User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Self-developed

High potential risk

Influence

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index7.46

Risk Management Index0.00

Software Index4.58

License Index0.00

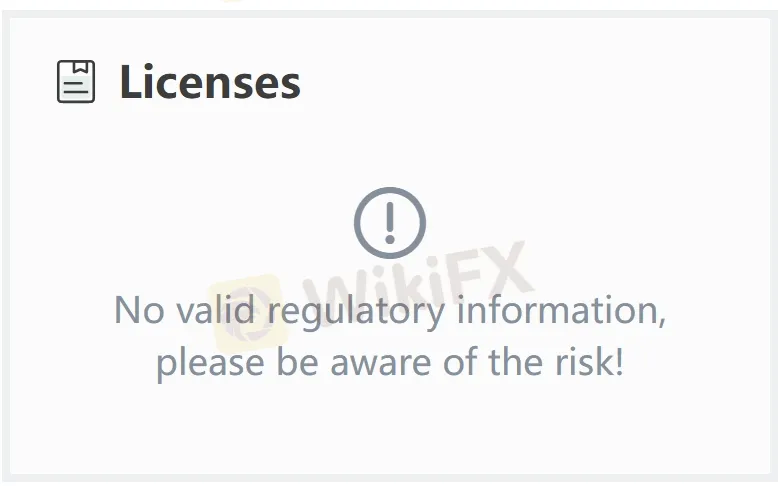

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Regal Securities, Inc.

Company Abbreviation

eOption

Platform registered country and region

United States

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| eOption Review Summary | |

| Founded | 2007 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | No regulation |

| Market Instruments | Stocks, ETFs, Options |

| Demo Account | ✅ |

| Trading Platform | eOption Mobile |

| Minimum Deposit | 0 |

| Trading Platform | eOption: Trading & Investing |

| Customer Support | Contact form |

| Customer service: 1-888-793-5333 (Toll-free); 1-847-375-6151 (International) | |

| NEW ACCOUNTS: 1-888-793-5333 (Toll-free) | |

| Fax: 1-877-367-8466 | |

| Email: support@eoption.com. | |

| Social platforms: LinkedIn, YouTube, Facebook, Twitter | |

| Address: 950 Milwaukee Ave., Ste. 102 Glenview, IL 60025 | |

eOption, a division of Regal Securities, Inc., is a US-based investment firm mainly focuses on trading in stocks, ETFs, and options. The company also allows option trading in IRAs based on investor's individual suitability.

It offers a free demo account for traders to practice in a risk-free environment, and several live accounts for individuals and small business clients.

Furthermore, eOption provides account protection through SIPC coverage up to $500,000 (including $250,000 for cash), supplemented by Excess SIPC Insurance from Lloyds of London covering customer equity up to $25 million, protecting clients' funds even against member insolvency.

In addition, educational resources like options strategies, investing & money management, research reports, webinars and videos are provided to equip investors with necessary knowledge and skills for successful trading.

However, a critical consideration when choosing to trade with this broker is that it currently operates without oversight from any regulatory authority, which increases risks to client protection and fund security.

| Pros | Cons |

| Rich educational resources | No regulation |

| Free demo accounts | |

| Clear fee structure |

The most important factor in measuring the safety of a brokerage platform is whether it is formally regulated. eOption is an unregulated broker, which means that the safety of users' funds and trading activities are not effectively protected. Investors should choose eOption with caution.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| ETFs | ✔ |

| Options | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

Except for a free demo account for investors to practice and try their trading strategies before commiting real money, eOption also offers different IRA accounts for both individual retirements and small businesses, there include:

Individual Retirement Accounts

Retirement Plans for Small Business

eOption charges a series of trading fees, for example, commission are as below:

| Instruments | Type | Commission/Fee |

| Options | Equity or Index, Market or Limit | $0.10 per contract + $1.99 per trade |

| Broker-Assisted Orders | Additional $15.00 | |

| Option Exercise and Assignment | $9.00 | |

| Stocks and ETFs | Market or Limit (Unlimited Shares) | $0 |

| Broker-Assisted Orders | Additional $15.00 | |

| Foreign Stocks | $39.00 | |

| Extended Hours Trading | All Trades | $0.00 per trade |

| Mutual Funds | All Mutual Fund Trades | $5.00 |

| Periodic Invest – Withdraw | $5.00 | |

| Listed Bonds | First 25 Bonds | $5.00 per bond |

| Each Additional Bond | $3.00 per bond | |

| Minimum | $39.00 | |

| Auto Trade Commissions | Equities | $2.00 |

| Options | $3.99 + $0.10 per contract |

To be fully aware of your trading costs, you should approach https://www.eoption.com/rates/ or conact with the broker's representatives to get better understanding and confirmation.

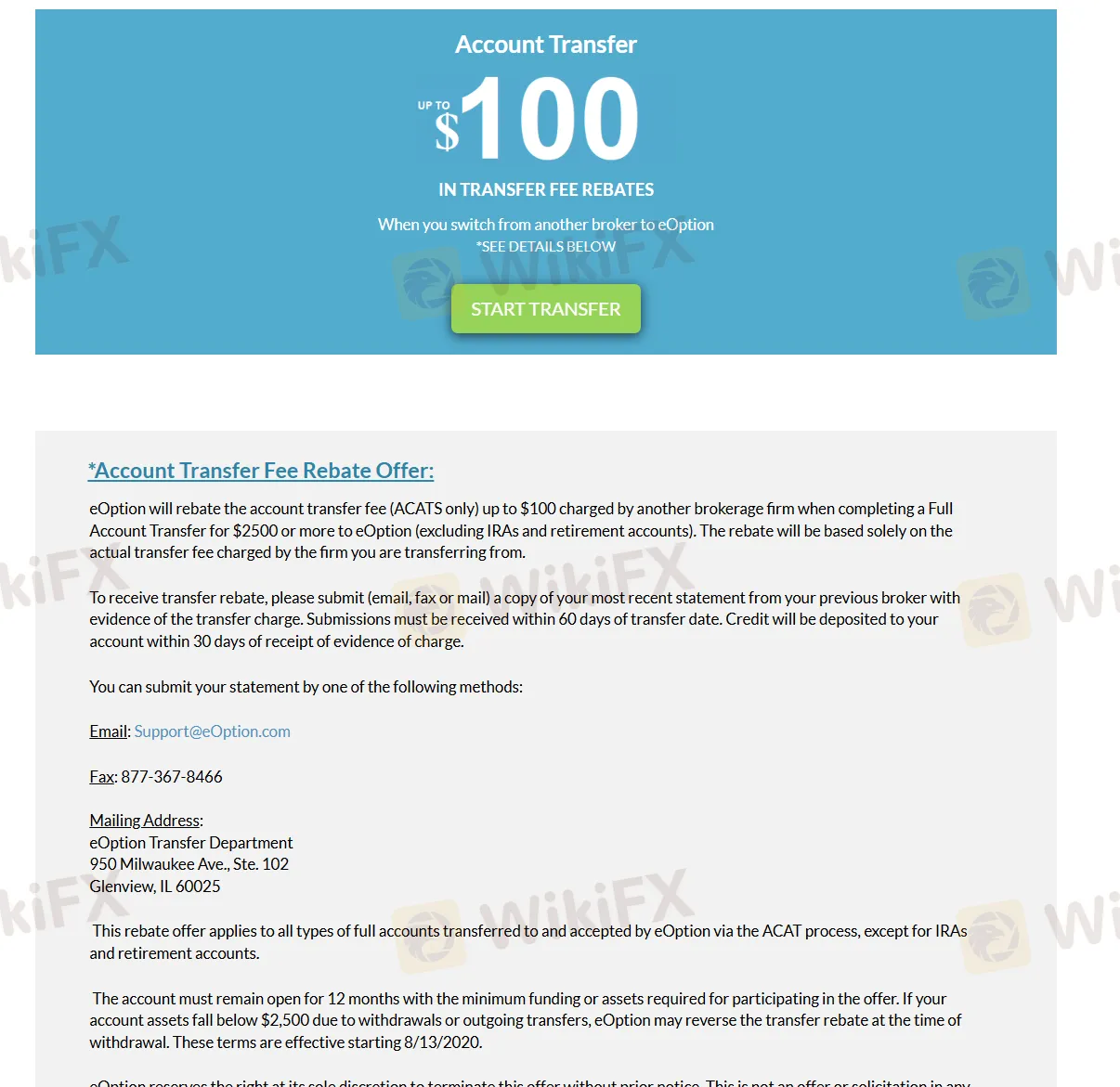

eOption offers a rebate program that refunds up to $100 of your account transfer fee when you complete a full account transfer of $2,500 or more (excluding IRAs and retirement accounts) via the ACAT process.

To qualify, submit proof of the transfer fee from your previous broker within 60 days of the transfer. The rebate is credited within 30 days of receipt. Accounts must remain open with the required minimum assets for 12 months, or the rebate may be reversed.

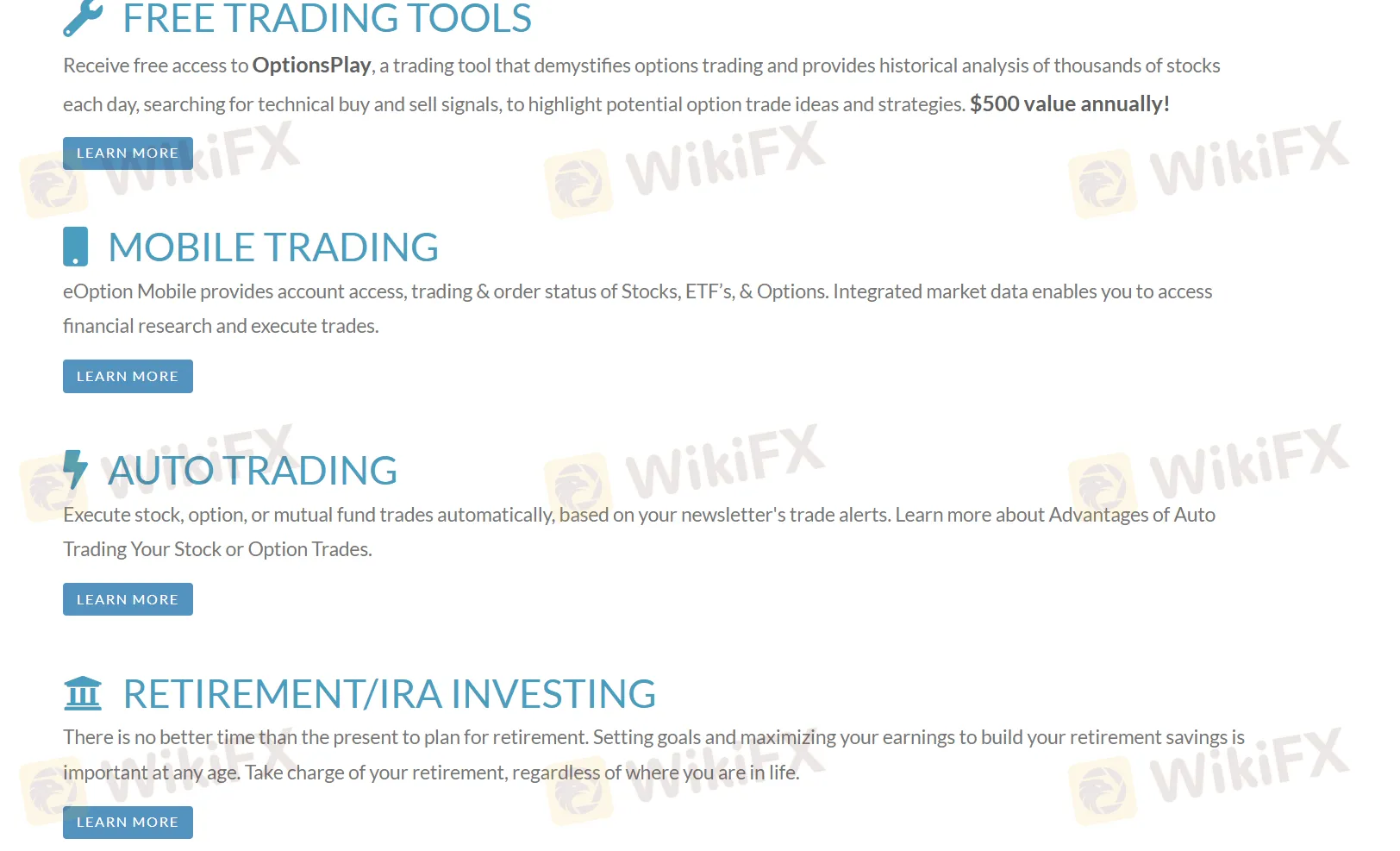

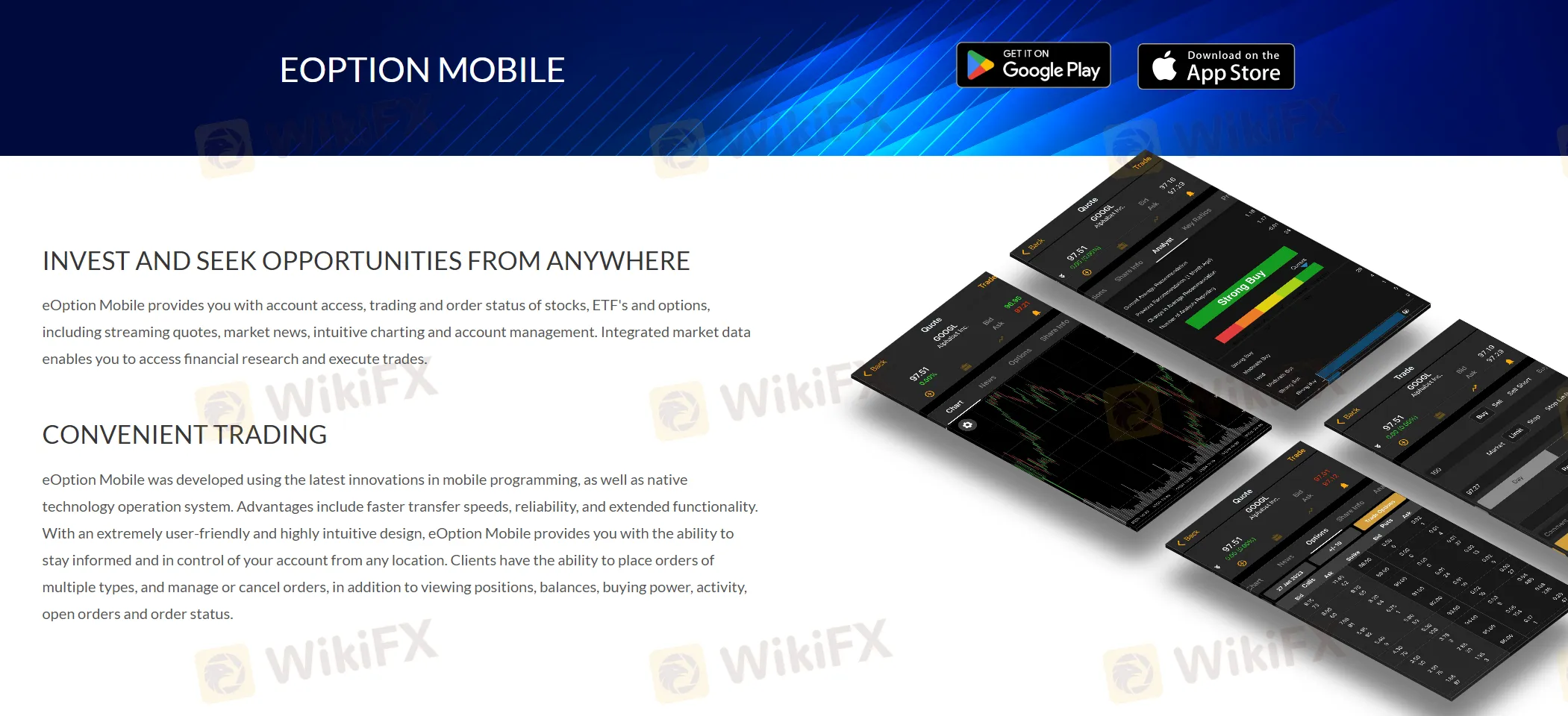

eOption offers a proprietary trading platform, namely “eOption: Trading & Investing”, available on both web and mobile apps.

It is said the platform provides users with account access, trading and order status checking, market updates, charting analysis and account management, etc.

| Trading Platform | Supported | Available Devices |

| eOption: Trading & Investing | ✔ | Web, mobile |

eOption accepts account funding by check, ACH, wire transfer, stock certificate or account transfer.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment