User Reviews

More

User comment

7

CommentsWrite a review

2024-01-02 18:17

2024-01-02 18:17

2023-10-03 14:22

2023-10-03 14:22

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 3

Exposure

Score

Regulatory Index0.00

Business Index7.07

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Ace Global Limited

Company Abbreviation

AceFxPro

Platform registered country and region

United Kingdom

Company website

X

Company summary

Pyramid scheme complaint

Expose

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Feature | Detail |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Found | 2015 |

| Regulation | unregulated |

| Market Instrument | Forex, commodities, indices and cryptocurrencies |

| Account Type | Standard, Pro and Ultimate |

| Demo Account | yes |

| Maximum Leverage | 1:500 |

| Spread | Vary on the account type |

| Commission | $7.00 round turn for a standard lot |

| Trading Platform | MT5, Mobile, Web |

| Minimum Deposit | $200 |

| Deposit & Withdrawal Method | Visa, MasterCard, bank transfers and Bitcoin |

AceFxPro, a trading name of Ace Global Limited, is allegedly a multi-asset broker founded in 2015 and registered in Saint Vincent and the Grenadines, claiming to provide its clients with the worlds most widely-used MT5 platform, flexible leverage up to 1:500, variable spreads on a variety of tradable assets, as well as a choice of three different account types.

The platform supports the popular MT5 trading platform, providing access to advanced charting tools, technical indicators, and customizable options. However, there are some drawbacks to consider. AceFxPro is an unregulated broker, which may raise concerns for some traders who prefer a regulated trading environment. The platform also has limited educational resources available, which may be a disadvantage for beginners or those seeking comprehensive educational materials. Furthermore, the commission rates vary depending on the account type and trading volume, which can make it challenging to determine the exact trading costs.

Here is the home page of this brokers official site:

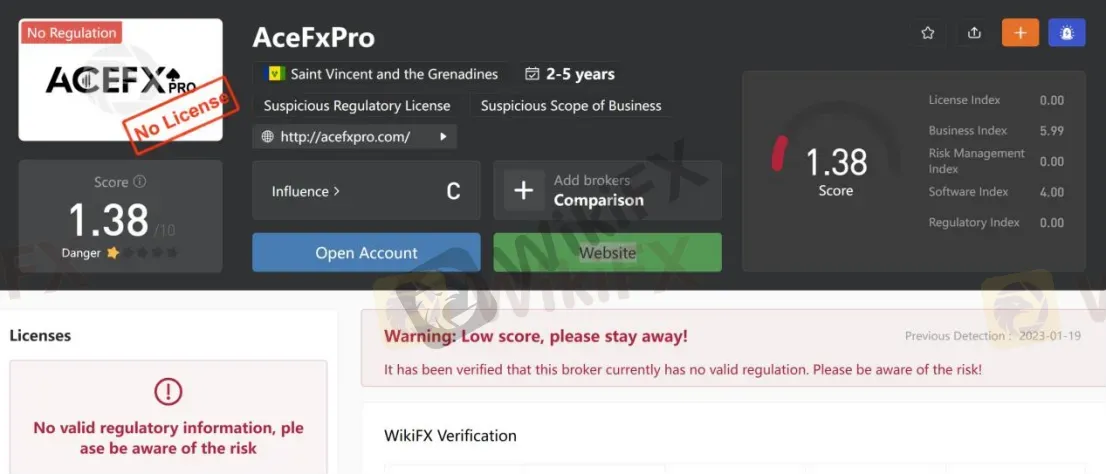

As for regulation, it has been verified that Kaiser International currently has no valid regulation. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.29/10. Please be aware of the risk.

Note: The screenshot date is January 19, 2023. WikiFX gives dynamic scores, which will update in real time based on the broker's dynamics. So the scores taken at the current time do not represent past and future scores.

AceFxPro is a trading provider that offers both advantages and disadvantages for traders to consider. It is important to evaluate these factors based on individual preferences and requirements.

| Pros | Cons |

| Diverse range of tradable assets | Unregulated broker |

| Deep liquidity, tight spreads, fast execution | Limited educational resources |

| Support for MT5 trading platform | Varying commission rates |

| Opportunities for diversification | |

| Customization options |

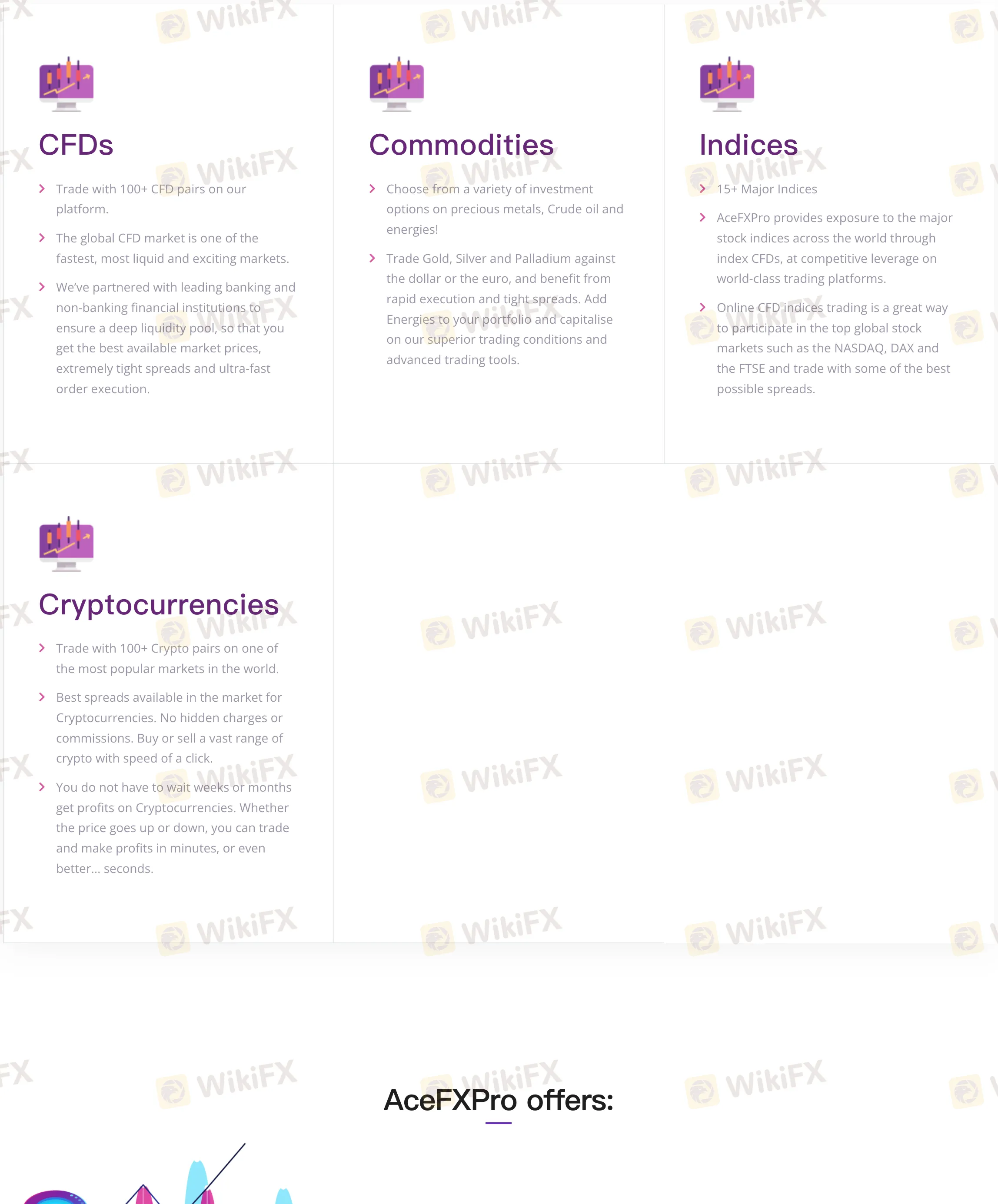

AceFxPro provides a diverse range of market instruments, including CFDs, commodities, index CFDs, and cryptocurrencies.

Contracts for Difference (CFDs): AceFxPro provides access to over 100 CFD pairs, allowing traders to participate in the fast-paced and liquid global CFD market. Through partnerships with leading financial institutions, they ensure deep liquidity, tight spreads, and fast order execution for optimal trading conditions.

Commodities Trading: Traders can invest in precious metals like Gold, Silver, and Palladium, as well as Crude oil and energies. AceFxPro offers rapid execution, tight spreads, and favorable trading conditions for commodities, enabling traders to diversify their portfolios and take advantage of market opportunities.

Index CFDs: AceFxPro allows traders to participate in major stock indices worldwide, including NASDAQ, DAX, and FTSE. With leveraged trading options and access to top-notch trading platforms, traders can benefit from index performance and favorable spreads.

Cryptocurrency Trading: AceFxPro caters to the growing popularity of cryptocurrencies by offering trading in over 100 crypto pairs. Traders enjoy competitive spreads, transparent pricing without hidden charges or commissions, and the ability to buy or sell a wide range of cryptocurrencies quickly. The fast-paced nature of the cryptocurrency market allows traders to potentially profit within minutes or seconds, regardless of price direction.

Here is a comparison table of trading instruments offered by different brokers:

| Products | AceFXPro | AvaTrade | IG | IC Markets |

| Forex | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Cryptocurrencies | Yes | Yes | Yes | No |

| Stocks | Yes | Yes | Yes | Yes |

| Indices | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | No |

| Bonds | No | Yes | No | Yes |

| ETFs | No | Yes | No | No |

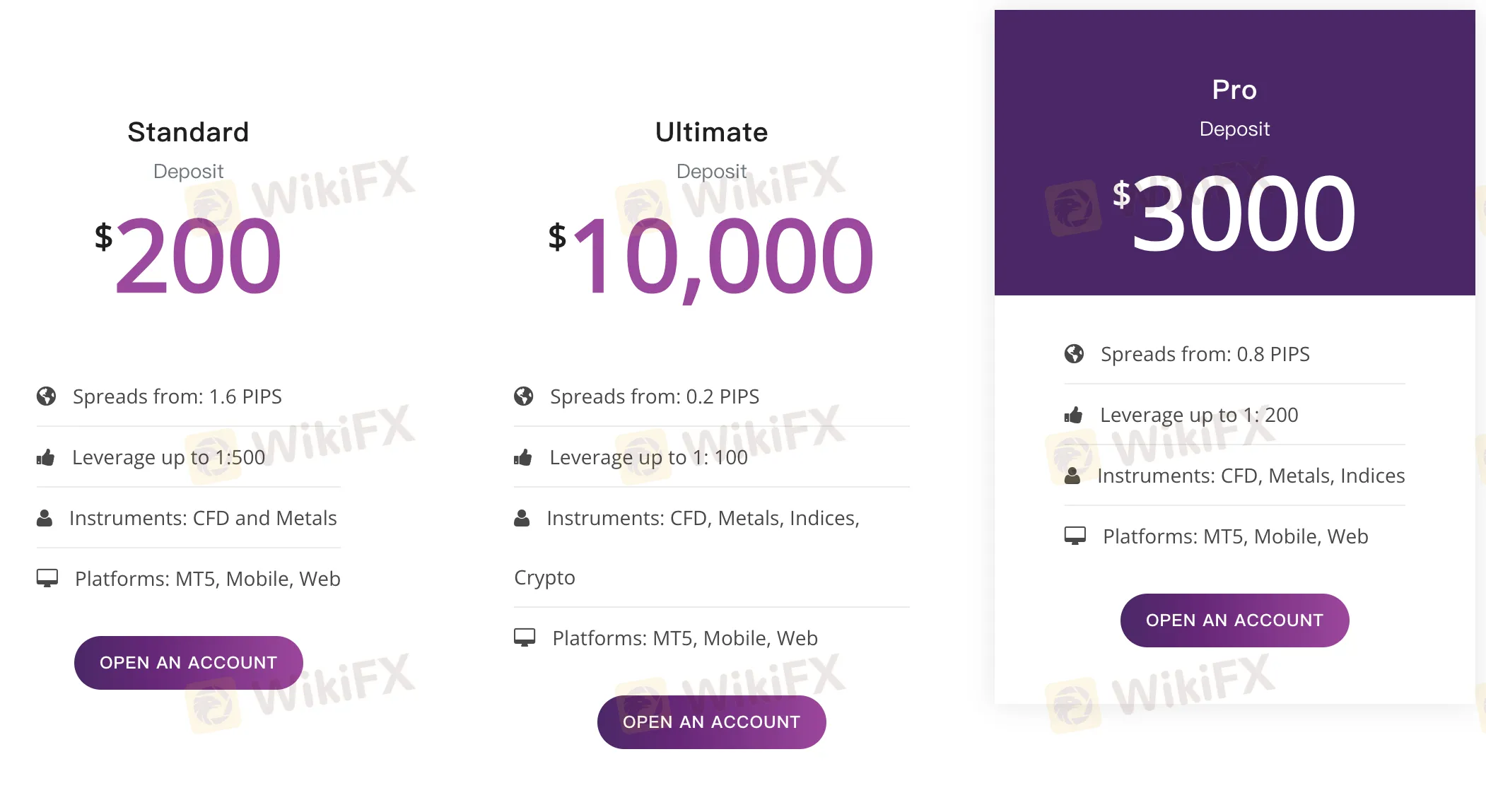

AceFxPro offers different account types to cater to the varying needs of traders. Here is a brief description of each account type:

Standard Account:

Minimum Deposit: $200

Spreads from: 1.6 PIPS

Leverage: Up to 1:500

Instruments: CFD and Metals

Platforms: MT5, Mobile, Web

Ultimate Account:

Minimum Deposit: $10,000

Spreads from: 0.2 PIPS

Leverage: Up to 1:100

Instruments: CFD, Metals, Indices, Crypto

Platforms: MT5, Mobile, Web

Pro Account:

Minimum Deposit: $3,000

Spreads from: 0.8 PIPS

Leverage: Up to 1:200

Instruments: CFD, Metals, Indices

Platforms: MT5, Mobile, Web

Additionally, AceFxPro offers swap-free accounts for clients of Muslim faith. Traders can request this option by sending an email to support@acefxpro.com along with proof of their faith. Account managers are available to provide further details and assistance.

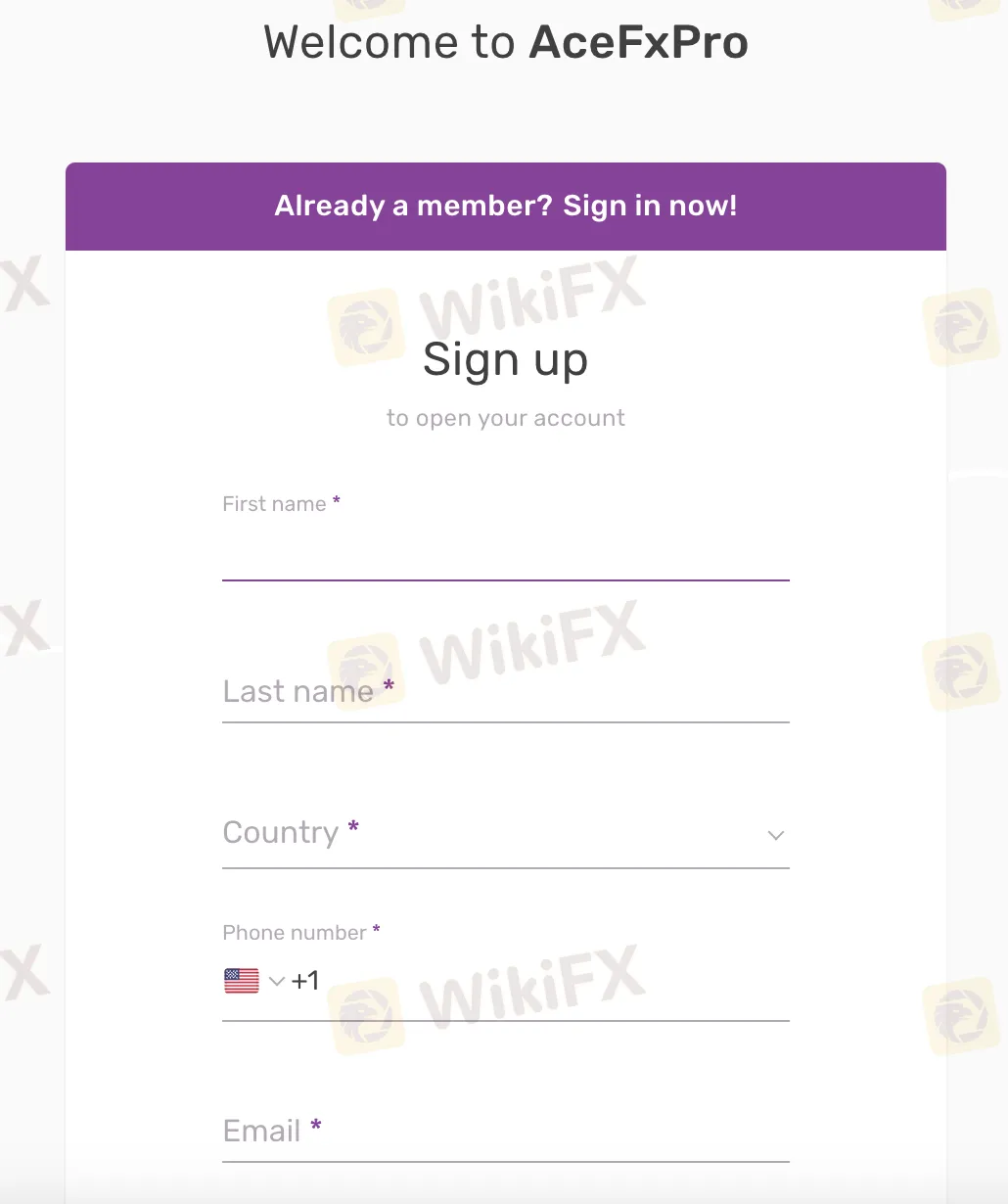

Visit the TRADEHALL website. Look for the “STARTING TRADING” or “OPEN A LIVE ACCOUNT” button on the homepage and click on it.

Sign up on websites registration page.

Receive your personal account login from an automated email

Login in

Proceed to deposit funds to your account

Download the platform and start trading

You can watch the video below to learn more details:

https://youtu.be/GIYFyRwseXc

AceFxPro offers different leverage options for its account types, allowing traders to amplify their trading positions. Here is a summary of the leverage offered:

1. Standard Account:

- Leverage: Up to 1:500

2. Ultimate Account:

- Leverage: Up to 1:100

3. Pro Account:

- Leverage: Up to 1:200

It's important to note that while leverage can enhance potential profits, it also magnifies losses. Traders should exercise caution and have a solid risk management strategy in place when using leverage. AceFxPro provides varying leverage options across its account types to accommodate different trading preferences and risk tolerances. Traders should carefully consider their trading goals and the potential risks associated with higher leverage before selecting an account type.

AceFxPro offers spreads and commission structures that are designed to provide value and flexibility for traders.

In the Standard Account, traders can enjoy spreads starting from 1.6 pips, allowing them to trade CFDs and metals with competitive pricing.

The Ultimate Account offers even tighter spreads, starting from 0.2 pips. This account type allows traders to access a wider range of instruments, including CFDs, metals, indices, and cryptocurrencies.

For the Pro Account, traders can benefit from spreads starting from 0.8 pips while trading CFDs, metals, and indices.

Commissions are applicable to the Pro and Ultimate account types. The commission amounts vary depending on the instrument, account type, and trading volume. For a mini lot (10,000 units), the commission starts from 0.70 USD round turn, and for a standard lot (100,000 units), it starts from 7.00 USD round turn. Please note that if you are trading non-USD pairs, the commission will vary based on the market conversion rate.

AceFxPro offers swap-free accounts for Muslim clients, allowing them to trade without incurring overnight swap charges. Cross-device trading is enabled, enabling clients to trade on multiple platforms simultaneously. The platform also supports one-click trading for quick trade execution. Hedging is allowed on all accounts, providing clients with risk management options. The stop-out level is set at 50% margin for all account types, and it may vary under certain conditions. Commissions are applicable to Pro and Ultimate accounts, and the rates depend on factors such as the instrument, account type, and trading volume.

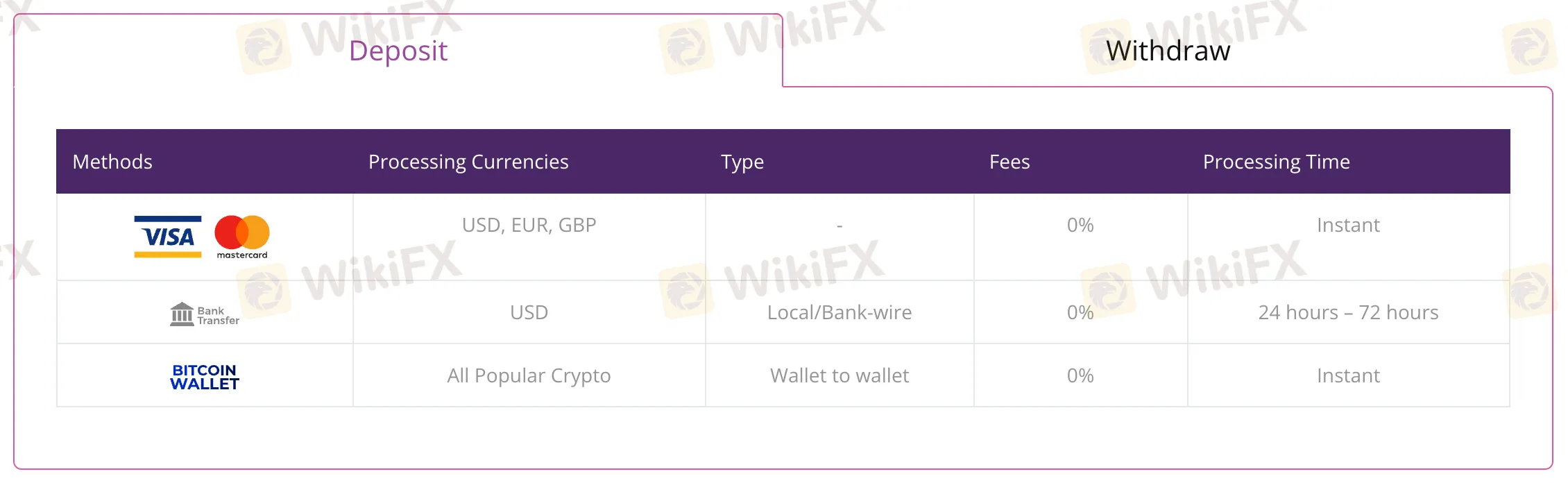

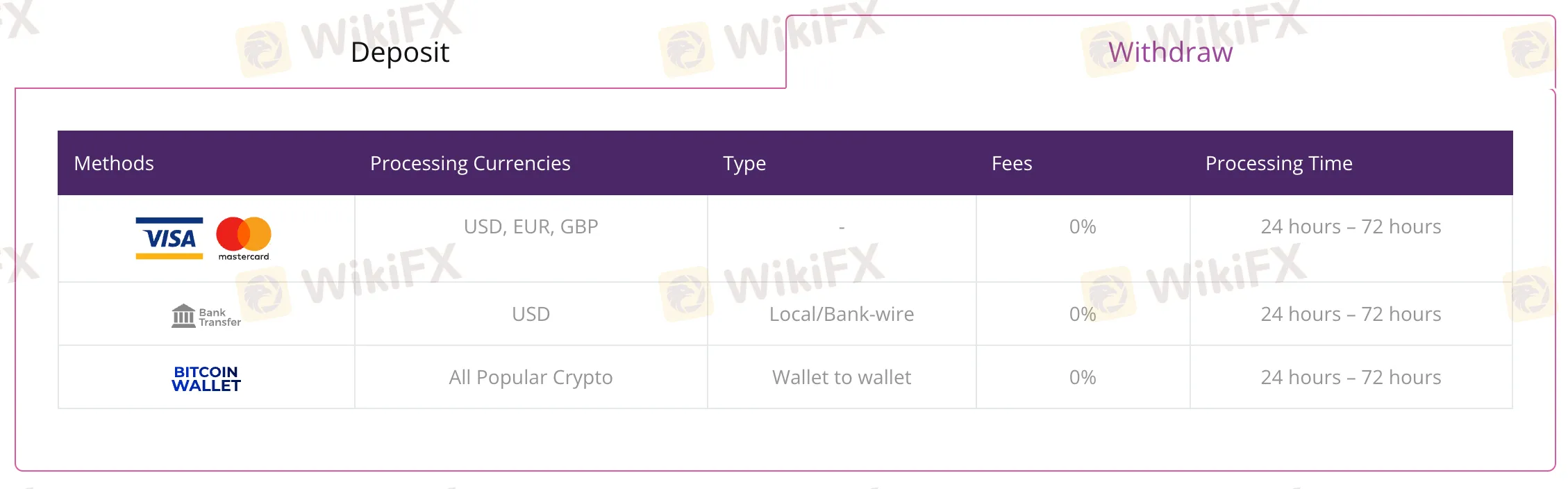

AceFxPro accepts deposits and withdrawals with credit/debit cards like Visa and MasterCard, bank transfers and Bitcoin. The minimum deposit requirement is $200 or the amount equivalent to HKD/INR. As for the processing time of deposit and withdrawal requests, deposits via Visa and MasterCard can be processed instantly, while deposits via bank transfers all withdrawals require 24 hours-72 hours to process.

Here is a comparison table of minimum deposit required by different brokers::

| AceFxPro | RoboForex | Pocket Option | Tickmill | |

| Min deposit | $200 | $10 | $50 | $100 |

AceFxPro provides traders with a choice of trading platforms to suit their preferences. The MetaTrader 5 (MT5) platform is available for PC and mobile devices, offering customization options, one-click trading, live price streaming, and access to technical indicators and charting tools. Traders can also benefit from the MetaTrader market and MQL5 community.

In addition to MT5, AceFxPro offers the web-based trading platform, which allows traders to access their accounts without the need for any downloads or installations.

AceFxPro offers various channels for contacting their customer service team:

Contact Form: Fill out a contact form on their website, providing your name, email, subject, and message. A representative will get back to you.

Live Chat: Utilize the live chat feature on their website for instant assistance.

Hotline: Call +44 239 216 0334 to speak directly with a customer service representative.

Customer Service Locations:

Registered Address: Suite 305, Griffith Corporate Centre, Kingstown, Saint Vincent and the Grenadines.

Physical Address: 101, Khalid Bin Waleed Rd, Dubai, UAE.

AceFxPro provides limited information on its website regarding the educational resources and community support available to traders.

| Q 1: | Is AceFxPro regulated? |

| A 1: | No. It has been verified that AceFxPro currently has no valid regulation. |

| Q 2: | Does AceFxPro offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does AceFxPro offer the industry-standard MT4 & MT5? |

| A 3: | Yes. AceFxPro supports MT5. |

| Q 4: | What is the minimum deposit for AceFxPro? |

| A 4: | The minimum initial deposit at AceFxPro to open an account is $200. |

| Q 5: | Is AceFxPro a good broker for beginners? |

| A 5: | No. AceFxPro is not a good choice for beginners. Not only because of its unregulated condition, but also because of its high initial deposit requirement, |

More

User comment

7

CommentsWrite a review

2024-01-02 18:17

2024-01-02 18:17

2023-10-03 14:22

2023-10-03 14:22