User Reviews

More

User comment

1

CommentsWrite a review

2023-03-28 10:05

2023-03-28 10:05

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.28

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| INVESTEDGE Review Summary | |

| Founded | 2020 |

| Registered Country/Region | Italy |

| Regulation | No regulation |

| Market Instruments | Forex, cryptocurrency, stocks, indices, energy and products and so on |

| Demo Account | Unavailable |

| Trading Platforms | Gain trades |

| Customer Support | Phone, email |

INVESTEDGE is a financial services company that focuses on providing investment solutions and wealth management services to its clients. With a strong emphasis on delivering personalized strategies, INVESTEDGE aims to assist individuals and institutions in achieving their financial goals.

As a comprehensive financial services provider, INVESTEDGE offers a range of investment products and services tailored to meet the diverse needs of its clients. These offerings may involve investment advisory services, portfolio management, asset allocation, retirement planning, and more. The company is dedicated to helping clients navigate the complexities of the financial markets and make informed investment decisions. However, it is noted that INVESTEDGE has no regulation.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

| Pros | Cons |

| • A range of trading tools | • No demo accounts |

| • Not regulated | |

| • Limited information on the Website |

There are many alternative brokers to INVESTEDGE depending on the specific needs and preferences of the trader. Some popular options include:

Axi – A well-regulated and respected trading broker with a range of advanced trading tools, making it an excellent choice for professional traders seeking advanced trading capabilities.

UFX- A user-friendly trading platform and a wide range of tradable assets, making it suitable for both beginner and experienced traders.

Valutrades - It provides competitive spreads, reliable trade execution, and a range of trading platforms, making it a solid choice for traders looking for a reliable brokerage.

INVESTEDGEs claim of offering certain protection measures such as opening segregated accounts, diversification of company assets in different banks of the world. However, it is concerning that now INVESTEDGE has no valid regulation. It means that there is no government or financial authority oversighting their operations. It makes investing with them risky. The absence of valid regulation and the expiry of the license can be a cause for concern regarding the safety and legitimacy of INVESTEDGE. Valid regulation is crucial as it provides oversight, ensures adherence to industry standards, and offers investor protection measures.

If you are considering investing with TD Markets, it is important to do your research thoroughly and weigh the potential risks against the potential rewards before making a decision. In general, it is recommended to invest with well-regulated brokers to ensure your funds are protected.

INVESTEDGE offers a variety of trading instruments across different asset classes, including forex, cryptocurrency, stocks, indices, energy and products and so on. Here are introductions about many of trading instruments of INVESTEDGE:

- Forex: INVESTEDGE offers a comprehensive range of Forex pairs for traders to invest in, including major, minor, and exotic currency pairs. Foreign exchange, or Forex refers to the trading of currencies. Countries, businesses and individuals all participate in this market, making it the most heavily traded market. Forex trading holds low entry barriers due to the fact that it is accessible to clients without requiring significant amounts of capital by trading on margin. The continuously fluctuating exchange rate enables market participants to make profits by executing successful trades.

- Cryptocurrencies: The platform offers traders access to major cryptocurrencies such as Bitcoin, Ethereum, and Ripple. Cryptocurrencies present the opportunity to trade 24/7. Cryptocurrencies only exist in the blockchain and are accessible through codes called private and public keys. INVESTEDGE facilitates your access to a wide selection of cryptocurrency instruments combined with excellent trading conditions and low margin requirements.

-Stocks: Stocks are traded on organized exchanges, which provide a platform for buyers and sellers to trade shares. Exchanges facilitate the transparent and regulated trading of stocks, ensuring fair pricing and orderly transactions. There are different types of stocks available for trading. Common stocks represent ownership in a company and typically provide voting rights and a share in profits through dividends.

- Indices: Traders can invest in global stock indices such as the S&P500, Nasdaq, DAX30, and FTSE100 through INVESTEDGE. Indices are calculated based on the market capitalization of the component companies. A variety of factors, including commodity prices, company announcements and financial results all play an important role in determining the indexs price. Indices traders speculate on the price movements of stock Indices. Indices are traded in large volumes and they are very popular amongst investors.

