User Reviews

More

User comment

4

CommentsWrite a review

2025-11-04 21:02

2025-11-04 21:02 2023-12-13 15:32

2023-12-13 15:32

Score

5-10 years

5-10 yearsRegulated in Cyprus

Market Making License (MM)

MT5 Full License

Regional Brokers

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index6.67

Business Index7.98

Risk Management Index9.79

Software Index9.20

License Index6.67

Single Core

1G

40G

More

Company Name

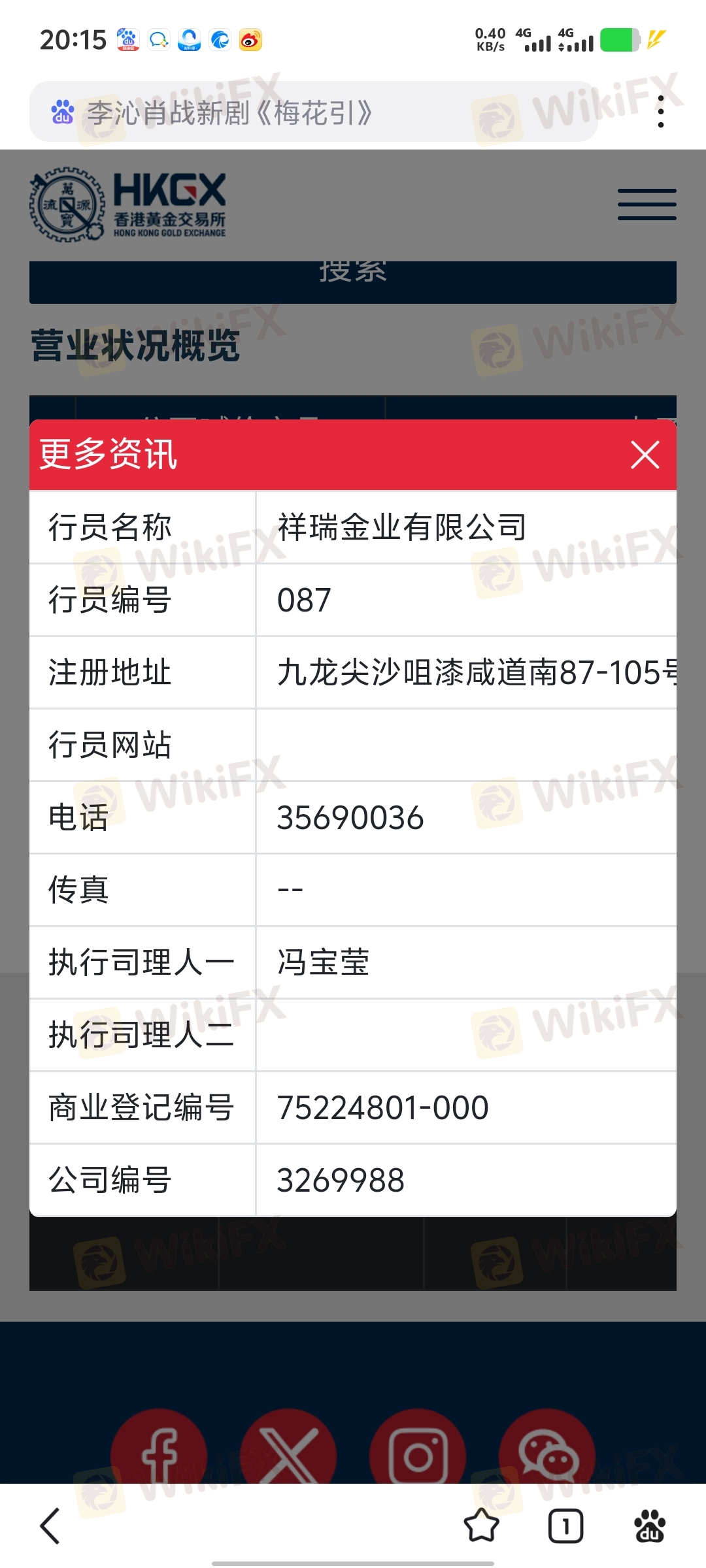

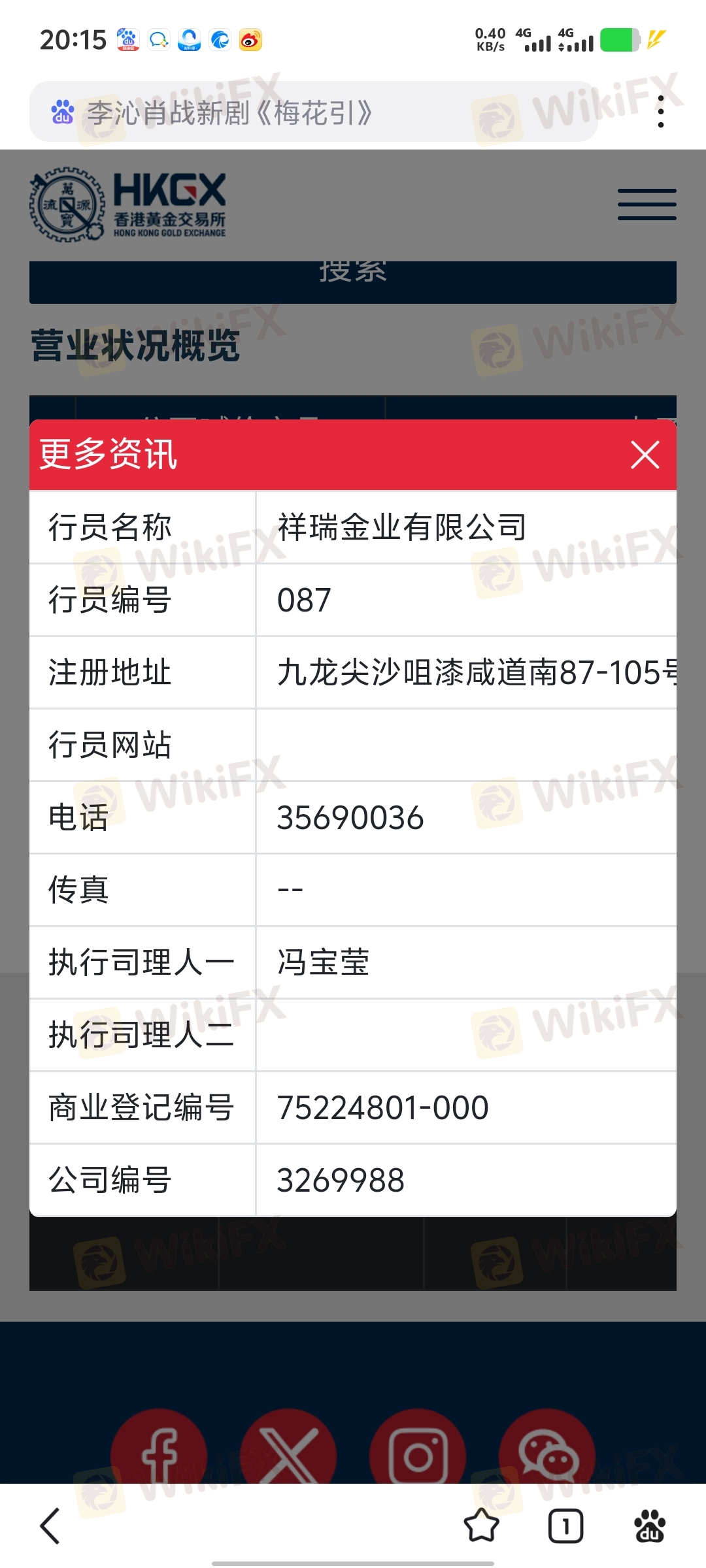

Magic Compass Ltd

Company Abbreviation

MAGIC COMPASS

Platform registered country and region

Cyprus

Company website

Company summary

Pyramid scheme complaint

Expose

| Feature | Details |

| Company Name | Magic Compass Ltd |

| Registered Country/Region | Cyprus |

| Founded | 2016 |

| Regulation | Cyprus Securities and Exchange Commission (CySEC) |

| Tradable Assets | 90+ assets, CFDs on Forex, Metals, Energy, and Indices |

| Demo Account | Available |

| Minimum Deposit | $/€/£100 |

| Leverage | 1:5, 1:10 and 1:20 |

| Spread | Floating from 0.1 pips |

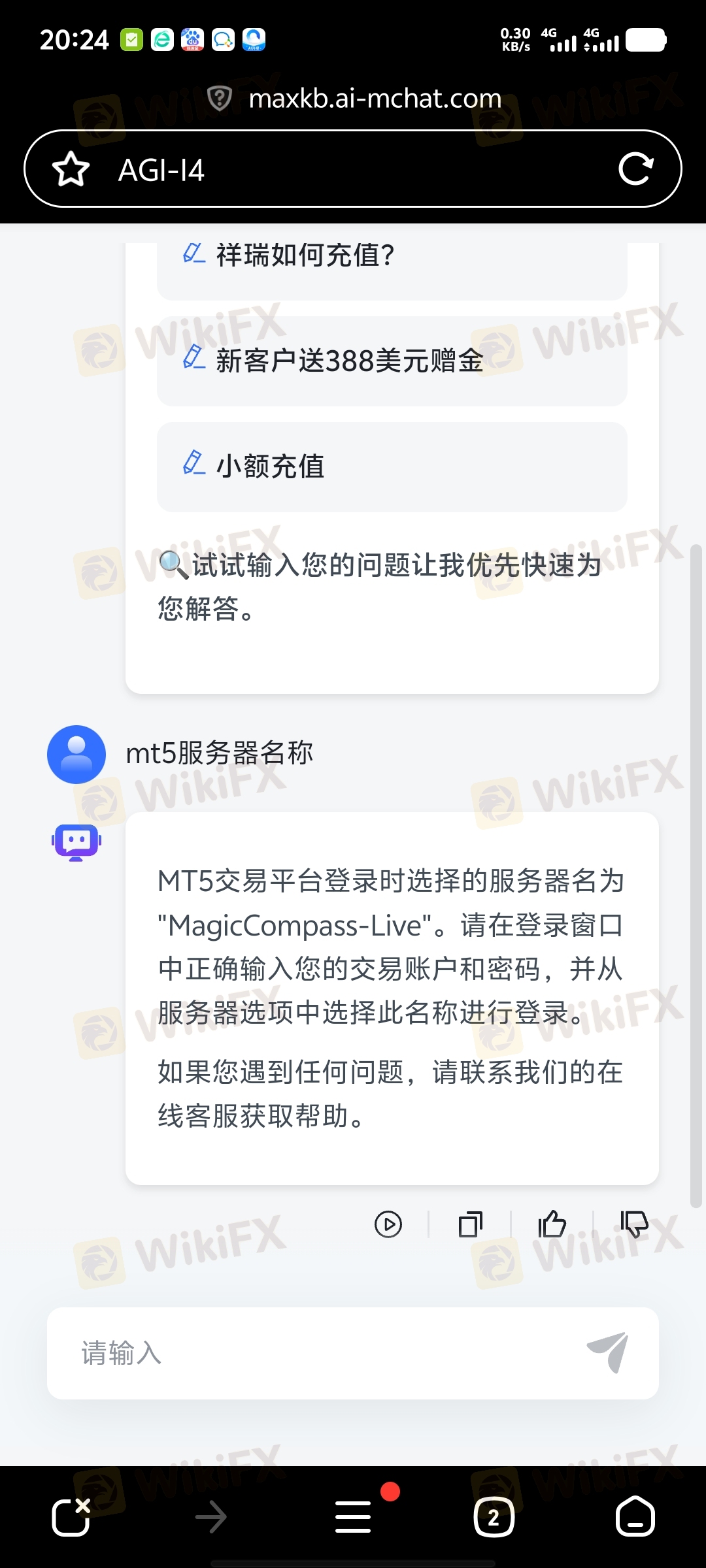

| Trading Platforms | MetaTrader 4, MCtrader |

| Deposit & Withdrawal | Bank Wire |

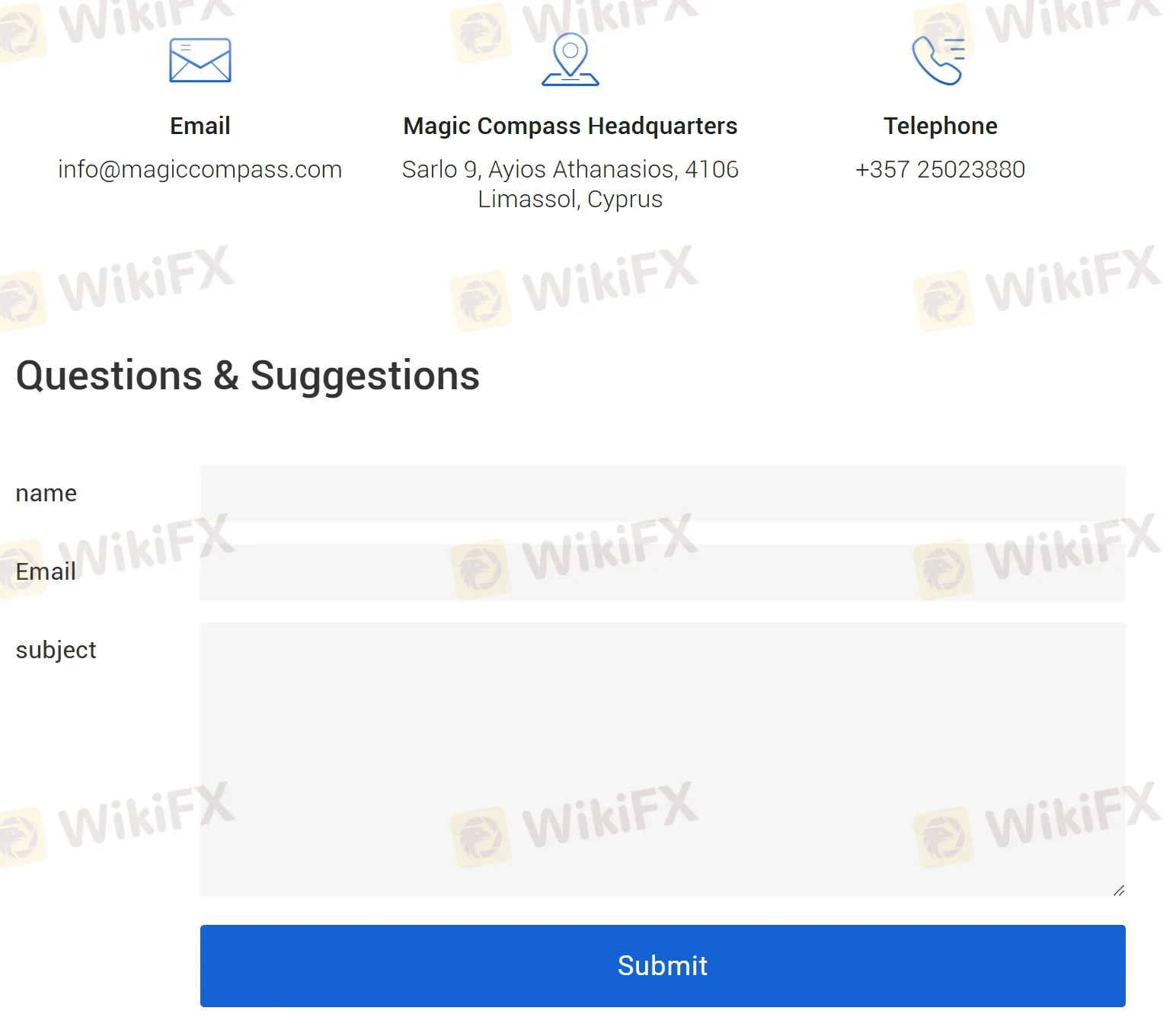

| Customer Support | Contact form, phone: +357 25023880, email: info@magiccompass.com |

Magic Compass is a regulated financial services company that offers trading and investment solutions, regulated by the Cyprus Securities and Exchange Commission (CySEC). It provides essential information and data to traders, such as economic calendars and real-time quotes, to assist in making informed trading decisions. Additionally, Magic Compass emphasizes client security through measures like Negative Balance Protection, which safeguards clients from losing more money than they have deposited.

