User Reviews

More

User comment

7

CommentsWrite a review

2024-07-16 17:58

2024-07-16 17:58

2023-12-07 11:57

2023-12-07 11:57

Score

2-5 years

2-5 yearsRegulated in Seychelles

Retail Forex License

Suspicious Scope of Business

Medium potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index3.92

Business Index5.93

Risk Management Index8.22

Software Index4.00

License Index3.92

Single Core

1G

40G

More

Company Name

Brisk Markets LLC

Company Abbreviation

Brisk Markets

Platform registered country and region

Saint Vincent and the Grenadines

Company website

Company summary

Pyramid scheme complaint

Expose

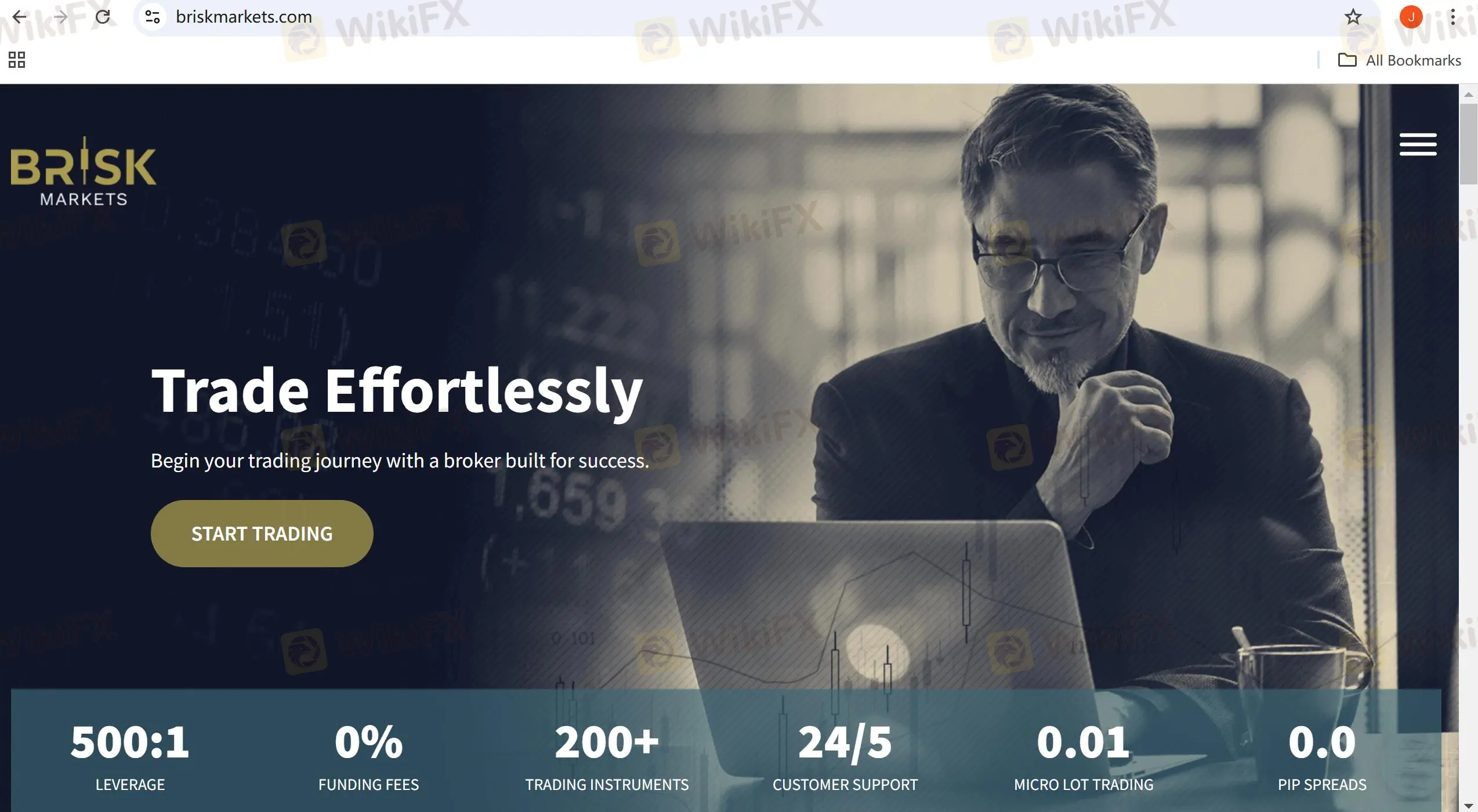

| Brisk Markets Review Summary | |

| Founded | 2022 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | FSA (offshore) |

| Market Instruments | Forex, commodities, stocks, indices |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Leverage | Up to 1:500 |

| EUR/USD Spread | From 1.2 pips (Classic account) |

| Trading Platform | MT5 |

| Social/Copy Trading | ✅ |

| Min Deposit | $250 |

| Customer Support | 24/5 support - live chat, contact form |

| Tel: +442035191820 | |

| Email: support@briskmarkets.com | |

| Social media: Facebook, Instagram, Twitter, Linkedin | |

| Physical Address: Richmond Hill Road, Kingstown, St. Vincent and the Grenadines, P.O. Box 2897 | |

Brisk Markets was registered in 2022 in Saint Vincent and the Grenadines, specializing the forex, commodity, stock, and indices markets. It provides 3 types of accounts, with a minimum deposit of $250 and a maximum leverage of 1:500. What's more, this company is offshore regulated, which means potential risks may exist, and customers need to be careful.

| Pros | Cons |

| Various tradable assets | Offshore regulation risks |

| Demo accounts and Islamic accounts | High minimum deposit |

| Multiple account types | No 24/7 support |

| Commission-free account offered | |

| MT5 provided | |

| Social/copy trading provided | |

| Multiple payment options | |

| No deposit and withdrawal fees | |

| Live chat support |

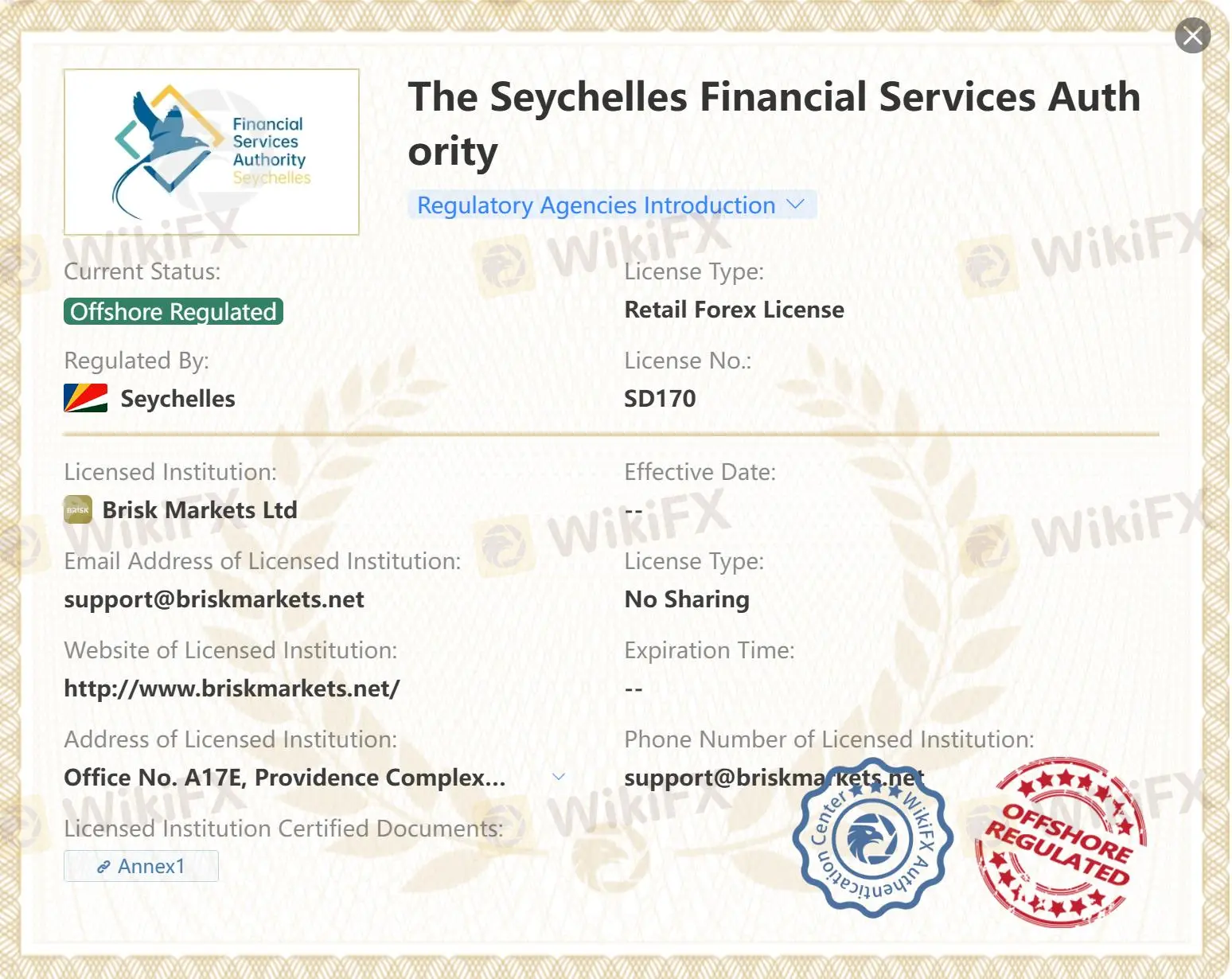

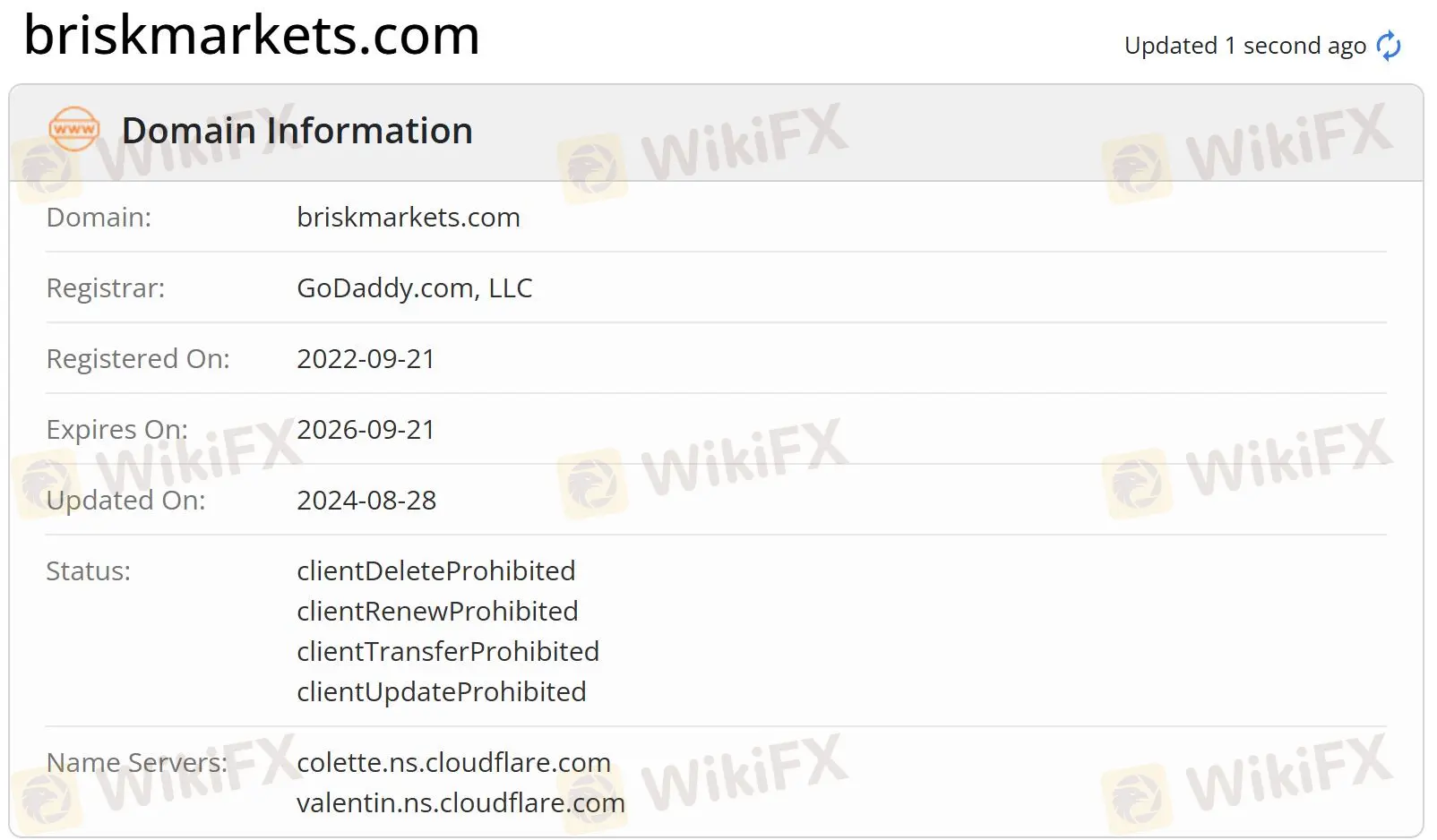

Brisk Markets is offshore regulated by the Seychelles Financial Services Authority (FSA). Besides, the current status shows that activities such as client transferring and updating are prohibited. Therefore, potential risks cannot be ignored.

| Regulated Authority | Current Status | Regulated Country | License Type | License No. |

| The Seychelles Financial Services Authority (FSA) | Offshore Regulated | Seychelles | Retail Forex License | SD170 |

