User Reviews

More

User comment

1

CommentsWrite a review

2024-03-08 16:06

2024-03-08 16:06

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index7.50

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Danger

More

Company Name

TW Capital LTD

Company Abbreviation

YFX Capital

Platform registered country and region

Marshall Islands

Company website

Company summary

Pyramid scheme complaint

Expose

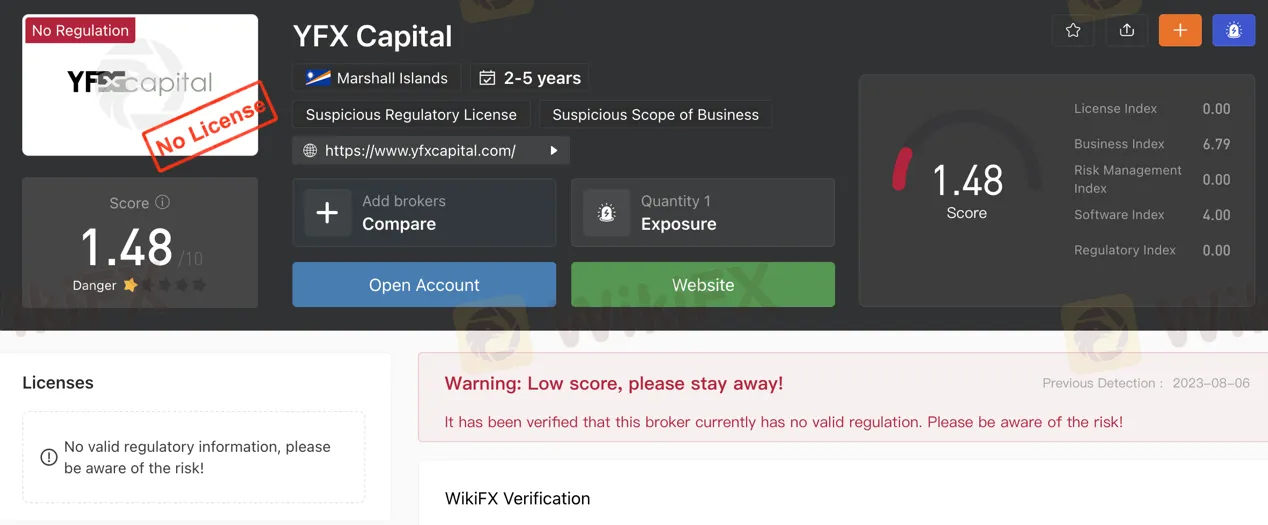

| Aspect | Information |

| Registered Country | Marshall Islands |

| Founded Year | 2-5 years |

| Company Name | TW Capital LTD |

| Regulation | Unregulated |

| Minimum Deposit | $250 - $25,000 (depending on account type) |

| Maximum Leverage | 1:100 - 1:400 (depending on account type) |

| Spreads | 0.3 pips - 3.0 pips (depending on account type) |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex, Indices, Commodities, Share CFDs |

| Account Types | Mini, Silver, Gold, Platinum |

| Customer Support | Phone: English +442080684238, Spanish +34935504852, Email: support@yfxcapital.com |

| Payment Methods | Visa, MasterCard, Bank wire |

YFX Capital, operated by TW Capital LTD in the Marshall Islands, has been active for 2-5 years in the trading industry.

YFX Capital provides a range of market instruments for trading, including diverse Forex pairs encompassing major, minor, and exotic currencies. In addition, traders can speculate on indices such as S&P 500, FTSE 100, and Nikkei 225, engage in commodities trading, and access Share CFDs on notable companies like Apple, Amazon, and Google.

The brokerage offers various account types. Leverage options are available, ranging from 1:100 to 1:400. YFX Capital presents a fee structure with spreads varying between 0.3 pips to 3.0 pips on different accounts.

| Pros | Cons |

| Offers diverse Forex instruments | Potential risks due to |

| Provides indices and commodities trading options | Reports of withdrawal challenges and potential fraud |

| Offers CFDs on shares for stock price speculation | Unregulated status |

| Offers a range of account types with varying minimum deposit requirements | Lack of transparency on withdrawal details |

| Offers leverage up to 1:400 | |

| Spreads from 0.3 pips | |

| Utilizes the widely used MetaTrader 4 platform |

YFX Capital lacks proper regulation, with forex trading falling outside the scope of oversight by the government of the Marshall Islands.

Market Instruments

Forex: YFX Capital provides diverse Forex instruments, encompassing major, minor, and exotic currency pairs like EUR/USD, GBP/JPY, and USD/SGD. Traders can profit from currency exchange rate fluctuations.

Indices: YFX Capital offers index market instruments such as S&P 500, FTSE 100, and Nikkei 225. Traders can speculate on overall market trends without direct asset ownership.

Commodities: YFX Capital includes commodities like gold, silver, crude oil, corn, and soybeans. Traders can engage in price speculation based on global supply and demand factors.

Share CFDs: YFX Capital features CFDs on shares like Apple, Amazon, and Google, allowing traders to profit from stock price changes without owning the actual shares.

MINI ACCOUNT: YFX Capital's Mini Account is designed for traders looking to start with a modest deposit of $250. The minimum trade size is 0.01 lots, allowing traders to engage in smaller positions. With a maximum leverage of 1:400, traders have the potential to amplify their trading exposure. The spreads for this account type are fixed at 3.0 pips.

SILVER ACCOUNT: YFX Capital's Silver Account offers a benchmark trading experience with a maximum leverage of 1:400. The minimum deposit is $2500, and traders can choose fixed spreads from 1 pip or variable spreads from 0.5 pips. It covers Forex, Indices, Commodities, and Share CFDs, with a minimum position size of 0.1 lots (10,000 units).

GOLD ACCOUNT: The Gold Account requires a minimum deposit of $10,000 and provides fixed spreads from 0.7 pips or variable spreads from 0.5 pips. It includes Forex, Indices, Commodities, and Share CFDs, maintaining a minimum position size of 0.1 lots (10,000 units).

PLATINUM ACCOUNT: YFX Capital's Platinum Account demands a &25,000 minimum deposit and offers fixed spreads from 0.4 pips or variable spreads from 0.3 pips. It covers Forex, Indices, Commodities, and Share CFDs, with a consistent minimum position size of 0.1 lots (10,000 units).

YFX Capital offers leverage options to traders, allowing them to amplify their trading exposure. Leverage ratios range from 1:100 to 1:400.

YFX Capital offers a fee structure with spreads ranging from 0.3 pips to 3.0 pips on different account types. There are no additional commissions charged on trades.

YFX Capital offers a range of account types with varying minimum deposit requirements, starting from $250.

YFX Capital allows deposits and withdrawals exclusively through Visa, MasterCard, and Bank wire methods.

MetaTrader 4 (MT4)

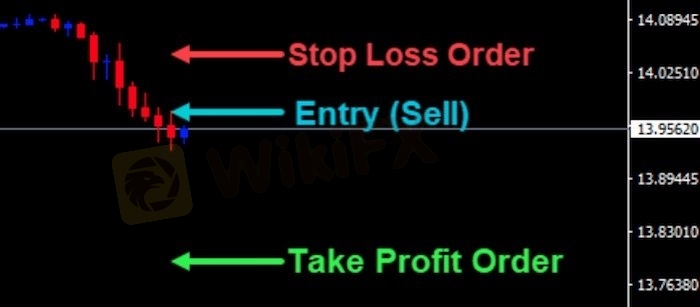

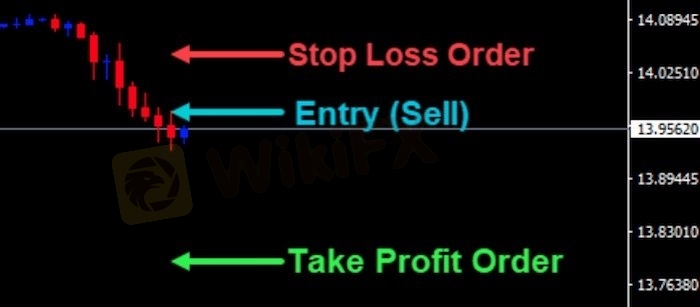

YFX Capital offers MetaTrader 4 (MT4) as one of its primary trading platforms. MT4 is accessible through desktop applications, web-based interfaces, and mobile apps. This versatile platform enables traders to execute transactions and monitor the market across various devices. Its user-friendly interface and comprehensive charting tools aid in technical analysis. Additionally, MT4 supports automated trading through Expert Advisors (EAs), providing traders with algorithmic trading capabilities.

For English inquiries, customers can reach them at 442080684238, while Spanish-speaking clients can contact them at 34935504852. Additionally, support can be accessed via email at support@yfxcapital.com.

Reviews

YFX Capital's WikiFX reviews express worries about pyramid schemes, withdrawal challenges, and potential fraud. A specific case from September 7, 2020, details failed withdrawal attempts following a broker's advice and requests for more deposits.

Why is the main website of YFX Capital unavailable?

YFX Capital's main website is currently inaccessible, potentially due to technical issues or maintenance.

What trading instruments does YFX Capital offer?

YFX Capital provides a variety of trading instruments, including Forex, indices, commodities, and share CFDs, enabling traders to speculate on various market trends.

How can I contact YFX Capital's customer support?

English-speaking customers can contact YFX Capital at 442080684238, while Spanish-speaking clients can reach them at 34935504852. Alternatively, support can be reached via email at support@yfxcapital.com.

What trading platform does YFX Capital offer?

YFX Capital provides MetaTrader 4 (MT4), a versatile trading platform accessible through desktop, web, and mobile interfaces. MT4 supports technical analysis and automated trading.

How can I deposit and withdraw funds with YFX Capital?

YFX Capital allows deposits and withdrawals exclusively through Visa, MasterCard, and Bank wire methods.

YFX Capital, operated by TW Capital LTD in the Marshall Islands, has been active in the trading industry for 2-5 years. The company's legitimacy raises concerns due to its lack of proper regulation, as forex trading falls beyond the oversight of the Marshall Islands government. This unregulated status introduces significant risks for potential clients considering engagement with this offshore brokerage.

WikiFX

WikiFX

In this article, we’ll look in-depth at YFX Capital, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikIFX aims to provide you with the information you need to make an informed decision about using this platform.

WikiFX

WikiFX

More

User comment

1

CommentsWrite a review

2024-03-08 16:06

2024-03-08 16:06