| Pros | Cons |

|

|

|

|

|

|

|

Magic Compass is a legitimate financial services provider, operating under the stringent regulatory framework of the Cyprus Securities and Exchange Commission (CySEC) with a license number 299/16. CySEC is well-regarded in the financial industry for enforcing strict compliance standards that ensure transparency, fairness, and security for investors' funds. The regulation by such a reputable authority indicates that Magic Compass adheres to high regulatory standards and practices required within the European Union.

Additionally, the provision of Negative Balance Protection is a significant feature that safeguards clients from losing more money than they have deposited, further enhancing investor protection and underscoring Magic Compass's commitment to client safety and ethical financial practices. These regulatory and protective measures provide a solid foundation for trusting in the services offered by Magic Compass.

Magic Compass offers 90+ tradable assets, including over 20 Forex Pairs, Metals such as Gold and Silver, Energy contracts like Oil and Natural Gas, and Spot Indices.

However, popular cryptocurrency trading are not supported on this platform.

| Tradable Instruments | Supported |

| Forex Pairs | ✔ |

| Metals | ✔ |

| Energy | ✔ |

| Spot Indices | ✔ |

| Cryptos | ❌ |

Magic Compass provides different account types to cater to different types of traders: Silver Account, Raw Spread Account, and Gold Account.

| Account | Silver Account | Raw Spread Account | Gold Account |

| Currency | USD-EUR-GBP | ||

| Initial Minimum Deposit | 100 | 5000 | 2500 |

| Leverage | 1:5, 1:10, 1:20 | ||

| Margin requirements to open a lock position | No extra margin (*Note Only if Margin Level > 100%) | ||

| Execution Type | Market no requotes | ||

| Trading Instrument | CFDs on FOREX, METAL, ENERGY and SPOT INDICES | ||

| MetaTrader 4 | Yes | ||

| iOS Trading | Yes | ||

| Android Trading | Yes | ||

| Spreads | Floating | ||

| Expert Advisor | No | Yes | Yes |

| Execution Type | No | Yes | Yes |

| Minimum Trade Size | According to different trading instruments(Forex, Metals, Energy and Spot Indices) | ||

| Maximum Trade Size per single order | According to different trading instruments(Forex, Metals, Energy and Spot Indices) | ||

| Maximum Positions | Unlimited | ||

| Margin Call | 80% | ||

| Stop Out Level | 50% | ||

| Negative Balance Protection | Yes | ||

| EVERY FRIDAY 21:00 - 23:30 | Margin call 80% Stop Out 50% | ||

| Swap Free Account | No | ||

| Triple Swap Day | Wednesday | ||

| Commission | No | Yes | No |

The Silver Account is designed for those who are starting or who prefer a low-risk trading environment. It has an initial minimum deposit of $100. The account offers leverages of 1:5, 1:10, 1:20, and does not require any additional margin to open a lock position, provided the Margin Level is greater than 100%. It offers market execution with no requotes and allows for trading CFDs on Forex, Metal, Energy, and Spot Indices. This account comes with support for MetaTrader 4 and mobile trading on both iOS and Android platforms. It offers floating spreads and does not allow the use of Expert Advisors. The Silver Account does not charge any commission and no swap-free account option is available.

The Raw Spread Account is meant for more experienced traders. The initial deposit requirement is $5000. It comes with the same benefits as the Silver Account, but with a couple of notable additions. Expert Advisors are allowed and execution type is provided. This account charges a commission, but it offers more tight spreads, which are desirable for many advanced traders.

The Gold Account is ideal for professional traders with its initial minimum deposit of $2500. It comes with the same benefits and features as the Raw Spread Account, including support for Expert Advisors, providing an execution type, and floating spreads. However, unlike the Raw Spread Account, there's no commission charged in Gold Account.

All account types offer negative balance protection, a margin call at 80%, a stop out level at 50%, and unlimited maximum positions. Please note that for all accounts, minimum and maximum trade size vary according to the specific trading instrument selected. Also, each account executes the 'triple swap day' on Wednesday, and every Friday from 21:00 - 23:30, margin call and stop out levels are set at 80% and 50% respectively.

Magic Compass Ltd offers varying levels of maximum leverage based on the account type, with options ranging from 1:5, 1:10, to 1:20. This means that for every unit of currency (euro, in this case) a trader has in their account, they can control a trade worth 5, 10, or 20 units, depending on the chosen leverage. However, it's critical to understand that leverage, while it can significantly increase potential profits, can also magnify losses, so it should be used with careful consideration and proper risk management.

Magic Compass Ltd offers floating spreads that start from as low as 0.1 pips. Floating spreads adjust in real-time according to the market's volatility, so they can be narrower or wider depending on market conditions.

As for commissions, it varies based on the account type chosen. For example, the Silver and Gold Account does not charge any commission, while the Raw Spread Account does. The specific commission amount for the Raw Spread Account isn't specified and could depend on factors like the trading volume.

| Account Type | Spread | Commission |

| Silver | Floating | No |

| Raw Spread | Yes | |

| Gold | No |

Magic Compass offers two main trading platforms:

The MetaTrader 4 platform caters to desktop users. This platform is renowned for its powerful features and flexible customization options. On MetaTrader 4, traders can access three different chart types and nine time frames, enabling them to analyze the market comprehensively. It comes with over fifty pre-installed technical indicators. This makes it easier for traders to predict future market movements and to develop a trading strategy that fits their risk tolerance and trading goals. Moreover, MetaTrader 4 has a highly customizable interface that allows traders to tailor the platform's layout and functionalities to their trading needs.

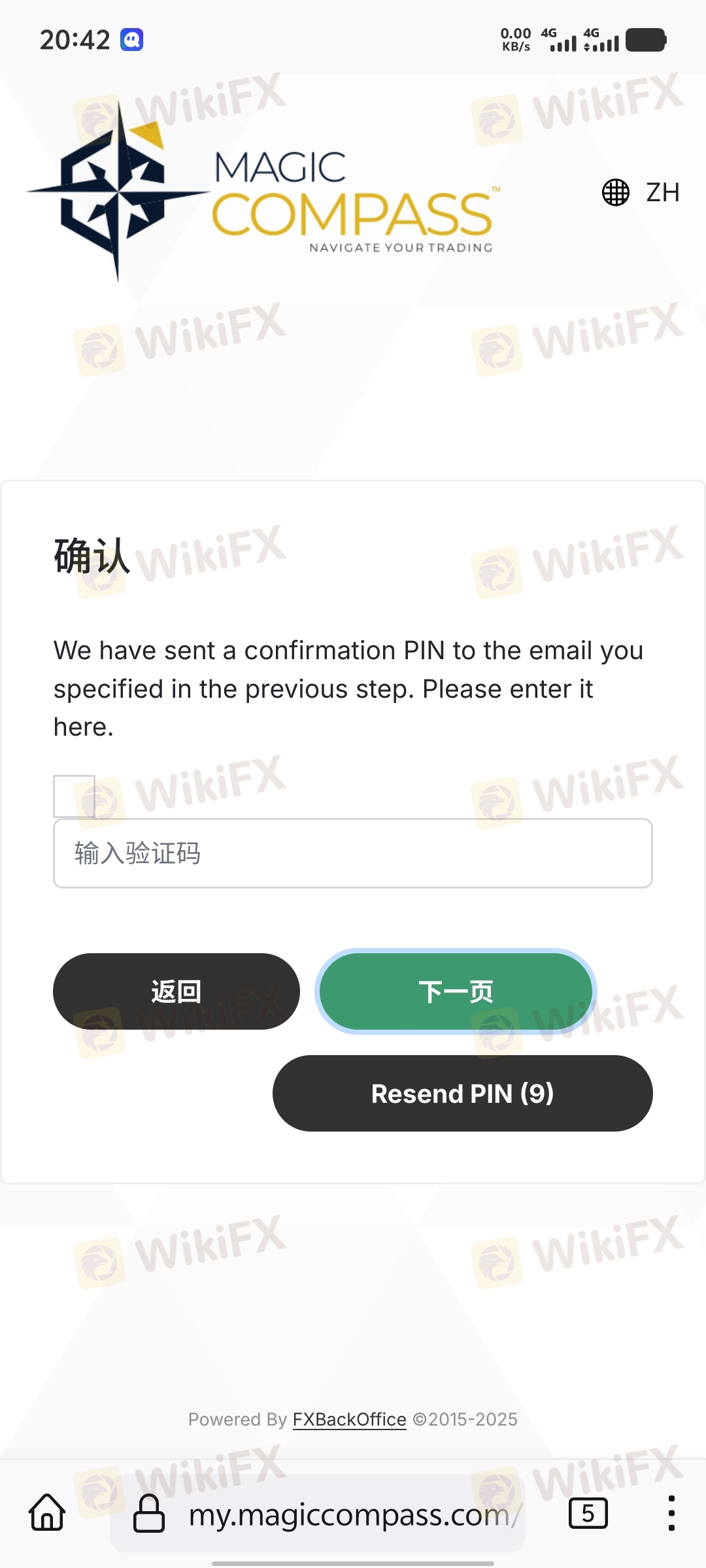

The MCtrader is available for mobile users. With the MCtrader app, traders can enjoy the functionalities of a fully-fledged trading platform on their iOS or Android devices. This platform allows for seamless trading anytime and anywhere, providing the flexibility that modern traders require. Whether you're on the move or away from your desktop, with the MCtrader app, the financial markets are always just a few taps away. The app retains many of the powerful features found on the MetaTrader 4 platform, ensuring that traders do not miss any trading opportunities when they are not at their desktops. This way, Magic Compass Ltd ensures that its clients can trade conveniently, irrespective of their preferred devices.

Magic Compass equips its traders with essential trading tools designed to enhance their trading experience and improve decision-making. Among these tools, the economic calendar is a standout feature, providing traders with timely updates on important economic events and indicators that can influence market movements. This strategic tool helps traders anticipate volatility and plan their trades accordingly.

Additionally, Magic Compass offers real-time quotes, enabling traders to see live market prices without delay. This feature is crucial for effective trading, as it allows traders to react swiftly to market changes and capitalize on opportunities as they arise.

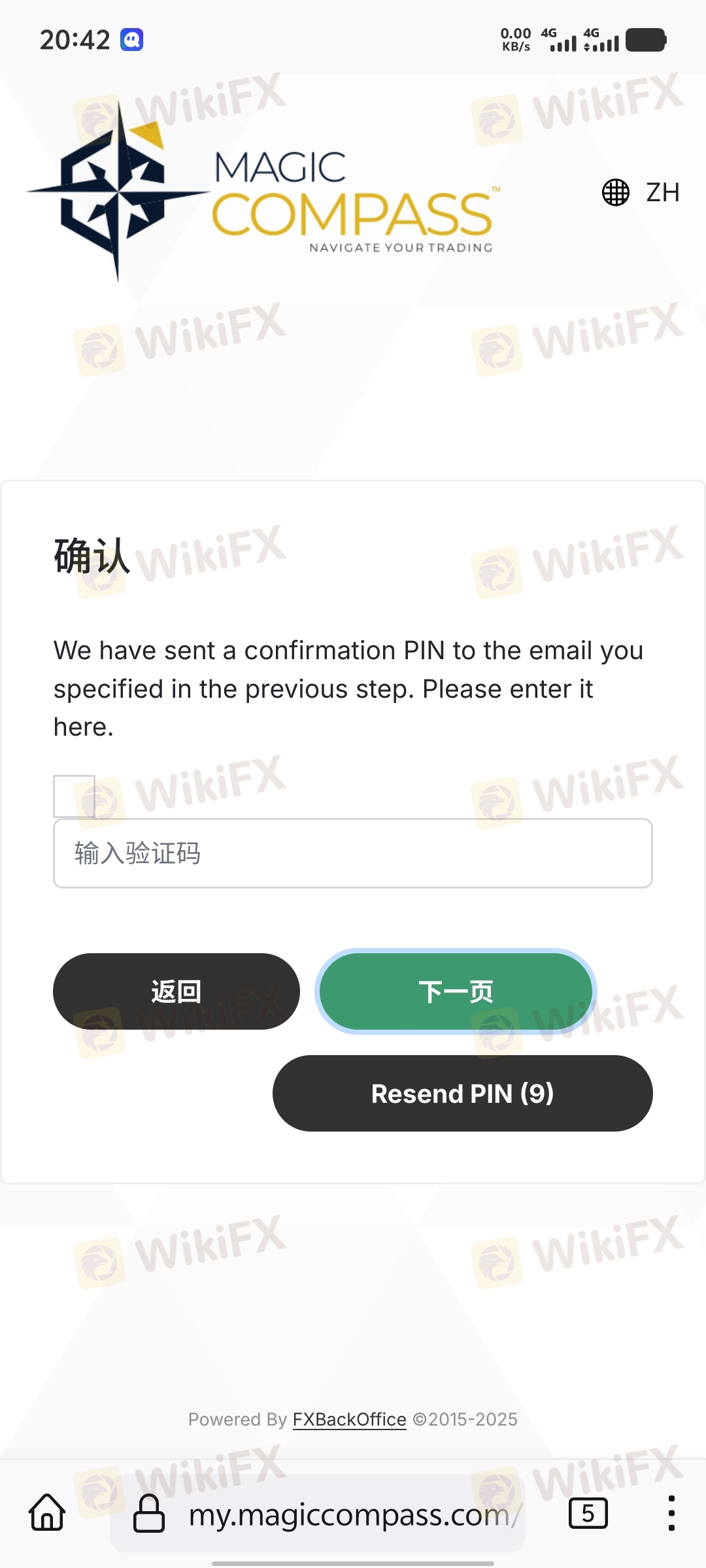

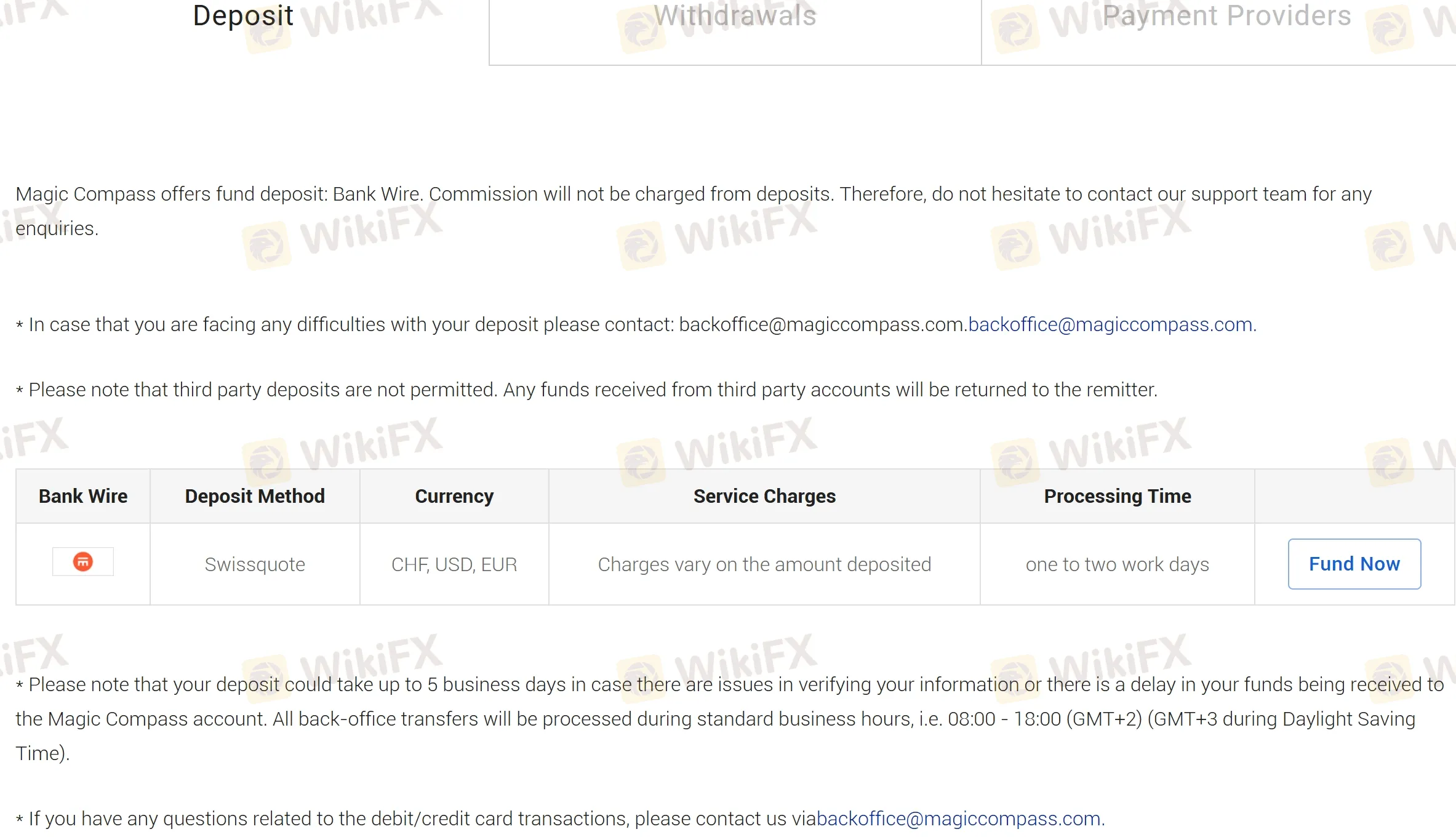

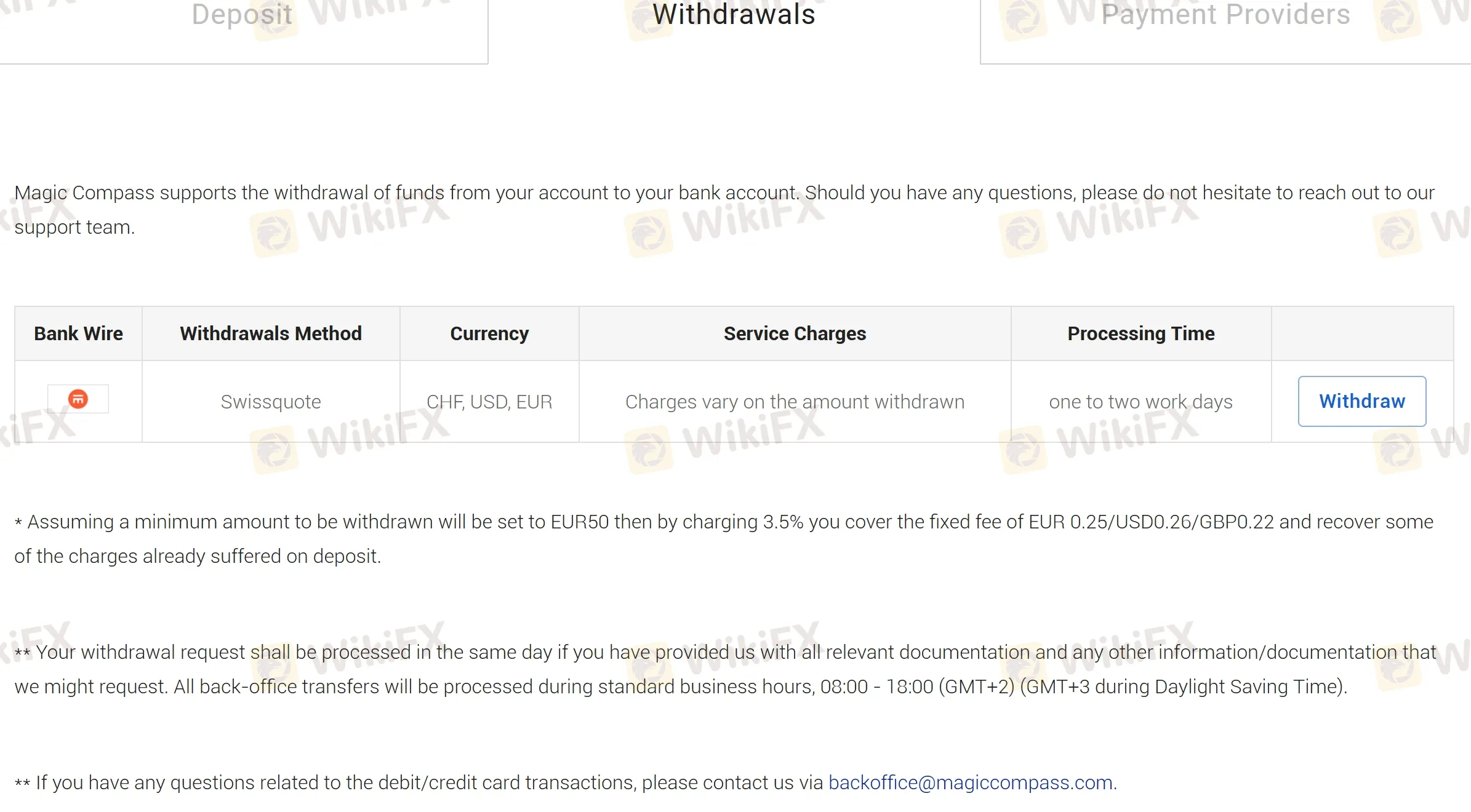

Magic Compass offers a streamlined and efficient process for handling deposits and withdrawals, ensuring that clients can manage their funds with ease. The firm accepts bank wire transfers for both deposits and withdrawals, supporting major currencies such as CHF, USD, and EUR.

Importantly, service charges for these transactions vary depending on the amount moved, which allows for flexibility based on the client's needs. Typically, deposit and withdrawal requests are processed swiftly within 1-2 working days. However, it is noted that deposits might take up to 5 business days if delays occur due to verification processes or slow receipt of funds into Magic Compass accounts.

For withdrawals, a minimum amount of EUR 50 is set, and a fee of 3.5% is applied, which covers fixed fees and helps recuperate some charges incurred during deposit transactions. Moreover, if all required documentation is provided promptly by the client, withdrawal requests can be processed on the same day during standard business hours from 08:00 to 18:00 (GMT+2), adjusting to GMT+3 during Daylight Saving Time.

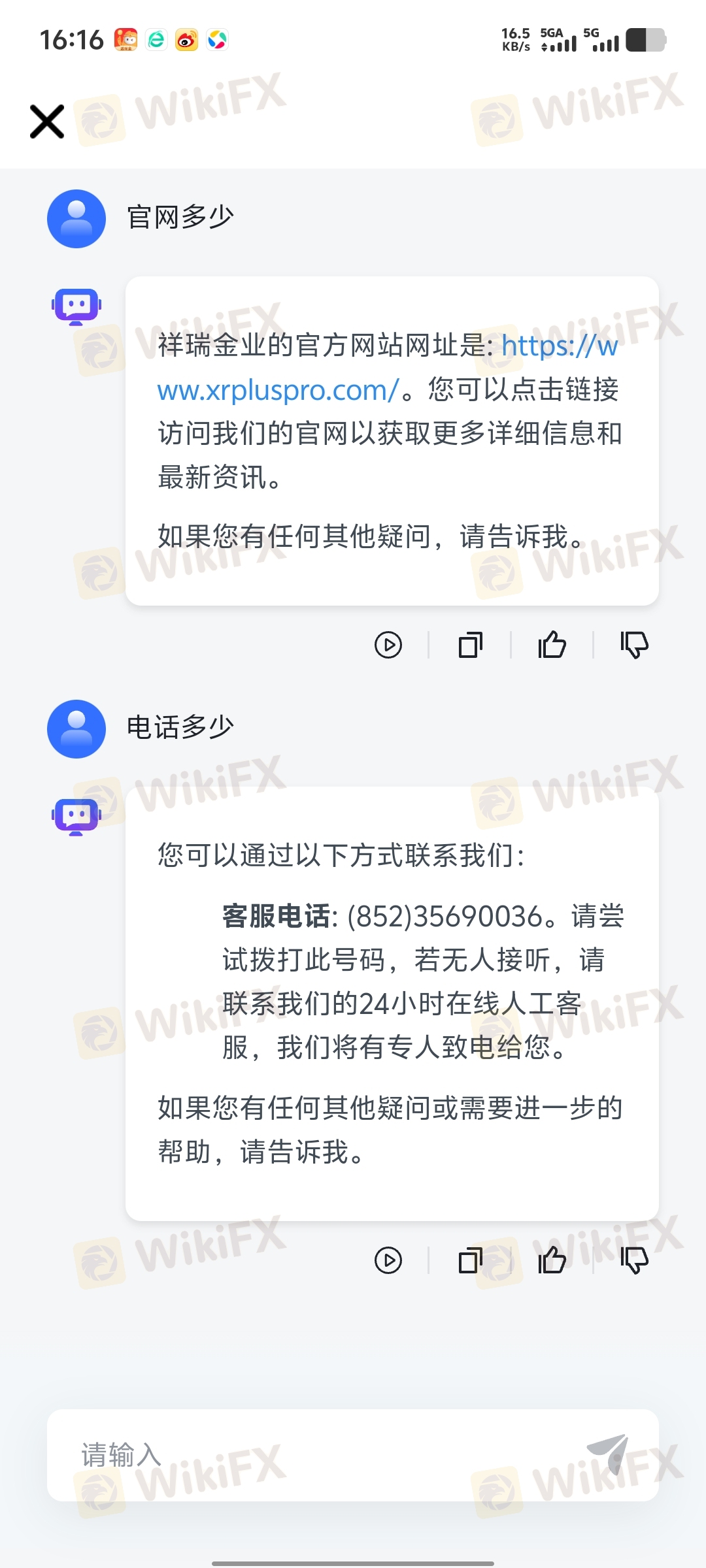

Clients can easily reach the support team through various communication channels including a dedicated contact form, by phone at +357 25023880, or via email at info@magiccompass.com. The headquarters of Magic Compass is strategically located at Sarlo 9, Ayios Athanasios, 4106 Limassol, Cyprus, anchoring its presence in a key financial hub.

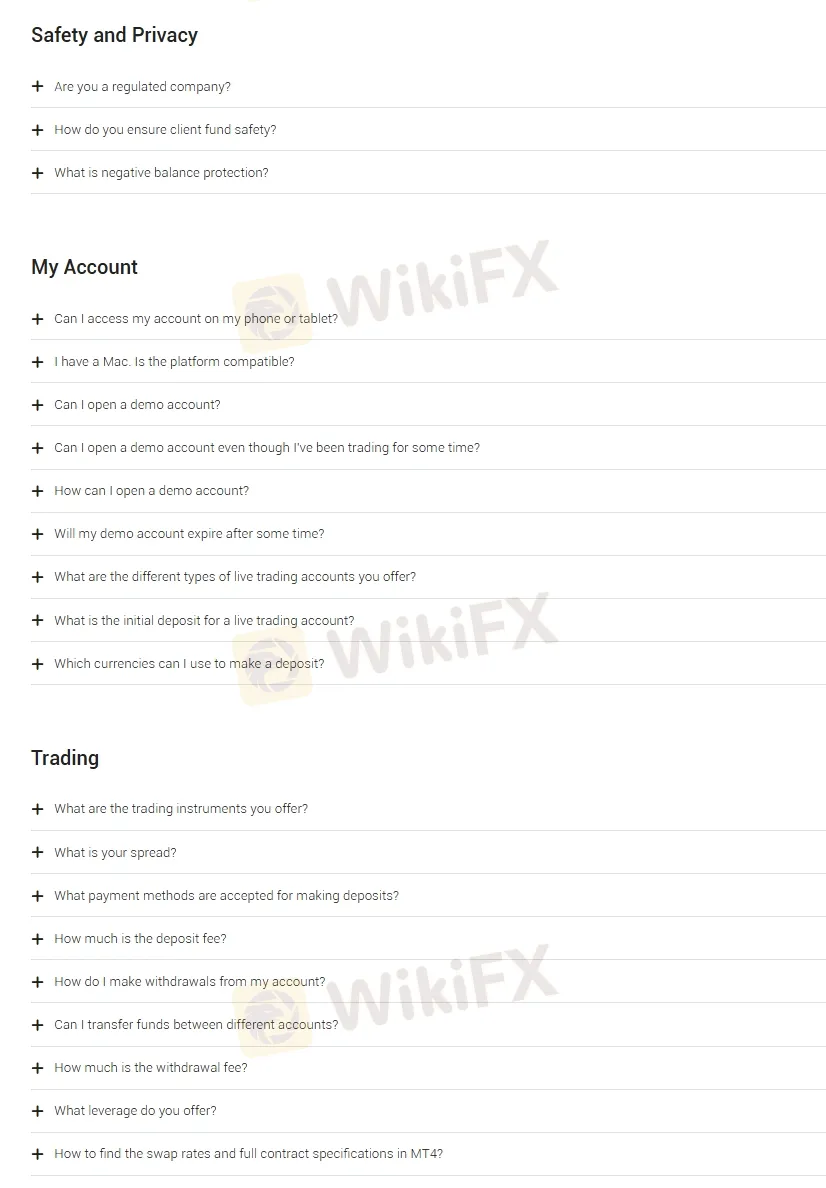

Additionally, the company offers a detailed FAQ section on its website, which addresses a range of topics from safety and privacy concerns to account management and trading queries.

To provide a summary, traders in the present era have flexible options when it comes to trading and investing with Magic Compass. High degree of security is ensured by its regulation under CySEC in Crypus. Economic calendars, real-time quotes, and Negative Balance Protection all contribute to better trading by providing market information and financial stability. Besides, Magic Compass's customer service and FAQs section show how customer satisfaction is their first priority. All things considered, Magic Compass seems to be an ideal broker for most traders.

What is Magic Compass?

Magic Compass is a regulated trading platform that offers access to a wide range of financial markets, including Forex, indices, commodities, and cryptocurrencies.

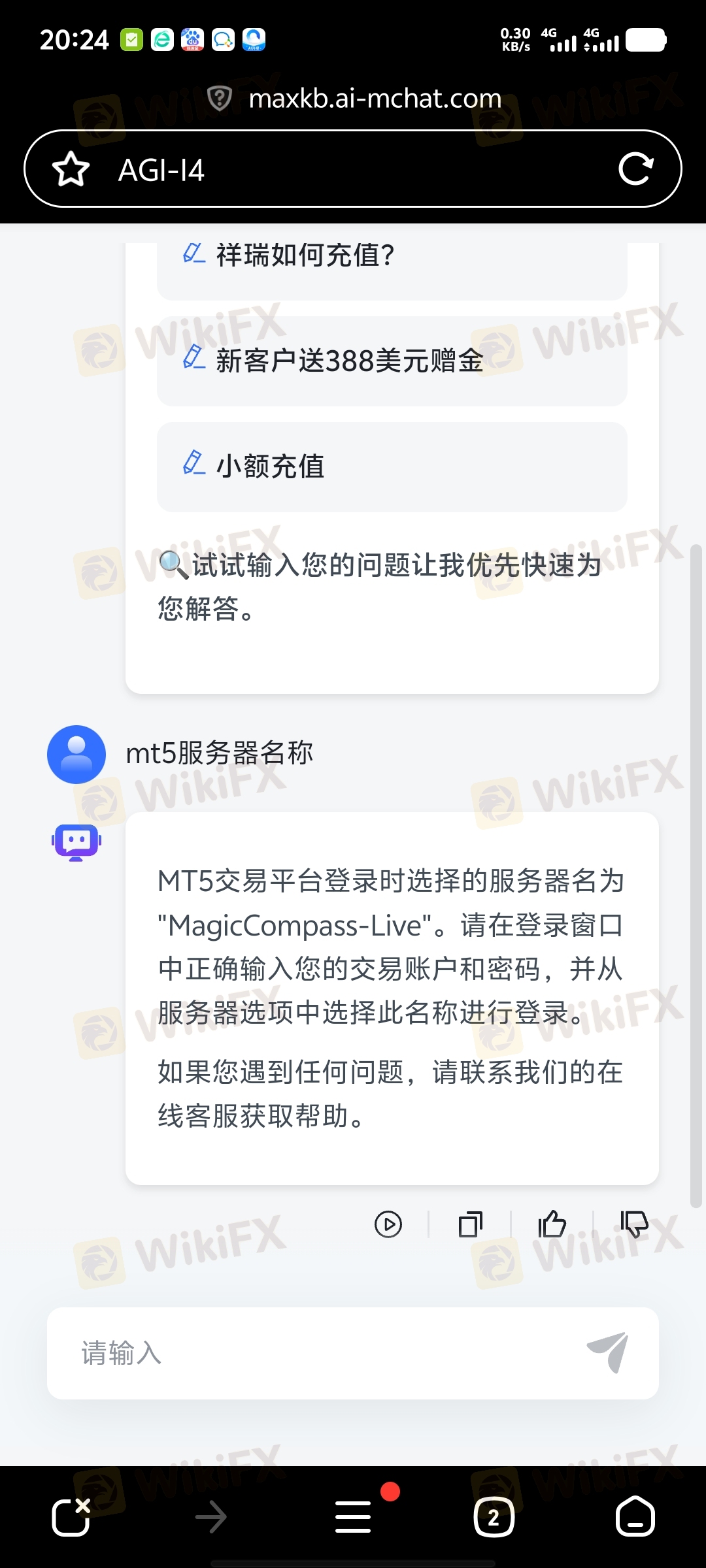

What trading platforms does Magic Compass offer?

Magic Compass offers two trading platforms: MetaTrader 4 (MT4) and MCtrader. MT4 is a popular trading platform that is known for its user-friendly interface and wide range of features. MCtrader is a proprietary mobile trading platform that is designed for traders on the go.

DoesMagic Compass offer swap-free accounts?

No, swap-free accounts are not supported here.

Are there any regional restrictions?

Yes. Magic Compass does not provide services for citizens/residents of certain jurisdiction, such as Canada, Cuba, Iran, Iraq, Japan, Myanmar, North Korea, Sudan, Syria, Turkey, and the United States.

More

User comment

4

CommentsWrite a review

2025-11-04 21:02

2025-11-04 21:02 2023-12-13 15:32

2023-12-13 15:32