User Reviews

More

User comment

8

CommentsWrite a review

2023-12-04 20:28

2023-12-04 20:28 2023-12-02 13:19

2023-12-02 13:19

Score

10-15 years

10-15 yearsRegulated in Australia

Market Making License (MM)

Self-developed

Global Business

Vanuatu Forex Trading License (EP) Revoked

Medium potential risk

Influence

Add brokers

Comparison

Quantity 5

Exposure

Score

Regulatory Index9.24

Business Index8.00

Risk Management Index7.63

Software Index8.32

License Index9.25

Single Core

1G

40G

Danger

More

Company Name

Trading 212 UK Ltd

Company Abbreviation

TRADING 212

Platform registered country and region

United Kingdom

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Trading212 Review Summary | |

| Founded | 2006 |

| Registered Region | United Kingdom |

| Regulation | ASIC, FCA, CySEC, VFSC (Revoked), FSC (Exceeded) |

| Market Instruments | CFDs on stocks, indices, commodities, and forex |

| Demo Account | / |

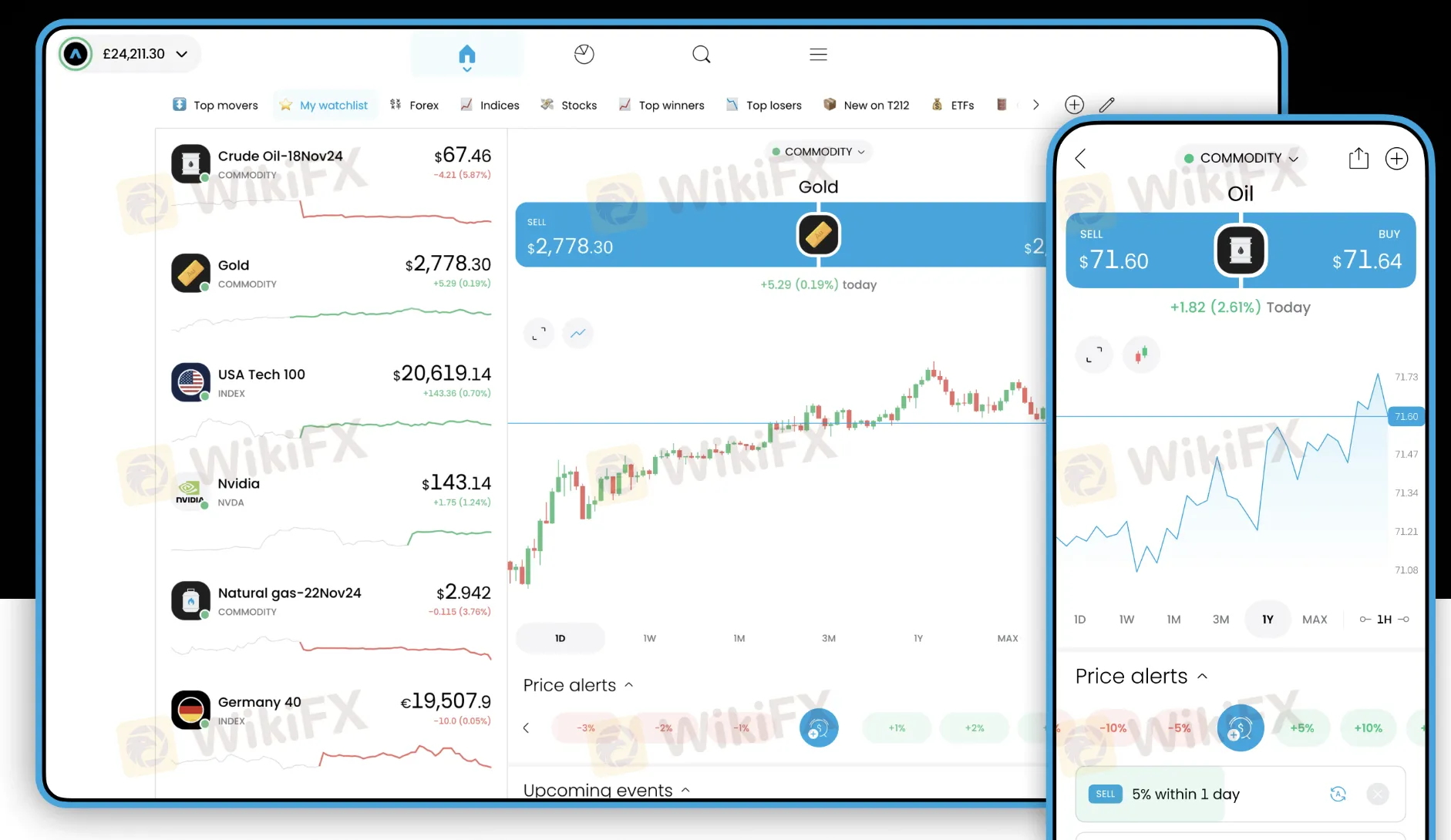

| Trading Platform | Trading 212 App, Trading 212 Web Platform |

| Minimum Deposit | £/€/$1 |

| Customer Support | Email: info@trading212.com |

| Address: Aldermary House, 10-15 Queen Street, London, EC4N 1TX | |

Trading 212, a UK-based fintech business launched in 2006, is licensed by both the FCA and CySEC. You can trade CFDs on a lot of different markets, such as equities, indices, commodities, and more than 180 FX pairs. It works with both web and mobile platforms and has a clear, low-cost fee structure.

| Pros | Cons |

| Regulated by FCA and CySEC | No support for MetaTrader (MT4/MT5) platforms |

| Commission-free trading on stocks & ETFs | Card deposits over £2,000 incur a 0.7% fee |

| User-friendly mobile and web apps | |

| Low minimum deposit requirement |

Yes, Trading 212 is a legitimate and regulated financial services provider.

| Regulatory Authority | License Type | License Number | Licensed Entity | Current Status |

| Australia Securities & Investment Commission (ASIC) | Market Maker (MM) | 000541122 | Trading 212 AU PTY LTD | ✅ Regulated |

| UK Financial Conduct Authority (FCA) | Market Maker (MM) | 609146 | Trading 212 UK Limited | ✅ Regulated |

| Cyprus Securities and Exchange Commission (CySEC) | Market Maker (MM) | 398/21 | Trading 212 Markets Ltd | ✅ Regulated |

| Vanuatu Financial Services Commission (VFSC) | Retail Forex License | 40517 | Trading 212 Global Ltd | ❌ Revoked |

| Financial Supervision Commission (FSC) | Common Financial Service License | RG-03-0237 | TRADING 212 EOOD | ❌ Exceeded |

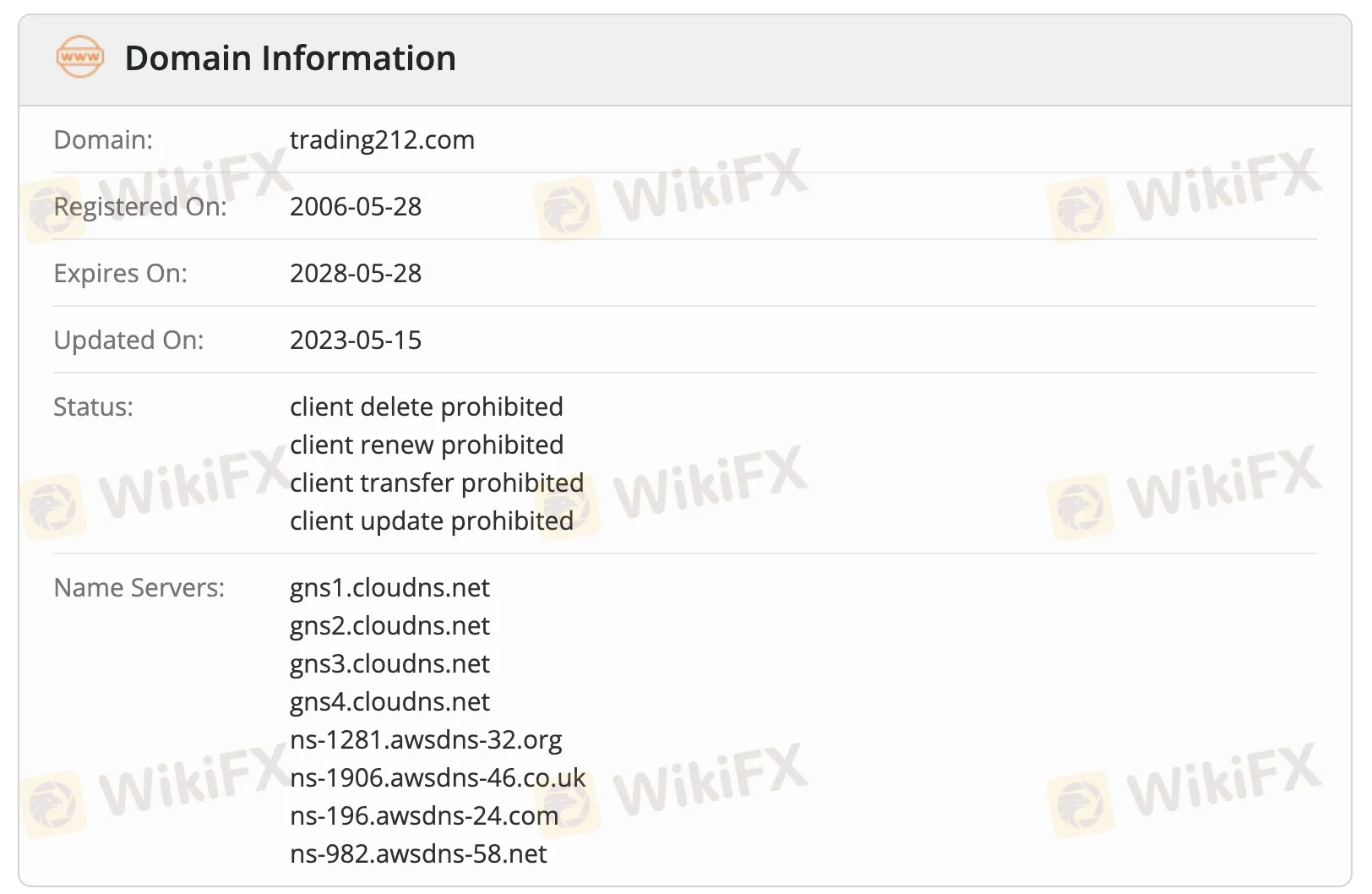

The WHOIS database says that the domain trading212.com was registered on May 28, 2006, and that it was last updated on May 15, 2023. It will end on May 28, 2028.

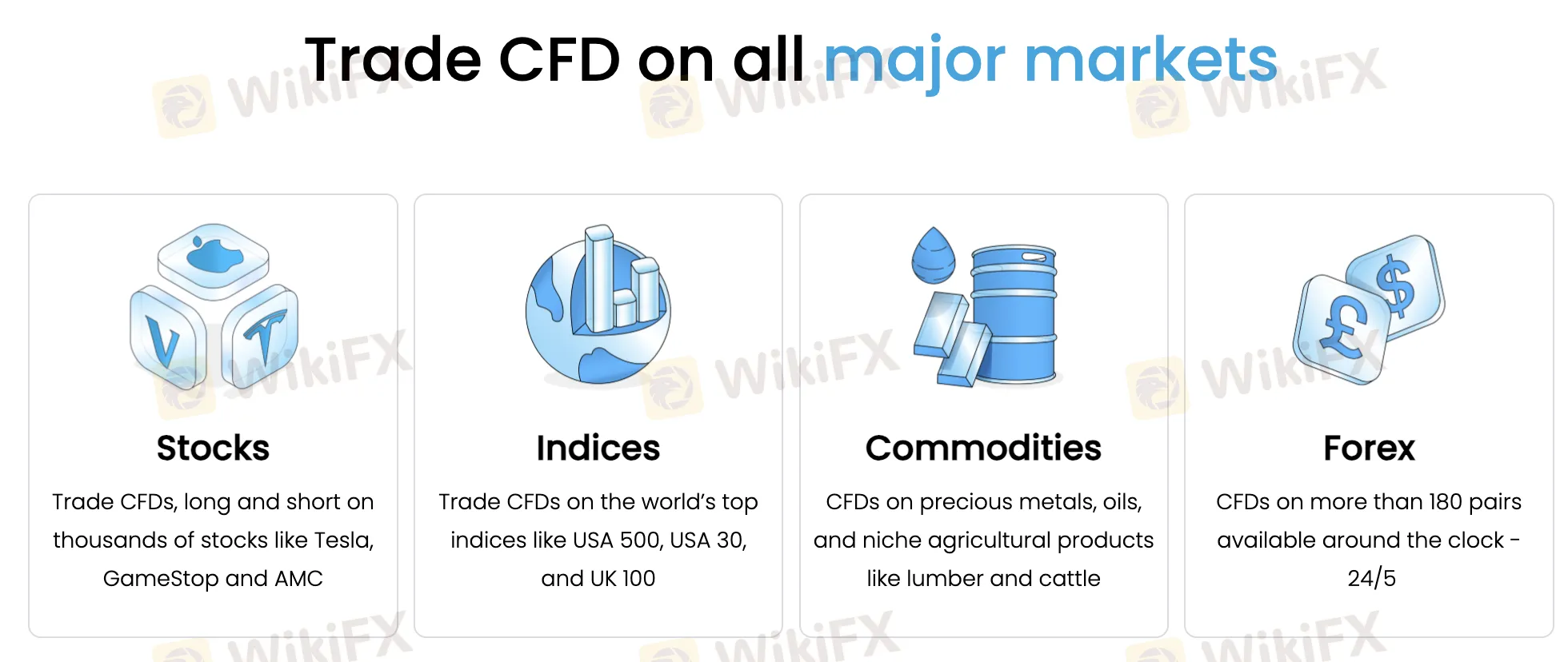

Trading 212 lets you trade CFDs on a lot of different global markets. Investors can trade CFDs on stocks, indices, commodities, and more than 180 FX pairs.

| Trading Instruments | Supported |

| CFDs | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Forex | ✔ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

