User Reviews

More

User comment

1

CommentsWrite a review

2023-11-17 16:37

2023-11-17 16:37

Score

15-20 years

15-20 yearsRegulated in Hong Kong

Derivatives Trading License (AGN)

Suspicious Scope of Business

Medium potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index6.54

Business Index8.00

Risk Management Index8.90

Software Index5.89

License Index6.58

Single Core

1G

40G

More

Company Name

Hantec Securities Company Limited

Company Abbreviation

HANTEC

Platform registered country and region

Hong Kong

Company website

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Registered Country/Area | Hong Kong |

| Founded Year | 10-15 years ago (approximately between 2008 and 2013) |

| Company Name | Hantec Securities Limited |

| Regulation | Regulated by the Securities and Futures Commission of Hong Kong (License number ARV980) |

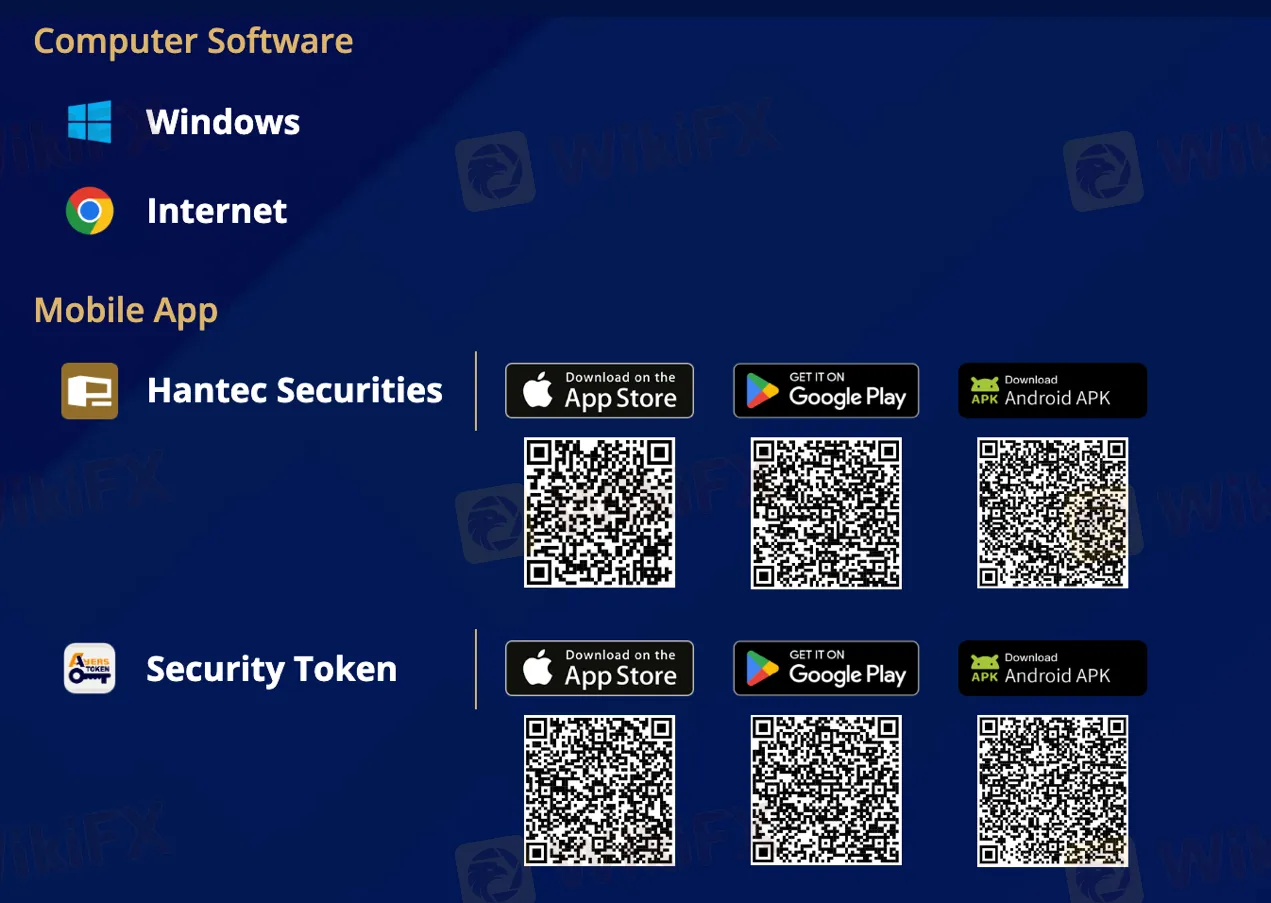

| Trading Platforms | Various platforms for Windows, internet-based, and mobile apps for stock and futures trading |

| Tradable Assets | Stocks, bonds, options, stock index futures, commodities futures, stock options, ETFs, fixed-income securities |

| Account Types | Individual and Corporate |

| Customer Support | Telephone and email |

| Payment Methods | Cheque deposits in HKD, RMB, and USD, online banking, phone banking, ATM, Faster Payment System (FPS) |

Hantec, operating in Hong Kong for a decade and a half, offers a range of financial services. It is regulated by the Securities and Futures Commission of Hong Kong (License Number ARV980) for futures trading within its jurisdiction. However, caution is advised as the latest information suggests that Hantec Futures Limited may be operating outside its authorized region and lacks trading software (Regulatory Number AFL779).

Hantec provides brokerage services, allowing trading in various financial instruments such as stocks, bonds, and options. Clients can access wealth management services for portfolio diversification and insurance products for risk management. Hantec offers market access to Hong Kong, mainland China, and the US, including stock, futures, and stock options trading.

| Pros | Cons |

| Regulated by SFC | Cautionary note about operations |

| Diverse services | Limited types of market instruments available |

| Multiple platforms | Charges subject to change, need verification |

| Multiple account types | Lack of specific account benefits |

| Various deposit methods | No cash deposits accepted |

| Multiple communication channels | Limited information about support responsiveness |

Hantec Futures Limited is regulated by the Securities and Futures Commission of Hong Kong under license number ARV980. It holds a private license for trading futures contracts in Hong Kong.

BROKERAGE: Hantec offers a diverse range of brokerage services, allowing clients to trade various financial instruments such as stocks, bonds, and options. Examples of stocks available for trading include Apple Inc. (AAPL) and Microsoft Corporation (MSFT). Clients can also access government and corporate bonds, as well as trade options on indices like the S&P 500 and the Nasdaq 100.

WEALTH MANAGEMENT: Hantec provides comprehensive wealth management services, assisting clients in managing their investment portfolios. They offer investment options across different asset classes, including stocks, bonds, and mutual funds. Clients can diversify their investments using products like exchange-traded funds (ETFs) and fixed-income securities.

INSURANCE: Hantec offers a range of insurance products to meet clients' risk management needs. These insurance options encompass various aspects, including life insurance, health insurance, and property insurance. Clients can choose from multiple insurance providers and policies tailored to their specific requirements, ensuring they have appropriate coverage in place.

Stock Trading: Hantec offers stock trading services across various markets, including the Hong Kong Stock Market. Clients can engage in the trading of stocks listed on the Hong Kong Stock Exchange, such as Apple Inc. (AAPL) and China Mobile Ltd. (0941.HK). Additionally, Hantec provides access to the Shanghai and Shenzhen Stock Connect, allowing clients to trade mainland Chinese stocks. For clients interested in the US market, Hantec facilitates trading with charges associated with US stock transactions.

Futures Trading: Hantec provides futures trading services with a focus on the Hong Kong Futures market. Clients can participate in futures trading on various financial instruments, including stock index futures and commodities futures. Hantec specifies charges associated with trading these futures contracts.

Stock Options Trading: In addition to stock and futures trading, Hantec offers stock options trading services. Clients can trade stock options on the Hong Kong Stock Exchange, providing them with the opportunity to manage and hedge their stock positions. Hantec outlines the charges associated with stock options trading for clients' reference.

Hantec offers two primary account types: Individual and Corporate. The Individual account type is designed for individual investors, providing them with access to the brokerage's services. On the other hand, the Corporate account type is tailored for businesses and corporate entities, allowing them to manage and trade financial instruments through Hantec's platform.

Hantec's fee and commission structure includes a 0.25% commission on normal trades, with additional charges like a 0.00341% handling fee and a 0.002% securities management fee. Transfer fees amount to 0.001% of each transaction per side under China Clear's Rules and 0.002% under the General Rules of CCASS. Sellers incur a 0.05% stamp duty. Receipt (SI) is waived, but withdrawal (SI) comes with a minimum RMB200.00 handling fee per stock. Other fees involve scrip fees, cash dividend collection fees at 0.2% (minimum RMB20), and corporate action service fees at RMB2 per board lot (minimum RMB20). Excess rights shares have a charge of RMB20 per transaction. The portfolio fee is at an annual interest rate of 0.008%, calculated daily, and collected monthly. Dividend and capital gain taxes apply, with specifics subject to clarification with SAT.

Heres the fee and commission structure for Hantec in a clear table format:

| Fee Type | Information |

|---|---|

| Commission on Normal Trades | 0.25% |

| Handling Fee | 0.00341% |

| Securities Management Fee | 0.002% |

| Transfer Fee (China Clear's Rules) | 0.001% per transaction per side |

| Transfer Fee (CCASS General Rules) | 0.002% per transaction per side |

| Stamp Duty (Seller) | 0.05% |

| Receipt (SI) | Waived |

| Withdrawal (SI) | Minimum RMB 200.00 per stock |

| Scrip Fee | Varies (Additional charge depending on the specific transaction) |

| Cash Dividend Collection Fee | 0.2% (Minimum RMB 20) |

| Corporate Action Service Fee | RMB 2 per board lot (Minimum RMB 20) |

| Excess Rights Shares Charge | RMB 20 per transaction |

| Portfolio Fee | Annual interest rate of 0.008%, calculated daily, collected monthly |

| Dividend & Capital Gain Taxes | Subject to clarification with SAT |

Deposit & Withdraw

Hantec offers multiple deposit methods, including cheque deposits in HKD, RMB, and USD, with specific bank account details provided. Clients can deposit funds in person at Hantec's offices, through online banking, phone banking, ATM, or cheque deposit at counters, and via the Faster Payment System (FPS). Cash deposits are not accepted. For withdrawals, customers need to submit instructions to the Customer Service Hotline before 11:00 am on the same trading day, with late instructions processed the next working day. Hantec issues crossed cheques and directly deposits them into designated bank accounts in the afternoon, or customers can collect the cheque in person at their office.

Hantec offers trading platforms for stock and futures trading, accessible through computer software for Windows users, internet-based platforms, and mobile apps. For stock trading, Hantec Securities provides both Windows software and internet access. For mobile trading, clients can use the Hantec Securities mobile app, which includes a Security Token feature for added security. In the case of futures trading, Hantec Futures offers computer software compatible with Windows and a mobile app. An iPad version of the Hantec Futures app is also available. Additionally, a Security (2FA) Guide is provided to enhance security measures for trading.

Hantec provides clients with access to educational tools, including the latest news and insights. These tools keep clients informed about critical themes and market news. For instance, as of September 5, 2023, they offer insights into the performance of companies like 藥明生物 (WuXi AppTec) and provide updates on the stock market, such as trends in the technology sector and new stock listings like ARM. These resources aim to keep clients informed about current market developments and events.

Hantec offers customer support through various communication channels, including telephone and email, for its different entities. For Hantec Securities Company Limited and Hantec Futures Limited, clients can contact them at (852) 2526 1085 or via email at internet@hantec.hk, with a physical address at 12/F, South China Building, 1-3 Wyndham Street, Central, Hong Kong. Hantec Wealth Management Company Limited can be reached at (852) 2129 0240 or hwm_cs@hantec.hk, with an address at Units 2103-5, 21/F, 9 Queen's Road Central, Central, Hong Kong. For Hantec Insurance Broker Company Limited, clients can use (852) 2129 0246 or info@hib.hk for inquiries, with the same address as Hantec Wealth Management. These contact options are available for client assistance and inquiries.

Is Hantec a legitimate company?

Yes, Hantec Futures Limited is regulated by the Securities and Futures Commission of Hong Kong under license number ARV980.

What types of accounts does Hantec offer?

Hantec offers two primary account types: Individual accounts for individual investors and Corporate accounts for businesses and corporate entities.

What trading platforms does Hantec offer?

Hantec provides trading platforms for stock and futures trading, accessible via computer software, internet-based platforms, and mobile apps. Security measures like 2FA are also available.

More

User comment

1

CommentsWrite a review

2023-11-17 16:37

2023-11-17 16:37