User Reviews

More

User comment

1

CommentsWrite a review

2023-03-24 14:25

2023-03-24 14:25

Score

15-20 years

15-20 yearsRegulated in Hong Kong

Derivatives Trading License (AGN)

Suspicious Scope of Business

Medium potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index6.54

Business Index8.00

Risk Management Index8.90

Software Index5.89

License Index6.58

Single Core

1G

40G

More

Company Name

Core Pacific Yamaichi Int’l(H.K.)Ltd.

Company Abbreviation

CPY

Platform registered country and region

Hong Kong

Company website

Company summary

Pyramid scheme complaint

Expose

| CPY Review Summary | |

| Founded | 1969 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Market Instruments | Global equities, futures, bonds, IPOs |

| Demo Account | ❌ |

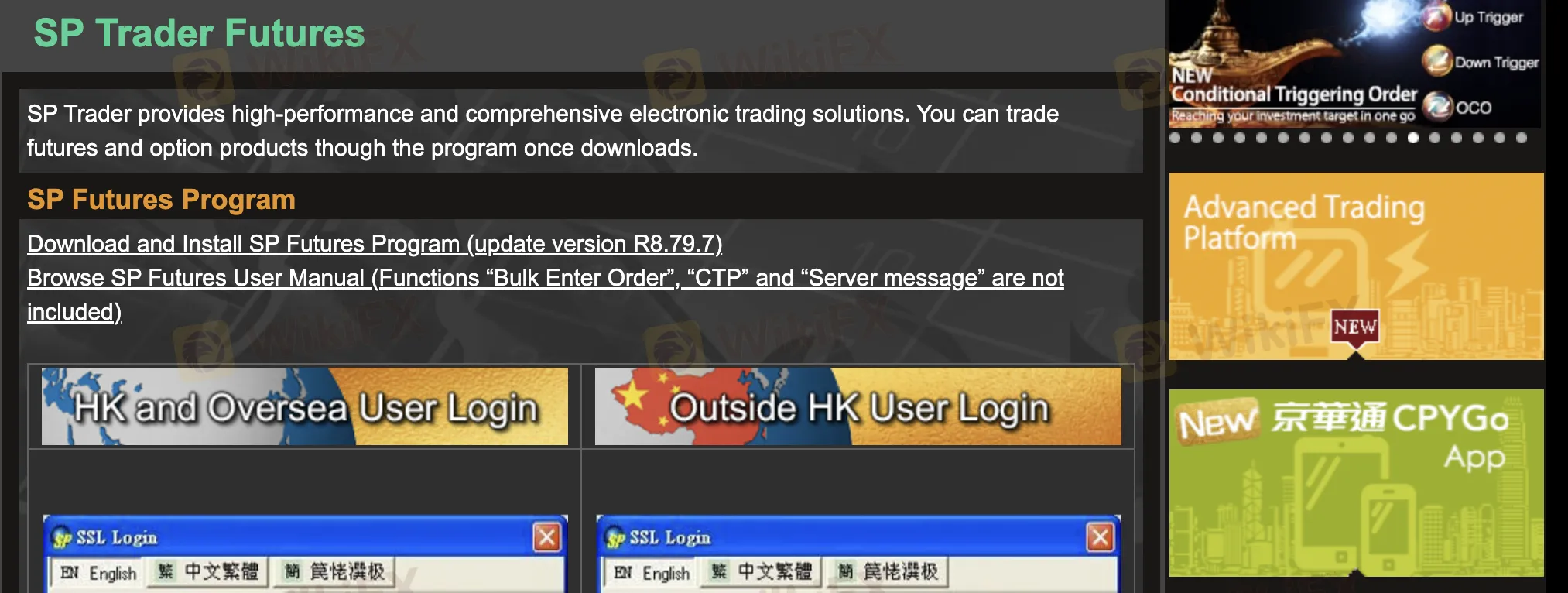

| Trading Platform | SP Trader Futures, TSCI (PC Download), 京華通 CPYGo Mobile App |

| Customer Support | Phone: (852) 2826 0700 |

| Facsimile: (852) 2918 0409 | |

| Email: info@cpy.com.hk (reply within 3 working days) | |

| Address: Room 1101, 11/F, China Resources Building, 26 Harbour Road, Wanchai, Hong Kong | |

Core Pacific - Yamaichi (CPY), a Hong Kong-based SFC-regulated financial services company, was founded in 1969. It holds a “Dealing in Futures Contracts” license (ABY048). CPY provides worldwide stocks, futures, bonds, asset and wealth management, IPO sponsorship, and corporate finance. The platforms offer desktop and mobile access with extensive analysis features, but demo accounts are unavailable.

| Pros | Cons |

| Offers comprehensive financial services (stocks, futures, etc.) | No demo accounts |

| Regulated by Hong Kong SFC | International withdrawals incur HKD 100 + bank charges |

| Feature-rich platforms with multi-language support |

Yes, Core Pacific-Yamaichi Futures (H.K.) Limited (CPY) is legitimate and regulated. It holds a “Dealing in futures contracts” license issued by the Securities and Futures Commission (SFC) of Hong Kong, License No. ABY048, which has been in effect since September 19, 2007.

Core Pacific - Yamaichi (CPY) provides a comprehensive range of financial services in both global and regional markets. Its primary services include trading, investment banking, asset management, and wealth management.

| Trading Instruments | Supported |

| Equities | ✔ |

| Futures | ✔ |

| Bonds | ✔ |

| IPOs | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

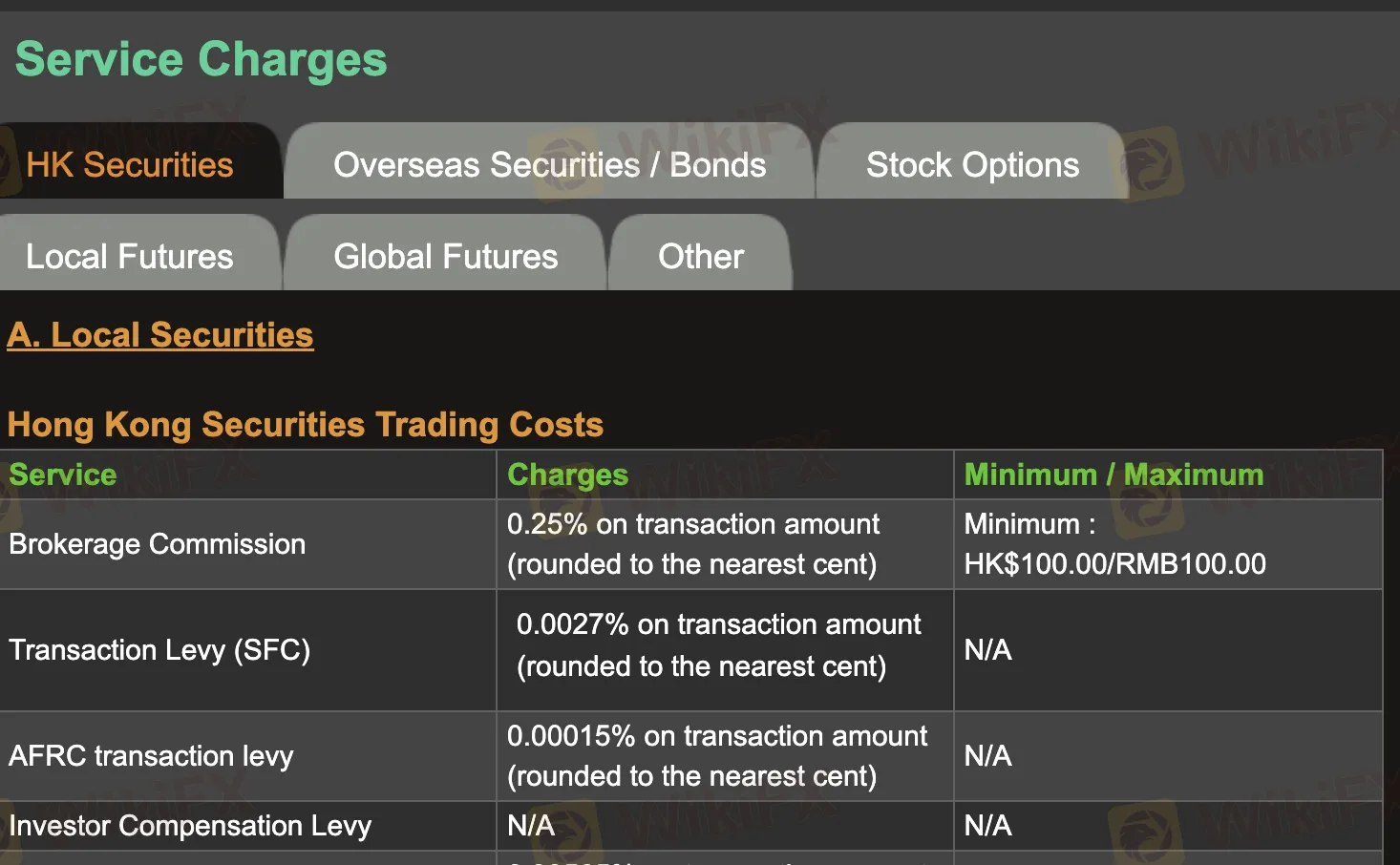

Core Pacific - Yamaichi (CPY) often has competitive fee structures as compared to industry averages. Local trading fees are fixed, whereas offshore securities and futures fees are flexible but may include additional custodian and processing fees.

| Category | Main Fees Summary |

| HK Securities | 0.25% commission (min. HK$100), plus levies and stamp duty |

| Shanghai/Shenzhen A Shares | 0.25% commission (min. RMB100), handling fees, stamp, transfer, portfolio fees |

| Stock Connect ETFs | 0.25% commission (min. RMB100), handling and transfer fees; management fee waived |

| Grey Market | 0.3% commission (min. HK$150) |

| Overseas Bonds | 0.05% p.a. custody, 0.5% interest collection, HKD400 transfer fee |

| Overseas Stocks | 0.25–0.6% commission depending on region, various taxes/levies + custodian fees |

| Options | 1% of contracted value (min. HKD20–30), plus fees for exercise |

| Local Futures | HKD 20–60 (day trade), up to HKD 100 (overnight), plus exchange fees & settlement |

| Global Futures | Commission negotiable, varies by exchange/product; margin as per exchange rules |

| Custody & Admin | Most services (custody, dormant, reprints, maintenance) are free or low cost |

| Trading Platform | Supported | Available Devices | Suitable for |

| SP Trader Futures | ✔ | Windows (Desktop) | Futures and options traders needing advanced tools |

| TSCI (PC Download) | ✔ | Windows (PC) | Active traders seeking deep analysis and advanced features |

| 京華通 CPYGo App | ✔ | iOS, Android (Mobile) | Retail investors needing multi-market access on the go |

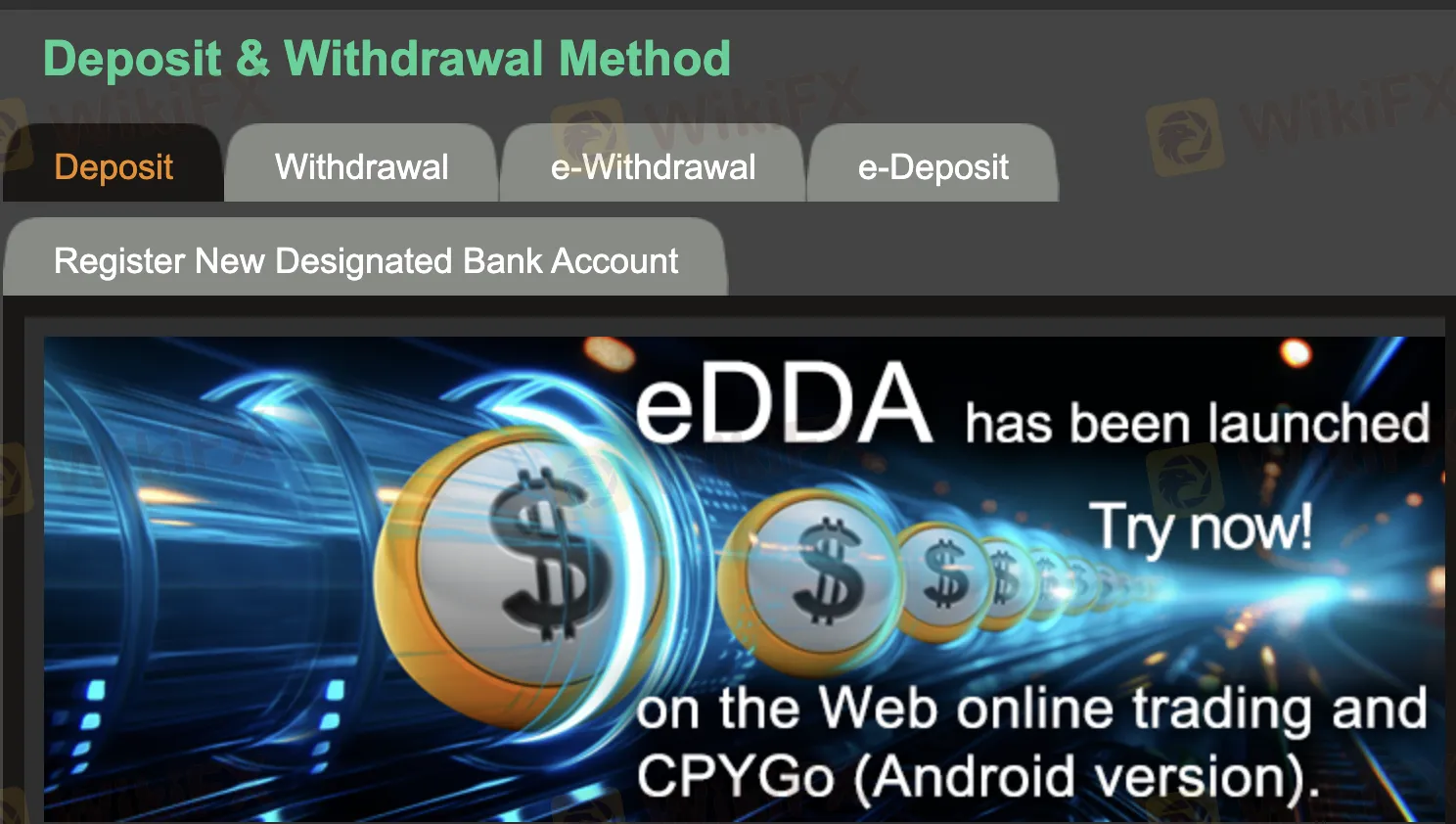

Core Pacific - Yamaichi (CPY) charges no deposit fees, although certain withdrawal methods, such as wire transfers, have a HKD 100 handling fee. The minimum deposit amount is not mentioned, but if it exceeds HKD 10,000, supporting documentation and phone verification are necessary.

Deposit Options

| Deposit Method | Deposit Fees | Deposit Time |

| eDDA Express Deposit | ❌ | Instant or within minutes |

| FPS (HKD / RMB via FPS ID) | ❌ | Same day (with deposit proof) |

| Bank Transfer (ATM / Online) | ❌ | Same day if before 4:00 PM |

| Cheque (Bank Counter / Machine) | ❌ | 2 working days (clearing time) |

| eCheque (by email) | ❌ | 2 working days after approval |

| HSBC e-Bill Payment | ❌ | Instant (with proof) |

| Phone Banking | ❌ | Same day if before 4:00 PM |

| Overseas Remittance | Bank charges apply | 1–3 business days |

| Cash Deposit (not recommended) | ❌ | Same day |

Withdrawal Options

| Withdrawal Method | Withdrawal Fees | Withdrawal Time |

| e-Withdrawal (Registered Bank) | ❌ | Same day if submitted before 12:00 PM (Mon–Fri) |

| Cheque Withdrawal | ❌ | Same day (HKD only) |

| Local Bank Transfer | ❌ | Same day (to HSBC/Hang Seng/BOC HK) |

| Overseas Remittance | HKD 100 + bank charges | 1–3 business days |

More

User comment

1

CommentsWrite a review

2023-03-24 14:25

2023-03-24 14:25