User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.74

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Company Name | Fairfield Financial LLP |

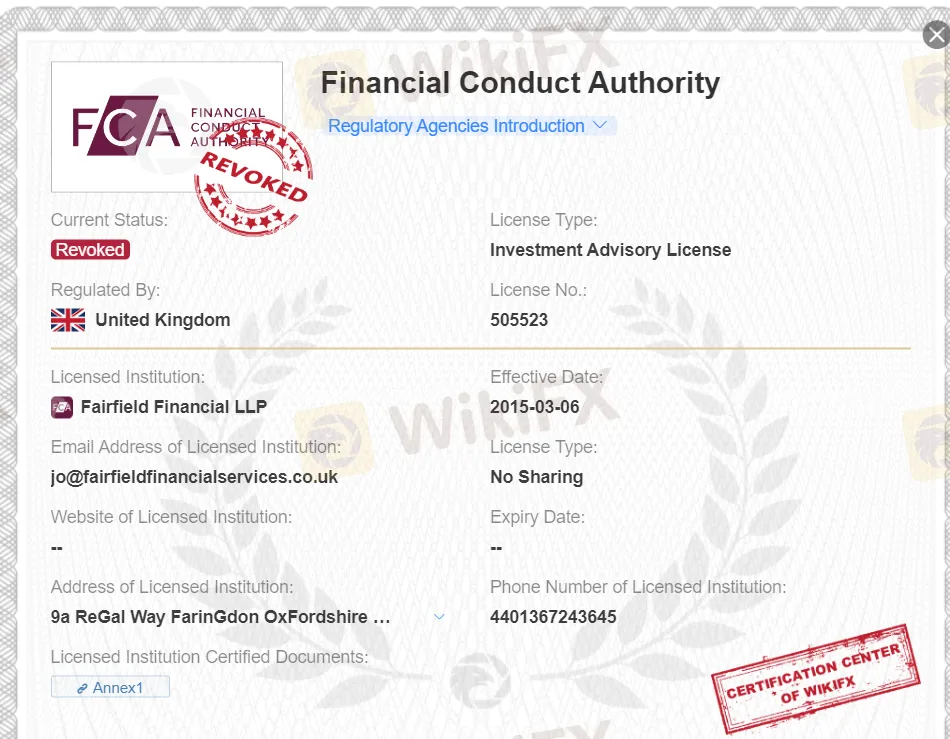

| Regulation | Previously regulated by the FCA (Revoked) |

| Minimum Deposit | $1,000 (Standard Forex Account - FXS) |

| Maximum Leverage | Up to 100:1 |

| Spreads | Vary by account type and trading instrument |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex, Cryptocurrencies |

| Account Types | - Standard Forex Account (FXS) Pro Forex Account (FXP) Cryptocurrency Portfolio Account (CPAP) |

| Customer Support | Multiple email addresses (potentially fragmented) |

| Payment Methods | Bank Wire Transfers, Credit/Debit Cards, E-Wallets |

| Educational Tools | Limited to educational resources and webinars for FXS account holders |

Fairfield Financial LLP presents several concerning aspects in its overview. Firstly, its regulation has been revoked, raising questions about its compliance and trustworthiness. The high minimum deposit requirement of $1,000 for the Standard Forex Account (FXS) may deter potential traders, limiting accessibility. While a maximum leverage of up to 100:1 can offer opportunities, it also poses significant risks, potentially leading to substantial losses for less experienced traders. The lack of specific spread details and fragmented customer support through multiple email addresses can create confusion and hinder efficient communication. Additionally, the absence of a functional website and limited educational resources raises concerns about the support and resources available to clients, potentially impeding their trading success and knowledge growth. Overall, Fairfield Financial LLP's negative aspects may deter many traders seeking a more regulated and supportive trading environment.

Unregulated.

Fairfield Financial LLP held an Investment Advisory License (License No. 505523), which was regulated by the Financial Conduct Authority (FCA). However, it's important to note that this license has been revoked, indicating that Fairfield Financial LLP is no longer authorized to provide investment advisory services. The institution's license is no longer in effect, and it currently does not hold a valid license for such activities. Fairfield Financial LLP is located at 9a ReGal Way, Faringdon, Oxfordshire, SN7 7BX, United Kingdom, and can be reached at +44 01367 243645.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

In summary, Fairfield Financial LLP offers a range of trading opportunities with a focus on cryptocurrencies and customizable account types. However, the revocation of its regulatory license, high minimum deposit, limited educational resources, fragmented customer support, and unclear fee details raise concerns for potential traders.

Fairfield Financial LLP provides its clients with access to Forex and cryptocurrency trading. In the Forex market, Fairfield offers a diverse range of currency pairs, catering to both novice and experienced traders. Clients can utilize user-friendly trading platforms and leverage options while benefitting from expert analysis to inform their trading decisions.

In addition to Forex, Fairfield Financial LLP offers cryptocurrency trading services. Clients can invest in digital assets like Bitcoin and Ethereum, leveraging real-time market data and advanced analysis tools. The platform supports a variety of trading pairs, allowing clients to diversify their cryptocurrency portfolios. The firm places a strong emphasis on security and regulatory compliance to safeguard clients' investments.

Here are detailed descriptions of the three account types offered by Fairfield Financial LLP:

Standard Forex Account - FXS:

The Standard Forex Account (FXS) is designed to cater to traders who are looking to start their Forex journey with confidence. To open this account, clients are required to make a minimum deposit of $1,000. With leverage of up to 50:1, clients can amplify their trading positions. FXS offers a range of major and select exotic currency pairs for trading.

Clients can access the markets through user-friendly web and mobile trading platforms, providing flexibility in trading from anywhere. As part of the FXS package, clients receive daily market analysis and research to help them make informed trading decisions. Standard customer support is available to assist clients with their queries and concerns. Additionally, clients enjoy access to educational resources and webinars, making it an ideal choice for traders looking to enhance their Forex knowledge and skills.

Pro Forex Account - FXP:

The Pro Forex Account (FXP) is tailored for more experienced traders and those who seek advanced trading tools and personalized support. To open this account, a minimum deposit of $10,000 is required, providing access to higher leverage of up to 100:1. FXP offers a comprehensive range of major and exotic currency pairs for trading.

With FXP, clients gain access to advanced trading platforms equipped with technical analysis tools, empowering them to conduct in-depth market analysis. Daily market analysis is provided, and clients have the advantage of a dedicated account manager for personalized support. Priority customer support ensures swift responses to inquiries. Furthermore, FXP account holders can customize their trading strategies and access premium research reports, making it a preferred choice for serious Forex traders.

Cryptocurrency Portfolio Account - CPAP:

The Cryptocurrency Portfolio Account (CPAP) is designed for investors interested in the world of cryptocurrencies. To open this account, clients need to deposit a minimum of $5,000 in cryptocurrency assets. CPAP provides support for leading digital currencies such as Bitcoin (BTC), Ethereum (ETH), and select altcoins.

Security is a top priority for CPAP, with assets stored in a multi-signature wallet for maximum safety. Clients can explore a diverse range of cryptocurrency trading pairs on the platform, capitalizing on real-time market data and advanced charting tools for analysis. CPAP offers 24/7 cryptocurrency specialist support to assist clients in navigating the crypto market.

In addition to trading, CPAP account holders have access to features like staking and yield-generating options, allowing them to optimize their cryptocurrency holdings. The account also offers portfolio rebalancing to help clients manage their crypto investments effectively. CPAP is an excellent choice for investors looking to diversify their portfolios with digital assets and maximize their cryptocurrency holdings.

Fairfield Financial LLP offers a maximum trading leverage of up to 1:100. This means that for every $1 in the trader's account, they can control a trading position of up to $100. Leverage allows traders to potentially amplify their profits, but it also increases the risk, as losses can also be magnified. Traders should exercise caution and have a solid risk management strategy in place when utilizing leverage to ensure responsible and informed trading decisions.

Spreads:

Spreads represent the price difference between buying (ask) and selling (bid) for a given financial instrument. Fairfield Financial LLP offers a range of spreads depending on the account type. For example, in the Standard Forex Account (FXS), spreads might range from 2 to 3 pips for major currency pairs. In contrast, the Pro Forex Account (FXP) provides narrower spreads, typically ranging from 1 to 2.5 pips. The Cryptocurrency Portfolio Account (CPAP) could have spreads that vary depending on the specific cryptocurrency pair, such as a $50 spread for Bitcoin (BTC)/USD.

Commissions:

Commissions are fees charged by the broker for executing trades on behalf of the client. Fairfield Financial LLP applies commissions to specific account types. For instance, the Pro Forex Account (FXP) incurs a fixed commission of $5 per standard lot (100,000 units), which is added to the spreads. In contrast, the Standard Forex Account (FXS) does not have additional commissions beyond the spreads. The Cryptocurrency Portfolio Account (CPAP) might apply a commission of 0.2% of the total cryptocurrency trade value, offering a variable fee structure based on the trade's size. Traders should be aware of the spread and commission ranges associated with their chosen account type to assess the overall cost of trading.

Deposits:

Fairfield Financial LLP provides clients with multiple deposit methods to fund their trading accounts. One option is through traditional Bank Wire Transfers, allowing clients to transfer funds directly from their bank accounts to their trading account with the broker. This method is secure and suitable for larger deposits, although processing times may vary depending on the banks involved.

Another option is to use Credit/Debit Card Transactions. Clients can deposit funds using major credit and debit cards such as Visa, MasterCard, and American Express. This method offers the advantage of instant fund crediting to the trading account, making it a quick and convenient choice for traders.

For added flexibility, Fairfield Financial LLP also supports popular e-wallet services like PayPal and Skrill. E-wallets provide a swift and secure way to manage funds, with the benefit of near-instant deposits. Clients can link their e-wallet accounts to their trading accounts to streamline the deposit process.

Withdrawals:

Fairfield Financial LLP offers clients flexibility in withdrawing their profits. They can use the same methods they used for deposits. This includes traditional Bank Wire Transfers, which are secure but may have varying processing times depending on the banks involved.

Clients can also opt for Credit/Debit Card Withdrawals, with funds transferred back to their cards. This method is straightforward but may take a few business days to complete.

Alternatively, clients can choose E-Wallet Services like PayPal and Skrill for quicker withdrawal processing times, ensuring prompt access to their funds.

Fairfield offers its clients access to the renowned MetaTrader 4 (MT4) trading platform. MT4 is a robust and user-friendly trading platform that empowers traders with a comprehensive set of tools and features, making it an ideal choice for both beginners and experienced traders alike. With MT4, Fairfield clients can enjoy advanced charting tools, customizable trading indicators, and the ability to automate trading strategies using Expert Advisors (EAs). This platform provides a seamless and efficient trading experience, helping clients make informed decisions and execute trades with ease. Whether you're new to trading or a seasoned professional, Fairfield's MT4 platform is designed to enhance your trading journey.

Fairfield Financial LLP's customer support, as indicated by their provided email addresses (service@fairfield-llp.com and service@fairfield-llp.com.cn), may be viewed in a negative light due to its potentially fragmented and confusing nature. Operating with multiple email addresses, including one with a country-specific domain, can create confusion and inefficiencies in communication for clients seeking assistance. This may lead to frustration and delays in addressing customer inquiries and concerns. A more streamlined and centralized customer support system could improve the overall experience for clients, enhancing clarity and responsiveness.

Fairfield Financial LLP's lack of educational resources, as indicated by the absence of such materials, may limit the potential for clients to enhance their trading knowledge and skills. This deficiency can be viewed as a missed opportunity to support clients in making informed investment decisions. Without educational resources, clients may face challenges in understanding market dynamics, trading strategies, and risk management techniques, potentially leading to less effective trading experiences and outcomes. A comprehensive educational program can often contribute significantly to a trader's success and confidence in the financial markets, making it a valuable aspect of a brokerage service.

Fairfield Financial LLP presents several notable drawbacks. Its revoked regulatory status with the FCA raises significant concerns regarding compliance and trustworthiness. The imposing minimum deposit requirement of $1,000 limits accessibility, potentially alienating traders with smaller budgets. The absence of comprehensive educational resources and fragmented customer support further dampen the overall client experience. Additionally, the lack of clear information on spreads and commissions adds to the uncertainty for traders. These negative aspects may discourage many potential traders seeking a more regulated and supportive trading environment.

Q1: Is Fairfield Financial LLP a regulated broker?

A1: No, Fairfield Financial LLP's regulatory license with the Financial Conduct Authority (FCA) has been revoked, and it currently operates without regulation.

Q2: What is the minimum deposit required to open a Standard Forex Account (FXS)?

A2: To open a Standard Forex Account (FXS), a minimum deposit of $1,000 is required.

Q3: Does Fairfield Financial LLP offer educational resources for traders?

A3: Fairfield Financial LLP provides limited educational resources and webinars primarily for Standard Forex Account (FXS) holders.

Q4: What is the maximum leverage offered by Fairfield Financial LLP?

A4: Fairfield Financial LLP offers a maximum trading leverage of up to 1:100.

Q5: Are there any additional commissions for trading with Fairfield Financial LLP?

A5: Commissions vary by account type, with the Pro Forex Account (FXP) incurring a fixed commission of $5 per standard lot (100,000 units), while the Standard Forex Account (FXS) typically includes spreads without additional commissions. The Cryptocurrency Portfolio Account (CPAP) may apply a commission of 0.2% based on the cryptocurrency trade's value.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment