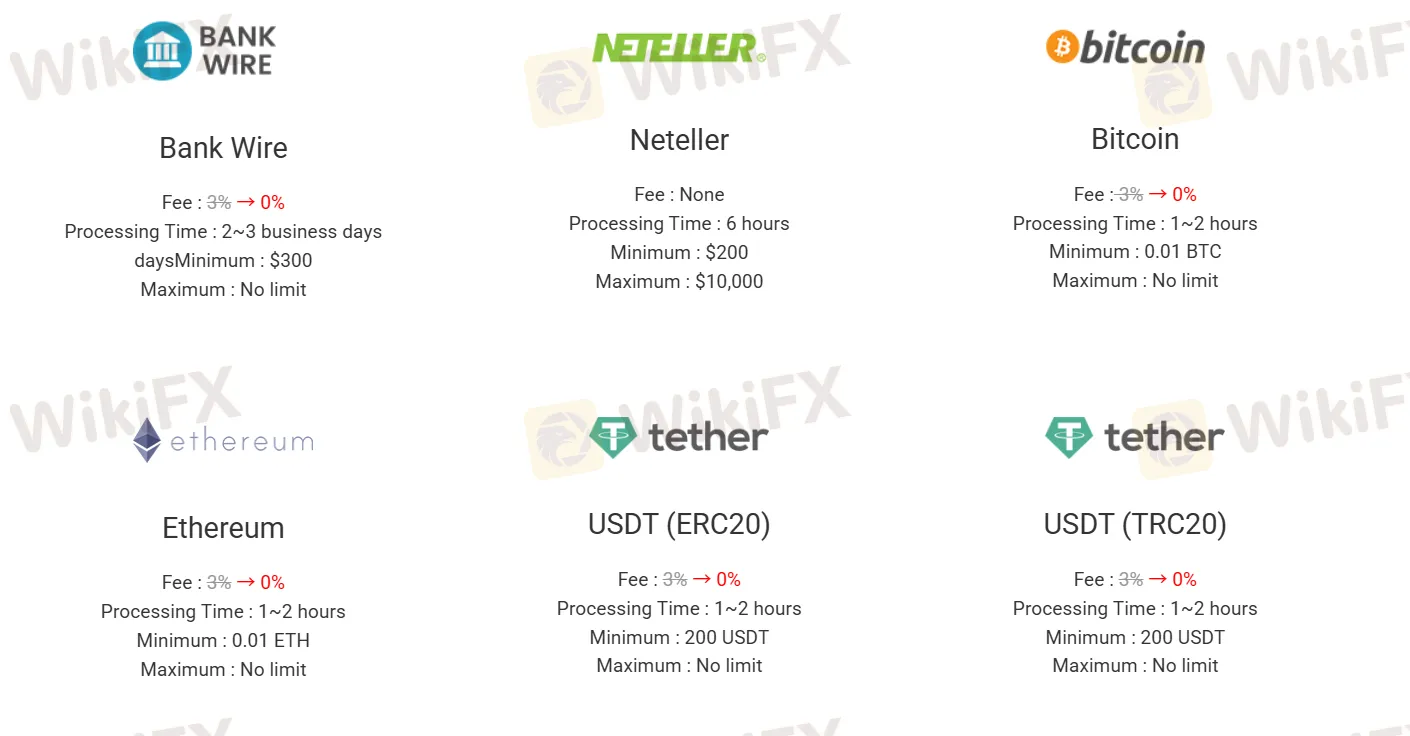

| Deposit Options | Minimum Deposit | Deposit Fees | Deposit Time |

| Bank Wire | $300 | 0 | 2-3 business days |

| Neteller | $200 | 6 hours | |

| Bitcoin | 0.01 BTC | 1-2 hours | |

| Ethereum | 0.01 ETH | ||

| USDT (ERC20) | 200 USDT | ||

| USDT (TRC20) |

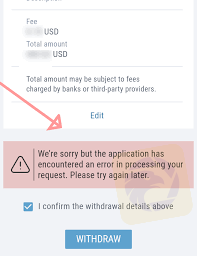

| Withdrawal Options | Minimum Withdrawal | Withdrawal Fees | Withdrawal Time |

| Bank Wire | $300 | 1% (Min. $20 & up to $100 or less) | 3-5 business days |

| Neteller | $200 | 1-2 business days | |

| Bitcoin | 0.01 BTC | 1-2 hours | |

| Ethereum | 0.01 ETH | ||

| USDT (ERC20) | 200 USDT | ||

| USDT (TRC20) |

More

User comment

5

CommentsWrite a review

2024-08-14 11:09

2024-08-14 11:09

2024-03-29 14:42

2024-03-29 14:42