User Reviews

More

User comment

3

CommentsWrite a review

2024-03-27 10:53

2024-03-27 10:53 2024-01-15 23:39

2024-01-15 23:39

Score

15-20 years

15-20 yearsRegulated in Japan

Retail Forex License

Suspicious Scope of Business

Medium potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index7.83

Business Index8.89

Risk Management Index8.90

Software Index7.05

License Index7.83

Single Core

1G

40G

More

Company Name

Kuni Umi AI Securities Co. Ltd

Company Abbreviation

Kuni Umi AI Securities

Platform registered country and region

Japan

Company website

Company summary

Pyramid scheme complaint

Expose

| Kuni Umi AI Securities Review Summary | |

| Founded | 2007 |

| Registered Country/Region | Japan |

| Regulation | FSA |

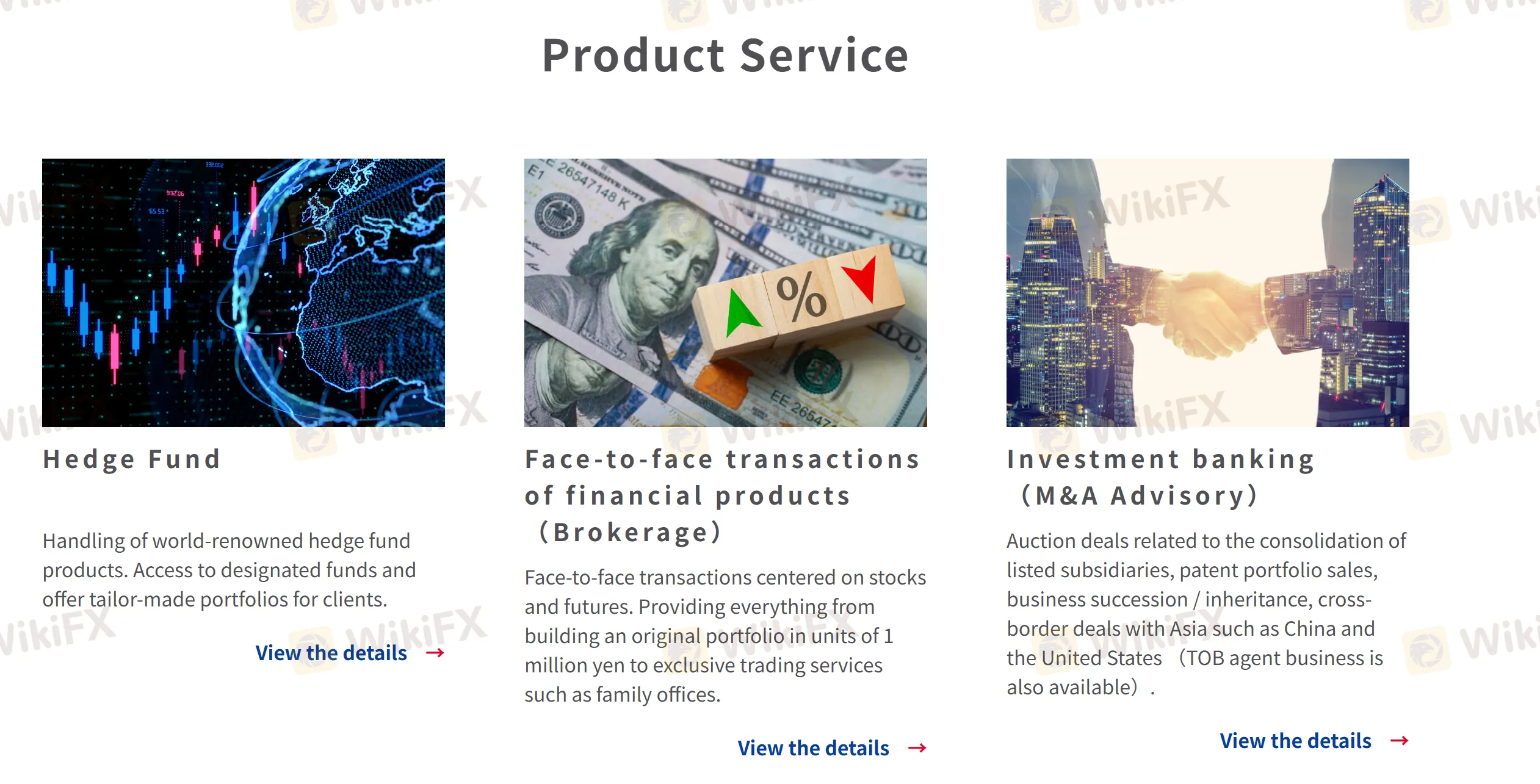

| Products & Services | Hedge Fund, Face-to-face transactions of financial products, Investment banking (M&A Advisory) |

| Demo Account | ❌ |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Phone: +81-3-5288-6766 |

| Fax: +81-3-5288-6767 | |

| Address: 6th Floor Marunouchi-nakadori Bldg. 2-2-3 Marunouchi, Chiyoda-ku, Tokyo, Japan, 100-0005 | |

Founded in 2007, Kuni Umi AI Securities is a Japan-based financial firm regulated by the Financial Services Agency (FSA). They offer a range of services including hedge funds, face-to-face financial product transactions, and investment banking services like M&A advisory. However, there's limited info on trading fees and accounts.

| Pros | Cons |

| Regulated by FSA | Limited info on accounts |

| Diverse customer support channels | Limited info on trading fees |

| Various products and services | No demo accounts |

| Lack of info on trading platforms |

Yes, Kuni Umi AI Securities is currently regulated by FSA with a retail forex license.

| Regulated Country | Regulated Authority | Regulated Entity | Current Status | License Type | License Number |

| The Financial Services Agency (FSA) | くにうみAI証券株式会社 | Regulated | Retail Forex License | 関東財務局長(金商)第1627号 |

Kuni Umi AI Securities offers diverse product services, including handling world-renowned hedge fund products with access to designated funds and tailor-made portfolios. They also provide face-to-face transactions centered on stocks and futures, offering portfolio building services and exclusive trading services.

Additionally, they offer investment banking services, including M&A advisory, auction deals related to the consolidation of listed subsidiaries, patent portfolio sales, business succession/inheritance, and cross-border deals with Asia such as China and the United States.

More

User comment

3

CommentsWrite a review

2024-03-27 10:53

2024-03-27 10:53 2024-01-15 23:39

2024-01-15 23:39