User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

High potential risk

Influence

Add brokers

Comparison

Quantity 1

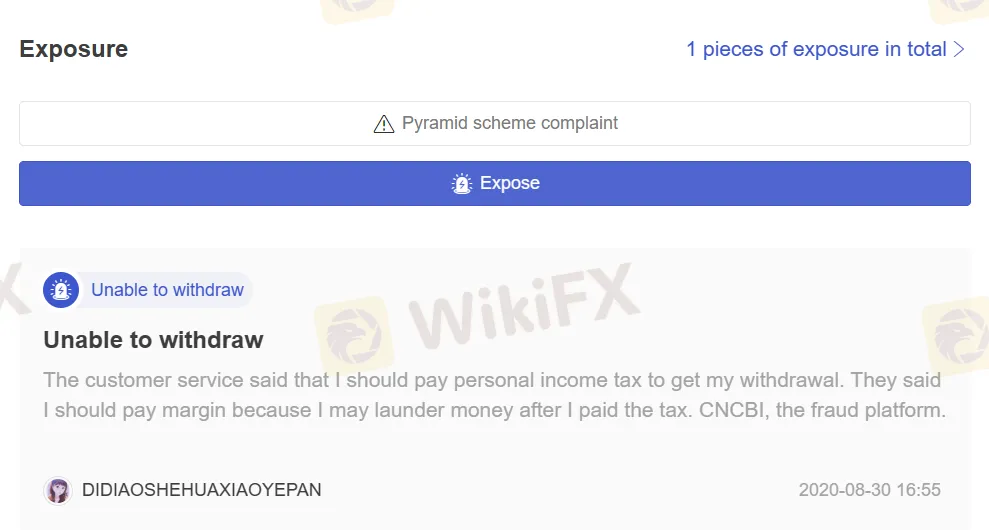

Exposure

Score

Regulatory Index0.00

Business Index7.18

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

China CITIC Bank International Limited

Company Abbreviation

CNCBI

Platform registered country and region

Hong Kong

Company website

Company summary

Pyramid scheme complaint

Expose

| CNCBI Review Summary | |

| Founded | 2-5 years |

| Registered Country/Region | China Hong Kong |

| Regulation | No regulation |

| Business Scopes | Wealth management, personal banking, wholesale banking, global markets and treasury solutions |

| Customer Support | Phone, email, live chat |

CNCBI, a Hong Kong-based full-service commercial bank, offers a wide range of financial services including wealth management, personal banking, wholesale banking, global markets, and treasury solutions. They aim to become an outstanding bank with professional capabilities focused on success for their customers, staff, and community.

However, it is important to note that currently, CNCBI operates without valid regulation, meaning that there is no government or financial authority oversighting their operations.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

| Pros | Cons |

| • A range of services and products | • Not regulated |

| • Live chat available | • No social media presence |

There are many alternative brokers to CNCBI depending on the specific needs and preferences of the trader. Some popular options include:

Access Bank – A wholly-owned subsidiary of Access Bank, a global private bank that commenced operations in 2013 and specializes in providing solutions in trade finance, commercial banking, and asset management.

EC Investment Bank – A bank that offers a broad array of banking, financial and wealth management services, ranging from consumer, corporate, investment, private and transaction banking to treasury, insurance, asset management and stockbroking services.

United Trust Bank - A specialized bank offering an array of instant execution and tailor-made services, which serves different fields of clients including finance brokers, developers, and individuals with the main services of deposit and lending.

CNCBI currently has no valid regulation, which means that there is no government or financial authority oversighting their operations. It makes investing with them risky.

If you are considering investing with CNCBI, it is important to do your research thoroughly and weigh the potential risks against the potential rewards before making a decision. In general, it is recommended to invest with well-regulated brokers to ensure your funds are protected.

The business scopes of CNCBI, which stands for China CITIC Bank International, include wealth management, personal banking, wholesale banking, global markets, and treasury solutions.

- Wealth management services including investment advisory, asset management, and financial planning.

- Personal banking services such as savings accounts, credit cards, loans, and mortgages.

- Wholesale banking services catering to large corporate clients, institutional customers, and government entities, offering corporate banking, trade finance, cash management, and treasury services.

- Global markets services providing a wide range of financial products and services to institutional investors, including foreign exchange, fixed income, equities, derivatives, and structured products.

- Treasury solutions encompassing services related to managing and optimizing liquidity, foreign exchange risk, interest rate risk, and other treasury-related functions for clients.