- Energies: INVESTEDGE provides access to the energy markets, where traders can invest in crude oil and natural gas. Energy Markets refer to commodities that refer specifically to the trade and supply of energy. Commodities such as oil and gas are crucial to the functioning of the global economy. Prices are driven by demand and supply as opposed to speculation. Trade CFDs on Spot Energies such as Brent Oil, WTI and Natural Gas to diversify your portfolio. Trades take advantage of market volatility and benefit from flexible contract sizes. Various advantages exist when trading commodities through CFDs which includes the easy monitoring of prices and the ability to trade any market direction.

INVESTEDGE offers Invest Edge account. The INVESTEDGEs Invest Edge account is a platform that allows individuals to invest in a variety of financial instruments. The account offers access to a wide range of investment options, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more. This allows you to build a diversified portfolio tailored to your investment goals. Besides, the Invest Edge account provides investors with sophisticated research tools and analysis to help make informed investment decisions. These tools may include market updates, financial charts, news feeds, and portfolio management features.

With the Invest Edge account, you can trade and manage your investments online. This allows for convenient access to your portfolio, the ability to place trades, review account activity, and monitor performance at any time.

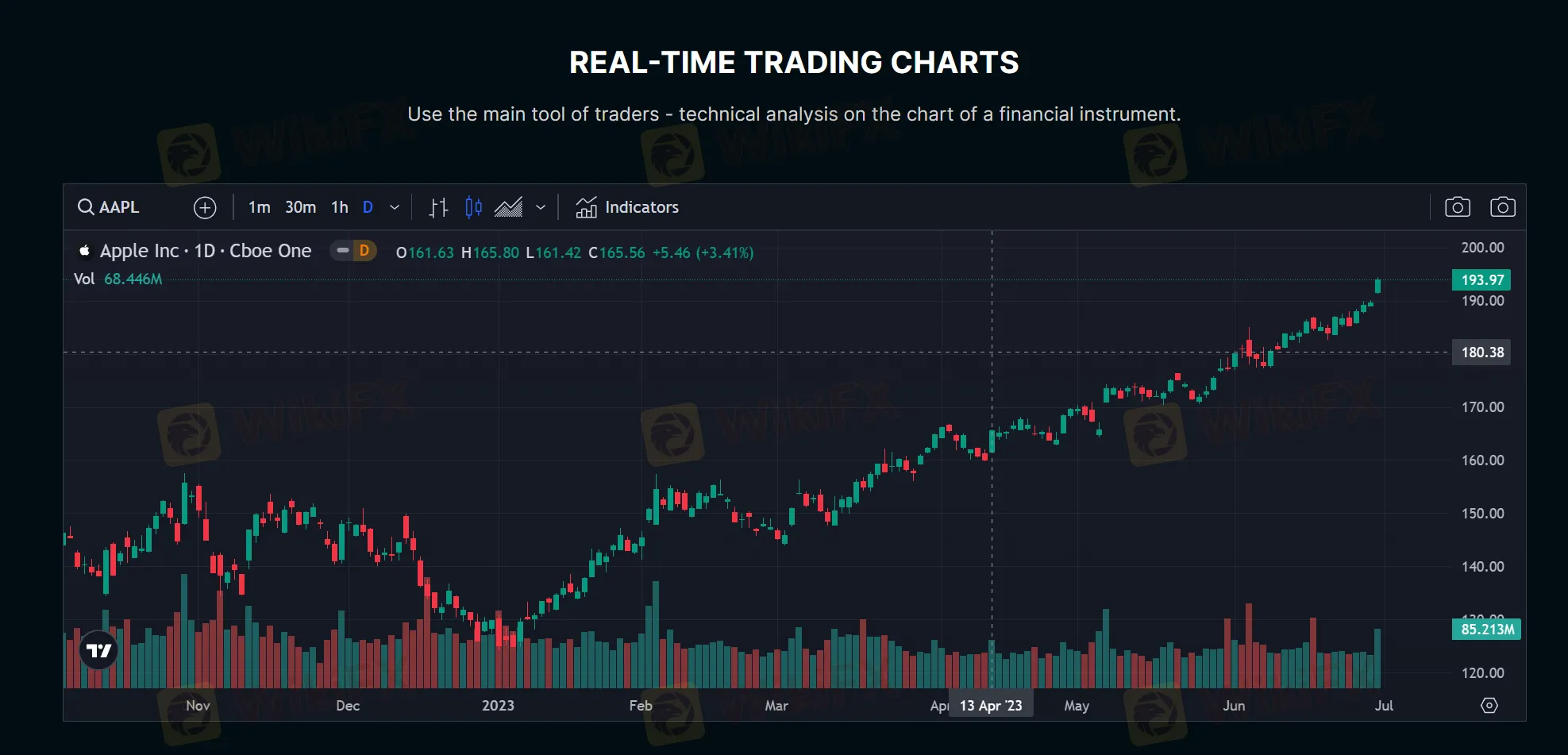

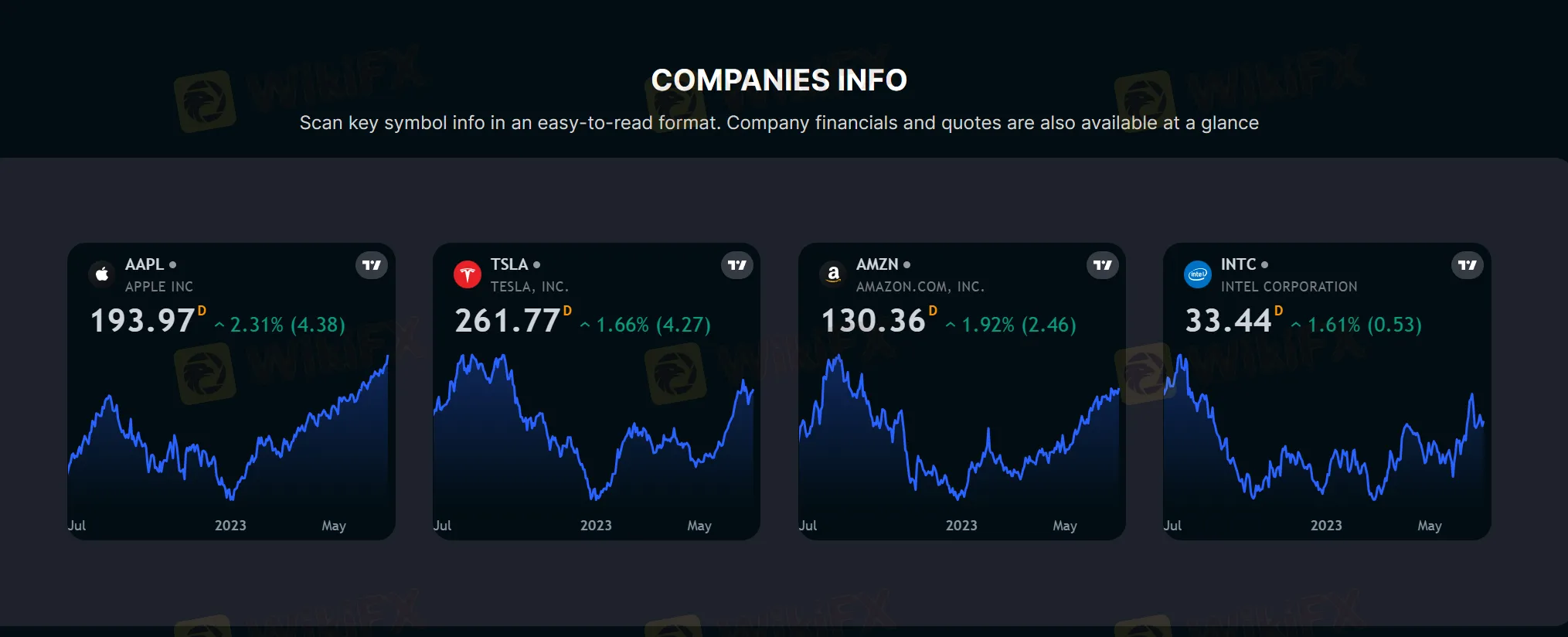

INVESTEDGE's trading platform, Gain Trades, is a proprietary platform designed to cater to the trading needs of its clients. Gain Trades provides clients with a user-friendly interface that allows them to execute trades, monitor their portfolios, and access real-time market information. The platform may support various asset classes to diversify their investment strategies. Key features that are often found in the trading platform include real-time market data, advanced charting tools, technical analysis indicators, and customizable watchlists.

However, the Tradingweb platform is not as feature-rich as the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platforms, which are two of the most popular trading platforms in the industry.

See the trading platform comparison table below:

| Broker | Trading Platform |

| INVESTEDGE | Gain Traders |

| Axi | MT4 |

| UFX | MT4, MT5 |

| Valutrades | MT4, MT5 |

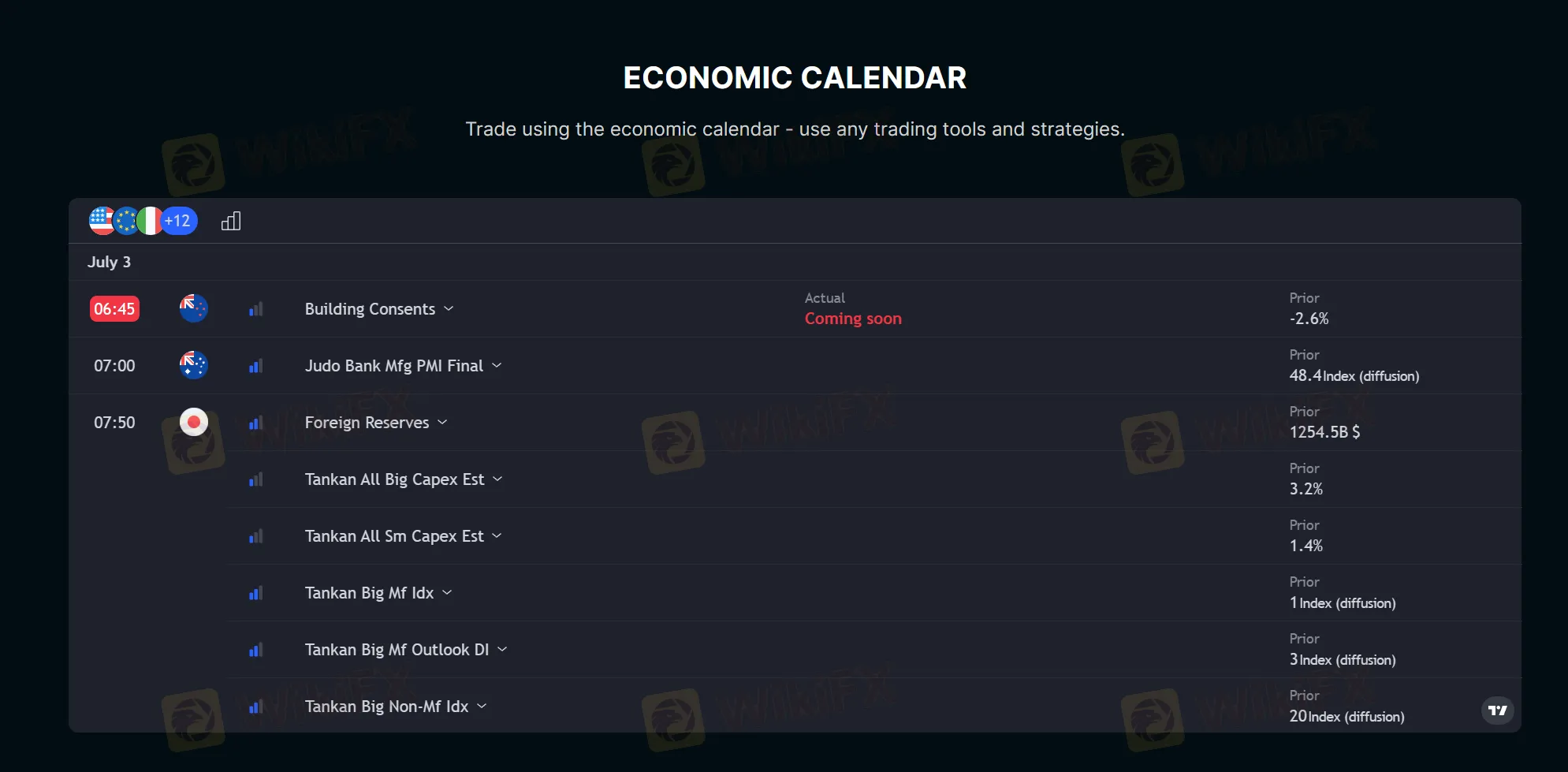

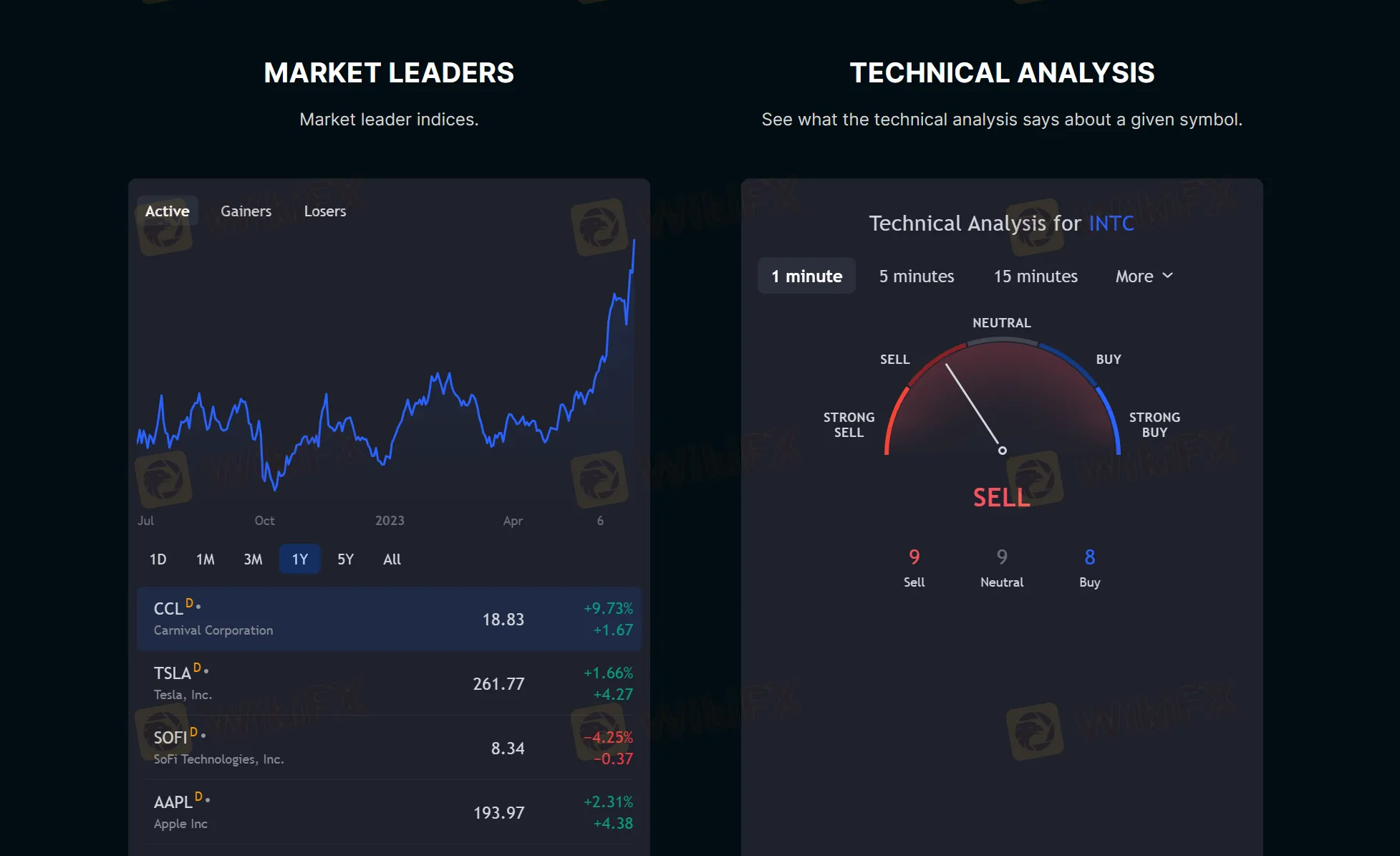

INVESTEDGE offers economic calendar, market overview, global financial market connectivity and research and analysis tools to help its clients stay informed and make informed investment decisions.

Economic Calendar:

INVESTEDGE provides an economic calendar that highlights important economic events, such as central bank meetings, economic indicators releases, and corporate earnings announcements. This tool helps traders and investors stay up to date with key events that may impact the financial markets. It provides insights into market trends, potential volatility, and opportunities.

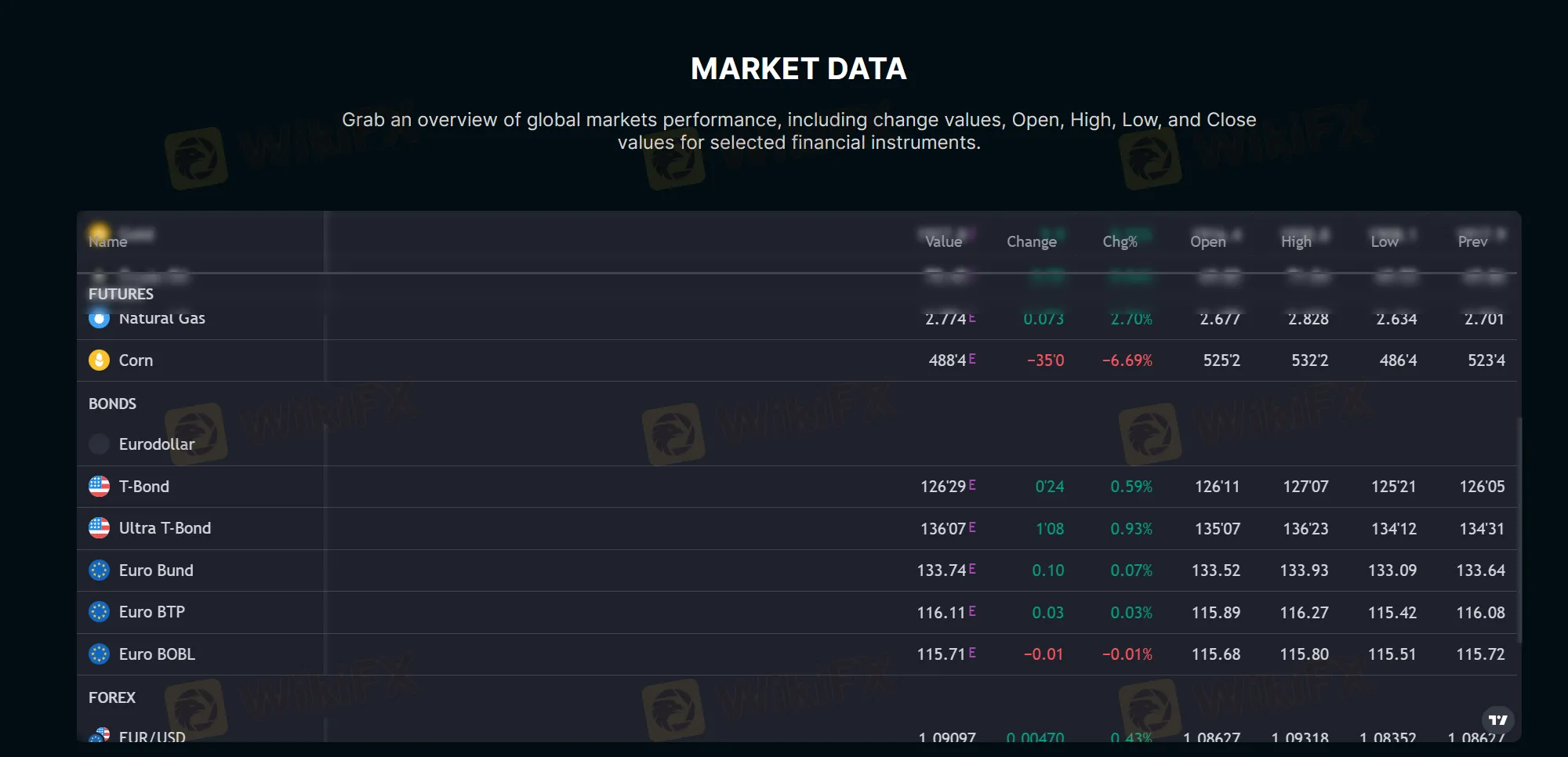

Market Overview:

The market overview tool offered by INVESTEDGE provides a snapshot of the overall market conditions. It typically includes key market indices, such as stock market indices, bond yields, and commodity prices. This tool allows clients to quickly assess market performance, identify trends, and gauge investor sentiment. It provides a broader perspective on the financial markets to aid in decision-making.

Global Financial Market Connectivity:

INVESTEDGE provides connectivity to the global financial markets, ensuring clients have access to a wide range of investment opportunities. This includes trading access to major stock exchanges, fixed-income markets, commodity markets, and foreign exchange markets. By connecting clients to the global financial ecosystem, INVESTEDGE allows them to diversify their portfolios and take advantage of investment opportunities across different asset classes and regions.

Research and Analysis Tools:

INVESTEDGE offers a suite of research and analysis tools to assist clients in conducting in-depth market research and analysis. This may include tools for market state, market data, real-time trading charts, companies information technical analysis and market leaders. These tools provide clients with insights and data to help identify potential investment opportunities, analyze market trends, and assess the performance of specific securities or asset classes.

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: (888)234-5686 (MON – FRI, 9AM – 5PM)

Email: hello@company.com

Address: 50 Wellington Avenue, London, England, N15 6BA

| Pros | Cons |

|

|

|

Note: These pros and cons are subjective and may vary depending on the individual's experience with INVESTEDGE's customer service.

In conclusion, INVESTEDGE is a trading platform that offers a range of services to its clients. The platform provides access to various financial markets, allowing traders to diversify their portfolios and capitalize on different trading opportunities. With its user-friendly interface and advanced charting tools, INVESTEDGE's trading platform, Gain Trades, caters to the needs of both beginner and advanced traders.

However, INVESTEDGE doesnt have regulation. Therefore, traders should verify the regulatory status of Murrentrade or any broker they choose to work with to ensure compliance with industry standards and regulatory requirements.

| Q 1: | Is INVESTEDGE regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at INVESTEDGE? |

| A 2: | You can contact via phone,(888)234-5686 and email, hello@company.com. |

| Q 3: | Does INVESTEDGE offer demo accounts? |

| A 3: | No. |

| Q 4: | Does INVESTEDGE offer the industry leading MT4 & MT5? |

| A 4: | No. Instead, it offers Gain Trades. |

| Q 5: | What financial instruments can I trade with INVESTEDGE? |

| A 5: | You can trade forex, cryptocurrency, stocks, indices, energy and products and so on. |

| Q 6: | Is INVESTEDGE a good broker for beginners? |

| A 6: | No. It is not a good choice for beginners because of its unregulated condition. |

More

User comment

1

CommentsWrite a review

2023-03-28 10:05

2023-03-28 10:05