User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

1-2 years

1-2 yearsRegulated in South Africa

Derivatives Trading License (EP)

MT5 Full License

Global Business

Offshore Regulated

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index3.80

Business Index4.60

Risk Management Index9.22

Software Index8.61

License Index3.71

Single Core

1G

40G

More

Company Name

YWO (CM) Ltd

Company Abbreviation

YWO

Platform registered country and region

Comoros

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| YWO Review Summary | |

| Founded | 1998 |

| Registered Country/Region | Comoros |

| Regulation | No Regulation |

| Market Instruments | Forex, Indices, Metals, Energies, Stocks, Cryptocurrencies, Commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 0 pips |

| Trading Platform | MT5 |

| Minimum Deposit | $10 |

| Customer Support | Social Media: Facebook, Instagram, Telegram, Twitter, LinkedIn |

| Regional Restriction | The European Union |

YWO is an online broker registered in the Comoros, offering multiple market instruments like forex, indices, metals, energies, stocks, cryptocurrencies, and commodities. YWO provides MT5, a demo account, and two live accounts. The leverage on this platform is up to 1:1000, which is high. However, YWO doesn't offer its service to the residents of the European Union or any other jurisdiction where such services conflict with local laws and regulations.

| Pros | Cons |

| Low minimum deposit requirement | Lack of regulation |

| MT5 supported | EU clients are not accepted |

| Demo accounts available | Limited customer support channels |

| 24/7 support | Commission charged |

YWO lacks regulatory oversight from any major authorities, which indicates that trading on this platform involves risks.

YWO provides various tradable assets on its platform, such as forex, metals, crypto, energies, stocks, indices, and commodities.

| Trading Asset | Available |

| forex | ✔ |

| metals | ✔ |

| commodities | ✔ |

| energies | ✔ |

| indices | ✔ |

| stocks | ✔ |

| cryptocurrencies | ✔ |

| bonds | ❌ |

| options | ❌ |

| funds | ❌ |

| ETFs | ❌ |

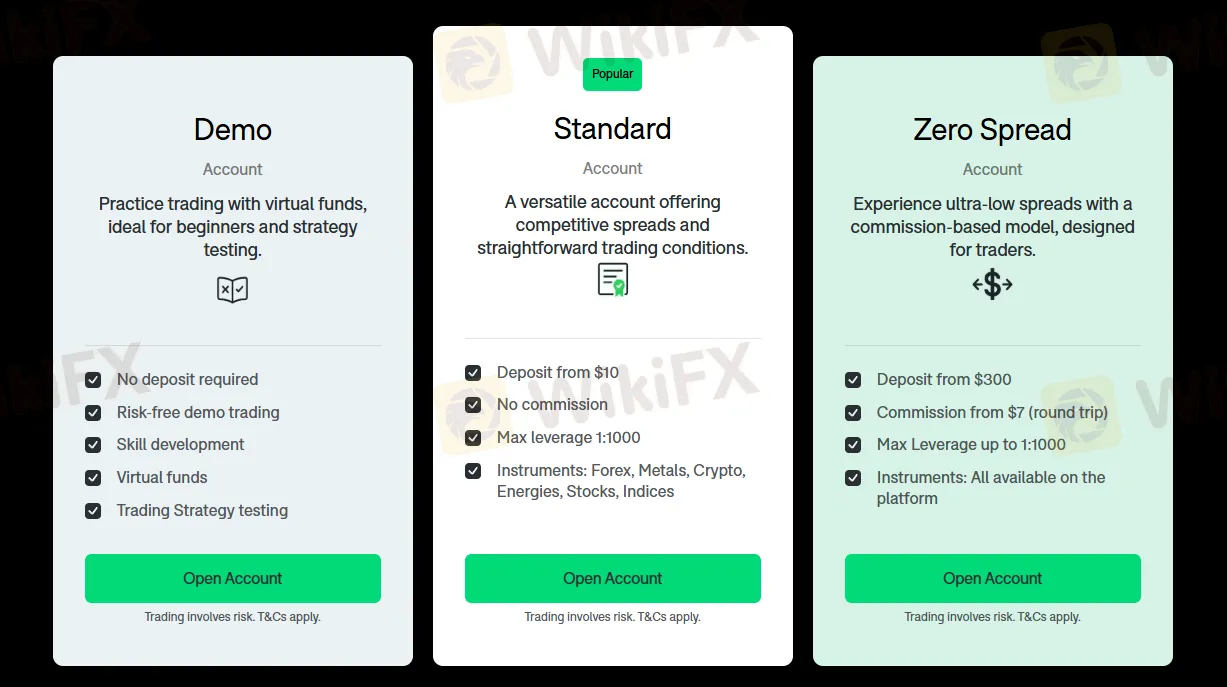

YWO offers access to a demo account and two types of live accounts.

YMO claims that its demo account has several features, like:

In terms of live accounts, the Standard Account and the Zero Spread Account can have very different features.

| Account Type | Standard | Zero Spread |

| Minimum Deposit | $10 | $300 |

| Maximum Leverage | 1:1000 | |

| Commission | 0 | From $7 (round trip) |

The leverage on this platform is up to a high 1:1000. Leverage allows traders to increase the potential return on an investment by using borrowed funds (debt) to finance the purchase of assets. However, it also increases risks.

If you are a Standard Account user, then the commission is free. But when it comes to the Zero Spread Account, the commission is from $7 per round trip.

YWO doesn't disclose much information about the spread on its website. But the spread seems to start from 0 pip, since YWO offers a “Zero Spread Account”.

MT5 (MetaTrader 5) is offered by this platform. It is a popular multi-asset trading platform developed by MetaQuotes. It is widely used by traders for online trading in various financial markets. Being the successor to MT4 (MetaTrader 4), MT5 offers enhanced features and expanded functionality.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced traders |

| MT4 | ❌ | / | Beginners |

Traders can deposit and withdraw through bank cards, bank transfers, and cryptocurrencies. Deposit and withdrawal fees may apply depending on the payment method and provider.

As the fintech industry gathers in Dubai for this years iFX EXPO, YWO has announced a limited-time promotional initiative for traders attending the event week.During the iFX EXPO Dubai period, YWO is

WikiFX

WikiFX

DUBAI, UAE – February 2, 2026 – When iFX EXPO opens in Dubai between February 10-12, 2026, YWO will make its debut (Booth No. 225) with a focus on the Gulf Cooperation Council (GCC) and North African

WikiFX

WikiFX

The cryptocurrency market has been divided into two distinct trading behaviors. On one side sits the maturing asset class of Bitcoin and Ethereum which in recent market cycles has demonstrated more st

WikiFX

WikiFX

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment