User Reviews

More

User comment

8

CommentsWrite a review

2024-08-06 18:34

2024-08-06 18:34 2024-06-04 14:34

2024-06-04 14:34

Score

5-10 years

5-10 yearsRegulated in South Africa

Derivatives Trading License (EP)

White label MT4

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index3.60

Business Index7.51

Risk Management Index9.71

Software Index8.67

License Index3.60

Single Core

1G

40G

Danger

Danger

More

Company Name

TD Markets (Pty) Ltd

Company Abbreviation

TD MARKETS

Platform registered country and region

South Africa

Company website

X

Company summary

Pyramid scheme complaint

Expose

| TD Markets Review Summary | |

| Founded | 2006 |

| Registered Country/Region | South Africa |

| Regulation | FSCA (Exceeded) |

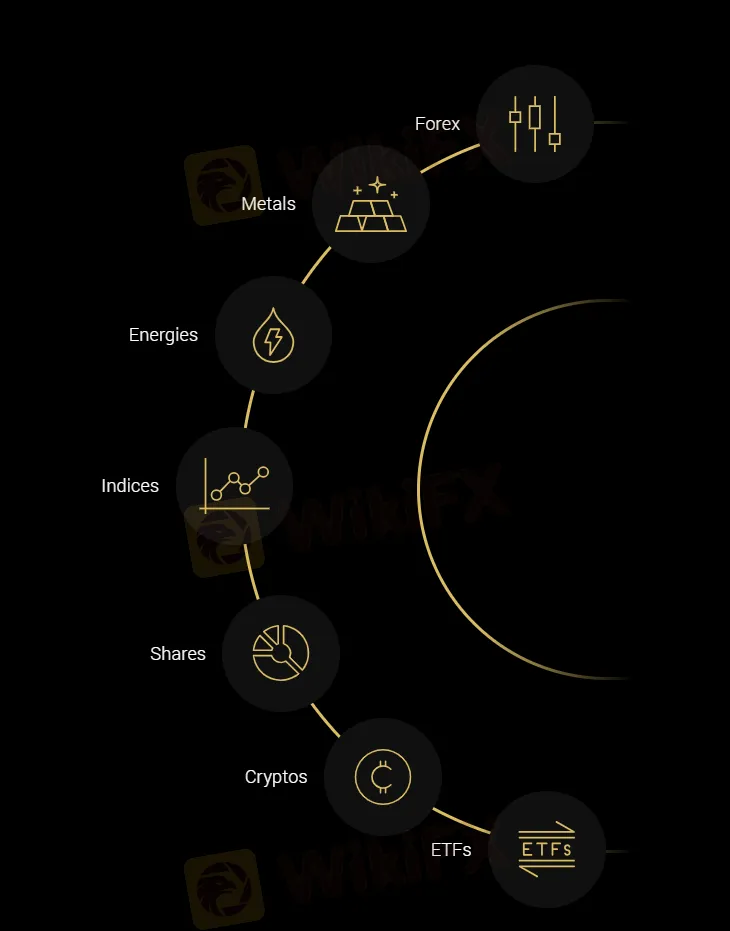

| Market Instruments | Forex, commodities, indices, cryptocurrencies, shares, ETFs |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Spread | From 1.8 pips (TDM MINI account) |

| Leverage | / |

| Trading Platform | MT4, MT5 |

| Social Trading | ✅ |

| Minimum Deposit | $5 |

| Customer Support | Contact form, live chat, FAQ |

| Tel: 010 300 0011 | |

| Email: care@tdmarkets.com | |

| Address: Floor 12 Green Park Corner, 3 Lower Rd, Sandton, 2196 | |

| Instagram, Facebook, Twitter, LinkedIn | |

| Restricted Countries | United States of America, Canada, Iran, Iraq, Syria, Libya |

TD Markets is a South African brokerage company who offers trading services in in forex, commodities, indices, stocks, ETFs and cryptocurrencies.

It offers a risk-free demo account and seven live accounts for different products and client groups, with an affordable minimum deposit $5 and tight starting spread from 0.1 pips. You can also execute trades through the renowned MetaTrader 4 or 5 platform, which is popular worldwide.

In addition, trading tools such as economic calendars and technical analysis are available to enhance trading efficiency. Educational resources are also provided to equip traders with essential knowledge and skills.

Furtheremore, the broker enables social trading for investors to communicate within interaction community to learn from successful predecessors.

The broker also implements fund segregation, which protects customer assets even during insolvency.

However, one crucial thing that should raise your great attention is that the broker exceeds FSCA regulation,requesting extreme cautiousness from you before deciding to trade with them.

| Pros | Cons |

| Demo accounts | Exceeded FSCA regulation |

| Affordable minimum deposit | Limited info on funding methods |

| Tight starting spreads | |

| MT4 and MT5 platforms | |

| Social trading | |

| Fund segregation |

TD Markets is currently being regulated by FSCA (Financial Sector Conduct Authority) with license no. 49128.

However, you should aware that the regulation status is exceeded, indicating possible engagement in financial activities beyond what is legally permitted by FSCA.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| FSCA | Exceeded | TD MARKETS (PTY) LTD | Financial Service Corporate | 49128 |

| Trading Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Shares | ✔ |

| ETFs | ✔ |

| Bonds | ❌ |

| Options | ❌ |

TD Markets offers a demo account simulating real trading, allowing traders to practice their trading strategies without losing real money.

Furthermore, seven live accounts are also avialable to suit varying needs for different client groups:

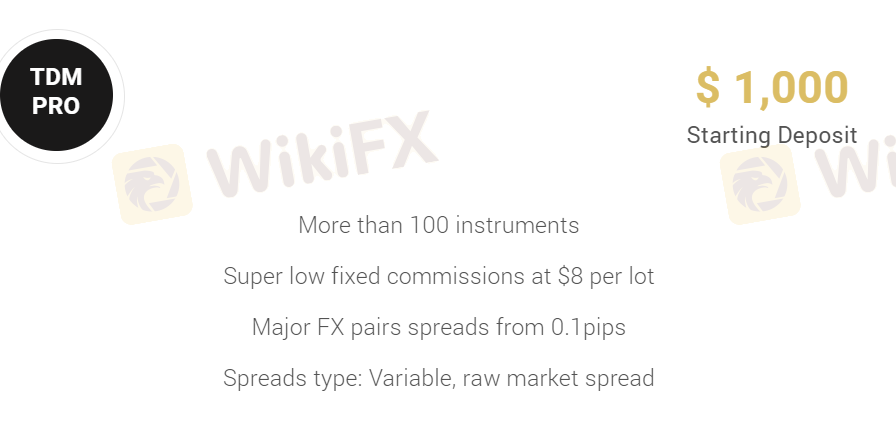

| Account Type | Minimum Deposit | Spread | Commission |

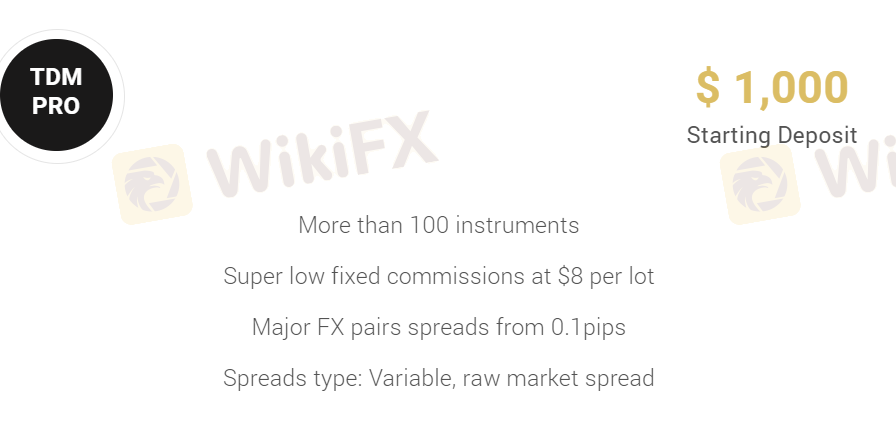

| TDM PRO | $1,000 | From 0.1 pips | $8 per lot |

| TDM GOLD | $50 | From 1.8 pips | ❌ |

| TDM MINI | $1 per mini lot | ||

| TDM ISLAMIC | ❌ | ||

| TDM CRYPTO | BTC 0.03 | From 0.2 pips | $8 per standard lot |

| TDM CENT | $10 | $0.1 per cent lot | |

| TDM MAX | $5 | From 1.8 pips | ❌ |

TD Markets uses the world renowned MetaTrader 4 and 5 platforms for investors to execute trades, which is well-recognized by their robust functionalities such as advanced charting tools, automated trading and analysis indicators.

You can reach the platform on web, or download app from Windows, mobiles phones and Linux devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web/Windows/Mobile phones/Linux | Beginners |

| MT5 | ✔ | Web/Windows/Mobile phones/Linux | Experienced traders |

Is your winning trade converted into a loss upon closing it at TD Markets due to heavy price manipulation? Is withdrawing funds too much of a hassle at this South Africa-based forex broker? Does even the customer support fail to respond to your withdrawal requests? Have you been defrauded on the promise of zero commission upon withdrawal? Have you failed to close the trade due to the systemic issue at TD Markets? You are not alone! Many traders have commented while sharing the negative TD Markets review. We have shared some of them in this article. Take a look!

WikiFX

WikiFX

As of April 2019, the spot FX market, which includes currency options and futures contracts, exchanged about $6.6 trillion each day. 1 With such a large quantity of money moving about in an unregulated spot market that trades instantaneously, over the counter, and with little accountability, forex scams entice unscrupulous operators to make quick money. While many once-popular scams have faded away owing to the Commodity Futures Trading Commission's (CFTC) aggressive enforcement efforts and the founding of the self-regulatory National Futures Association (NFA) in 1982, some old scams persist, and new ones keep cropping up.

WikiFX

WikiFX

The federal high court in Abuja has ordered the central bank of Nigeria, CBN, to unfreeze the account of ojukwu that has been frozen which is controlled by Mr. chikaosolu ojukwu and his firm, stabilization energy ltd.

WikiFX

WikiFX

In this article, my second installment in a series of Rtickes focused on the top two scams in the South African forex industry and also who are being named and shamed as the main players in these elaborate schemes, helping the masses to piece together for themselves if these gurus are in fact who they claim to be.

WikiFX

WikiFX

More

User comment

8

CommentsWrite a review

2024-08-06 18:34

2024-08-06 18:34 2024-06-04 14:34

2024-06-04 14:34