CNCBI implements Service Items Fees for their wealth management services. To obtain detailed information on the specific fees and charges, traders are advised to either visit the CNCBI website or directly contact their customer service. This will allow them to receive the latest and most accurate details regarding the fees associated with CNCBI's wealth management services.

On our website, you can see that reports of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

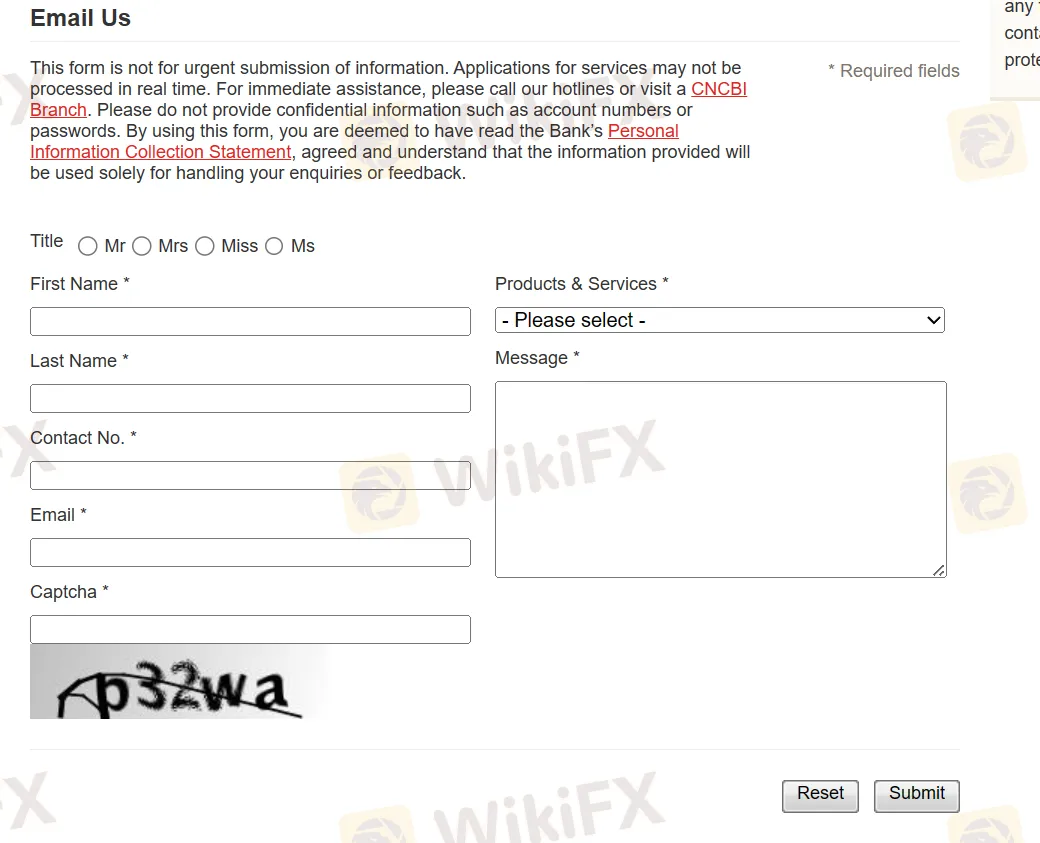

CNCBI offers live chat. With live chat, customers can get their questions answered quickly and receive help with any issues they may have. It's a convenient and effective communication channel that can improve customer satisfaction and increase sales.

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: (852) 3603 2333

(852)3603 2333

Email: cs@cncbinternational.com

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, Instagram and Linkedin.

CNCBIoffers online messaging as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform. Online messaging can be a convenient way to get real-time assistance or to engage in discussions with fellow traders.

In conclusion, CNCBI is a Hong Kong-based commercial bank that offers a range of financial services. However, it is important to note that currently, CNCBI operates without valid regulation, meaning there is no government or financial authority overseeing their operations. This lack of regulation introduces potential risks for customers and investors. It is advised for individuals to carefully consider these factors before engaging in any financial activities with CNCBI.

| Q 1: | Is CNCBI regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at CNCBI? |

| A 2: | You can contact via telephone, (852) 3603 2333 and(852)3603 2333 and email, cs@cncbinternational.com. |

| Q 3: | Is CNCBI a good broker for beginners? |

| A 3: | No. It is not a good choice for beginners because of its unregulated condition. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment