User Reviews

More

User comment

3

CommentsWrite a review

2022-11-27 11:06

2022-11-27 11:06

2022-11-24 15:54

2022-11-24 15:54

Score

10-15 years

10-15 yearsRegulated in Czech Republic

Retail Forex License

Self-developed

Global Business

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index2.49

Business Index8.22

Risk Management Index9.82

Software Index4.58

License Index2.49

Single Core

1G

40G

More

Company Name

LYNX BV

Company Abbreviation

LYNX

Platform registered country and region

Netherlands

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| LYNX Review Summary | |

| Founded | 2006 |

| Registered Country | Netherlands |

| Regulation | CNB |

| Market Instruments | Currencies, CFDs, Stocks, ETFs, Options, Futures |

| Demo Account | ❌ |

| Leverage | / |

| Spread | From 0.1 pips |

| Trading Platform | LYNX+ Platform, TWS Platform, Mobile APP |

| Minimum Deposit | / |

| Customer Support | Phone: +31 (0)20 6251524 |

| Email: info@lynxbroker.com | |

Based in the Netherlands, LYNX is a licensed regulated internet broker of the Czech National Bank, launched in 2006. Covering a wide spectrum of instruments like FX, equities, futures, and ETFs, it provides access to more than 150 marketplaces across 30+ nations.

| Pros | Cons |

| Regulated by Czech National Bank | No demo or Islamic account |

| Access to 150+ markets in 30+ countries | Minimum deposit not mentioned |

| Raw spreads from 0.1 pips, no hidden fees | Swap/overnight fees not transparently listed |

| Only bank transfer supported |

LYNX is a regulated broker licensed by the Czech National Bank(CNB) with a Retail Forex License (License No. 02451778), active since August 28, 2013.

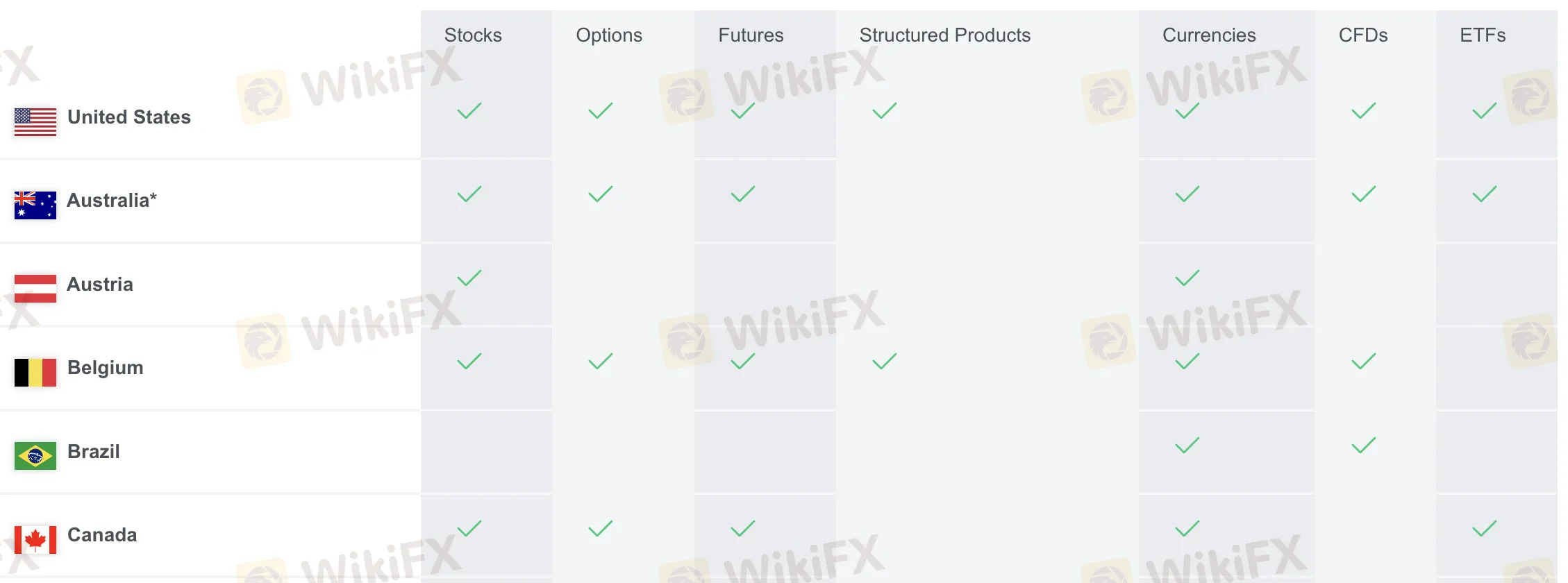

With access to more than 150 markets spread across 30+ nations, LYNX lets customers trade a broad spectrum of assets including stocks, ETFs, options, futures, currencies, CFDs, and structured products.

| Tradable Instruments | Supported |

| Currencies | ✔ |

| CFDs | ✔ |

| Stocks | ✔ |

| ETFs | ✔ |

| Options | ✔ |

| Futures | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

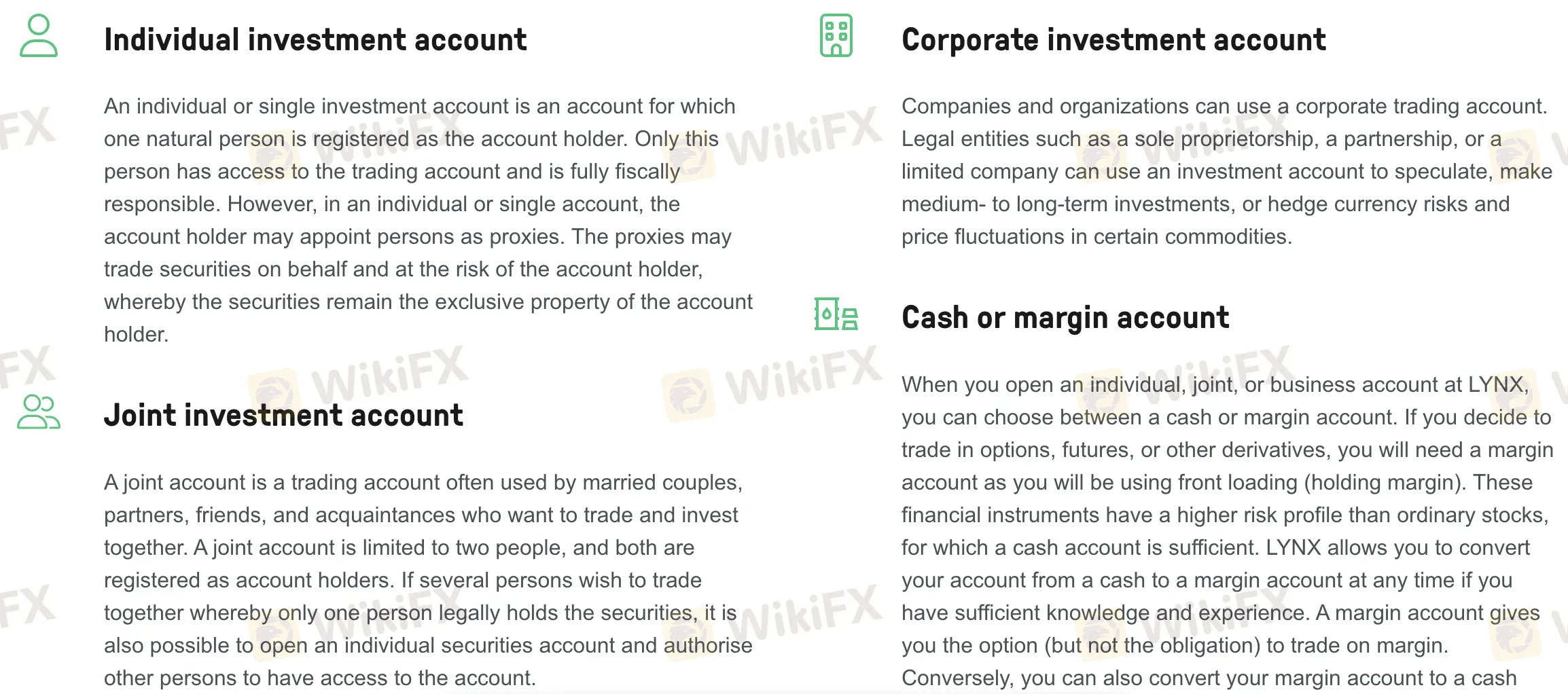

LYNX has three primary kinds of live trading accounts: Individual, Joint, and Corporate. Furthermore, every account can be setup as either a Cash Account or a Margin Account, based on the trader's experience and product requirements. At the moment, LYNX lacks Islamic or demo accounts.

Especially for forex traders, LYNX's trading costs are reasonable in comparison to industry standards. It provides no spread markups or concealed costs, raw spreads as low as 0.1 pips. Usually modest non-trading expenses include free deposits and one monthly free withdrawal. Though not publicly specified, swap fees—or overnight fees—apply.

| Trading Platform | Supported | Available Devices |

| LYNX+ Platform | ✔ | Web, Desktop, Mobile |

| Mobile Trading App | ✔ | iOS, Android |

| TWS Platform | ✔ | Desktop (Windows/macOS) |

Processed through the Client Portal, LYNX provides bank transfer as the only means for deposits and withdrawals. The first monthly withdrawal is free; deposits incur no cost; bank fees could apply. Two-factor login must be used to manually start and verify deposits and withdrawals.

| Payment Method | Deposit Fees | Withdrawal Fees | Processing Time |

| Bank Transfer | 0 | 1st withdrawal/month free | 1–2 business days |

More

User comment

3

CommentsWrite a review

2022-11-27 11:06

2022-11-27 11:06

2022-11-24 15:54

2022-11-24 15:54