User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.36

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Note: ProperTrade's official website: https://www.proper-trade.com/ is currently inaccessible normally.

| ProperTrade Review Summary | |

| Founded | / |

| Registered Country/Region | Marshall Islands |

| Regulation | Unregulated |

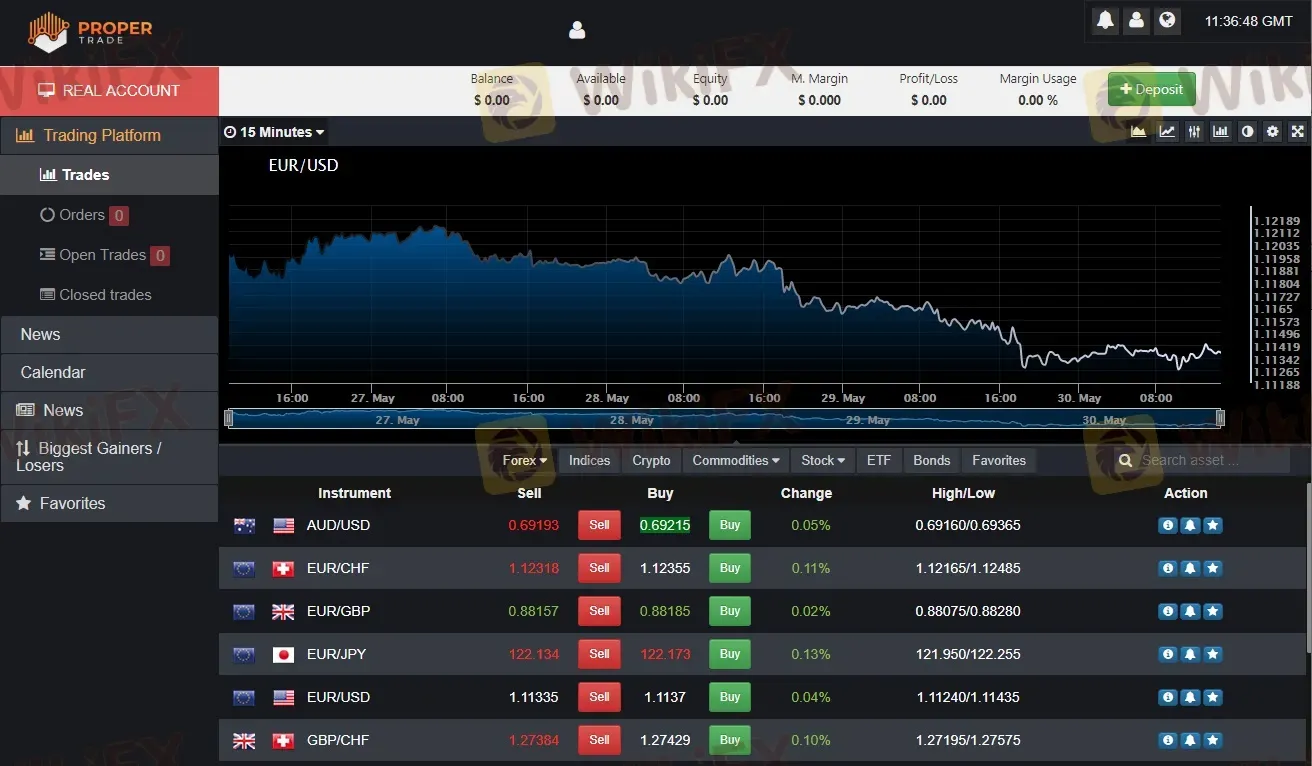

| Market Instruments | Currency pairs, CFDs on commodities, 23 indices, 30 ETFs, individual stocks, bonds, and major cryptocurrencies |

| Demo Account | / |

| Leverage | 1:200 |

| EUR/USD Spread | 3.5 pips |

| Trading Platforms | Web-based platform |

| Minimum Deposit | / |

| Customer Support | Telephone: +442039669160 |

| Email: contact@proper-trade.com, support@proper-trade.com | |

ProperTrade is a brokerage company based in the Marshall Islands and offers a range of market instruments including currency pairs, CFDs on commodities, indices, ETFs, individual stocks, bonds, and major cryptocurrencies, etc.

However, the broker does not maintain accessible website so far, leaving the public confused about its operational status. Furthermore, the lack of regulation of the company degrade its credibility and legitimacy significantly.

Unavailable website: ProperTrade's website cannot be opened currently.

Regulatory concerns: The company operates without any regulations, meanig that it does not comply to rules from any regulatory authorities. This heightens trading risks with them.

Limited transparency on trading conditions: The broker does not disclose enough information on its trading conditions such as account details, fees, etc.

Simplistic trading platform: ProperTrade only offers a simplistic trading platform with basic trading functions only, undermining user experience.

Regulation is a crucial aspect of evaluating the legitimacy and reliability of a brokerage firm, and in the case of ProperTrade, the broker operates without any valid regulatory oversight. The absence of a regulatory framework raises huge concerns regarding the broker's adherence to industry standards, financial transparency, and the protection of client interests.

ProperTrade offers over 50 currency pairs including major, exotic, and minor pairs such as USDZAR, USDTRY, USDSGD, USDSEK, USDRUB, USDPLN, USDNOK, USDMXN, USDILS, USDHUF, USDHKD, and USDDKK.

In addition to forex pairs, ProperTrade also provides CFDs on commodities like Brent, WTI Crude, natural gas, silver, gold, platinum, palladium, and copper. Moreover, CFDs on agricultural commodities such as cocoa, coffee, corn, cotton, orange juice, soybean, sugar, and wheat are also on their offering table.

Furthermore, investors can trade on 23 indices, 30 ETFs, individual stocks, bonds, and major cryptocurrencies including Cardano, Bitcoin Cash, Bitcoin, Bitcoin Gold, Dash, EOS, Ethereum, Ethereum Classic, IOTA, Litecoin, NEO, Qtum, Tron, Stellar, Monero, Ripple, and Zcash.

To achieve the goal of successful trading, always choose several products once at a time instead of only one to scatter risks.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ✔ |

| Bonds | ✔ |

| ETFs | ✔ |

| Options | ❌ |

| Mutual Funds | ❌ |

ProperTrade does not disclose any information regarding its account types and minimums. The only info we obtain from the Internet is that the broker has a floating spread from 3.5 pips, which is wider than industry average and will bring higher costs for your trading.

Other key info like commission is unavailable, either.

ProperTrade offers a maximum leverage of 1:200 so there's possibility for you to amplify trading positions and maximize profits.

However, while leverage offers the potential for higher returns, it also magnifies losses if the market moves against you. So be prudent to use leverage and always implement risk management.

ProperTrade offers a web-based trading platform that is overly simplified compared to more advanced platforms like MetaTrader4/5. You can only trade with the most basic functions.

ProperTrade accepts payments through credit and debit cards such as VISA, MasterCard, and American Express. In addition to card payments, electronic payment systems like Neteller, Okpay, Perfect Money, Skrill, QIWI, and Webmoney are also supported to add further flexibility.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment