User Reviews

More

User comment

2

CommentsWrite a review

2024-01-03 23:31

2024-01-03 23:31

2023-03-23 10:54

2023-03-23 10:54

Score

5-10 years

5-10 yearsRegulated in Canada

Derivatives Trading License (EP)

Self-developed

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index6.32

Business Index7.29

Risk Management Index9.66

Software Index5.69

License Index6.32

Single Core

1G

40G

More

Company Name

Canaccord Genuity Direct

Company Abbreviation

cg/ Direct

Platform registered country and region

Canada

Company website

Company summary

Pyramid scheme complaint

Expose

| CGD Review Summary | |

| Founded | 2001 |

| Registered Country/Region | Canada |

| Regulation | CIRO |

| Market Instruments | Equities, ETFs, Options, Futures, Fixed Income, GICs, Forex |

| Demo Account | ❌ |

| Leverage | Not mentioned |

| Spread | Not mentioned |

| Min Deposit | $5,000 (cash/registered account) / $15,000 (margin account) |

| Customer Support | Phone: (514) 985-8080, 1-866-608-0099 |

| Address: 360, Saint-Jacques Street West, Suite G-102Montreal (Québec) CanadaH2Y 1P5 | |

Canaccord Genuity Direct (CGD), founded in 2001 and regulated by CIRO, offers a range of self-directed investing services to Canadian residents. It provides access to equities, ETFs, options, fixed income, futures, and forex but does not offer a demo or Islamic account.

| Pros | Cons |

| Access to major Canadian markets | High non-trading fees |

| Strong regulatory background (CIRO) | No demo account and no Islamic account |

| Wide asset offering (Equities, ETFs, Fixed Income) | High minimum deposit requirement ($5,000 / $15,000) |

Yes, CGD (Canaccord Genuity Corp.) is legitimately regulated.

It is regulated by the Canadian Investment Regulatory Organization (CIRO).

The license type is Market Maker (MM), although the license number is unreleased.

Canaccord Genuity Direct (CGD) offers access to a wide range of trading products, focusing mainly on equities, ETFs, options, futures, fixed income, and foreign exchange, with professional-grade Direct Market Access (DMA).

| Tradable Instruments | Supported |

| Equities | ✅ |

| ETFs | ✅ |

| Options | ✅ |

| Futures | ✅ |

| Fixed Income (Bonds) | ✅ |

| GICs | ✅ |

| Forex (Foreign Exchange) | ✅ |

| CFDs | ❌ |

| Commodities | ❌ |

| Crypto | ❌ |

Canaccord Genuity Direct offers several types of real (live) accounts including investment, retirement, and savings accounts. Demo accounts and Islamic (swap-free) accounts are not available. Different accounts suit different investor needs, mainly for Canadian residents interested in self-directed investing or retirement planning.

| Account Type | Description | Suitable for |

| Standard Investment Account | For self-directed equity, ETF, and options trading | Active traders, investors |

| TFSA (Tax-Free Savings Account) | Investment gains are tax-free | Long-term savings without tax |

| RSP (Registered Savings Plan) | Tax-deferred savings plan for retirement | Retirement-focused investors |

| RIF (Retirement Income Fund) | Withdrawals from RSP after retirement | Retirees managing their savings |

| GIC Investment Account | Purchase of guaranteed investment certificates | Conservative investors seeking security |

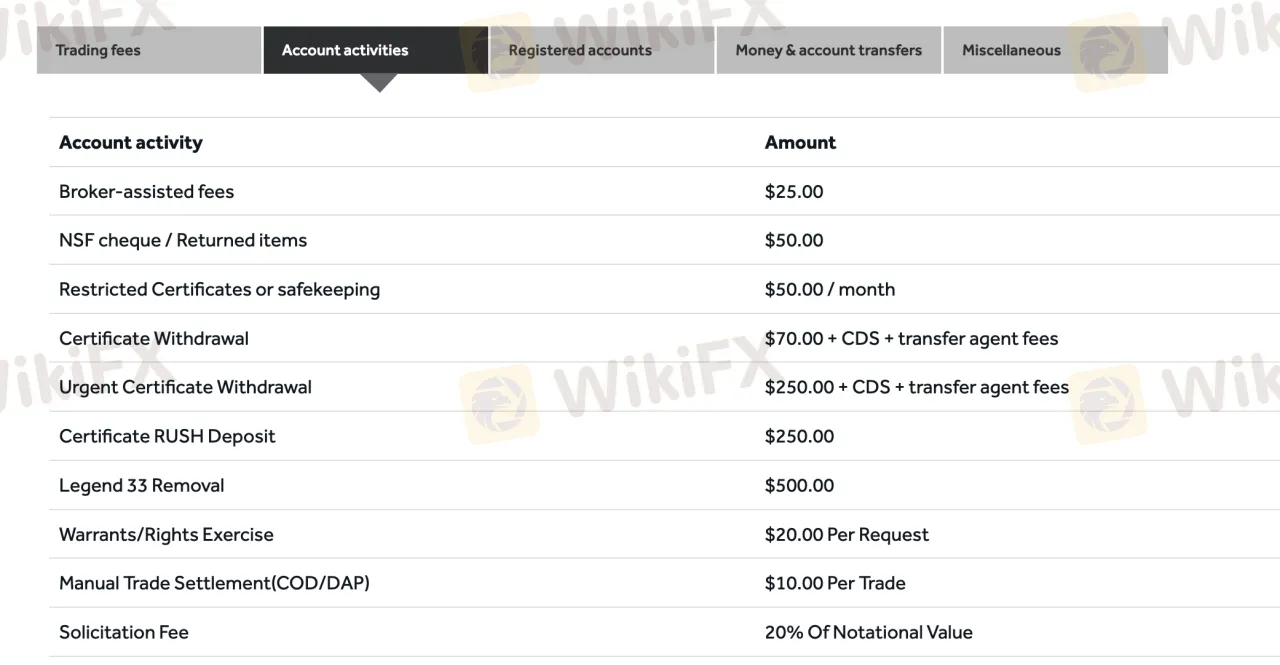

CGDs trading fees are higher than industry average, especially for active or high-volume traders. While flat fees may suit occasional retail investors, per-trade and account activity costs can accumulate for more frequent users.

| Trading fee | Amount |

| Guaranteed Investment Certificated-GIC (Buy) | $1.00 per $1000 investment* |

| *minimum $25.00, maximum $250.00 | |

| Equities & ETFs (Sell & buy) | $9.99 / trade* |

| *exchange fees passed through | |

| Options (Sell & buy) | $1.00 / contract* |

| *minimum $10.00 |

| Non-Trading Fee Type | Amount |

| Deposit Fee | Not explicitly listed |

| Withdrawal Fee (EFT) | $5.00 |

| Wire Transfer (CAD) | $40.00 |

| Wire Transfer (USD) | $50.00 |

| Wire Transfer (International) | $65.00 |

| Inactivity Fee | $20.00 / month |

| Close Account | $75.00 |

| Annual Registered Account | $125.00 |

| Transfer of Account (Full) | $125.00 |

| Partial Transfer | $75.00 |

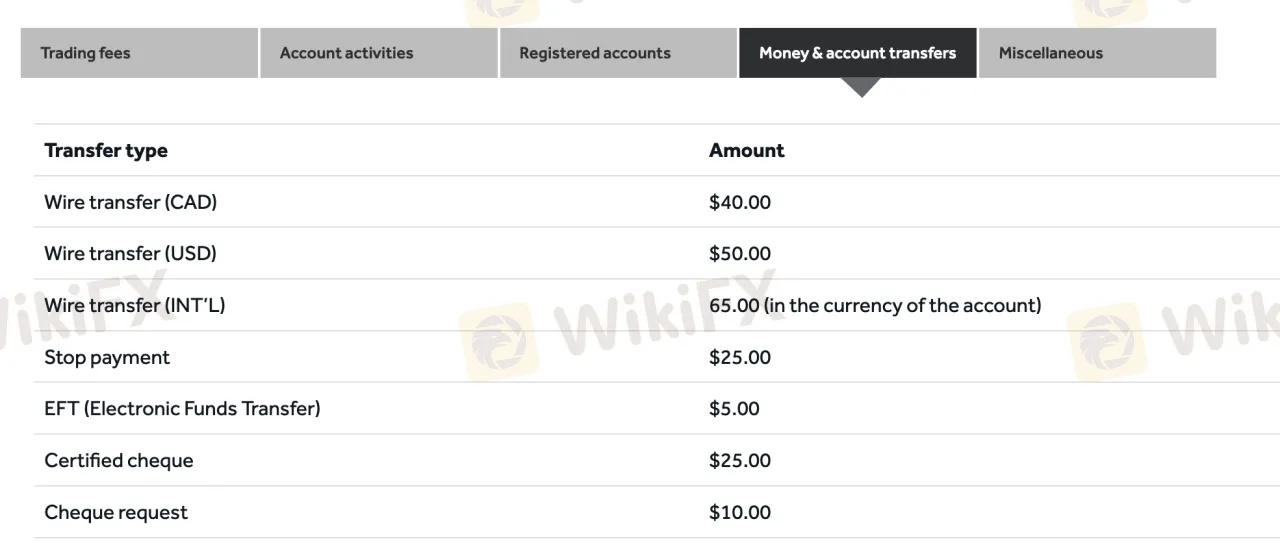

Canaccord Genuity Direct charges fees for deposits and withdrawals depending on the method used. The minimum deposit is $5,000 for cash or registered accounts and $15,000 for margin accounts.

Deposit Options

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Wire Transfer (CAD) | $5,000 (cash/registered) / $15,000 (margin) | $40 | 1–2 business days |

| Wire Transfer (USD) | $5,000 / $15,000 | $50 | 1–2 business days |

| Wire Transfer (International) | $5,000 / $15,000 | $65 (in account currency) | 1–3 business days |

| EFT (Electronic Funds Transfer) | $5,000 / $15,000 | $5 | 1–2 business days |

| Certified Cheque | $5,000 / $15,000 | $25 | Varies |

| Cheque (Standard) | $5,000 / $15,000 | $10 | Varies |

| Withdrawal Options | Min. Withdrawal | Fees | Processing Time |

| Wire Transfer (CAD) | Not mentioned | $40 | 1–2 business days |

| Wire Transfer (USD) | Not mentioned | $50 | 1–2 business days |

| Wire Transfer (International) | Not mentioned | $65 (in account currency) | 1–3 business days |

| EFT (Electronic Funds Transfer) | Not mentioned | $5 | 1–2 business days |

| Certified Cheque | Not mentioned | $25 | Varies |

| Cheque (Standard) | Not mentioned | $10 | Varies |

More

User comment

2

CommentsWrite a review

2024-01-03 23:31

2024-01-03 23:31

2023-03-23 10:54

2023-03-23 10:54