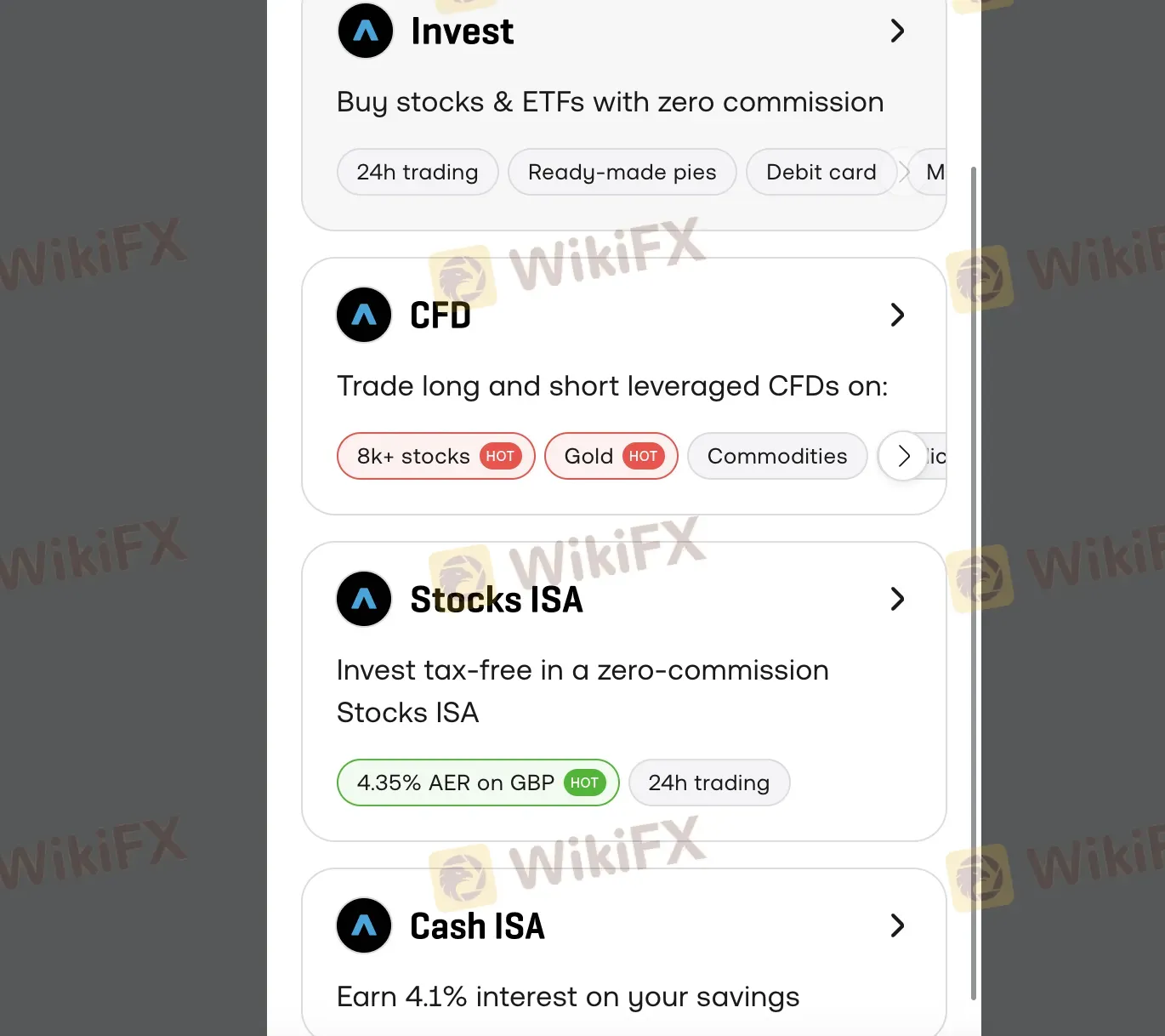

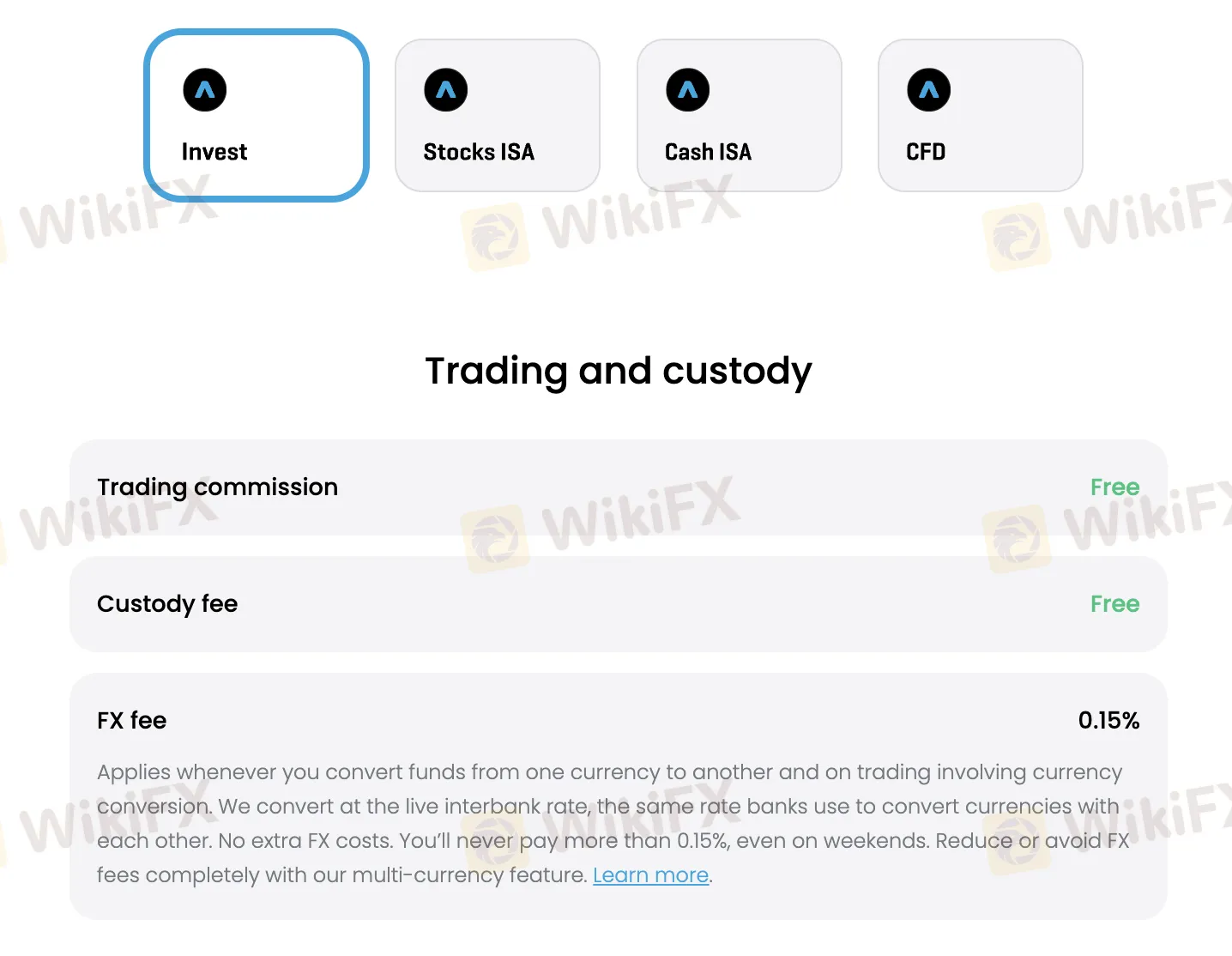

Trading 212 offers four live account types: Invest, CFD, Stocks ISA, and Cash ISA — each suited for different investor needs. No Demo or Islamic account is mentioned.

| Account Type | Feature | Suitable for |

| Invest | Buy stocks & ETFs commission-free | Long-term investors & beginners |

| CFD | Trade CFDs with leverage on multiple asset classes | Active traders & speculators |

| Stocks ISA | Tax-free stock & ETF investments (UK only) | UK investors seeking tax advantages |

| Cash ISA | Earn interest on uninvested cash (GBP only) | UK residents looking for safe returns |

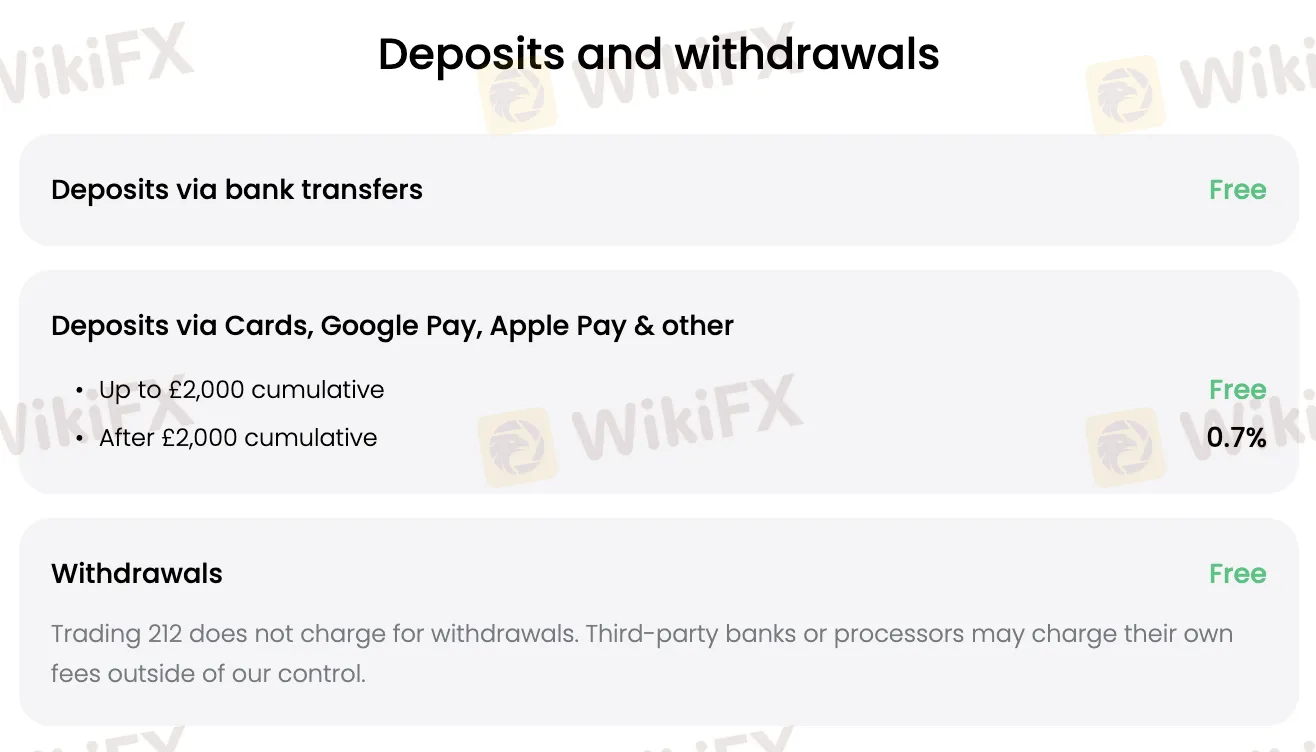

Trading 212 has an extremely affordable and clear pricing structure. Most trades don't have any commissions, and there are no fees for deposits or withdrawals. The prices for converting currencies are also inexpensive. Its fees are usually lower than normal for the industry, especially for retail investors.

| Commission | FX Fee | Custody Fee | Overnight Fees | Spread | |

| Invest Account | 0 | 0.15% | 0 | 0 | Dynamic (instrument dependent) |

| CFD Account | 0 | 0.5% (on result) | 0 | Yes (varies by instrument, ± interest) | Dynamic (market conditions) |

| Stocks ISA | 0 | 0.15% | 0 | 0 | / |

| Cash ISA | / | / | 0 | / | / |

Non-Trading Fees

| Non-Trading Fee | Fee |

| Deposit Fee (bank transfer) | 0 |

| Deposit Fee (card, Apple/Google Pay) | Free up to £2,000, then 0.7% |

| Withdrawal Fee | Free (3rd party bank fees may apply) |

| Inactivity Fee | 0 |

| Account Closure | 0 |

| Trading Platform | Supported | Available Devices | Suitable for |

| Trading 212 App | ✔ | iOS, Android | / |

| Trading 212 Web Platform | ✔ | Web browsers (Windows, macOS) | / |

| MetaTrader 4 (MT4) | ❌ | – | Beginners |

| MetaTrader 5 (MT5) | ❌ | – | Experienced traders |

Most of the time, Trading212 doesn't impose fees for deposits or withdrawals. Card payments, like Apple Pay and Google Pay, are free up to a total of £2,000. After that, a 0.7% cost applies. Bank transfers are still free. You can also withdraw money for free, although third-party banks or payment processors may charge you fees. The minimum deposit and withdrawal amount is £/€/$1.

| Payment Method | Minimum Deposit | Minimum Withdrawal | Fees | Processing Time |

| Visa / Visa Electron | £/€/$1 | Free up to £2,000, 0.7% afterward | Instant | |

| Mastercard | ||||

| Maestro | ||||

| Apple Pay | ||||

| Google Pay | ||||

| Bank Wire | 0 | 0–2 business days | ||

Trading 212, a leading Forex trading broker, strengthens its presence in Germany with a new Berlin office. Discover how the platform is shifting focus from CFDs to stockbroking and tax-efficient savings.

WikiFX

WikiFX

Trading 212 reports a record £39.7 million profit in 2024, driven by user growth, new products like Cash ISA, and strong trading volumes. Expands into Europe and launches debit card.

WikiFX

WikiFX

Trading 212 simplifies automated investing with BlackRock-powered ETFs. Set goals, deposit funds, and let your portfolio grow effortlessly.

WikiFX

WikiFX

Have you ever heard about a broker named Trading212? WikiFX made a comprehension review on this broker to help you better understand the truth, we will analyze the reliability of this broker from specific information, regulation, exposure, etc. And you should never miss it.

WikiFX

WikiFX

More

User comment

8

CommentsWrite a review

2023-12-04 20:28

2023-12-04 20:28 2023-12-02 13:19

2023-12-02 13:19