User Reviews

More

User comment

1

CommentsWrite a review

2023-03-27 18:18

2023-03-27 18:18

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Self-developed

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index7.27

Risk Management Index0.00

Software Index4.37

License Index0.00

Single Core

1G

40G

More

Company Name

GFA Capital Markets LTD

Company Abbreviation

GFA Capital markets

Platform registered country and region

Australia

Company website

Company summary

Pyramid scheme complaint

Expose

| GFA Capital Markets LTD Review Summary | |

| Founded | 2019 |

| Registered Country/Region | Australia |

| Regulation | ASIC (suspicious clone) |

| Market Instruments | forex, metals |

| Demo Account | ✅ |

| Leverage | Up to 30:1 (major FX) |

| Spread | / |

| Trading Platform | GFA Trading Platform |

| Minimum Deposit | $100 (Mini Account) |

| Customer Support | Email: gfa.customer@gfacm.com.au |

| Phone: +61 2 8599 8111 / 8112 / 8113 | |

| Address: Suite 201, Level 2, 46 Market Street, Sydney NSW 2000 | |

GFA Capital Markets LTD specializes in CFDs on forex and metals on its own trading platform. But it runs on a suspiciously cloned ASIC licence and isn't officially regulated. The company has several account levels and customer service available 24/7. Besides, a demo account is also available.

| Pros | Cons |

| Demo account available | Suspicious clone ASIC license |

| 4 account types | Lack of transparency |

| 24/7 customer service | No MT4/MT5 support |

| Various contact channels |

| Regulatory Status | Suspicious Clone |

| Regulated By | Australia (ASIC) |

| License Type | Market Maker (MM) |

| Licensed Institution | GFA Capital Markets LTD |

| License Number | 398104 |

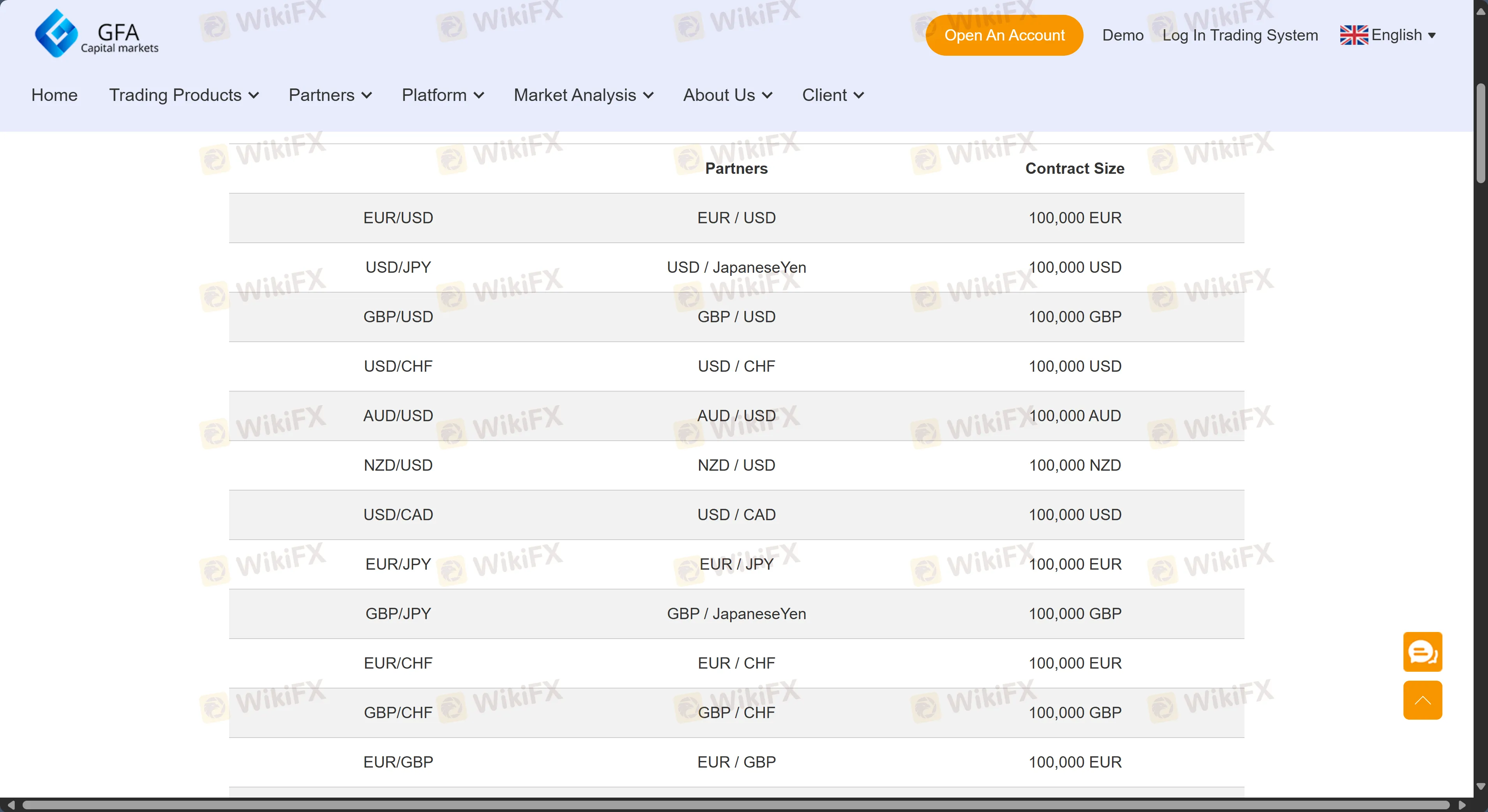

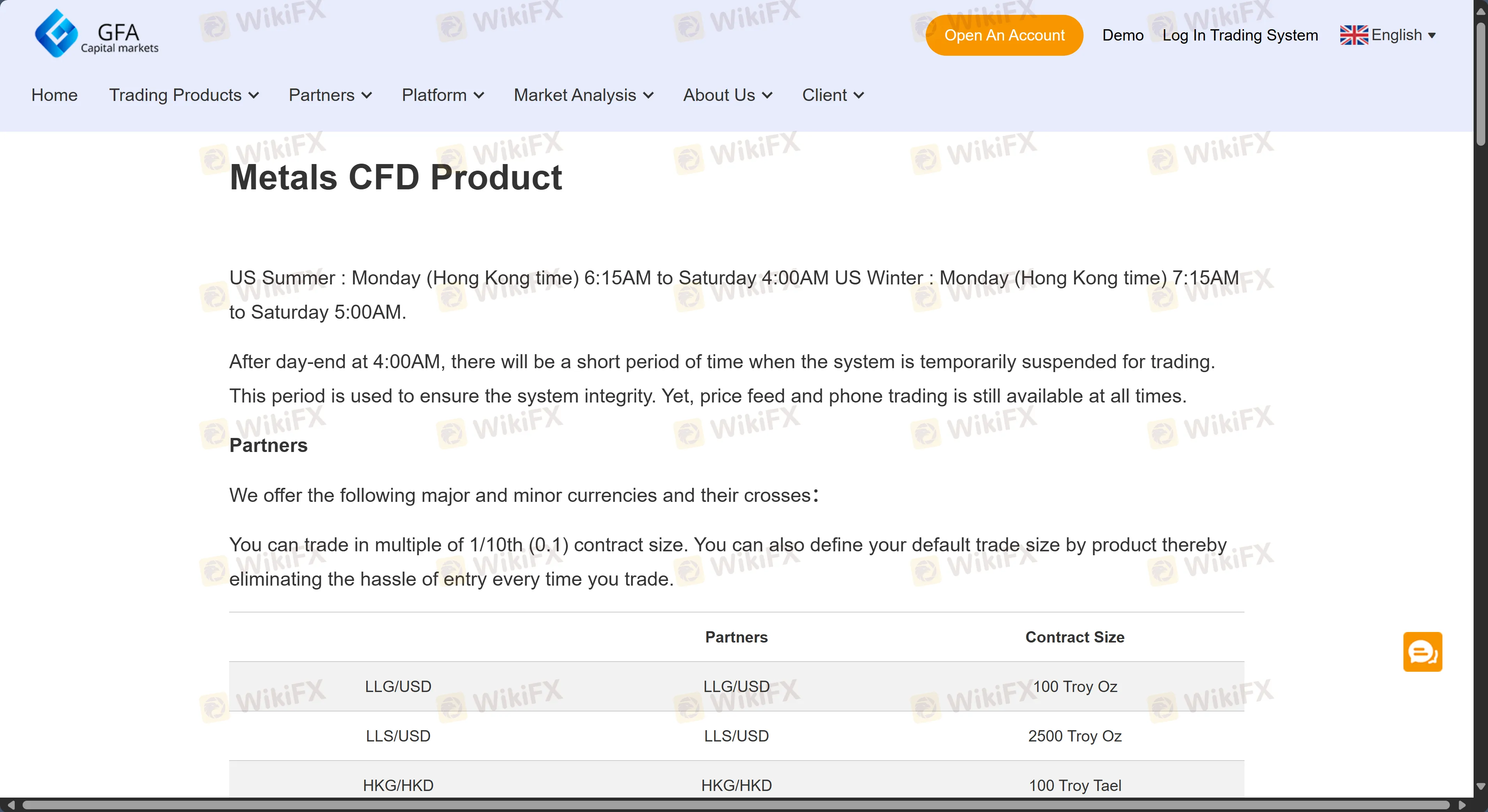

GFA Capital offers CFDs on multiple asset types. Example instruments include:

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Indices | ❌ |

| Futures | ❌ |

| Cryptos | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Options | ❌ |

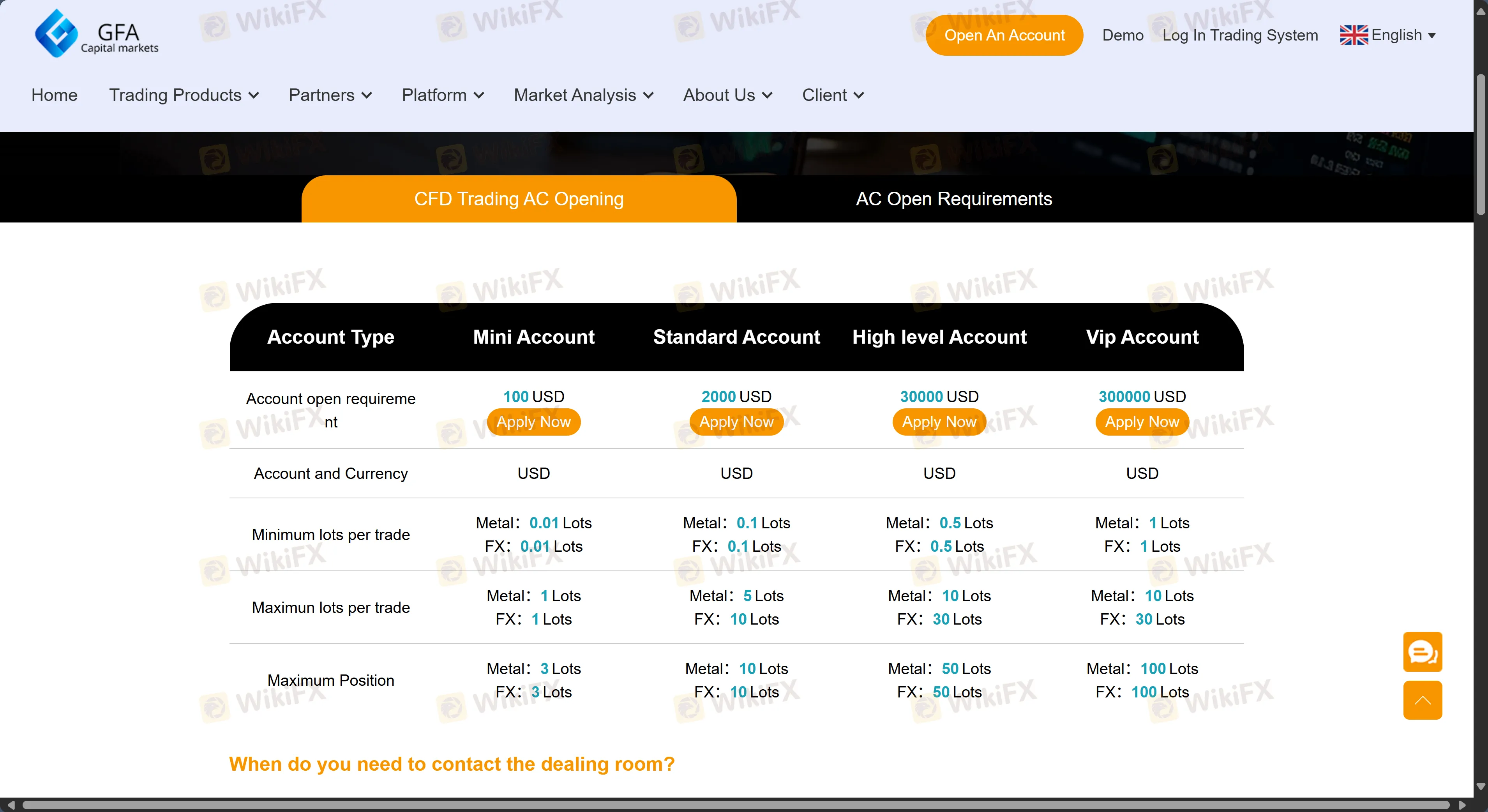

GFA offers four CFD account tiers with a minimum deposit of $100. Demo account is also available.

| Type | Minimum Deposit | Lot Size (FX) |

| Mini Account | $100 | 0.01 lots |

| Standard Account | $2,000 | 0.1 lots |

| High Level | $30,000 | 0.5 lots |

| VIP Account | $300,000 | 1 lot |

Leverage ranges from 2:1 (crypto) to 30:1 (major forex pairs), following ASICs restrictions.

| Instrument Type | Maximum Leverage |

| Major FX Pairs | 30:1 |

| Minor FX Pairs, Gold, Major Indices | 20:1 |

| Other Commodities, Minor Indices | 10:1 |

| Crypto Assets | 2:1 |

| Shares & Other Assets | 5:1 |

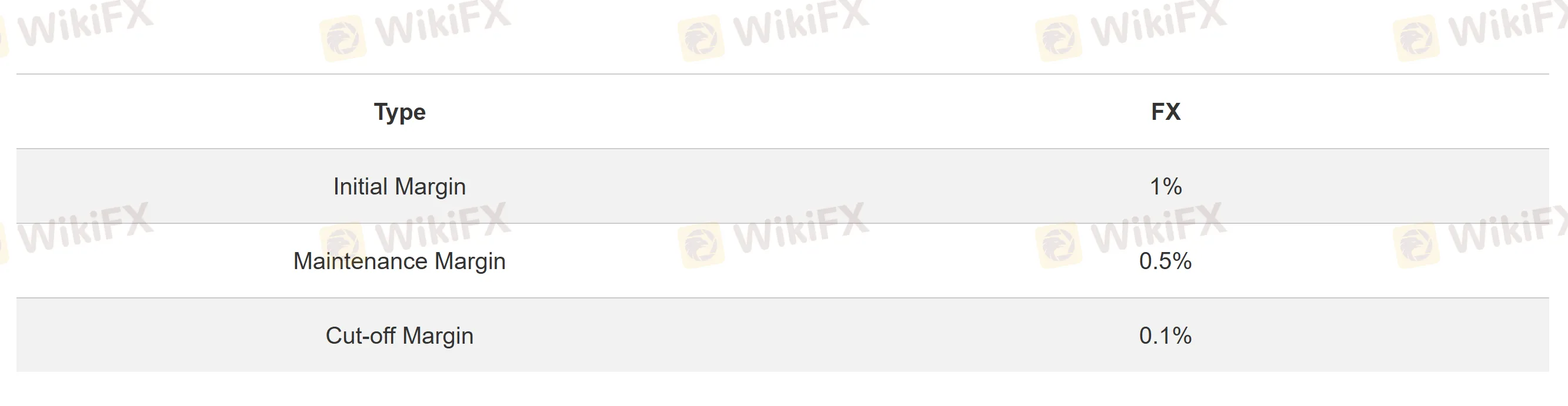

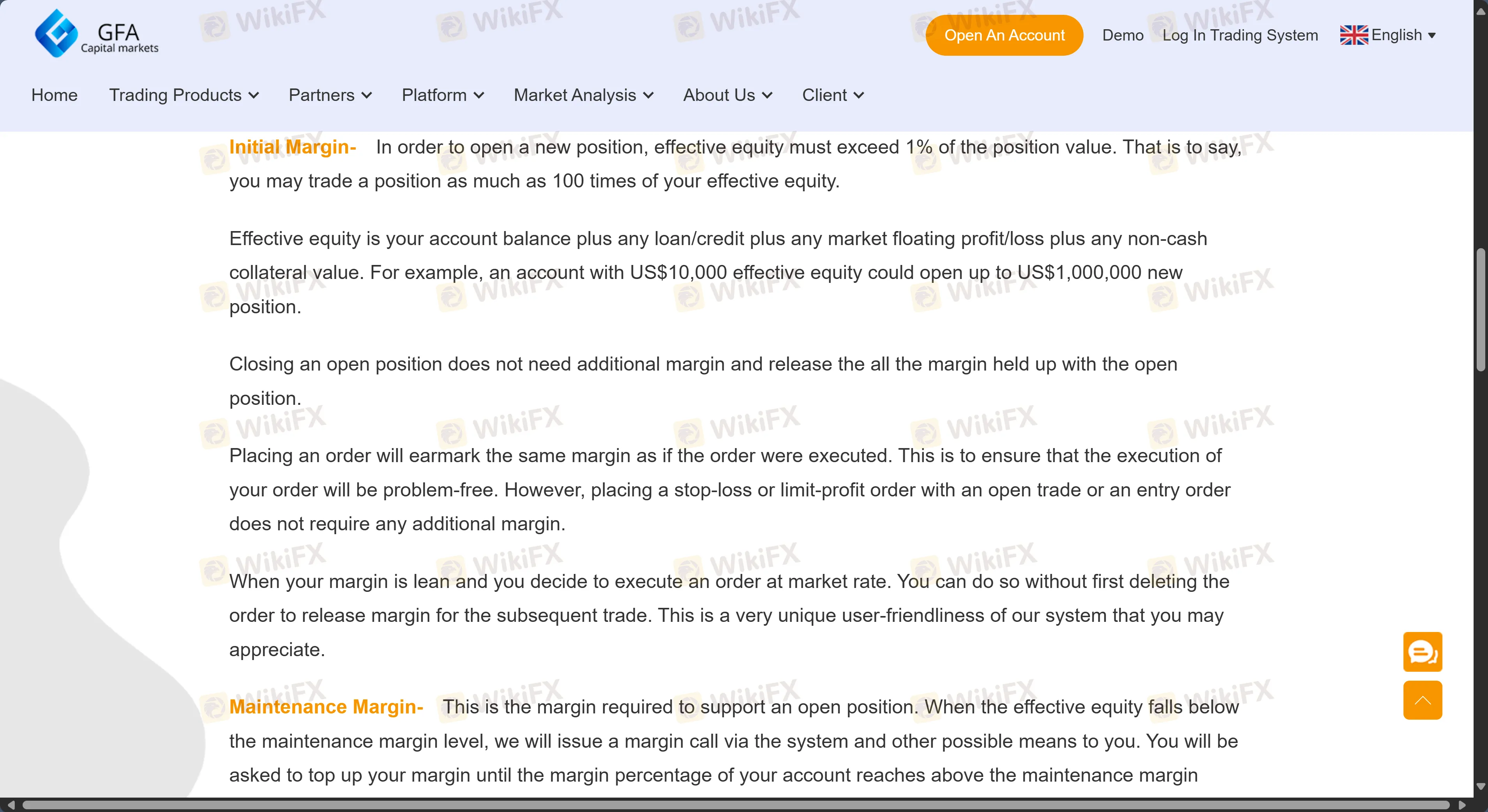

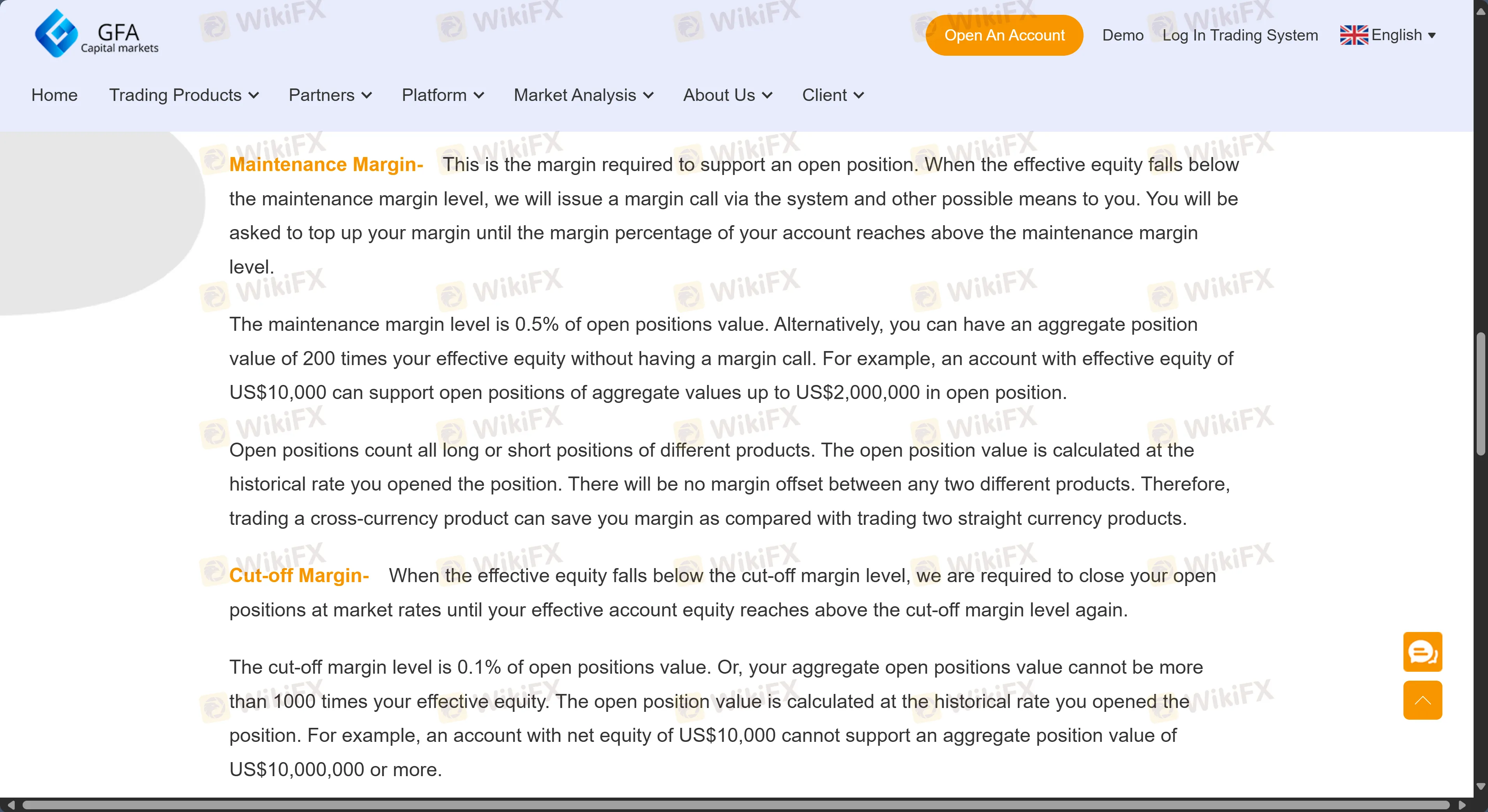

GFA Capital Markets LTD requires initial margin from 1%, with overnight interest applied to all rolled-over positions.

| Fee Item | Description |

| Overnight Interest | Applied daily on rollover positions, rate based on market conditions. |

| Margin Requirements (FX & Metals) | Initial: 1% |

| Maintenance: 0.5% | |

| Cut-off: 0.1% |

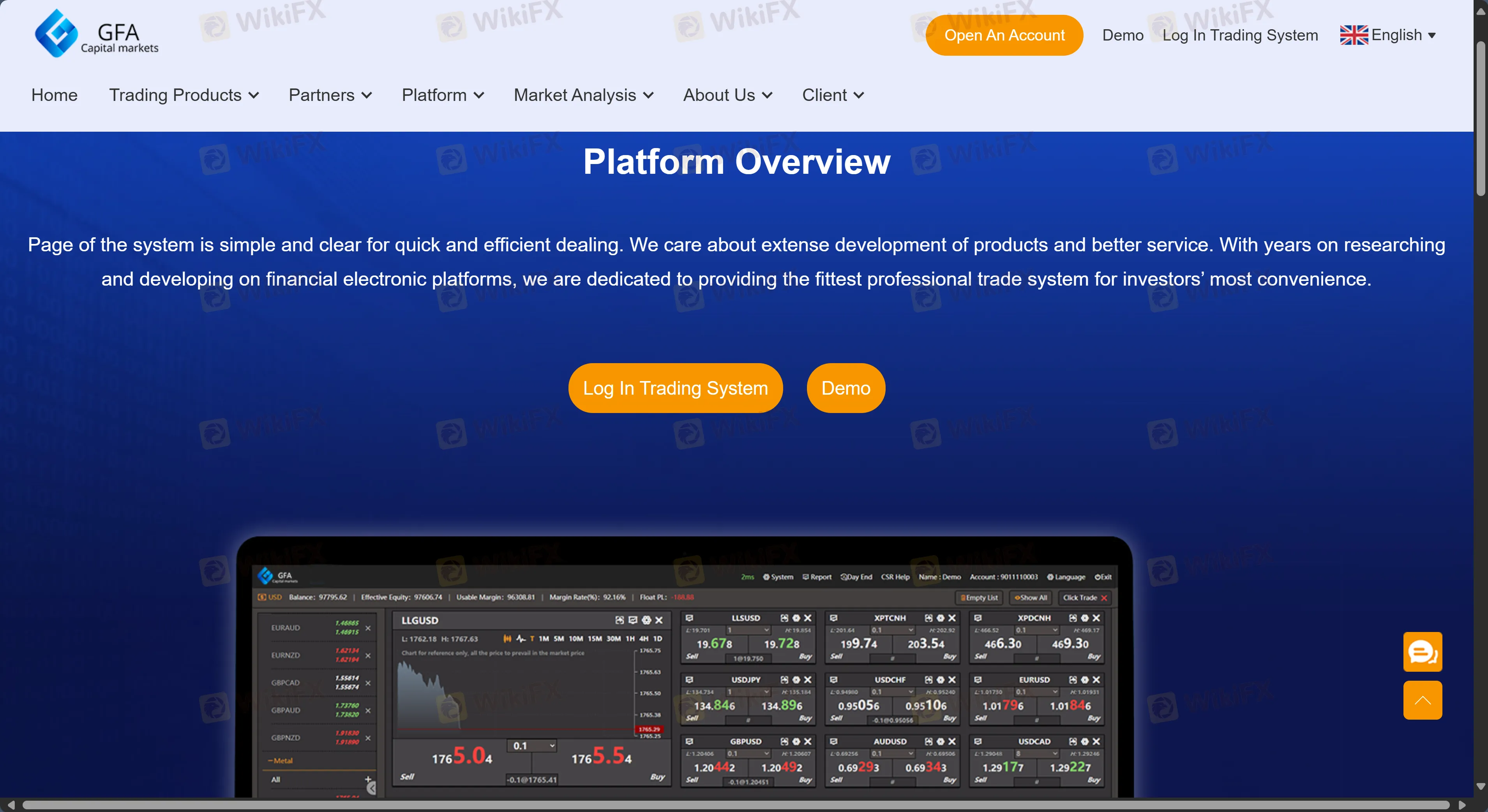

GFA provides its own GFA Trading Platform, available on all major devices:

| Trading Platform | Supported | Available Devices | Suitable For |

| GFA Trading Platform | ✔ | Windows, Mac, Web, iOS, Android | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

More

User comment

1

CommentsWrite a review

2023-03-27 18:18

2023-03-27 18:18