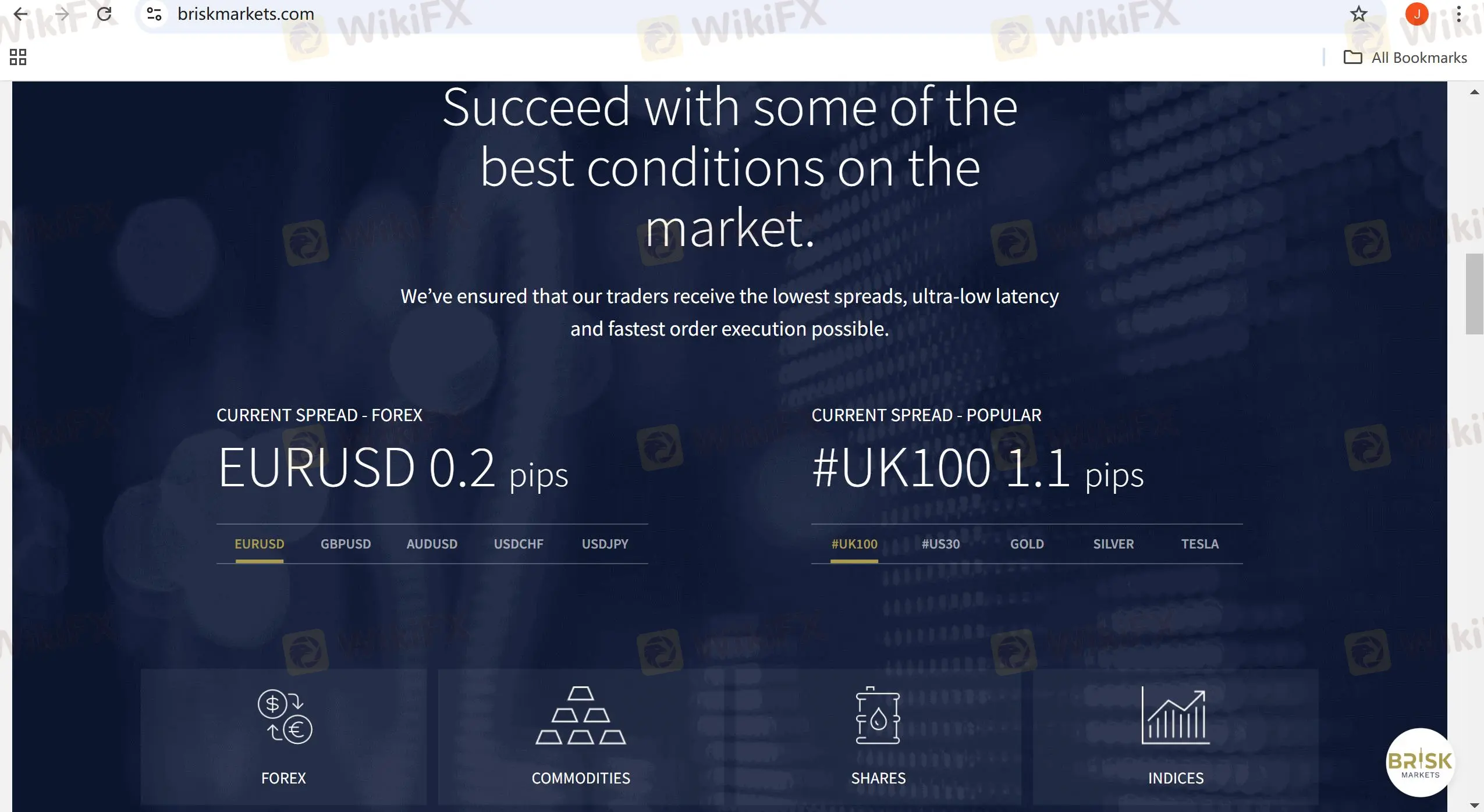

Brisk Markets provides several types of products, including forex, commodities, stocks, and indices.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

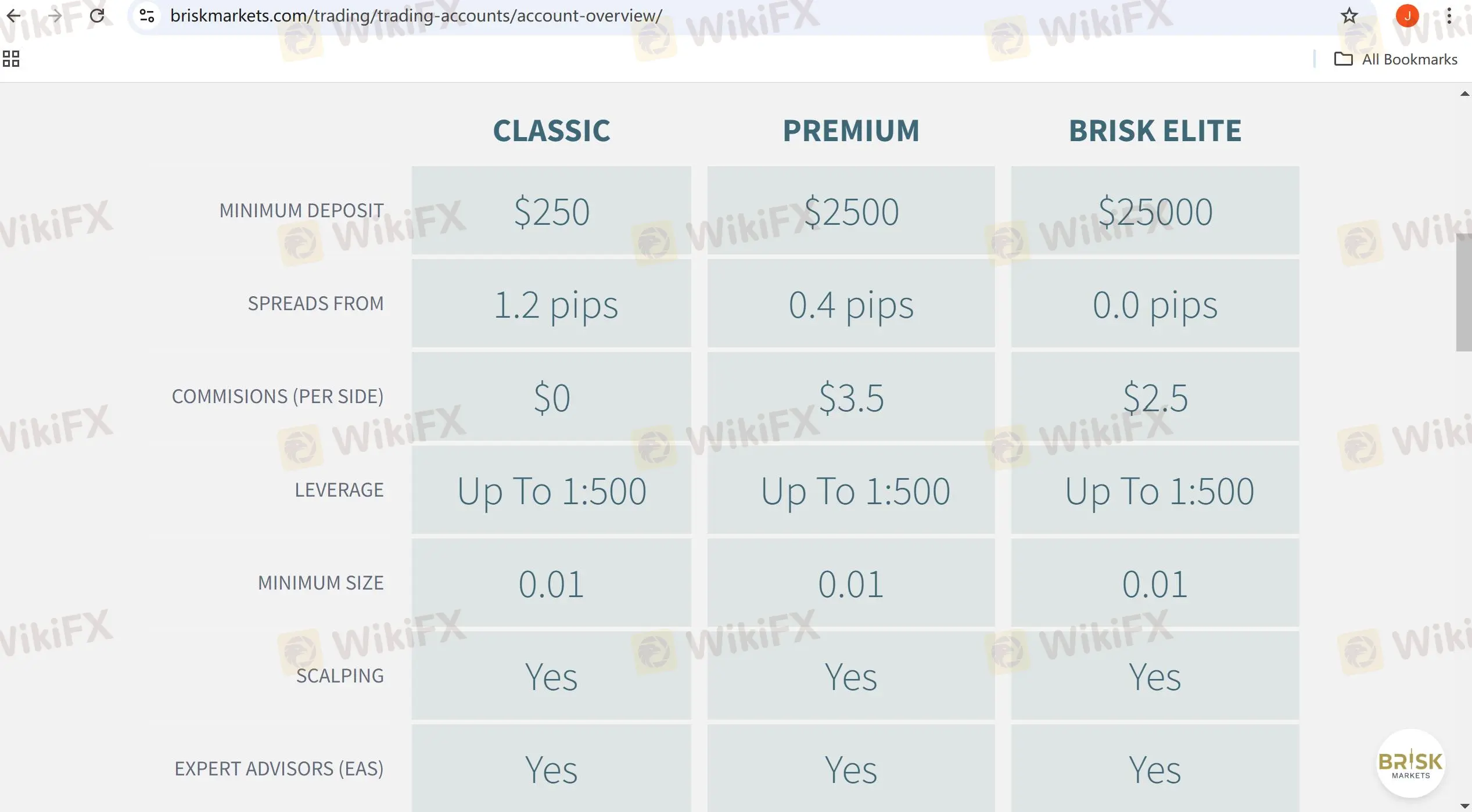

Brisk Markets offers 3 types of accounts, including Classic, Premium, and Brisk Elite. Besides, a demo account is also available. In gold trading, Brisk Markets also provides Islamic accounts for customers.

| Account Type | Min Deposit |

| Classic | $250 |

| Premium | $2,500 |

| Brisk Elite | $25,000 |

The leverage can be up to 1:500 for all account types, which is not low. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

| Account Type | Spread | Commission |

| Classic | From 1.2 pips | ❌ |

| Premium | From 0.4 pips | $3.5 per side |

| Brisk Elite | From 0.0 pips | $2.5 per side |

Brisk Markets uses MT5 as its trading platform, a highly regarded trading platform known for its robust capabilities and versatility. MT5 supports trading across various devices including desktops, mobile devices, and via a web browser

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | PC, web, mobile | Experienced traders |

| MT4 | ❌ | / | Beginners |

Brisk Markets provides copy trading services, which means customers can follow top traders and learn from their trading experiences.

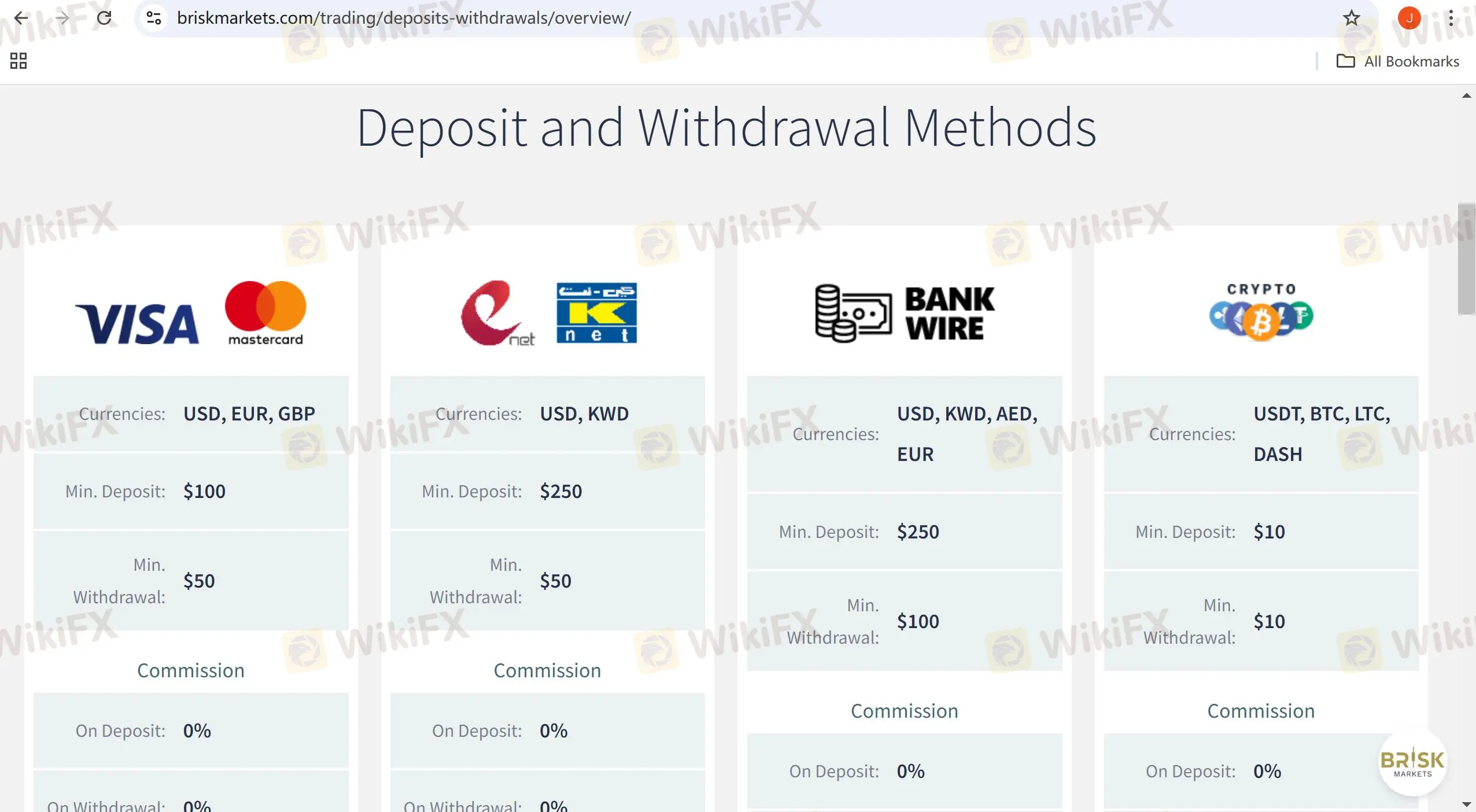

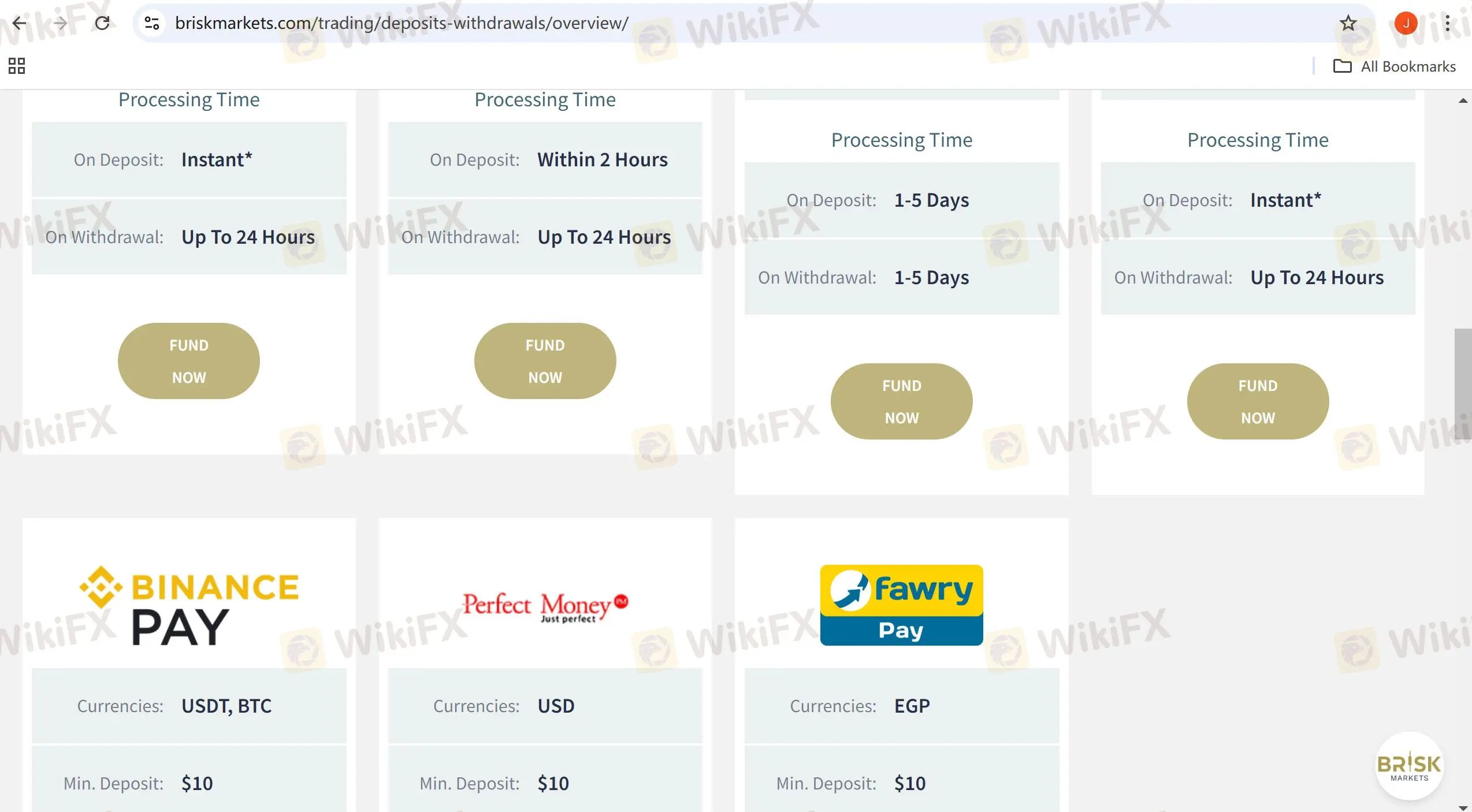

Brisk Markets accepts different types of payment options, and it does not charge any deposit/withdrawal fees.

| Payment Options | Min Deposit | Min Withdrawal | Accepted Currencies | Deposit Time | Withdrawal Time |

| VISA/Mastercard | $100 | $50 | USD, EUR, GBP | Instant | Up to 24 hrs |

| E-net/K-net | $250 | $50 | USD, KWD | Within 2 hrs | |

| Bank wire | $250 | $100 | USD, KWD, AED, EUR | 1-5 days | 1-5 days |

| Bitcoin | $10 | $10 | USDT, BTC, LTC, DASH | Instant | Up to 24 hrs |

| Binance Pay | USDT, BTC | ||||

| Perfect Money | USD | Within 2 hrs | |||

| Fawry Pay | EGP |

More

User comment

7

CommentsWrite a review

2024-07-16 17:58

2024-07-16 17:58

2023-12-07 11:57

2023-12-07 11:57